Figure blockchain IPO successfully raised $787.5 million in its U.S. initial public offering. This groundbreaking public offering represents one of the most substantial fundraising efforts by a blockchain-focused company in recent years, highlighting the growing mainstream acceptance of digital asset companies in traditional financial markets.

The company and its selling shareholders, including Ribbit Capital, sold 31.5 million shares at $25 per share, exceeding initial market expectations and demonstrating strong investor confidence in blockchain technology’s commercial viability. This Figure blockchain IPO achievement comes at a crucial time when cryptocurrency companies are increasingly seeking legitimacy through public market participation.

The successful completion of this blockchain IPO Figure offering signals a new era for digital asset companies entering traditional capital markets. As institutional and retail investors continue to embrace blockchain technology, Figure’s public debut provides a compelling case study for other cryptocurrency firms considering similar paths to public ownership.

Figure Technology’s Blockchain Revolution

Figure Technology Solutions Inc. has established itself as a pioneer in blockchain-based financial services, leveraging distributed ledger technology to transform traditional lending and credit operations. The company’s innovative approach combines cutting-edge blockchain infrastructure with practical financial solutions, creating a unique value proposition in the rapidly evolving fintech landscape.

The Figure IPO blockchain success story begins with the company’s founding vision to democratize access to financial services through decentralized technology. By utilizing blockchain for loan origination, servicing, and securitization, Figure has created a more transparent and efficient alternative to conventional banking processes.

Figure’s Blockchain Technology Platform

Figure’s proprietary blockchain platform, known as Provenance, serves as the foundation for the company’s financial services ecosystem. This sophisticated infrastructure enables secure, transparent, and immutable record-keeping for all financial transactions, providing unprecedented levels of trust and accountability in the lending process.

The platform’s capabilities extend beyond simple transaction processing, incorporating smart contracts that automate loan servicing, compliance monitoring, and risk assessment procedures. This technological sophistication has attracted significant attention from institutional investors, contributing to the success of the blockchain company Figure’s IPO.

Stablecoin Operations and Digital Asset Services

Figure Technology operates as a stablecoin issuer, adding another dimension to its blockchain-based business model. The company’s involvement in the digital asset ecosystem positions it strategically within the broader cryptocurrency market, providing multiple revenue streams and growth opportunities.

The integration of stablecoin services with traditional lending products creates a comprehensive financial ecosystem that appeals to both cryptocurrency enthusiasts and conventional financial institutions. This diversified approach has strengthened investor confidence in the Figure blockchain public offering.

Breaking Down the $787.5 Million Figure Blockchain IPO

The Figure blockchain IPO represents a carefully orchestrated public offering that exceeded initial market expectations and demonstrated strong institutional support for blockchain-focused companies. The offering’s structure and pricing strategy reflect sophisticated market positioning and strategic investor engagement.

IPO Pricing Strategy and Market Reception

The shares were priced at $25 per share, above the initially marketed range, indicating robust demand from institutional and retail investors. This premium pricing reflects market confidence in Figure’s business model and growth prospects within the expanding blockchain financial services sector.

The successful pricing above the initial range demonstrates that investors view blockchain technology as a legitimate and profitable business foundation rather than a speculative venture. This market validation is crucial for the broader cryptocurrency industry’s efforts to achieve mainstream financial legitimacy.

Institutional Investor Participation

High-profile investors in the company include Stanley Druckenmiller’s Duquesne Family Office, showcasing the caliber of institutional support behind the Figure IPO blockchain offering. Such prestigious backing provides additional credibility and market confidence for the public debut.

The participation of established institutional investors signals a maturation of the blockchain investment landscape, where sophisticated financial professionals are increasingly comfortable with cryptocurrency-related business models. This institutional endorsement strengthens the long-term prospects for the blockchain IPO Figure’s success.

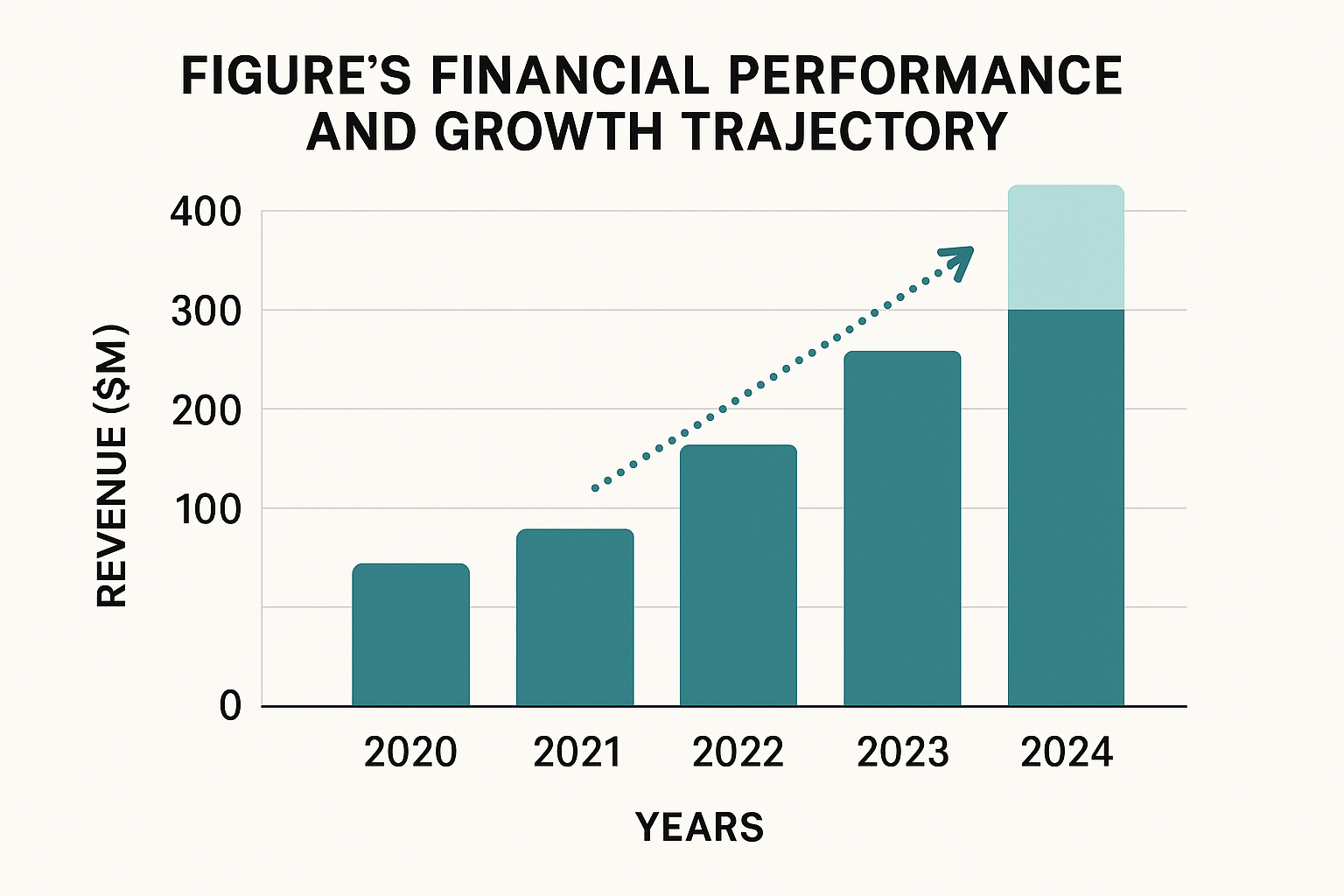

Figure’s Financial Performance and Growth Trajectory

The Figure blockchain IPO is supported by impressive financial fundamentals that demonstrate the company’s transition from startup to profitable enterprise. The company reported $29.1 million in net income on $190.6 million in revenue for the first six months of 2025, up from a $15.6 million loss on $156 million in revenue a year earlier.

This remarkable financial turnaround showcases Figure’s ability to monetize its blockchain technology effectively while scaling operations efficiently. The path to profitability is particularly significant for cryptocurrency companies, which often face skepticism about their long-term viability.

Revenue Growth and Market Expansion

The blockchain-focused firm saw a 22.4% increase in revenue for the first half of 2025 to $191 million, demonstrating consistent growth momentum that supported investor confidence in the Figure blockchain public offering. This revenue growth reflects expanding market adoption of Figure’s blockchain-based financial services.

The company’s ability to achieve double-digit revenue growth while maintaining profitability positions it favorably within the competitive fintech landscape. This financial performance provides a solid foundation for the blockchain company Figure IPO long-term success.

Operational Efficiency and Cost Management

The figure’s transition from operational losses to significant profitability within a single year demonstrates exceptional cost management and operational efficiency improvements. This financial discipline is particularly important for public companies, where quarterly performance scrutiny requires consistent execution.

The company’s demonstrated ability to scale revenue while controlling costs provides investors with confidence in management’s ability to navigate public market requirements successfully. This operational excellence strengthens the investment thesis for the Figure IPO blockchain offering.

Market Implications of Figure’s Blockchain IPO Success

The successful completion of the Figure blockchain IPO carries significant implications for the broader cryptocurrency and blockchain industry. This public offering serves as a benchmark for other digital asset companies considering public market entry, potentially catalyzing additional IPO activity within the sector.

Cryptocurrency Industry Validation

Figure’s IPO makes it the latest crypto firm to tap public markets as digital assets gain mainstream acceptance. This trend represents a fundamental shift in how traditional financial markets perceive cryptocurrency and blockchain companies, moving beyond speculative interest toward genuine business evaluation.

The successful blockchain IPO Figure completion provides a roadmap for other cryptocurrency companies seeking public market validation. This precedent could accelerate the integration of blockchain businesses into traditional capital markets, expanding investor access to digital asset opportunities.

Regulatory Environment and Compliance

Figure’s ability to navigate the complex regulatory requirements for a U.S. public offering demonstrates the maturation of blockchain companies’ compliance capabilities. This regulatory success provides a template for other cryptocurrency firms seeking to achieve similar public market milestones.

The Figure blockchain public offering compliance achievement is particularly significant given the evolving regulatory landscape surrounding cryptocurrency businesses. This successful navigation of regulatory requirements could influence policy discussions and industry standards moving forward.

Technology Innovation and Competitive Advantages

Figure’s blockchain platform represents significant technological innovation within the financial services sector, providing competitive advantages that justify premium market valuation. The company’s proprietary technology stack addresses fundamental inefficiencies in traditional lending and credit markets.

Blockchain-Based Loan Origination

Figure’s use of blockchain technology for loan origination creates unprecedented transparency and efficiency in the lending process. Smart contracts automate many traditional manual processes, reducing costs and processing times while improving accuracy and compliance monitoring.

This technological innovation provides Figure with sustainable competitive advantages that are difficult for traditional financial institutions to replicate quickly. The Figure blockchain IPO success validates this technology-first approach to financial services transformation.

Provenance Blockchain Infrastructure

The Provenance blockchain platform serves as Figure’s technological foundation, enabling secure, transparent, and efficient financial transaction processing. This proprietary infrastructure represents years of development investment and provides significant barriers to competitive replication.

The platform’s capabilities extend beyond simple transaction processing, incorporating sophisticated risk assessment, compliance monitoring, and automated servicing features. This comprehensive technology platform strengthens the long-term investment prospects for the blockchain company Figure IPO.

Investment Considerations and Market Outlook

The Figure blockchain IPO presents investors with exposure to the growing blockchain financial services market while providing the regulatory security and transparency of public market participation. This investment opportunity combines innovative technology with traditional financial services applications.

Growth Potential in Blockchain Financial Services

The blockchain financial services market continues to expand rapidly, driven by increasing institutional adoption and regulatory clarity. Figure’s established market position and proven technology platform position the company to capitalize on this growing market opportunity.

The Figure IPO blockchain success demonstrates that blockchain companies can achieve sustainable profitability while scaling operations effectively. This proven business model provides investors with confidence in the sector’s long-term growth prospects.

Risk Assessment and Market Volatility

While the blockchain IPO Figure’s success is encouraging, investors must consider the inherent volatility and regulatory risks associated with cryptocurrency and blockchain companies. Market sentiment toward digital assets can fluctuate significantly, potentially impacting share price performance.

The company’s diversified business model, including traditional lending operations alongside blockchain services, provides some protection against cryptocurrency market volatility. This business diversification strengthens the investment case for the Figure blockchain public offering.

Strategic Partnerships and Industry Relationships

Figure’s success in the blockchain company Figure IPO has been supported by strategic partnerships and industry relationships that enhance the company’s market position and growth prospects. These collaborations provide access to expanded customer bases and technological capabilities.

Financial Institution Partnerships

Figure has developed partnerships with traditional financial institutions seeking to integrate blockchain technology into their operations. These relationships provide revenue opportunities while validating Figure’s technology platform within established financial services markets.

The company’s ability to bridge traditional finance and blockchain technology creates unique value propositions for institutional partners. This strategic positioning strengthens the long-term prospects for the Figure blockchain IPO investment thesis.

Technology Integration and Innovation

Figure’s ongoing technology development efforts focus on expanding blockchain applications within financial services while maintaining compatibility with existing financial infrastructure. This balanced approach ensures sustainable growth while minimizing implementation risks for enterprise customers.

The company’s commitment to continuous innovation provides competitive advantages within the rapidly evolving blockchain financial services market. This innovation focus supports investor confidence in the Figure IPO blockchain long-term success.

Future Outlook and Expansion Plans

The successful Figure blockchain public offering provides the company with capital resources to accelerate growth initiatives and expand market reach. The funding will support technology development, market expansion, and strategic acquisition opportunities within the blockchain financial services sector.

Market Expansion Opportunities

Figure’s proven business model and technology platform create opportunities for expansion into new geographic markets and financial service categories. The public offering capital provides the resources necessary to execute ambitious growth strategies while maintaining operational excellence.

The company’s established relationships with institutional investors and financial partners provide a foundation for accelerated market expansion. This strategic positioning supports optimistic projections for the blockchain IPO Figure’s future performance.

Technology Development Initiatives

Continued investment in blockchain technology development remains central to Figure’s competitive strategy and long-term success. The IPO funding enables accelerated research and development efforts while maintaining focus on practical financial services applications.

The company’s commitment to innovation ensures continued relevance within the rapidly evolving blockchain technology landscape. This technological focus provides sustainable competitive advantages for the Figure blockchain IPO investment opportunity.

Conclusion

The Figure blockchain IPO’s success represents a watershed moment for the cryptocurrency and blockchain industry, demonstrating that innovative technology companies can achieve sustainable profitability while accessing traditional capital markets. Figure’s $787.5 million public offering at $25 per share provides validation for blockchain-based business models and creates a template for other digital asset companies seeking public market participation.

The combination of proven financial performance, innovative technology, and strong institutional backing positions Figure as a compelling investment opportunity within the expanding blockchain financial services market. As the cryptocurrency industry continues maturing, the Figure blockchain public offering serves as an important milestone in the sector’s evolution toward mainstream financial legitimacy.