The bitcoin-gold correlation increasingly strengthens between the world’s leading digital asset and humanity’s most established store of value. Bitcoin, once dismissed as purely speculative digital currency, is transitioning toward the same role that gold has occupied for centuries—serving as a reliable hedge against inflation and economic uncertainty. This shift in BTC gold correlation represents a fundamental evolution in how investors perceive Bitcoin within their broader portfolio strategies.

Bitcoin-gold correlation requires examining both the structural similarities between these assets and the market dynamics driving their synchronized movements. As central banks implement aggressive monetary policies and governments navigate economic challenges, both Bitcoin and gold have emerged as preferred defensive assets for investors seeking to protect wealth. The rising correlation between Bitcoin and gold demonstrates that cryptocurrency is maturing beyond its image as a speculative investment vehicle and establishing itself as a legitimate store of value alongside traditional precious metals.

The implications of this strengthening BTC gold correlation extend far beyond mere investment returns. This relationship signals a critical juncture in the broader adoption of cryptocurrencies within mainstream financial markets. As Bitcoin increasingly behaves like gold—responding to inflation concerns, geopolitical tensions, and currency devaluation fears—institutional and retail investors are reassessing their views on digital assets as portfolio components worthy of serious consideration.

What Is Bitcoin-Gold Correlation and Why It Matters

Bitcoin-gold correlation refers to the statistical relationship between Bitcoin price movements and gold price movements over specific time periods. Correlation is measured on a scale from -1 to +1, where positive correlation indicates that two assets tend to move in the same direction simultaneously. In contrast, negative or zero correlation suggests independence in price movements.

For years, Bitcoin and gold demonstrated minimal correlation or even negative correlation at times. Bitcoin moved according to technology adoption trends, regulatory news, and sentiment within cryptocurrency communities. Gold, conversely, responded to macroeconomic factors, interest rates, inflation expectations, and currency movements. This independence meant that holding both assets in a portfolio provided genuine diversification benefits.

The emerging BTC gold correlation is different. Recent market data indicate that the bitcoin-gold correlation has shifted into positive territory during critical economic periods. When inflation fears surge or geopolitical tensions escalate, both Bitcoin and gold tend to appreciate simultaneously. This parallel movement suggests that market participants increasingly view Bitcoin through the same defensive, store-of-value lens that has traditionally applied to precious metals.

Why Correlation Matters for Investors

The rise in bitcoin-gold correlation carries significant implications for portfolio construction and risk management. When correlation increases, the diversification benefits of holding both assets diminish. However, the strengthening correlation also validates Bitcoin’s transition from speculative asset to defensive store of value—a crucial milestone in cryptocurrency’s evolution toward mainstream acceptance.

Investors who previously viewed Bitcoin and gold as alternatives now recognize them as complementary components of a defensive portfolio allocation. This perceptual shift drives demand for Bitcoin from institutional investors who have historically been gold advocates, creating a self-reinforcing cycle where increasing institutional ownership further elevates Bitcoin-gold correlation.

The Historical Evolution of the Bitcoin-Gold Relationship

Understanding the current strength of the bitcoin-gold correlation requires examining how this relationship has developed over Bitcoin’s history.

Early Years: Minimal Correlation

In Bitcoin’s first decade (2011-2016), BTC gold correlation remained essentially zero. Bitcoin operated in isolation from traditional precious metals markets because cryptocurrency adoption was limited to tech enthusiasts and cryptocurrency believers. Gold continued responding to macroeconomic factors while Bitcoin responded to technology adoption news and regulatory developments. These different drivers meant their price movements showed no consistent relationship.

The Awakening Period: Growing Institutional Interest (2017-2020)

During the 2017 bull market and subsequent cycles, the bitcoin-gold correlation began to strengthen modestly. As Bitcoin attracted increasing institutional attention and gained recognition as a potential hedge against monetary debasement, the asset started responding more predictably to macroeconomic conditions similar to gold. The 2020 COVID-19 pandemic accelerated this trend as both Bitcoin and gold surged during periods of economic uncertainty and unprecedented monetary stimulus.

Modern Era: Strong Correlation (2021-Present)

The most recent period has witnessed the strongest bitcoin-gold correlation since Bitcoin’s inception. Following massive government stimulus, concerns about inflation, geopolitical tensions, and currency devaluation, Bitcoin has consistently moved alongside gold. When the Federal Reserve raised interest rates in 2022, both assets declined together. When recession fears mounted in 2023, both surged as safe-haven assets. This parallel movement indicates genuine convergence in how markets treat these assets.

Why Bitcoin and Gold Now Move Together: The Store of Value Evolution

The strengthening bitcoin-gold correlation reflects Bitcoin’s successful transition toward establishing itself as a legitimate store of value, a role that gold has maintained for millennia.

Bitcoin as Digital Gold

The concept of Bitcoin as “digital gold” has evolved from theoretical aspiration to practical reality. Bitcoin possesses several key characteristics that align with gold’s fundamental appeal: scarcity (21 million coins maximum), divisibility, portability primarily through digital networks, durability, and universal recognition of value. These shared attributes explain why the Bitcoin-gold correlation strengthens as markets recognize Bitcoin’s store-of-value properties.

Gold’s primary appeal stems from its fixed supply and inability to be manufactured or devalued through inflation. Similarly, Bitcoin’s fixed supply and transparent, immutable ledger provide comparable properties. As global monetary systems face criticism for currency debasement and negative real interest rates, both Bitcoin and gold benefit from investors’ desire to hold assets that preserve purchasing power regardless of government monetary policy.

Monetary Policy and Inflation Concerns

Modern central bank policies, characterized by low interest rates and quantitative easing, have dramatically elevated the appeal of assets that cannot be debased through monetary expansion. The Federal Reserve, European Central Bank, and other major institutions have maintained extraordinarily loose monetary policies despite inflationary pressures, creating the conditions where both Bitcoin and gold flourish.

When inflation concerns dominate market sentiment, investors seeking inflation hedges move capital into both Bitcoin and gold simultaneously. This coordinated buying pressure creates a strong positive bitcoin-gold correlation during inflationary periods. The inverse relationship between real interest rates and both Bitcoin and gold prices demonstrates that these assets respond similarly to monetary policy conditions.

Geopolitical Uncertainty and Safe-Haven Demand

Geopolitical tensions traditionally drive demand for gold as investors seek safe-haven assets during uncertain times. Increasingly, Bitcoin is joining gold as a geopolitical hedge. The 2022 Russia-Ukraine conflict and ongoing tensions in the Middle East demonstrated that Bitcoin tends to correlate with gold during geopolitical crises. Investors view bitcoin-gold correlation as rising during these periods because both assets benefit from demand for decentralized, seizure-resistant stores of value beyond government control.

Currency Devaluation Pressures

In countries experiencing currency crises or rapid devaluation, both Bitcoin and gold represent alternatives to deteriorating local currencies. Residents of countries with unstable monetary systems have historically purchased gold for wealth preservation. Increasingly, Bitcoin serves this function, particularly for younger populations and those in regions with limited physical gold access. This growing adoption pattern strengthens the bitcoin-gold correlation in emerging markets experiencing currency pressures.

Measuring Bitcoin-Gold Correlation: Data and Trends

Empirical evidence demonstrates the rising bitcoin-gold correlation through multiple measurement approaches and time periods.

Correlation Coefficient Analysis

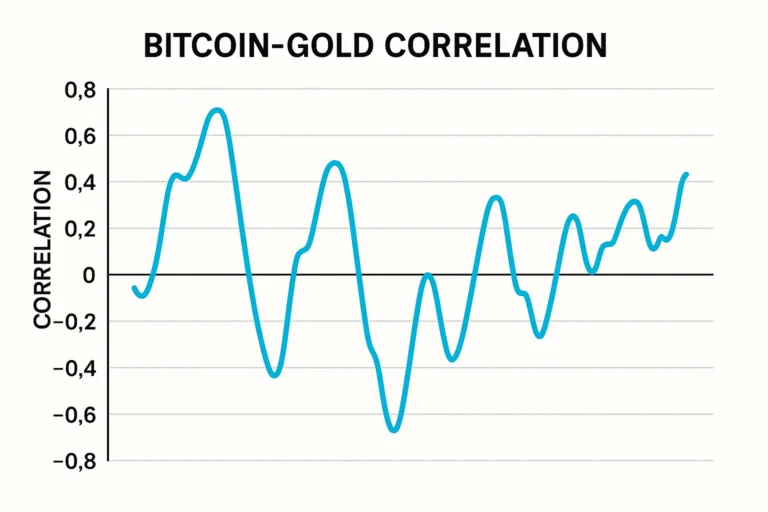

Statistical analysis of Bitcoin and gold returns over rolling time windows reveals the evolution of Bitcoin-gold correlation. In 2016-2018, correlation averaged approximately 0.1 to 0.3. By 2020-2021, correlation increased to 0.3-0.5 during volatile periods. Most recently, the bitcoin-gold correlation has exceeded 0.5 during major market disruptions, indicating increasingly synchronized movements.

These correlation coefficients demonstrate that the bitcoin-gold correlation strengthens precisely when investors most need hedging properties: during market stress, inflationary periods, and geopolitical crises. This inverse relationship—where the correlation is weaker during calm periods and stronger during turbulent periods—exactly mirrors how precious metals and other defensive assets behave, validating Bitcoin’s emergence as a store of value.

Bitcoin Outperformance Within the Correlation

While the bitcoin-gold correlation has strengthened, Bitcoin has substantially outperformed gold over longer time horizons. This outperformance reflects Bitcoin’s higher volatility, technological adoption curve, and network effects. However, the key insight is that when correlation is positive—meaning the movements are synchronized—Bitcoin tends to move more dramatically than gold in both directions. This amplified movement provides a higher return on capital allocation to Bitcoin without sacrificing the store-of-value properties that drive Bitcoin-gold correlation.

Volatility and Correlation Relationship

The relationship between bitcoin-gold correlation and overall market volatility reveals essential market dynamics. During low-volatility periods, Bitcoin tends to operate independently, responding to technology and adoption factors. During high-volatility periods, bitcoin-gold correlation spikes as investors categorize Bitcoin alongside gold as a defensive asset. This volatility-correlation relationship demonstrates that defensive positioning—the desire to hedge against macroeconomic risks—is the primary driver of bitcoin-gold correlation.

Store of Value Characteristics: Bitcoin Versus Gold

The convergence reflected in rising bitcoin-gold correlation stems from Bitcoin increasingly exhibiting the same store-of-value characteristics that made gold valuable for centuries.

Scarcity and Supply Dynamics

Gold’s appeal as a store of value depends critically on scarcity. There is only so much gold available in Earth’s crust, and extracting it becomes increasingly complex as easily accessible deposits deplete. This natural scarcity creates a supply floor that preserves value. Bitcoin replicates this characteristic through its 21 million coin hard cap, which is mathematically enforced through the protocol. This comparable scarcity explains why the bitcoin-gold correlation strengthens among investors seeking durable stores of value.

Divisibility and Fungibility

Gold can be divided into smaller units while maintaining value, and individual gold units are fungible (interchangeable). Bitcoin surpasses gold in divisibility—Bitcoin can be divided into satoshis (0.00000001 BTC units)—and maintains perfect fungibility through its cryptographic structure. These properties make Bitcoin easier to transact in while preserving the fungibility that supports gold’s store-of-value function.

Portability and Accessibility

Gold’s primary limitation as a store of value is its physical nature—it requires secure storage, insurance, and is difficult to transport. Bitcoin operates as digital gold, instantly transferable across any distance without intermediaries, insurance costs, or custody complications. This superior portability makes Bitcoin more practical as a modern store of value while preserving the core characteristics that give gold its enduring appeal. The practical advantages of Bitcoin’s portability, combined with its store-of-value properties, further strengthen the Bitcoin-gold correlation as adoption grows.

Universal Recognition and Liquidity

Both Bitcoin and gold maintain universal recognition as valuable assets, with deep, liquid markets that enable conversion to fiat currency at any time. This universal liquidity distinguishes both assets from alternative storage mediums and explains why they serve similar portfolio functions. The emergence of Bitcoin futures, spot exchange-traded funds, and institutional custody services mirrors the infrastructure that supports gold trading, enabling comparable trading volumes and price discovery.

Institutional Adoption and Its Impact on Bitcoin-Gold Correlation

The institutional embrace of Bitcoin has been instrumental in strengthening the Bitcoin-gold correlation by legitimizing the asset as a serious portfolio component.

Traditional Asset Managers Entering Bitcoin

Major asset management firms and investment banks have begun establishing Bitcoin trading desks, launching cryptocurrency funds, and incorporating digital assets into client portfolios. These institutional investors approach Bitcoin using the same analytical frameworks they apply to gold, as a defensive asset providing portfolio diversification and inflation hedging. This institutional adoption drives bitcoin-gold correlation by creating demand from investors who simultaneously hold both assets.

Corporate Treasury Allocations

Large corporations have begun adding Bitcoin to their balance sheets as treasury reserves, just as they have historically held gold. This corporate adoption validates Bitcoin’s store-of-value positioning and increases institutional-scale trading volumes that align with macroeconomic conditions. Companies perceiving Bitcoin and gold as functionally similar store-of-value assets contribute to rising Bitcoin-gold correlation through their allocation decisions.

Central Bank Interest

While central banks have not formally adopted Bitcoin as reserve assets at scale, their increasing research interest in digital assets and cryptocurrency technology signals recognition of blockchain’s fundamental importance. Should central banks eventually incorporate Bitcoin into reserve portfolios alongside gold, this would dramatically accelerate Bitcoin-gold correlation by creating massive institutional demand from the world’s most important financial institutions.

Insurance and Pension Funds

Insurance companies and pension funds managing long-term liabilities increasingly view Bitcoin as a portfolio component for achieving inflation protection and diversification goals. These sophisticated institutional investors, who have traditionally relied exclusively on gold for these functions, now implement strategies incorporating both assets. Their dual adoption strengthens the bitcoin-gold correlation as it reflects coordinated, systematic allocation decisions.

Bitcoin and Gold: Complementary Assets in Portfolio Strategy

The rising bitcoin-gold correlation does not diminish the value of holding both assets within a diversified investment strategy; rather, it enhances it.

Inflation Hedging Through Complementary Assets

During inflationary environments, both Bitcoin and gold typically appreciate as investors seek assets that preserve purchasing power. The complementary nature of these hedges provides redundancy—if one asset underperforms in terms of inflation, the other likely compensates. The strengthening bitcoin-gold correlation means investors can be more confident that their aggregate inflation hedge is robust, as both components tend to appreciate when inflation pressures mount.

Diversification Beyond Traditional Markets

While the bitcoin-gold correlation is positive, both assets maintain negative or minimal correlation with stock markets and bonds during economic stress. This makes them complementary even as their correlation to each other increases. Portfolio managers can use Bitcoin and gold together as defensive positions to diversify from traditional market volatility, relying on their collective Bitcoin-gold correlation to create a unified hedge.

Volatility Differences Create Strategic Advantages

Bitcoin’s higher volatility compared to gold creates an asymmetry within the rising bitcoin-gold correlation. Bitcoin moves more dramatically than gold in both directions, providing greater upside potential during risk-on environments while maintaining downside protection through the correlation with defensive gold. Sophisticated investors exploit this volatility differential, using gold as a stable anchor while allocating to Bitcoin for amplified returns within the shared store-of-value strategy.

Different Geographic Adoption Patterns

Gold maintains established liquidity and price discovery across global markets with no geographic preferences. Bitcoin adoption, while growing globally, shows concentration in technology-forward regions and markets with currency instability concerns. These different geographic distributions mean Bitcoin and gold can appreciate during different regional stress scenarios, providing proper diversification even as Bitcoin-gold correlation strengthens.

Challenges to Sustained Bitcoin-Gold Correlation

While rising bitcoin-gold correlation reflects Bitcoin’s maturation toward store-of-value status, several factors could disrupt this relationship.

Regulatory Risks Specific to Bitcoin

Harsh regulations targeting Bitcoin or cryptocurrency trading could depress Bitcoin prices while leaving gold unaffected, breaking the Bitcoin-gold correlation by introducing Bitcoin-specific downside pressures. Unlike gold, which faces minimal regulatory risk, Bitcoin remains subject to potential government restrictions that could alter its investment appeal. This regulatory asymmetry represents the primary risk to sustained bitcoin-gold correlation.

Technology Obsolescence Concerns

While gold faces no technological disruption risk, Bitcoin theoretically could be displaced by alternative cryptocurrencies or blockchain solutions. This technological risk premium, if it manifests through investor concerns, could weaken the bitcoin-gold correlation by introducing volatility specific to Bitcoin that gold does not experience. However, Bitcoin’s dominant network effects and established infrastructure make this risk increasingly unlikely.

Macro Factor Sensitivity Differences

Bitcoin and gold sometimes respond differently to specific macroeconomic developments. During periods of deflationary pressure accompanied by strong economic growth, gold may decline while Bitcoin appreciates due to technology adoption. Conversely, during periods of financial crisis accompanied by liquidity shortages, gold may outperform Bitcoin. These differential responses during specific macro scenarios could temporarily reduce bitcoin-gold correlation even as the long-term structural trend remains toward higher correlation.

Speculation Cycles in Bitcoin

Bitcoin remains subject to speculative cycles and technical trading patterns that gold largely avoids. During periods of excessive speculation in Bitcoin, the correlation may weaken as Bitcoin moves based on momentum rather than fundamental store-of-value characteristics. However, as Bitcoin’s investor base matures and becomes more long-term oriented, these speculative cycles should diminish, supporting sustained bitcoin-gold correlation.

The Future of Bitcoin-Gold Correlation

The trajectory of bitcoin-gold correlation offers insights into Bitcoin’s likely evolution within global financial markets.

Sustained Institutional Demand

Institutional investment in both Bitcoin and gold should continue growing, providing structural support for the Bitcoin-gold correlation. As more institutions implement allocation strategies incorporating both assets as store-of-value components, coordinated demand should keep the bitcoin-gold correlation elevated, particularly during periods when defensive positioning is optimal.

Potential for Stronger Correlation

As Bitcoin adoption matures and speculative elements diminish, Bitcoin-gold correlation could strengthen beyond current levels. A fully mature Bitcoin market, responding primarily to macroeconomic fundamentals rather than technology adoption sentiment, would likely exhibit stronger correlation with gold than currently observed. This progression would validate Bitcoin’s complete transition to store-of-value status.

Integration into Mainstream Financial Systems

As Bitcoin integrates more completely into mainstream financial infrastructure—through central bank digital currencies potentially incorporating Bitcoin elements, or through broader acceptance as collateral in financial systems—bitcoin-gold correlation should become increasingly stable and predictable. This integration would transform Bitcoin from an alternative asset to a standard portfolio component functioning alongside gold.

Potential Shifts in Gold’s Role

The rising Bitcoin-gold correlation ultimately suggests that Bitcoin is supplementing and potentially eventually partially replacing gold’s traditional role as the premier store of value. Digital gold offers superior portability, accessibility, and functionality compared to physical gold. Over decades, investors may gradually shift allocations from gold toward Bitcoin, potentially changing their correlation relationship as investors optimize their preferred storage medium.

Practical Implications for Different Investor Types

The rise of bitcoin-gold correlation carries different implications for various investor categories.

Retail Investors

Individual investors seeking inflation protection and portfolio diversification should recognize that the bitcoin-gold correlation means Bitcoin and gold now serve overlapping portfolio functions. Rather than viewing them as alternatives, retail investors can now employ both within a unified store-of-value strategy, adjusting allocations based on conviction in cryptocurrency’s long-term viability and risk tolerance for Bitcoin’s higher volatility.

Institutional Investors

Institutional investors managing large portfolios should incorporate an understanding of the bitcoin-gold correlation into their asset allocation models. The strengthening correlation means Bitcoin no longer provides complete diversification from gold, but rather enhances the store-of-value component of portfolio strategy. Institutions should allocate to Bitcoin based on store-of-value conviction rather than diversification benefits.

Hedge Funds and Active Traders

Active traders can exploit the volatility differential within rising bitcoin-gold correlation—using gold as a stable defensive anchor while actively trading Bitcoin’s amplified movements around the shared correlation trend. Understanding these dynamics enables sophisticated trading strategies that capitalize on the emerging relationship between these assets.

Financial Advisors

Financial advisors should educate clients about the bitcoin-gold correlation and its implications for portfolio strategy. The emergence of this correlation makes Bitcoin appropriate for clients seeking inflation hedges alongside gold, expanding Bitcoin’s relevant audience beyond technology enthusiasts to the broader investor base concerned with wealth preservation.

Conclusion

The rising bitcoin-gold correlation represents one of the most significant developments in cryptocurrency’s evolution from speculative asset to mainstream investment component. As BTC gold correlation strengthens, Bitcoin increasingly demonstrates the portfolio characteristics that have made gold valuable for centuries—providing inflation hedging, geopolitical protection, and wealth preservation regardless of government monetary policy.

The emergence of bitcoin-gold correlation validates the “digital gold” narrative and suggests that Bitcoin has successfully established itself as a legitimate store of value. This transformation took Bitcoin from a speculative technology asset to a defensive portfolio component deserving serious consideration alongside traditional precious metals. The practical and structural advantages Bitcoin offers over physical gold—superior portability, accessibility, and divisibility—position digital gold as an increasingly attractive alternative to traditional gold for modern investors.