The financial services industry is witnessing a groundbreaking transformation as traditional banking institutions embrace cutting-edge blockchain technology. In a landmark announcement that has sent ripples through the European banking sector, Wiener Bank’s blockchain alliance with Real Finance marks a pivotal moment in the evolution of digital banking services. This strategic partnership represents more than just a technological upgrade—it’s a bold step toward redefining how customers interact with financial institutions in the digital age.

The Wiener Bank blockchain alliance initiative demonstrates the Austrian banking giant’s commitment to innovation and customer-centric solutions. By partnering with Real Finance, a leading blockchain technology provider, Wiener Bank is positioning itself at the forefront of the digital banking revolution. This collaboration promises to deliver enhanced security, improved transaction efficiency, and unprecedented transparency in banking operations.

As traditional banking faces increasing pressure from fintech disruptors and changing consumer expectations, the Wiener Bank blockchain alliance serves as a blueprint for how established financial institutions can successfully navigate the transition to blockchain-based banking solutions. This partnership isn’t just about adopting new technology—it’s about reimagining the entire banking experience for the modern customer.

Wiener Bank Blockchain Alliance Strategy

The Foundation of Digital Banking Transformation

The Wiener Bank blockchain alliance with Real Finance builds upon a comprehensive strategy to modernise Austria’s banking infrastructure. This partnership leverages distributed ledger technology to create more secure, transparent, and efficient banking operations. The collaboration focuses on developing blockchain solutions that address critical banking challenges while maintaining regulatory compliance and customer trust.

Wiener Bank’s decision to forge this blockchain alliance stems from extensive market research and customer feedback, indicating a growing demand for digital banking solutions. The partnership with Real Finance provides access to cutting-edge blockchain expertise and proven technology platforms that can be seamlessly integrated into existing banking systems.

Key Components of the Blockchain Integration

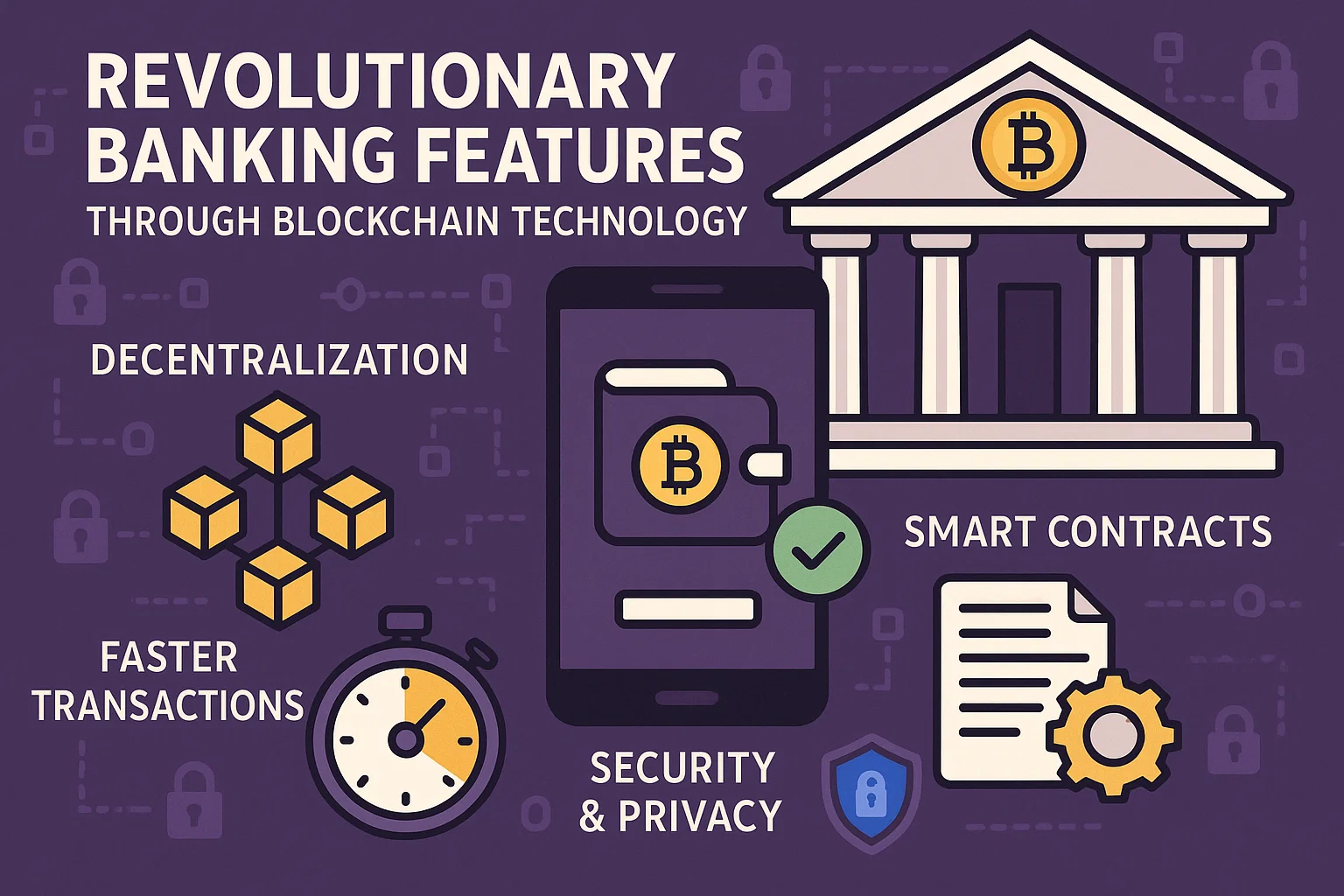

The Wiener Bank blockchain alliance encompasses several critical areas of banking operations. Smart contracts will automate routine banking processes, reducing processing times and minimising human error. Cryptocurrency integration will enable customers to manage both traditional and digital assets through a unified platform. Cross-border payments will benefit from blockchain’s ability to facilitate faster, cheaper international transactions.

Real Finance brings sophisticated blockchain infrastructure and development expertise to the partnership. Their proven track record in implementing enterprise-level blockchain solutions makes them an ideal partner for Wiener Bank’s digital transformation journey. The collaboration will focus on developing custom blockchain applications tailored to Wiener Bank’s specific operational requirements and customer needs.

Revolutionary Banking Features Through Blockchain Technolog

Enhanced Security and Fraud Prevention

The Wiener Bank blockchain alliance prioritises security enhancement through advanced cryptographic protocols and decentralised verification systems. Blockchain technology provides immutable transaction records, making it virtually impossible for fraudulent activities to go undetected. This enhanced security framework protects both customer assets and sensitive banking data.

Multi-signature authentication and biometric verification systems will be integrated into the blockchain platform, providing multiple layers of security for customer transactions. The decentralised nature of blockchain technology eliminates single points of failure, creating a more resilient banking infrastructure that can withstand cyber attacks and system failures.

Streamlined Transaction Processing

Traditional banking transactions often involve multiple intermediaries and lengthy processing times. The Wiener Bank blockchain alliance eliminates these inefficiencies by enabling direct peer-to-peer transactions through smart contracts. This streamlined approach significantly reduces transaction costs and processing times while maintaining the highest security standards.

Real-time settlement capabilities will transform how customers experience banking services. International wire transfers that previously took days to complete can now be processed within minutes. This improvement in transaction speed and efficiency provides Wiener Bank customers with a competitive advantage in today’s fast-paced business environment.

Impact on Customer Banking Experience

Digital Asset Management Solutions

The Wiener Bank blockchain alliance introduces comprehensive digital asset management capabilities that cater to the growing interest in cryptocurrency investments. Customers will have access to secure cryptocurrency wallets, real-time market data, and professional investment advisory services. This integration of traditional and digital banking services offers customers a comprehensive financial management solution.

Portfolio diversification opportunities expand significantly through blockchain integration. Customers can seamlessly move between traditional investments and cryptocurrency holdings while maintaining oversight through a single, unified platform. This comprehensive approach to asset management reflects the evolving needs of modern banking customers.

Improved Transparency and Accountability

Blockchain technology’s inherent transparency features enhance customer trust in banking operations. The Wiener Bank blockchain alliance provides customers with unprecedented visibility into transaction processes and fee structures. This transparency builds stronger relationships between the bank and its customers while demonstrating Wiener Bank’s commitment to ethical banking practices.

Immutable transaction records create a permanent audit trail that customers can access at any time. This level of transparency was previously unavailable in traditional banking systems and represents a significant advancement in customer service standards. The blockchain alliance ensures that all banking operations are conducted with the highest levels of accountability and transparency.

Regulatory Compliance and Risk Management

Navigating European Banking Regulations

The Wiener Bank blockchain alliance operates within the strict framework of European Union banking regulations and privacy laws. Both Wiener Bank and Real Finance have extensive experience in regulatory compliance, ensuring that all blockchain implementations meet or exceed current regulatory requirements. This proactive approach to compliance provides customers with confidence in the security and legality of blockchain banking services.

Anti-money laundering (AML) and know-your-customer (KYC) requirements are seamlessly integrated into the blockchain platform. Advanced analytics and machine learning algorithms monitor transactions for suspicious activities while maintaining customer privacy and data protection standards. This sophisticated approach to regulatory compliance demonstrates the maturity of the blockchain alliance’s risk management framework.

Risk Mitigation Strategies

Comprehensive risk assessment protocols form the foundation of the Wiener Bank blockchain alliance security framework. Multiple backup systems and disaster recovery procedures ensure continuous service availability even during system maintenance or unexpected technical issues. This robust risk management approach minimises potential disruptions to customer banking services.

Smart contract auditing and security testing protocols ensure that all blockchain applications meet enterprise-level security standards. Regular security assessments and penetration testing validate the effectiveness of security measures and identify potential vulnerabilities before they can be exploited. This proactive approach to risk management reflects the alliance’s commitment to maintaining the highest security standards.

Competitive Advantages in the Banking Sector

Market Differentiation Through Innovation

The Wiener Bank blockchain alliance creates significant competitive advantages in the increasingly crowded banking marketplace. Early adoption of blockchain technology positions Wiener Bank as an innovation leader, attracting tech-savvy customers and forward-thinking businesses. This market differentiation strategy helps Wiener Bank maintain its competitive position while expanding into new customer segments.

Cost reduction benefits from blockchain implementation can be passed on to customers through lower fees and improved service offerings. The efficiency gains from automated processes and reduced operational overhead enable Wiener Bank to offer more competitive pricing while maintaining healthy profit margins. This cost advantage strengthens Wiener Bank’s position in price-sensitive market segments.

Attracting Next-Generation Banking Customers

Digital natives and cryptocurrency enthusiasts represent a growing segment of the banking market. The Wiener Bank blockchain alliance appeals directly to these customers by offering services that align with their digital lifestyle preferences. This customer acquisition strategy enables Wiener Bank to build relationships with younger demographics, driving future growth in the banking industry.

Educational resources and customer support programs help traditional banking customers understand and adopt blockchain-based services. This comprehensive approach to customer onboarding ensures that the benefits of the blockchain alliance are accessible to all customer segments, not just technology enthusiasts. This inclusive strategy maximises the customer base that can benefit from blockchain banking innovations.

Future Expansion Plans and Development Roadmap

Phase-by-Phase Implementation Strategy

The Wiener Bank blockchain alliance follows a carefully planned implementation schedule that minimises disruption to existing banking operations while gradually introducing new blockchain capabilities. Initial phases focus on back-office operations and internal processes, allowing staff to become familiar with blockchain technology before customer-facing applications are launched.

Subsequent implementation phases will introduce customer-facing features, including cryptocurrency trading, enhanced mobile banking applications, and blockchain-based loan processing systems. This gradual rollout approach ensures that each new feature is thoroughly tested and optimised before being made available to customers. The phased implementation strategy reduces risks while maximising the benefits of blockchain technology adoption.

Long-term Vision for Blockchain Banking

The Wiener Bank blockchain alliance represents the first step in a comprehensive digital transformation journey. Future developments may include integration with other European banks’ blockchain networks, creating an interconnected financial ecosystem that benefits customers across multiple institutions. This collaborative approach to blockchain adoption could revolutionise European banking services.

Artificial intelligence and machine learning integration with blockchain platforms will create even more sophisticated banking services. Predictive analytics, automated investment advisory services, and personalised financial management tools will leverage blockchain’s security and transparency features to deliver unprecedented customer value. These advanced capabilities position the alliance for continued growth and innovation.

Industry Impact and Market Response

Influence on European Banking Standards

The Wiener Bank blockchain alliance is already influencing industry standards and best practices across the European banking sector. Other financial institutions are closely monitoring the partnership’s progress and considering similar blockchain adoption strategies. This industry influence extends Wiener Bank’s impact beyond its immediate customer base.

Regulatory bodies and industry associations are studying the alliance’s compliance frameworks and risk management approaches. The successful implementation of blockchain banking services by Wiener Bank and Real Finance could establish new benchmarks for industry standards and regulatory guidelines. This leadership position enhances Wiener Bank’s reputation and industry influence.

Investor and Stakeholder Reactions

Financial markets have responded positively to the Wiener Bank blockchain alliance announcement, with investors recognising the long-term growth potential of blockchain banking services. Stakeholder confidence in Wiener Bank’s strategic direction has strengthened, reflecting the market’s belief in the partnership’s potential for success.

Customer feedback and early adoption metrics indicate strong market acceptance of blockchain banking initiatives. Positive customer responses to pilot programs and beta testing phases validate the alliance’s customer-centric approach and market positioning strategy. This positive market response supports continued investment in the development of blockchain technology.

Technical Infrastructure and Implementation Details

Blockchain Platform Architecture

The Wiener Bank blockchain alliance utilises enterprise-grade blockchain infrastructure designed specifically for financial services applications. The platform architecture incorporates high-availability systems, scalable processing capabilities, and robust security protocols that meet the requirements of the banking industry. This technical foundation ensures reliable service delivery and supports future growth requirements.

Interoperability with existing banking systems was a critical consideration in platform selection and design. The blockchain infrastructure seamlessly integrates with Wiener Bank’s legacy systems while providing pathways for future system upgrades and replacements. This approach minimises implementation costs while maximising long-term flexibility and adaptability.

Data Management and Privacy Protection

Customer data protection remains a top priority throughout the Wiener Bank blockchain alliance implementation. Advanced encryption protocols and privacy-preserving technologies ensure that sensitive customer information is protected while enabling the transparency benefits of blockchain technology. This balanced approach addresses privacy concerns while leveraging the benefits of blockchain.

Data governance frameworks establish clear protocols for accessing, sharing, and retaining data. These frameworks ensure compliance with European data protection regulations while supporting the operational requirements of blockchain banking services. Comprehensive data management policies protect customer interests while enabling innovative service delivery.

Conclusion and Call to Action

The Wiener Bank blockchain alliance with Real Finance represents a transformative moment in European banking history. This groundbreaking partnership demonstrates how traditional financial institutions can successfully integrate blockchain technology while maintaining their commitment to security, compliance, and delivering exceptional customer service. The alliance creates new opportunities for customers to engage with both traditional and digital financial services through a unified, secure platform.

As the banking industry continues to evolve, the Wiener Bank blockchain alliance serves as a model for successful digital transformation. Customers, investors, and industry observers are witnessing the birth of a new era in banking services that combines the stability of traditional banking with the innovation of blockchain technology.