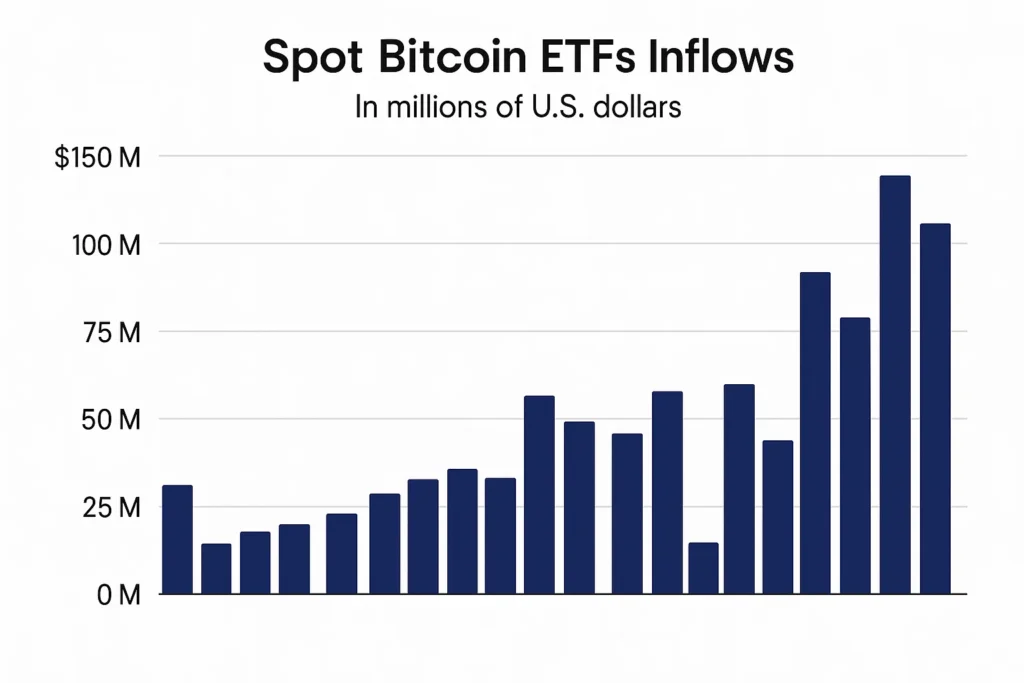

Spot bitcoin ETFs’ inflows reach an impressive $553 million in daily investments. This massive capital influx signals renewed institutional confidence in Bitcoin and marks a pivotal moment for digital asset adoption. The surge in spot bitcoin ETFs inflows represents one of the largest single-day investment flows since these exchange-traded funds gained regulatory approval.

Institutional investors are demonstrating unprecedented appetite for Bitcoin exposure through regulated investment vehicles. This renewed interest comes as market participants rotate capital back into Bitcoin, viewing it as a hedge against economic uncertainty and inflation concerns. The substantial spot bitcoin ETF inflows indicate that sophisticated investors are positioning themselves for potential long-term gains in the cryptocurrency space.

The record-breaking daily inflows highlight the growing mainstream acceptance of Bitcoin as a legitimate asset class. Financial advisors and institutional portfolio managers are increasingly recommending Bitcoin exposure through ETFs, making it easier for traditional investors to gain cryptocurrency exposure without directly holding digital assets.

$553 Million Daily Inflows Phenomenon

What Drives Massive Bitcoin ETF Investments

The spot bitcoin ETFs‘ inflows of $553 million didn’t occur in isolation. Several macroeconomic factors contributed to this significant capital rotation into Bitcoin-focused investment products. Institutional investors are responding to concerns about traditional asset valuations, currency debasement, and geopolitical uncertainties that make Bitcoin increasingly attractive as a store of value.

Market analysts point to several key drivers behind these substantial inflows. First, the Federal Reserve’s monetary policy stance has created an environment where investors seek alternative assets that could preserve purchasing power. Second, corporate treasuries are beginning to allocate portions of their cash reserves to Bitcoin through ETF structures, providing easier access than direct cryptocurrency purchases.

The timing of these spot bitcoin ETFs’ inflows coincides with improved regulatory clarity around digital assets. As compliance frameworks become more established, institutional investors feel more comfortable incorporating Bitcoin exposure into their portfolios through regulated ETF vehicles.

Institutional vs. Retail Investment Patterns

The composition of the $553 million in spot bitcoin ETFs inflows reveals interesting patterns about investor behavior. Institutional investors, including pension funds, endowments, and corporate treasuries, represent a significant portion of these flows. These sophisticated investors typically conduct extensive due diligence before making substantial allocations, suggesting long-term confidence in Bitcoin’s value proposition.

Retail investors are also contributing to the substantial inflows, though through different channels. Many individual investors prefer ETF structures because they provide Bitcoin exposure within existing brokerage accounts without requiring cryptocurrency wallets or direct exchange interactions. This accessibility factor has democratized Bitcoin investment for mainstream retail investors.

Financial advisors are increasingly recommending small Bitcoin allocations (typically 1-5% of portfolios) through ETF vehicles. This professional endorsement has helped drive consistent flows into spot bitcoin ETFs, creating a more stable demand base compared to speculative trading patterns seen in direct cryptocurrency markets.

Market Analysis: Capital Rotation Trends

From Traditional Assets to Digital Gold

The significant spot bitcoin ETFs inflows represent a broader capital rotation trend from traditional assets toward digital alternatives. Investors are increasingly viewing Bitcoin as “digital gold” – a scarce asset that could preserve value during periods of monetary expansion and economic uncertainty.

Bond markets have experienced outflows as yields remain compressed relative to inflation expectations. Some of this capital is flowing into alternative assets, including Bitcoin ETFs, as investors seek better risk-adjusted returns. The correlation between bond outflows and spot bitcoin ETFs inflows suggests institutional asset rebalancing rather than speculative investment.

Equity markets, while still attracting substantial flows, are seeing some allocation shifts toward alternative assets. Technology stock valuations have prompted some investors to diversify into cryptocurrency exposure through ETF structures, contributing to the record daily inflows.

Geographic Distribution of ETF Investments

The $553 million in spot bitcoin ETFs inflows comes from diverse geographic sources. North American investors represent the largest component, driven by established ETF markets and growing cryptocurrency acceptance among institutional investors. The regulatory framework in the United States has provided clarity that encourages institutional participation.

European investors are also contributing significantly to global Bitcoin ETF flows, though through different regulatory structures. The European Union’s Markets in Crypto-Assets (MiCA) regulation has created a framework that institutional investors find acceptable for cryptocurrency exposure.

Asian markets show growing interest in Bitcoin ETF products, particularly in jurisdictions with clear regulatory guidelines. While some Asian markets restrict direct cryptocurrency trading, ETF structures often provide acceptable alternatives for institutional Bitcoin exposure.

Investment Implications and Market Impact

How Record Inflows Affect Bitcoin Prices

The substantial spot bitcoin ETFs inflows create both immediate and long-term price implications for Bitcoin. Direct ETF purchases require underlying Bitcoin acquisitions, creating buying pressure in spot cryptocurrency markets. This mechanism helps translate ETF demand into actual Bitcoin price appreciation.

The $553 million daily inflow represents significant buying power in Bitcoin markets. When ETF providers purchase Bitcoin to back their shares, this creates sustained demand that supports price levels. Unlike speculative trading, ETF-driven demand tends to be more stable and long-term oriented.

Market liquidity patterns show that large spot Bitcoin ETF inflows can reduce available Bitcoin supply on exchanges. As ETF providers accumulate Bitcoin holdings, fewer coins remain available for trading, potentially amplifying price movements during periods of increased demand.

Portfolio Allocation Strategies for Bitcoin ETFs

Investment professionals are developing sophisticated strategies around Bitcoin ETF allocations. The record spot bitcoin ETFs inflows suggest that institutional investors are moving beyond experimental allocations toward meaningful portfolio weights. Many advisors recommend 1-5% Bitcoin exposure as a starting point for conservative portfolios.

Risk management considerations play a crucial role in Bitcoin ETF allocation decisions. The correlation between Bitcoin and traditional assets remains relatively low, providing diversification benefits that justify the allocation despite volatility concerns. During market stress periods, Bitcoin sometimes moves independently of traditional assets, offering portfolio protection.

Tax efficiency represents another advantage of ETF structures compared to direct Bitcoin ownership. Investors can gain cryptocurrency exposure while maintaining familiar tax reporting structures, making Bitcoin ETFs attractive for taxable investment accounts.

Regulatory Environment and Future Outlook

SEC Approval Impact on Investment Flows

The regulatory approval of spot bitcoin ETFs marked a watershed moment for cryptocurrency mainstream adoption. The Securities and Exchange Commission’s decision to approve these investment products removed a significant barrier for institutional investors who required regulated investment vehicles.

The approval process created investor confidence that translated into the substantial spot bitcoin ETF inflows we’re witnessing. Institutional investors who were previously unable to justify direct cryptocurrency exposure can now access Bitcoin through familiar ETF structures with appropriate regulatory oversight.

Compliance frameworks around Bitcoin ETFs provide institutional investors with the governance structures they require. These regulations ensure proper custody arrangements, transparent pricing mechanisms, and regular reporting that institutional investors demand from their investment vehicles.

Future Regulatory Developments

Additional regulatory clarity could further boost spot bitcoin ETFs’ inflows as more institutional investors gain approval for cryptocurrency allocations. Proposed regulations around digital asset custody, accounting treatment, and reporting requirements could streamline institutional adoption processes.

International regulatory harmonization efforts may create additional opportunities for Bitcoin ETF flows. As different jurisdictions develop compatible frameworks, cross-border institutional investment in Bitcoin ETFs could increase substantially.

The potential for retirement account eligibility represents a significant growth opportunity for Bitcoin ETFs. If regulatory changes allow 401(k) and IRA accounts to include Bitcoin ETF allocations, the addressable market for these products could expand dramatically.

Technical Analysis and Market Metrics

Trading Volume and Market Depth

The $553 million in spot bitcoin ETFs inflows corresponds with increased trading volumes across Bitcoin markets. Higher ETF demand creates additional trading activity as providers manage their underlying Bitcoin positions to maintain proper fund backing ratios.

Market depth measurements show improved liquidity conditions following substantial ETF inflows. As more institutional capital enters Bitcoin markets through ETF structures, bid-ask spreads tend to narrow, creating more efficient price discovery mechanisms.

The relationship between ETF flows and Bitcoin spot market activity demonstrates the growing integration between traditional finance and cryptocurrency markets. Large spot bitcoin ETF inflows often correlate with increased activity across major cryptocurrency exchanges.

Volatility Patterns and Risk Metrics

Bitcoin volatility characteristics are evolving as institutional investors increase their presence through ETF vehicles. The substantial spot bitcoin ETFs inflows suggest that institutional demand could help reduce extreme volatility over time by providing more stable, long-term oriented ownership.

Risk-adjusted return metrics for Bitcoin ETFs compare favorably to many traditional asset classes over medium to long-term periods. While short-term volatility remains elevated, the diversification benefits and potential returns attract institutional investors seeking alternative asset exposure.

Correlation analysis shows that Bitcoin maintains relatively low correlation with traditional assets, even as institutional adoption increases. This characteristic supports the investment thesis behind spot bitcoin ETFs’ inflows as portfolio diversification tools.

Investment Strategies and Best Practices

Dollar-Cost Averaging Through ETF Structures

Many investors contributing to the substantial spot bitcoin ETFs inflows employ dollar-cost averaging strategies to manage volatility risk. Regular, systematic investments help smooth out short-term price fluctuations while building Bitcoin exposure over time.

ETF structures facilitate automated investment strategies that would be more complex with direct Bitcoin ownership. Investors can establish regular purchase plans through their existing brokerage accounts, making Bitcoin investment as simple as traditional ETF investing.

The accessibility of Bitcoin ETFs enables retail investors to participate in the same investment strategies employed by institutions, contributing to the record spot bitcoin ETFs inflows. This democratization of investment approaches helps broaden Bitcoin’s investor base.

Risk Management and Position Sizing

Professional investors driving the $553 million spot bitcoin ETFs inflows typically employ sophisticated risk management techniques. Position sizing decisions consider Bitcoin’s volatility characteristics, correlation patterns, and potential impact on overall portfolio risk metrics.

Diversification across multiple Bitcoin ETF providers helps reduce counterparty risk while maintaining desired cryptocurrency exposure. Some institutional investors spread their Bitcoin allocations across several ETF products to minimize concentration risk.

Rebalancing strategies become important as Bitcoin positions appreciate or depreciate relative to other portfolio holdings. The substantial spot bitcoin ETF inflows suggest that many investors are systematically adjusting their cryptocurrency allocations as part of broader portfolio management approaches.

Global Economic Context and Bitcoin Adoption

Macroeconomic Factors Driving Investment Demand

The record spot bitcoin ETFs inflows occur within a complex macroeconomic environment characterized by inflation concerns, currency debasement fears, and geopolitical uncertainties. These factors create conditions that make Bitcoin attractive as an alternative store of value.

Central bank monetary policies worldwide have created environments where traditional safe-haven assets offer limited real returns after accounting for inflation. This situation encourages institutional investors to explore alternative assets, contributing to substantial Bitcoin ETF demand.

Geopolitical tensions and currency volatility in various regions drive demand for assets that operate independently of traditional financial systems. Bitcoin’s decentralized nature makes it attractive during periods of financial system stress, supporting continued spot bitcoin ETF inflows.

Corporate Treasury Adoption Trends

Corporate treasuries are increasingly considering Bitcoin allocations as part of cash management strategies. The accessibility of ETF structures makes it easier for companies to gain Bitcoin exposure without the operational complexities of direct cryptocurrency ownership.

Public companies that have announced Bitcoin treasury allocations often influence peer companies to consider similar strategies. This trend could drive additional institutional demand for Bitcoin ETFs as corporate adoption accelerates.

The $553 million daily spot bitcoin ETFs inflows may partially reflect corporate treasury diversification activities as companies seek alternatives to cash holdings that lose purchasing power during inflationary periods.

Conclusion

The remarkable $553 million in daily spot bitcoin ETFs inflows represents far more than a single day’s investment activity – it signals a fundamental shift in how institutional and retail investors approach cryptocurrency exposure. As capital continues rotating back into Bitcoin through regulated ETF structures, investors who understand these trends position themselves advantageously for the evolving digital asset landscape.

The substantial spot bitcoin ETFs inflows demonstrate that Bitcoin has achieved a level of mainstream acceptance that seemed impossible just a few years ago. Institutional investors, financial advisors, and sophisticated individuals are embracing Bitcoin exposure through familiar ETF structures, creating sustainable demand that supports long-term price appreciation.