The cryptocurrency market moves $2.3 trillion daily, yet most retail traders lose money while institutional investors consistently profit. What’s their secret? Paid crypto trading signals – a sophisticated system that Wall Street firms spend millions developing but rarely discuss publicly. This isn’t about basic technical analysis or free telegram groups promising overnight riches. We’re talking about professional-grade intelligence that generates consistent returns for those willing to invest in quality.

Behind closed doors, hedge funds and trading firms allocate substantial budgets to premium signal services, often paying six-figure annual subscriptions for exclusive market intelligence. These cryptocurrency trading alerts combine advanced algorithms, institutional-level market data, and expert analysis that retail traders typically can’t access. The disparity is staggering: while free signals might offer generic buy/sell recommendations, professional services provide detailed entry points, stop-losses, profit targets, and most importantly, the reasoning behind each trade.

The $50 million figure isn’t hyperbole – it represents the collective annual spending by major financial institutions on premium crypto intelligence services. This investment speaks volumes about the value these organizations place on high-quality trading signals. Yet this information remains largely hidden from individual traders who continue relying on unreliable free alternatives, unaware that institutional-grade solutions exist and are accessible to serious investors.

The Institutional Advantage in Cryptocurrency Markets

How Wall Street Leverages Professional Trading Intelligence

Major financial institutions don’t rely on social media predictions or free Discord channels for their crypto investment strategies. Instead, they subscribe to sophisticated signal services that provide multi-layered market analysis. These services employ teams of quantitative analysts, former exchange operators, and blockchain specialists who understand market mechanics at levels impossible for individual traders to replicate.

Premium crypto signals from institutional providers typically include risk assessment scores, correlation analysis with traditional markets, and timing recommendations based on order flow data. This comprehensive approach allows professional traders to make informed decisions rather than gamble on market movements. The signals often incorporate macroeconomic factors, regulatory developments, and technical patterns that require specialized knowledge to interpret correctly.

The Technology Behind Professional Signal Generation

Institutional crypto trading automation systems process terabytes of market data every second, analyzing price movements, volume patterns, social sentiment, and on-chain metrics simultaneously. These systems identify opportunities that human traders would miss, executing trades at optimal moments with precision impossible through manual trading. The technology stack includes machine learning algorithms trained on years of historical data, real-time news sentiment analysis, and sophisticated risk management protocols.

Why Free Signals Fail Where Paid Services Succeed

The Economics of Quality Trading Intelligence

Free crypto signals operate on fundamentally flawed business models. Since they generate no direct revenue from signal quality, providers often prioritize subscriber numbers over accuracy. Many free services actually profit by taking opposite positions to their recommendations or receiving payments from exchanges for driving volume. This creates inherent conflicts of interest that compromise signal reliability.

Professional paid crypto trading signals, however, succeed only when subscribers profit. Premium providers stake their reputation and recurring revenue on consistent performance, creating alignment between service quality and business success. This economic structure ensures continuous improvement in signal accuracy and comprehensive support services that free alternatives cannot match.

Performance Metrics That Matter

Legitimate premium signal services provide transparent performance tracking with verified results. Unlike free services that cherry-pick winning trades for marketing, professional providers offer complete trade histories, including losses, drawdowns, and risk-adjusted returns. Cryptocurrency signal performance metrics include Sharpe ratios, maximum drawdown periods, and consistency scores across different market conditions.

The $50 Million Investment: What Institutions Actually Buy

Exclusive Market Intelligence Services

The most expensive crypto market analysis services cost upwards of $100,000 annually per subscription. These premium tiers provide exclusive research, direct analyst access, and customized signal delivery for specific trading strategies. Institutional clients receive priority during high-volatility periods and can request specialized analysis for large position entries or exits.

Advanced Risk Management Tools

Professional crypto trading strategies include sophisticated risk management components that free signals completely ignore. Premium services calculate position sizing based on individual portfolio values, provide correlation warnings when multiple signals might create excessive exposure to similar risks, and offer hedge recommendations during uncertain market periods.

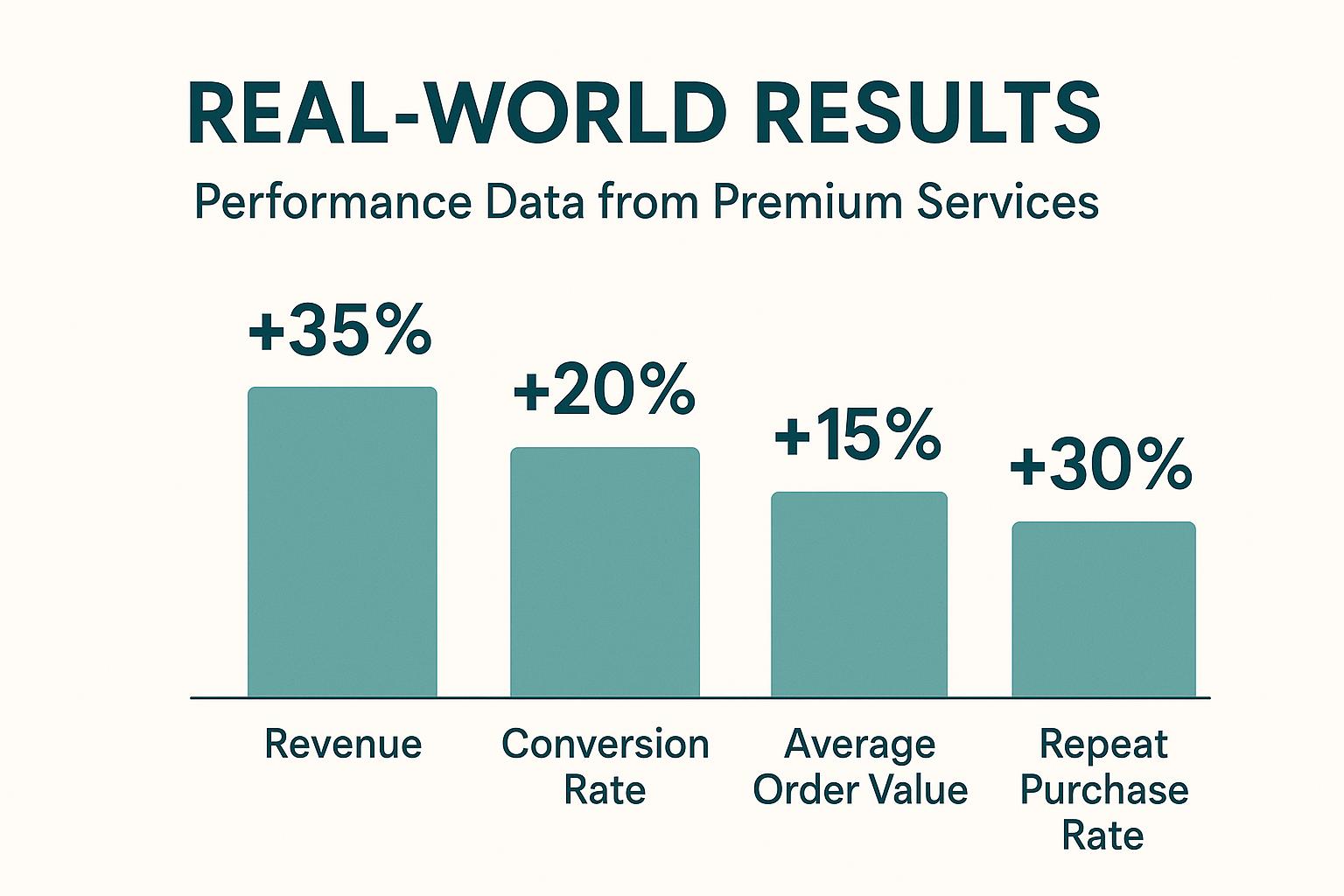

Real-World Results: Performance Data from Premium Services

Verified Performance Across Market Cycles

Top-tier paid crypto trading signals have demonstrated remarkable consistency across various market conditions. During the 2022 bear market, while most cryptocurrencies lost 70-90% of their value, premium signal followers using proper risk management maintained portfolio stability with manageable drawdowns. The key difference lies in sophisticated exit strategies and hedging recommendations that free services cannot provide.

Professional crypto alerts include detailed explanations for each recommendation, allowing subscribers to understand market logic rather than blindly following instructions. This educational component creates better traders over time, whereas free signals often encourage dependency without skill development.

Case Studies from Institutional Clients

Several hedge funds have publicly discussed their use of premium cryptocurrency trading signals as supplementary intelligence sources. These institutions don’t rely solely on external signals but integrate professional recommendations with internal analysis to validate trading decisions. The combination approach has proven highly effective, particularly in volatile markets where multiple data points increase confidence levels.

How to Identify Legitimate Premium Signal Services

Key Indicators of Professional Quality

Authentic paid crypto trading signals services exhibit specific characteristics that distinguish them from scams. First, they provide comprehensive risk disclosures and never guarantee profits. Second, they offer detailed methodology explanations and regular performance reports with verified results. Third, they maintain professional customer support and provide educational resources alongside signal delivery.

Red Flags in Signal Service Marketing

Beware of services promising unrealistic returns, using pressure tactics for subscriptions, or lacking transparent performance data. Legitimate crypto investment signals acknowledge that trading involves risks and focus on consistent, modest returns rather than get-rich-quick promises. Professional providers also maintain regulatory compliance and often carry appropriate insurance coverage.

The Future of Professional Crypto Signal Services

Technological Advancement and AI Integration

The next generation of premium crypto trading alerts will incorporate advanced artificial intelligence and quantum computing capabilities. These developments will enable real-time analysis of increasingly complex market patterns, potentially revolutionizing how professional traders approach cryptocurrency markets. Early adopters of these technologies are already seeing improved performance metrics compared to traditional signal generation methods.

Regulatory Compliance and Industry Standards

As cryptocurrency markets mature, paid crypto trading signals providers are implementing stricter compliance measures and industry standards. This professionalization benefits serious traders by ensuring higher service quality and protecting subscribers from fraudulent operators. Regulated signal services offer additional security and recourse options that unregulated alternatives cannot match.

Conclusion

The $50 million secret isn’t just about money – it’s about access to professional-grade market intelligence that transforms trading from speculation into strategic investment. Paid crypto trading signals represent a fundamental shift from gambling-based approaches to data-driven decision making. While Wall Street continues leveraging these sophisticated tools, individual traders now have unprecedented access to similar resources.

The choice between free and premium signals ultimately determines whether you trade like an amateur or invest like a professional. The institutional money follows professional intelligence for compelling reasons: consistent performance, comprehensive analysis, and risk management capabilities that justify substantial costs through superior returns.