The impact of the Fed’s Bitcoin policy on cryptocurrency markets has become increasingly significant as digital assets mature into mainstream financial instruments. With the Federal Reserve’s monetary policy decisions directly influencing global liquidity conditions, Bitcoin’s price movements are now more closely tied to traditional financial markets than ever before. As we approach 2025, understanding how Fed policy changes could drive Bitcoin prices higher requires examining the intricate relationship between central bank decisions, institutional adoption, and cryptocurrency market dynamics.

The Federal Reserve’s monetary policy stance has historically created ripple effects across all asset classes, and Bitcoin is no exception. Recent market analysis suggests that potential rate cuts and dovish policy shifts could create favourable conditions for Bitcoin’s price appreciation. This comprehensive analysis explores how the Bitcoin Fed policy impact could manifest in 2025, examining key factors that may drive prices to new heights.

Bitcoin Fed Policy Impact on Cryptocurrency Markets

How Federal Reserve Decisions Influence Bitcoin Prices

The Bitcoin Fed policy impact operates through several interconnected mechanisms that affect cryptocurrency valuations. When the Federal Reserve adjusts interest rates, it fundamentally alters the risk-reward profile of various investment options. Lower interest rates typically reduce the appeal of traditional fixed-income investments, prompting investors to turn to alternative assets, such as Bitcoin.

Monetary policy transmission effects on Bitcoin occur through multiple channels. First, interest rate changes affect the cost of capital for institutional investors and corporations considering Bitcoin allocations. When borrowing costs decrease, companies find it more attractive to finance Bitcoin purchases or include cryptocurrency in their treasury strategies.

The liquidity environment created by Fed policy decisions also plays a crucial role. Expansive monetary policy increases dollar liquidity in the financial system, often leading to inflation in asset prices across various markets. Bitcoin, with its fixed supply cap of 21 million coins, becomes particularly attractive due to concerns about currency debasement.

Quantitative Easing and Digital Asset Performance

Historical data reveals strong correlations between quantitative easing programs and Bitcoin price performance. During previous QE cycles, Bitcoin experienced significant appreciation as investors sought hedges against currency devaluation. The Bitcoin Fed policy impact during QE periods demonstrates how monetary stimulus can drive capital flows into scarce digital assets.

The mechanism works through portfolio rebalancing effects. As traditional bonds offer lower yields due to Federal Reserve purchases, institutional investors are increasingly considering Bitcoin as an uncorrelated asset that can provide portfolio diversification benefits. This institutional interest amplifies the impact of the Fed’s Bitcoin policy on price discovery.

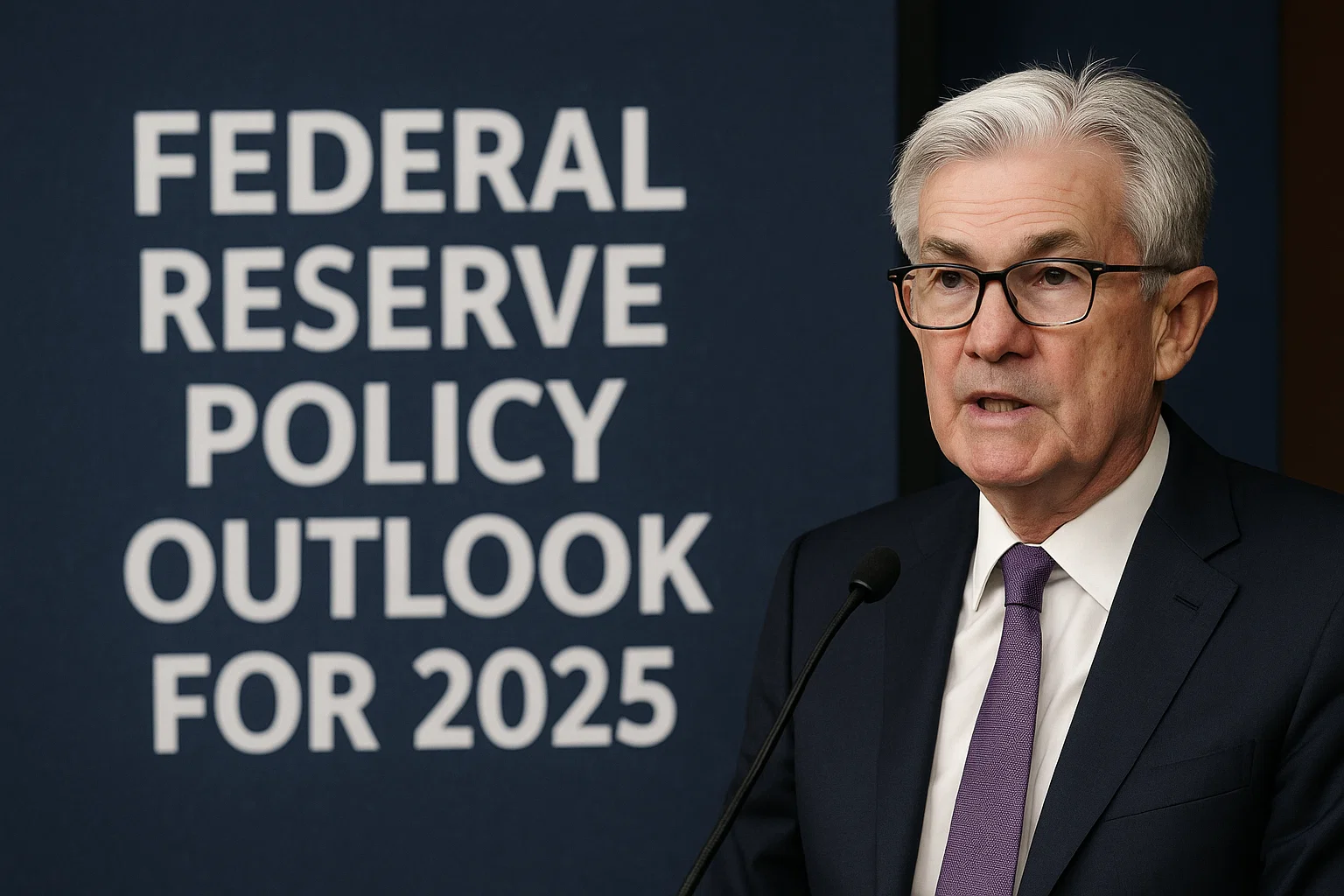

Federal Reserve Policy Outlook for 2025

Interest Rate Trajectory and Bitcoin Implications

Current Federal Reserve communications suggest a potential shift toward more accommodative monetary policy in 2025. Economic indicators pointing to slowing growth and moderating inflation could prompt the Fed to reduce interest rates, creating favourable conditions for Bitcoin appreciation.

The impact of the Fed’s Bitcoin policy becomes more pronounced during rate-cutting cycles because lower rates reduce the opportunity cost of holding non-yielding assets, such as Bitcoin. Additionally, concerns about currency debasement during periods of expansive monetary policy often drive investors toward Bitcoin as a store of value.

Market expectations for 2025 include potential rate cuts of 50-100 basis points, depending on economic conditions. Such policy shifts could trigger significant capital flows into Bitcoin, particularly from institutional investors seeking yield alternatives and inflation hedges.

Inflation Targeting and Bitcoin’s Role as Digital Gold

The Federal Reserve’s dual mandate of maintaining price stability and promoting full employment influences Bitcoin market dynamics through its impact on inflation expectations. As Bitcoin Fed policy impact analysis shows, periods of rising inflation concerns often coincide with increased Bitcoin adoption as investors seek inflation-resistant assets.

Bitcoin’s digital gold narrative gains strength when Fed policy suggests potential currency debasement. The cryptocurrency’s programmatic monetary policy, with predictable supply increases halving every four years, contrasts sharply with the discretionary central bank policies that can significantly expand the money supply.

Institutional Adoption Drivers Linked to Fed Policy

Corporate Treasury Strategies and Interest Rate Environment

The impact of the Bitcoin Fed policy on corporate adoption patterns has become increasingly evident as companies evaluate their treasury management strategies. Lower interest rates reduce returns on traditional cash equivalents, making Bitcoin’s volatility more acceptable relative to the opportunity cost of holding dollars.

Corporate Bitcoin adoption accelerated during the previous low-rate environment, with companies like Tesla, MicroStrategy, and Square adding Bitcoin to their balance sheets. Similar conditions in 2025 could trigger another wave of corporate adoption, thereby amplifying the impact of the Fed’s Bitcoin policy on price appreciation.

Treasury managers are increasingly viewing Bitcoin as a legitimate asset class for allocating surplus cash, particularly when traditional fixed-income investments offer minimal real returns. This institutional demand creates sustained buying pressure that can drive significant price increases.

Banking Sector Integration and Regulatory Clarity

Federal Reserve policy positions on digital assets influence banking sector engagement with Bitcoin. Recent regulatory developments suggest increasing acceptance of cryptocurrency services within traditional banking, creating new avenues for institutional Bitcoin exposure.

The Bitcoin Fed policy impact extends to custody services and prime brokerage offerings as banks develop infrastructure to serve institutional cryptocurrency clients. This infrastructure development reduces barriers to Bitcoin adoption among traditional financial institutions.

Regulatory clarity emerging from Fed policy positions helps institutional investors overcome compliance concerns that previously limited their exposure to Bitcoin. Clear regulatory frameworks encourage larger allocations and more sophisticated investment strategies in Bitcoin.

Technical Analysis: Bitcoin Price Predictions for 2025

Supply and Demand Dynamics

Bitcoin’s supply mechanics create unique dynamics that amplify the impact of the Fed’s policy on price formation. With approximately 19.7 million Bitcoins already mined and mining rewards halving every four years, new supply growth continues to decline, even as demand potentially increases due to favourable Fed policy.

Institutional demand projections for 2025 suggest continued growth in Bitcoin allocations among pension funds, endowments, and sovereign wealth funds. These large-scale buyers typically accumulate Bitcoin over extended periods, creating sustained demand pressure that interacts with Fed policy-driven market conditions.

The stock-to-flow model and other Bitcoin valuation frameworks suggest that a reduction in new supply, combined with increased institutional demand, could drive significant price appreciation. Federal Reserve policy that encourages risk asset allocation amplifies these underlying supply-demand dynamics.

Market Cycle Analysis and Fed Policy Alignment

Historical Bitcoin market cycles exhibit strong correlations with broader financial market conditions, which are influenced by Federal Reserve policy. The four-year Bitcoin halving cycle often aligns with broader economic cycles, creating compounding effects when Fed policy becomes accommodative.

Cycle timing analysis suggests that 2025 could represent an optimal convergence of Bitcoin’s internal supply dynamics with external monetary conditions. If Fed policy becomes more dovish while Bitcoin approaches its next halving event, the impact of Fed policy on Bitcoin could create exceptional price appreciation conditions.

Risks and Considerations

Policy Reversal Scenarios

While the Bitcoin Fed policy impact analysis suggests positive price drivers for 2025, potential policy reversals pose significant risks. If inflation resurges or economic conditions deteriorate differently than expected, the Federal Reserve might maintain restrictive monetary policy longer than anticipated.

Hawkish policy outcomes could reduce Bitcoin’s appeal relative to higher-yielding traditional investments. Interest rate increases typically strengthen the dollar and reduce appetite for risk assets, potentially limiting Bitcoin’s price appreciation despite its fundamental value propositions.

Regulatory and Geopolitical Factors

The impact of the Bitcoin Fed policy must be considered alongside broader regulatory developments and geopolitical tensions that could affect cryptocurrency markets. While Fed policy creates necessary market conditions, regulatory clarity and international adoption trends also significantly influence Bitcoin prices.

Central bank digital currencies (CBDCs) pose a potential competitive threat to Bitcoin, although their impact depends heavily on the implementation approaches and privacy considerations. Federal Reserve CBDC development could either complement or compete with Bitcoin adoption.

Investment Strategies for 2025

Portfolio Allocation Approaches

Understanding the impact of the Fed’s Bitcoin policy enables more sophisticated investment approaches for 2025. Dollar-cost averaging strategies can benefit from policy-driven volatility while reducing timing risks associated with Fed announcement cycles.

Strategic allocation models suggest that Bitcoin holdings of 1-5% in diversified portfolios can provide meaningful exposure to Fed policy-driven upside while managing overall portfolio risk. Institutional investors increasingly adopt such frameworks as the Bitcoin market infrastructure matures.

Timing Considerations and Market Entry Points

The Bitcoin Fed policy impact creates identifiable patterns around Federal Reserve meeting dates and policy announcements. Sophisticated investors monitor Fed communications for signals that could drive Bitcoin price movements, timing entries and exits accordingly.

Market sentiment analysis around Fed policy provides additional context for Bitcoin investment decisions. Understanding how policy expectations influence Bitcoin demand helps optimise investment timing and position sizing strategies.

Conclusion

The Bitcoin Fed policy impact represents a critical factor in cryptocurrency market dynamics as we approach 2025. Federal Reserve monetary policy decisions are likely to create favourable conditions for Bitcoin price appreciation through multiple channels, including reduced opportunity costs and increased institutional adoption as a store of value.

Investors seeking exposure to potential Bitcoin price appreciation in 2025 should carefully consider how Federal Reserve policy developments align with Bitcoin’s unique supply dynamics and growing institutional acceptance. The convergence of accommodative monetary policy with Bitcoin’s maturing market infrastructure could create exceptional opportunities for significant price appreciation.