The Ethereum price prediction 2026 has become one of the most searched topics among crypto enthusiasts and investors alike. Whether you’re a seasoned trader or someone considering their first cryptocurrency investment, understanding the potential trajectory of ETH is crucial for making informed decisions. This comprehensive analysis explores various factors that could influence Ethereum price prediction 2026, including technological advancements, market dynamics, regulatory developments, and expert forecasts. With Ethereum’s continuous evolution and its pivotal role in decentralized finance and Web3 applications, predicting its price range for 2026 requires careful examination of multiple variables that shape the cryptocurrency landscape.

Ethereum’s Current Market Position

Before diving into the Ethereum price prediction 2026, it’s essential to understand where Ethereum stands today in the cryptocurrency ecosystem. Ethereum has established itself as the second-largest cryptocurrency by market capitalization, trailing only Bitcoin. Unlike Bitcoin, which primarily serves as a store of value and digital currency, Ethereum functions as a decentralized platform that enables smart contracts and decentralized applications (dApps). This fundamental difference positions Ethereum uniquely in the market, as its value is intrinsically linked to the adoption and utilization of blockchain technology across various industries.

The current adoption rate of Ethereum spans across multiple sectors, including decentralized finance (DeFi), non-fungible tokens (NFTs), gaming, supply chain management, and enterprise solutions. Major corporations and financial institutions have begun exploring Ethereum’s potential, with many building infrastructure on or integrating with the Ethereum blockchain. This growing institutional interest signals confidence in Ethereum’s long-term viability and could significantly influence the Ethereum 2026 outlook. The network processes millions of transactions daily, hosts thousands of decentralized applications, and secures billions of dollars in total value locked across various DeFi protocols.

Key Factors Influencing Ethereum Price Prediction 2026

Technological Advancements and Network Upgrades

Ethereum’s roadmap through 2026 includes several crucial upgrades that could dramatically impact its price trajectory. The implementation of sharding, which is expected to roll out in phases, will significantly enhance the network’s scalability by allowing it to process thousands of transactions per second. This improvement addresses one of Ethereum’s most significant limitations and could attract more users and developers to the platform. Additionally, Layer 2 solutions like Optimism, Arbitrum, and zkSync are already reducing congestion and fees on the main network, making Ethereum more accessible and cost-effective for everyday users.

The continuous development of the Ethereum ecosystem demonstrates the community’s commitment to innovation and improvement. Proto-danksharding and eventually full danksharding are expected to further reduce transaction costs while maintaining security and decentralization. These technical enhancements aren’t just theoretical improvements; they directly impact Ethereum’s utility and, consequently, its value proposition. As the network becomes more efficient and user-friendly, demand for ETH could increase substantially, positively affecting the Ethereum price prediction 2026.

Regulatory Landscape and Institutional Adoption

The regulatory environment surrounding cryptocurrencies will play a pivotal role in determining Ethereum’s price trajectory toward 2026. Governments worldwide are developing frameworks to regulate digital assets, and clarity in this area could either catalyze or hinder cryptocurrency adoption. Favorable regulations that provide legal certainty while protecting investors could open the floodgates for institutional capital to flow into Ethereum. Conversely, overly restrictive regulations could dampen growth prospects. The classification of ETH as a commodity rather than a security in many jurisdictions has already provided some regulatory clarity, which is positive for long-term growth.

Macroeconomic Conditions and Market Sentiment

Broader economic conditions will undoubtedly impact cryptocurrency markets and the Ethereum price prediction for 2026. Factors such as inflation rates, interest rate policies, global economic growth, and geopolitical tensions all influence investor appetite for risk assets like cryptocurrencies. During periods of economic uncertainty, some investors view cryptocurrencies as alternative stores of value or hedges against inflation, while others perceive them as speculative assets to be avoided during turbulent times. Understanding these macroeconomic dynamics is essential for realistic price forecasting.

Market sentiment and crypto adoption trends will also significantly influence Ethereum’s price. The cryptocurrency market has historically experienced cycles of euphoria and despair, with sentiment often driving prices more than fundamentals in the short term. However, as the market matures and institutional participation increases, these cycles may become less extreme. The growing integration of blockchain technology into mainstream applications and services could create sustained demand for Ethereum regardless of speculative cycles. Consumer awareness and education about cryptocurrency benefits continue to expand, potentially broadening the investor base and supporting higher price levels by 2026.

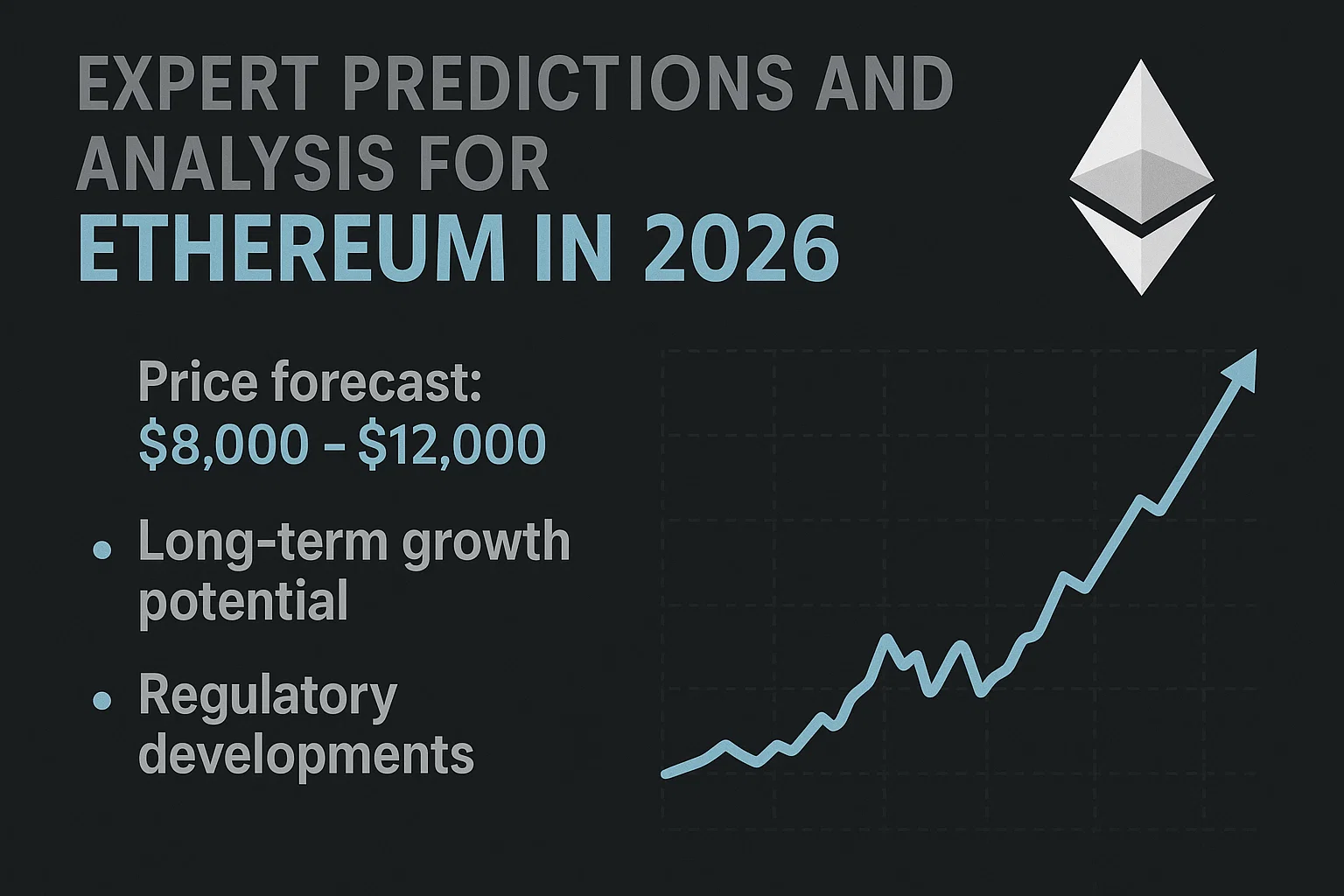

Expert Predictions and Analysis for Ethereum in 2026

Bullish Scenarios for ETH Price in 2026

Several analysts and forecasting platforms have published their Ethereum price prediction 2026 projections, with bullish scenarios painting an optimistic picture. Some crypto analysts predict that Ethereum could reach anywhere between $8,000 $15,000 by 2026 under favorable market conditions. These optimistic forecasts are predicated on several assumptions, including the successful implementation of all planned network upgrades, continued growth in the DeFi and NFT sectors, widespread institutional adoption, and a generally positive macroeconomic environment. The bullish case also assumes that Ethereum maintains its position as the leading smart contract platform and continues to capture the majority of blockchain development activity.

Proponents of higher price targets point to Ethereum’s deflationary tokenomics following the transition to proof-of-stake. With the implementation of EIP-1559, which burns a portion of transaction fees, and the reduction in new ETH issuance through staking rewards, Ethereum has become deflationary during periods of high network activity. This supply-side pressure, combined with increasing demand from various use cases, could create significant upward price momentum. Additionally, if the cryptocurrency market capitalization as a whole grows substantially by 2026, Ethereum would likely benefit proportionally or even outperform, given its fundamental utility and ecosystem strength.

Conservative and Realistic Price Estimates

More conservative analysts suggest that the Ethereum price prediction 2026 should account for potential headwinds and market corrections. Moderate projections place Ethereum’s price between $4,000 and $7,000 by 2026, representing significant growth from current levels but acknowledging the challenges and uncertainties that lie ahead. These estimates consider factors such as potential regulatory obstacles, competition from other blockchain platforms, technological setbacks, or broader market downturns that could temper Ethereum’s growth trajectory. A measured approach to price prediction recognizes that technological adoption often takes longer than anticipated and that markets don’t move in straight lines.

Conservative analysts also highlight the possibility of market consolidation where Ethereum maintains its leadership position but faces increased competition from more efficient or specialized blockchain platforms. In such scenarios, Ethereum might capture a smaller percentage of overall blockchain activity but still experience absolute growth as the entire crypto ecosystem expands. This nuanced view acknowledges both Ethereum’s strengths and the evolving competitive landscape, resulting in price predictions that reflect multiple possible outcomes rather than a single definitive forecast.

Bearish Considerations and Risk Factors

No comprehensive Ethereum price prediction 2026 analysis would be complete without examining potential bearish scenarios and risk factors. Several elements could negatively impact Ethereum’s price trajectory, including technological failures, security breaches, unexpected regulatory crackdowns, or the emergence of superior competing platforms. The cryptocurrency market’s inherent volatility means that significant price corrections are always possible, and Ethereum is not immune to broader market downturns. Some pessimistic forecasts suggest that Ethereum could trade below $3,000 in 2026 if multiple negative factors converge.

Technical risks include potential vulnerabilities in smart contract code, network congestion despite upgrades, or unforeseen complications with major protocol changes. While Ethereum has a strong track record of security and resilience, the complexity of continuous development and upgrades introduces inherent risks. Additionally, if Layer 2 solutions and competing blockchains successfully siphon away activity from the Ethereum mainnet without proportionally increasing demand for ETH itself, this could pressure prices downward. Understanding these risks is essential for maintaining realistic expectations about the ETH value projection.

Ethereum’s Role in the Broader Crypto Ecosystem

DeFi and Ethereum’s Dominance

Ethereum’s position as the backbone of decentralized finance (DeFi) significantly influences its price prospects through 2026. The DeFi sector has experienced explosive growth, with protocols for lending, borrowing, trading, and yield farming predominantly built on Ethereum. As of now, Ethereum hosts the vast majority of DeFi total value locked, demonstrating its critical importance to this burgeoning financial sector. The continued expansion of DeFi services, including more sophisticated financial instruments and broader accessibility, could drive substantial demand for ETH, positively impacting the Ethereum price prediction 2026.

The composability of Ethereum’s DeFi ecosystem creates network effects that strengthen its competitive position. Developers can build applications that interact seamlessly with existing protocols, creating an increasingly valuable and interconnected financial infrastructure. This “money lego” concept has resulted in innovative products that couldn’t exist on isolated platforms. As DeFi matures and potentially integrates with traditional finance (TradFi), Ethereum’s role as the foundational layer could become even more valuable. Real-world asset tokenization, decentralized identity solutions, and cross-border payment systems all rely heavily on Ethereum’s infrastructure.

NFTs, Gaming, and the Metaverse

The explosion of non-fungible tokens (NFTs) has demonstrated another significant use case for Ethereum, with the platform hosting the majority of NFT marketplaces and collections. While the NFT market experiences volatility and cycles of hype, the underlying technology has established legitimate use cases in digital art, collectibles, gaming assets, intellectual property rights, and identity verification. As the NFT ecosystem matures beyond speculative trading to utility-focused applications, sustained demand for Ethereum-based transactions could support higher prices through 2026.

Gaming represents one of the most promising growth areas for Ethereum adoption. Blockchain gaming introduces true ownership of in-game assets, play-to-earn models, and interoperability between different games and platforms. Major gaming companies are exploring blockchain integration, and if even a fraction of the massive gaming industry adopts Ethereum-based solutions, the network activity and ETH demand could increase substantially. The metaverse concept, while still largely theoretical, envisions interconnected virtual worlds where Ethereum could serve as the foundational economic layer, facilitating transactions, property ownership, and digital identity.

The convergence of NFTs, gaming, and metaverse applications creates multiple demand drivers for Ethereum that extend beyond traditional financial applications. As these sectors develop from nascent experiments to mature industries over the next few years, they could significantly influence the Ethereum 2026 outlook. The key question is whether Ethereum can scale sufficiently to support massive consumer adoption in these areas while maintaining reasonable transaction costs. Success in these consumer-facing applications could make Ethereum relevant to billions of users rather than millions, fundamentally transforming its value proposition.

Investment Strategies Considering Ethereum Price Prediction 2026

Long-Term Holding and Dollar-Cost Averaging

For investors bullish on the Ethereum price prediction 2026, a long-term holding strategy combined with dollar-cost averaging presents a measured approach to building ETH positions. Dollar-cost averaging involves investing fixed amounts at regular intervals regardless of price, which helps mitigate the impact of volatility and removes the pressure of timing the market perfectly. This strategy is particularly well-suited to cryptocurrency markets, where predicting short-term price movements is notoriously difficult, but long-term trends may be more discernible. By consistently accumulating ETH over time, investors can build substantial positions while averaging out the effects of market fluctuations.

Risk Management and Portfolio Allocation

Prudent investors considering the Ethereum price prediction 2026 must implement proper risk management strategies. Cryptocurrency should typically represent only a portion of a diversified investment portfolio, with the specific allocation depending on individual risk tolerance, investment timeline, and financial circumstances. Financial advisors often suggest limiting cryptocurrency exposure to 5-10% of investable assets for most retail investors, though this varies based on personal factors. Within cryptocurrency allocations, diversifying across multiple assets rather than concentrating entirely in Ethereum can further reduce risk.

Risk management also involves setting stop losses or having predetermined exit strategies for various scenarios. While stop-losses in highly volatile cryptocurrency markets can be challenging to implement effectively, having mental frameworks for when to reduce positions can prevent emotional decision-making during market stress. Similarly, establishing profit-taking targets helps investors lock in gains and avoid the temptation to hold indefinitely in search of perfectly timed exits. These disciplined approaches acknowledge that the ETH price forecast remains uncertain regardless of analytical rigor.

Staking and Yield Generation Opportunities

The transition to proof-of-stake has created opportunities for ETH holders to generate yield through staking, which could enhance returns beyond price appreciation. Staking involves locking up ETH to help secure the network and validate transactions, earning rewards in return. Current staking yields typically range from 3-5% annually, depending on network conditions and the total amount staked. For long-term holders planning to maintain ETH positions through 2026, staking provides additional return potential that compounds over time and could significantly improve overall investment performance relative to simply holding.

Various staking options exist with different risk-return profiles. Direct staking through running a validator node offers maximum rewards but requires technical knowledge and at least 32 ETH. Liquid staking solutions through platforms like Lido or Rocket Pool allow smaller holders to participate while maintaining liquidity through derivative tokens. Centralized exchange staking offers convenience but introduces counterparty risk. Each option has tradeoffs that investors should carefully evaluate based on their circumstances and comfort levels. The ability to generate yield while awaiting the Ethereum price prediction 2026 to materialize makes holding ETH potentially more attractive than non-yielding assets.

Comparing Ethereum with Competing Blockchain Platforms

Ethereum’s Competitive Advantages

When evaluating the Ethereum price prediction 2026, understanding Ethereum’s competitive advantages is essential. Ethereum benefits from substantial network effects, with the largest developer community, the most deployed smart contracts, and the highest number of decentralized applications among all blockchain platforms. This ecosystem advantage creates a moat that competitors struggle to overcome, as developers prefer building where users already exist, and users gravitate toward platforms with the most applications. The first-mover advantage in smart contract platforms has proven remarkably durable despite years of competition.

The continuous innovation within the Ethereum ecosystem, driven by a robust research community and significant funding through the Ethereum Foundation and grants programs, ensures ongoing development and improvement. Unlike some blockchain projects that launched with fixed designs, Ethereum evolves through regular upgrades that incorporate cutting-edge research. This adaptive approach positions Ethereum to integrate technological breakthroughs and address emerging challenges. The combination of established dominance, philosophical coherence, and ongoing innovation forms the foundation of optimistic Ethereum 2026 outlook projections.

Competition from Alternative Layer 1 Blockchains

Despite Ethereum’s advantages, competition from alternative Layer 1 blockchains poses real challenges to its dominance. Platforms like Solana, Cardano, Avalanche, and others offer different tradeoffs in the blockchain trilemma of scalability, security, and decentralization. Some competitors process transactions significantly faster and cheaper than Ethereum’s base layer, attracting developers and users seeking better performance. During periods when Ethereum experiences congestion and high gas fees, alternative platforms can capture meaningful market share and mindshare.

The “multi-chain” thesis suggests that no single blockchain will dominate entirely, with different platforms optimizing for specific use cases or user preferences. In this scenario, Ethereum might maintain leadership in high-value, security-critical applications like DeFi and enterprise solutions while ceding market share in gaming, NFTs, or consumer applications to faster competitors. This potential fragmentation of the blockchain ecosystem could limit Ethereum’s growth relative to a winner-take-all scenario, affecting the upper bounds of the Ethereum price prediction 2026.

Technical Analysis and Historical Price Patterns

Historical Bull and Bear Cycles

Examining Ethereum’s historical price patterns provides context for the ETH price forecast, though past performance doesn’t guarantee future results. Ethereum has experienced several major bull and bear cycles since its launch in 2015, with each cycle exhibiting certain characteristics. Bull markets have typically been driven by technological breakthroughs, increased adoption, and broader cryptocurrency market enthusiasm. Bear markets have followed periods of overextension, often triggered by regulatory concerns, security incidents, or macroeconomic headwinds affecting risk assets broadly.

The 2017 bull run saw Ethereum rally from under $10 to nearly $1,400 as initial coin offerings (ICOs) exploded in popularity, with most projects launching on Ethereum. The subsequent bear market saw ETH decline over 90% to approximately $80 by late 2018. The 2020-2021 bull cycle, fueled by DeFi summer and NFT mania, pushed Ethereum to an all-time high near $4,800 before another substantial correction. These cycles demonstrate both the tremendous upside potential and severe downside risks inherent in Ethereum investing. Understanding cyclical patterns helps investors maintain realistic expectations about the Ethereum 2026 outlook.

Real-World Adoption and Enterprise Use Cases

Corporate and Institutional Integration

The increasing integration of Ethereum into corporate and institutional operations provides strong fundamental support for price appreciation through 2026. Major corporations across various industries are exploring or implementing Ethereum-based solutions for supply chain tracking, digital identity verification, tokenization of assets, and more. Enterprise Ethereum, which can involve private or hybrid implementations that interact with the public mainnet, demonstrates blockchain’s value beyond cryptocurrency speculation. As more Fortune 500 companies adopt Ethereum technology, the perceived legitimacy and utility of ETH increase, potentially attracting more conservative investors.

Government adoption, though slower than private sector integration, also contributes to Ethereum’s legitimacy. Some governments have explored Ethereum for digital identity systems, land registries, or even central bank digital currencies (CBDCs) infrastructure. While governments remain cautious about cryptocurrencies, their acknowledgment of blockchain utility and specific engagement with Ethereum validates the technology’s real-world value. Continued expansion of corporate, institutional, and governmental Ethereum use cases through 2026 would significantly strengthen the fundamental case for ETH appreciation.

Tokenization of Real-World Assets

The tokenization of real-world assets on Ethereum represents a potentially transformative use case that could significantly impact the ETH value projection for 2026. Tokenization involves creating blockchain-based representations of physical or traditional financial assets, including real estate, commodities, art, stocks, bonds, and more. Ethereum’s programmability and established ecosystem make it well-suited for this application. Tokenization promises benefits like fractional ownership, increased liquidity, reduced transaction costs, and 24/7 global markets for traditionally illiquid assets.

Environmental Considerations and Sustainability

Ethereum’s Transition to Proof-of-Stake

Environmental concerns about cryptocurrency energy consumption have been a significant criticism, particularly regarding proof-of-work chains like Bitcoin. Ethereum’s successful transition to proof-of-stake through The Merge in September 2022 dramatically reduced its energy consumption by approximately 99.95%, effectively neutralizing this criticism. This environmental improvement removes a major obstacle to institutional adoption, as many corporations and investment funds face ESG (Environmental, Social, and Governance) mandates that previously precluded cryptocurrency investments. The sustainability credentials now associated with Ethereum could attract ESG-focused capital, positively influencing the Ethereum price prediction 2026.

Beyond simply reducing energy consumption, the Ethereum community has explored carbon offset initiatives and sustainability-focused projects built on the platform. Some DeFi protocols incorporate carbon credits, and NFT projects fund environmental causes. This conscious approach to environmental responsibility resonates with younger investors and organizations prioritizing sustainability. As ESG considerations become more central to investment decisions through 2026, Ethereum’s environmental positioning could become a significant driver of adoption and price appreciation, distinguishing it from less sustainable blockchain alternatives.

The Role of Ethereum 2.0 Upgrades Through 2026

Sharding and Scalability Improvements

The implementation of sharding represents perhaps the most significant remaining upgrade in Ethereum’s roadmap, with the potential to impact the ETH price forecast dramatically. Sharding will divide the Ethereum network into multiple parallel chains (shards), each capable of processing transactions and smart contracts independently. This architectural change could increase Ethereum’s transaction throughput from current levels to potentially tens of thousands of transactions per second. Such scalability improvements would enable Ethereum to support mainstream consumer applications serving millions or billions of users simultaneously.

Conclusion

As we’ve explored throughout this comprehensive analysis, the Ethereum price prediction 2026 encompasses a wide range of possibilities, reflecting both tremendous opportunities and significant uncertainties. Bullish scenarios envision Ethereum reaching $8,000 to $15,000 or potentially higher, driven by successful technological upgrades, widespread adoption across DeFi, NFTs, gaming, enterprise applications, favorable regulations, and continued institutional interest. More conservative projections place Ethereum between $4,000 and $7,000, acknowledging challenges from competition, potential regulatory obstacles, and the inherent uncertainties of technological adoption.

The factors influencing Ethereum’s price trajectory through 2026 are complex and interconnected. Technological development, particularly the successful implementation of sharding and continued Layer 2 growth, will be crucial. Regulatory clarity that enables rather than restricts innovation could unlock institutional capital flows. Macroeconomic conditions, including inflation trends, interest rates, and global economic growth, will affect investor appetite for risk assets like cryptocurrency.

Read More: Ethereum On-chain Transparency Alliance: 7 Protocols Unite