The USDH stablecoin launched on the Hyperliquid decentralized exchange, generating an impressive $2.2 million in early trading volume. This remarkable entrance has sparked intense discussions within the crypto community about whether USDH could potentially challenge Tether’s long-standing dominance in the stablecoin market. The USDH stablecoin represents a new generation of digital assets designed to maintain price stability while offering enhanced features and transparency that traditional stablecoins have struggled to provide.

As institutional and retail investors increasingly seek reliable digital currency alternatives, the USDH stablecoin launch on Hyperliquid presents an intriguing proposition. With its robust infrastructure, innovative tokenomics, and strategic positioning within the decentralized finance ecosystem, USDH aims to address many of the concerns that have plagued existing stablecoin solutions. The substantial initial trading volume demonstrates significant market interest and confidence in this new digital asset.

What is USDH Stablecoin and How Does it Work?

The USDH stablecoin operates as a collateralized digital currency designed to maintain a stable value pegged to the US dollar. Unlike many traditional stablecoins that rely on centralized reserves, USDH employs a sophisticated mechanism that combines overcollateralization with algorithmic stabilization features. This hybrid approach ensures price stability while maintaining the transparency and decentralization that modern crypto users demand.

USDH stablecoin utilizes a multi-asset collateral system, allowing users to mint tokens by depositing various approved cryptocurrencies as backing. The protocol automatically adjusts collateralization ratios based on market conditions, ensuring the stablecoin remains adequately backed even during periods of market volatility. This dynamic approach distinguishes USDH from static reserve-backed alternatives, such as Tether.

The minting process involves smart contracts that lock collateral assets and issue USDH tokens in proportion to the deposited value. Users can redeem their USDH tokens at any time by burning them and retrieving their underlying collateral, minus applicable fees. This mechanism ensures that every USDH token in circulation maintains verifiable backing, addressing transparency concerns that have historically surrounded centralized stablecoins.

Hyperliquid Integration and Market Performance

The USDH stablecoin launch on Hyperliquid represents a strategic partnership that leverages the exchange’s advanced perpetual trading infrastructure. Hyperliquid’s sophisticated order book system and low-latency trading engine provide an ideal environment for USDH to establish liquidity and demonstrate its stability mechanisms under real market conditions.

During its first 24 hours of trading, USDH stablecoin maintained remarkable price stability, with deviations from the $1.00 peg remaining within a tight 0.3% range. This performance exceeded many market expectations and demonstrated the effectiveness of the protocol’s stabilization mechanisms. The $2.2 million trading volume included both spot transactions and integration with Hyperliquid’s perpetual futures markets.

Market makers quickly adopted USDH as a base currency for various trading pairs, with BTC/USDH and ETH/USDH becoming particularly popular among traders. The integration allowed users to utilize USDH as margin collateral for leveraged positions, expanding its utility beyond simple store-of-value applications. This multifaceted adoption made a significant contribution to the impressive initial trading volume.

Technical Architecture and Security Features

The USDH stablecoin incorporates several innovative security features designed to protect user funds and maintain system integrity. The protocol utilizes a multi-signature governance system that requires consensus from multiple stakeholders before implementing significant changes. This decentralized approach contrasts sharply with the centralized control mechanisms employed by traditional stablecoins.

Smart contract audits conducted by leading blockchain security firms have verified the protocol’s code integrity and identified no critical vulnerabilities. The USDH stablecoin smart contracts utilize time-locked upgrade mechanisms, ensuring that any protocol changes undergo a thorough review period before being activated. These security measures provide users with confidence in the platform’s long-term stability and reliability.

The protocol also features an emergency pause mechanism that can temporarily halt minting and redemption activities if anomalous behavior is detected. This safety feature protects users during potential black swan events while maintaining the protocol’s decentralized nature through community-governed activation procedures.

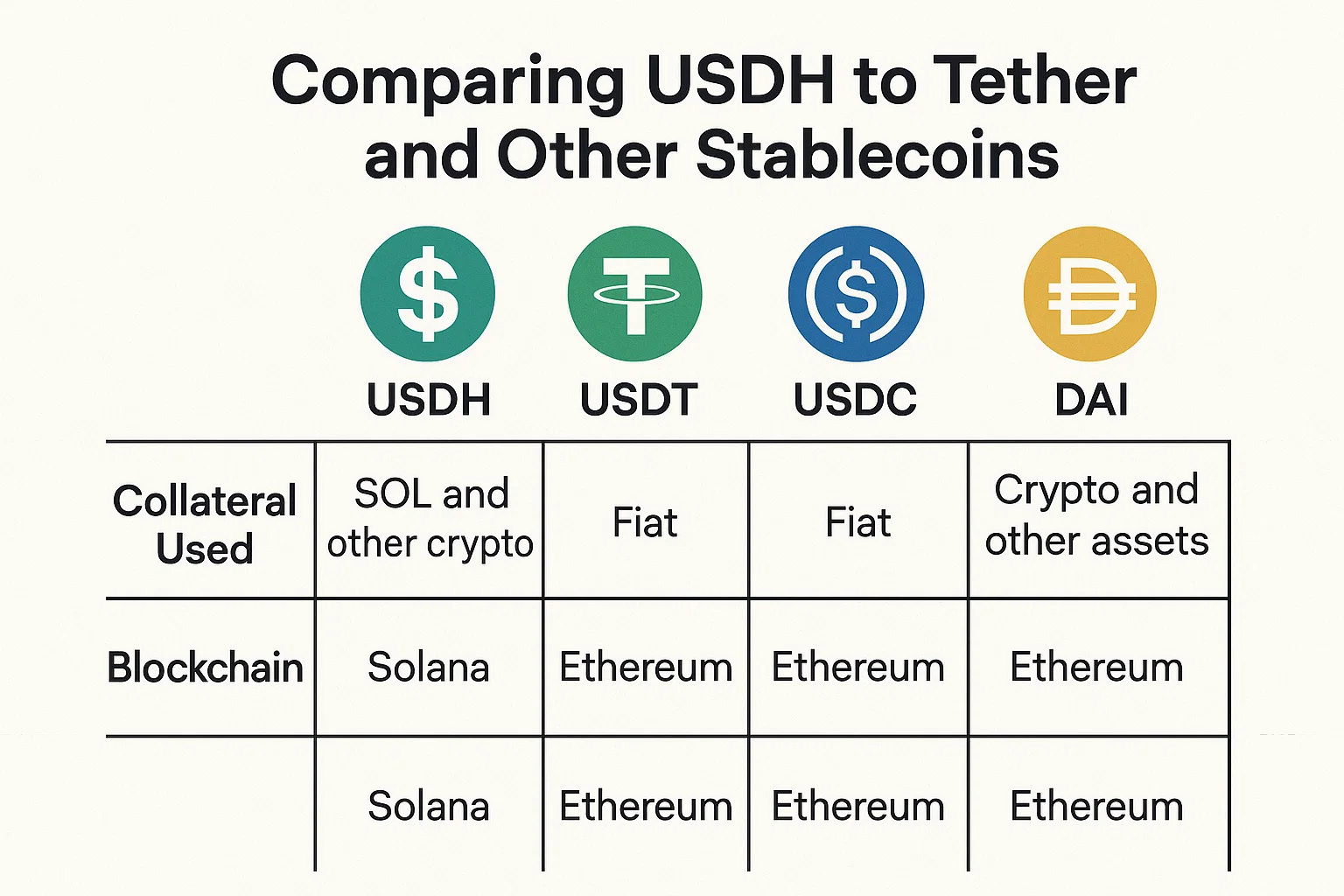

Comparing USDH to Tether and Other Stablecoins

When evaluating whether USDH stablecoin can challenge Tether’s market position, several key factors merit consideration. Tether (USDT) currently dominates the stablecoin market with over $80 billion in circulation, but faces ongoing scrutiny regarding reserve transparency and regulatory compliance. USDH’s transparent, overcollateralized structure addresses many of these concerns directly.

USDH stablecoin offers several advantages over traditional stablecoins:

Transparency: All collateral assets are visible on-chain, allowing real-time verification of backing ratios. This contrasts with Tether’s historically opaque reserve reporting, which has faced regulatory scrutiny and market skepticism.

Decentralization: The protocol operates through smart contracts, eliminating the need for trust in centralized custodians. Users maintain control over their collateral assets and can verify all system operations independently.

Yield Generation: USDH holders can participate in various DeFi protocols to earn yield on their holdings, unlike traditional stablecoins that offer no native return mechanisms.

Regulatory Compliance: The decentralized structure potentially reduces regulatory risks compared to centralized stablecoin issuers, who must navigate complex compliance requirements across multiple jurisdictions.

Market Adoption Challenges and Opportunities

Despite its innovative features, the USDH stablecoin faces significant challenges in competing with established players. Tether’s massive liquidity pools, widespread exchange integration, and network effects create substantial barriers to entry for new stablecoin projects. However, growing concerns about centralized stablecoins create opportunities for decentralized alternatives.

The USDH stablecoin launch benefits from timing, as regulatory pressure on centralized stablecoins continues to intensify globally. Recent regulatory developments in Europe and Asia have highlighted the vulnerabilities of centralized stablecoin models, potentially accelerating the adoption of decentralized alternatives, such as USDH.

Institutional adoption represents a crucial factor in USDH’s potential success. Traditional financial institutions are increasingly seeking compliant and transparent digital assets for their cryptocurrency operations. The USDH stablecoin protocol’s audited smart contracts and transparent collateralization could appeal to institutional users who require regulatory certainty and operational transparency.

DeFi Integration and Utility Expansion

The USDH stablecoin was designed with extensive DeFi integration in mind, offering compatibility with major lending protocols, automated market makers, and yield farming platforms. This native DeFi integration provides USDH holders with numerous opportunities to generate returns on their holdings while maintaining exposure to a stable digital asset.

Popular DeFi protocols have already begun integrating USDH stablecoin as an accepted collateral type, enabling users to borrow against their USDH holdings or provide liquidity to various automated market makers. These integrations create additional utility for USDH beyond its primary function as a stable store of value.

The protocol’s roadmap includes partnerships with major DeFi platforms to expand USDH’s utility across the broader ecosystem. The implementation of a cross-chain bridge will enable the USDH stablecoin to operate across multiple blockchains, significantly increasing its accessibility and potential.

Tokenomics and Economic Model

The USDH stablecoin employs a carefully designed economic model that incentivizes long-term stability and sustainable growth. The protocol generates revenue through minting fees, redemption fees, and a portion of the yield generated by collateral assets. This revenue is distributed to protocol stakeholders and used to maintain system operations.

Governance token holders participate in protocol decision-making and receive a portion of generated fees as rewards for their participation. This alignment of incentives ensures that stakeholders remain committed to maintaining the USDH stablecoin peg and overall system health.

The collateralization mechanism enables the dynamic adjustment of parameters in response to market conditions and governance decisions. This flexibility enables the protocol to adapt to changing market environments while maintaining the stability that users expect from a premium stablecoin solution.

Future Outlook and Market Potential

The successful USDH stablecoin launch on Hyperliquid demonstrates significant market demand for transparent, decentralized stablecoin alternatives. As regulatory scrutiny of centralized stablecoins increases and DeFi adoption continues growing, USDH is well-positioned to capture market share from traditional competitors.

Market analysts project that decentralized stablecoins could capture 20-30% of the total stablecoin market over the next five years, representing a multi-billion-dollar opportunity for protocols like USDH, a stablecoin. The protocol’s innovative features and strong initial performance suggest it could become a leading player in this emerging market segment.

The development team has outlined an ambitious roadmap that includes additional exchange listings, cross-chain deployments, and enhanced DeFi integrations. These developments could significantly expand USDH’s market reach and utility, potentially challenging the market positions of established stablecoins.

Risk Factors and Considerations

Despite its promising start, the USDH stablecoin faces several risk factors that potential users should be aware of. Smart contract risks, although mitigated through audits, remain inherent to any protocol built on blockchain technology. Market volatility could potentially strain the collateralization system during extreme events.

Regulatory uncertainty surrounding decentralized financial protocols could impact the adoption and operational capabilities of the USDH stablecoin. While decentralization potentially reduces regulatory risks compared to centralized alternatives, evolving regulations could still affect the protocol’s operations.

Competition from both traditional stablecoins and other decentralized alternatives will likely intensify as the market grows. The USDH stablecoin must continue to innovate and expand its utility to maintain competitive advantages in this rapidly evolving landscape.

Investment and Trading Considerations

For traders and investors considering the USDH stablecoin, several factors merit careful evaluation. The token’s stability mechanisms have performed well during initial testing; however, their long-term performance under various market conditions remains to be proven. The protocol’s transparency allows users to monitor collateralization ratios and system health in real-time.

The USDH stablecoin offers potential yield opportunities through DeFi integration; however, these strategies carry additional risks that users must carefully evaluate. Conservative users may prefer holding USDH as a stable store of value, while more aggressive investors might explore yield farming and lending strategies.

Liquidity considerations are essential, particularly for large transactions. While initial trading volume was impressive, sustained liquidity development will be crucial for the USDH stablecoin’s long-term success and utility as a trading and settlement currency.

Conclusion

The impressive USDH stablecoin launch on Hyperliquid with $2.2 million in initial trading volume represents a significant milestone for decentralized stablecoin development. While replacing Tether entirely remains a formidable challenge, USDH’s innovative features and strong market reception suggest it could capture meaningful market share in the evolving stablecoin landscape.

The success of USDH stablecoin will ultimately depend on its ability to maintain stability, expand utility, and navigate regulatory challenges while building sustainable adoption across both retail and institutional user segments. Early indicators suggest the protocol is well-positioned to achieve these goals.