The global banking landscape is witnessing a transformative shift as traditional financial institutions embrace digital innovation. Standard Chartered Hong Kong’s blockchain initiatives represent one of the most ambitious moves by a multinational bank to position itself at the forefront of cryptocurrency and distributed ledger technology. The London-headquartered banking giant has identified Hong Kong as the strategic epicenter for its blockchain operations, signaling a major commitment to digital asset services in Asia’s financial powerhouse. This strategic decision comes at a time when regulatory frameworks are evolving, institutional adoption is accelerating, and the demand for cryptocurrency banking services continues to surge across the Asia-Pacific region.

Standard Chartered’s blockchain ambitions extend beyond mere experimentation. The bank is building comprehensive infrastructure to serve institutional clients, retail investors, and corporate treasuries seeking exposure to digital assets. With Hong Kong’s progressive regulatory approach and its status as a global financial hub, Standard Chartered’s Hong Kong blockchain strategy positions the institution to capture significant market share in the rapidly expanding digital economy.

Why Standard Chartered Chose Hong Kong for Blockchain Expansion

Hong Kong’s emergence as a cryptocurrency-friendly jurisdiction has attracted global financial institutions seeking to establish legitimate digital asset operations. The city’s Securities and Futures Commission (SFC) has implemented comprehensive licensing frameworks for virtual asset service providers, creating regulatory clarity that institutional banks require before committing substantial resources.

Standard Chartered Hong Kong’s blockchain operations benefit from several strategic advantages. The city’s established financial infrastructure, deep liquidity pools, and proximity to mainland China create unique opportunities for blockchain-based cross-border payment solutions. Hong Kong serves as a natural bridge between Western capital markets and Asian growth economies, making it ideal for pioneering cryptocurrency custody services and tokenization platforms.

The Hong Kong Monetary Authority (HKMA) has actively promoted fintech innovation through initiatives like the Faster Payment System and regulatory sandboxes. These government-backed programs have reduced barriers to entry for blockchain experimentation, allowing banks like Standard Chartered to test innovative products before full-scale deployment. The city’s competitive tax regime and English common law system further enhance its appeal as a blockchain operations hub.

Regulatory Framework Supporting Blockchain Banking

Hong Kong’s regulatory environment strikes a balance between innovation and investor protection. The SFC’s licensing regime requires virtual asset trading platforms to implement robust anti-money laundering controls, custody arrangements, and cybersecurity measures. This structured approach aligns perfectly with Standard Chartered’s risk management culture and compliance standards.

The regulatory clarity extends to tokenized securities, stablecoins, and custody services. Hong Kong authorities have distinguished between different categories of digital assets, applying appropriate oversight to each classification. This nuanced approach enables Standard Chartered Hong Kong blockchain teams to develop specialized products for institutional clients without navigating ambiguous legal terrain.

Standard Chartered’s Blockchain Product Suite

The bank’s blockchain strategy encompasses multiple product categories designed to meet diverse client needs. Digital asset custody represents a cornerstone service, providing institutional-grade security for cryptocurrency holdings. Standard Chartered’s custody solution incorporates cold storage, multi-signature wallets, and insurance coverage, addressing the primary concerns of institutional investors hesitant to self-custody digital assets.

Standard Chartered’s Hong Kong blockchain infrastructure supports cryptocurrency trading and brokerage services for qualified clients. The bank facilitates spot transactions in major cryptocurrencies, including Bitcoin, Ethereum, and select altcoins, leveraging its foreign exchange expertise to provide competitive pricing and deep liquidity. Trading services integrate seamlessly with custody offerings, creating a comprehensive digital asset management platform.

Tokenization services represent another strategic focus area. The bank assists corporate clients in issuing blockchain-based securities, transforming traditional assets like real estate, private equity, and debt instruments into digital tokens. This tokenization capability unlocks fractional ownership, improves secondary market liquidity, and reduces settlement times from days to minutes.

Cross-Border Payment Innovation

Blockchain technology revolutionizes international payments by eliminating intermediary banks and reducing transaction costs. Standard Chartered Hong Kong blockchain payment corridors enable real-time settlement between Asian and European markets, significantly improving working capital efficiency for importers and exporters. The bank utilizes both public blockchains and permissioned networks depending on client requirements and regulatory considerations.

Stablecoin integration enhances payment efficiency by combining blockchain speed with fiat currency stability. Standard Chartered has partnered with leading stablecoin issuers to facilitate instant cross-border transfers denominated in US dollars, euros, and Hong Kong dollars. These partnerships position the bank as a bridge between traditional banking rails and decentralized finance ecosystems.

Smart contract automation further streamlines trade finance processes. The bank implements programmable payment conditions that trigger automatic settlements upon fulfillment of predefined criteria, reducing documentary verification requirements and accelerating capital turnover for supply chain participants.

Institutional Demand Driving Blockchain Adoption

Asset managers, hedge funds, and family offices increasingly demand access to cryptocurrency markets through regulated banking channels. Standard Chartered Hong Kong blockchain services address this institutional demand by providing compliant onramps for digital asset investment strategies. The bank’s established reputation and regulatory licenses overcome institutional hesitancy associated with unregulated cryptocurrency exchanges.

Corporate treasuries represent another growing client segment. Multinational corporations with exposure to volatile emerging market currencies utilize Bitcoin and stablecoins as hedging instruments and cross-border payment mechanisms. Standard Chartered’s blockchain platform enables treasurers to diversify currency risk while maintaining banking-grade security and regulatory compliance.

Sovereign wealth funds and pension funds have begun allocating small portfolio percentages to digital assets as alternative investments. These ultra-conservative institutions require banking partners with impeccable credentials and risk management capabilities. Standard Chartered’s Hong Kong blockchain infrastructure meets these exacting standards, facilitating institutional participation in cryptocurrency markets previously dominated by retail speculators.

Retail Banking and Blockchain Integration

While institutional services dominate current offerings, Standard Chartered is gradually introducing blockchain capabilities to retail banking segments. Wealth management clients with substantial portfolios can access cryptocurrency investment products through private banking channels. These curated offerings provide exposure to digital assets within diversified investment portfolios managed according to traditional wealth management principles.

The bank explores blockchain-based loyalty programs and remittance services for retail customers. Tokenized rewards points could enable seamless conversion across merchant ecosystems, while blockchain remittances would reduce fees for overseas workers sending funds to family members in developing markets.

Competitive Landscape in Blockchain Banking

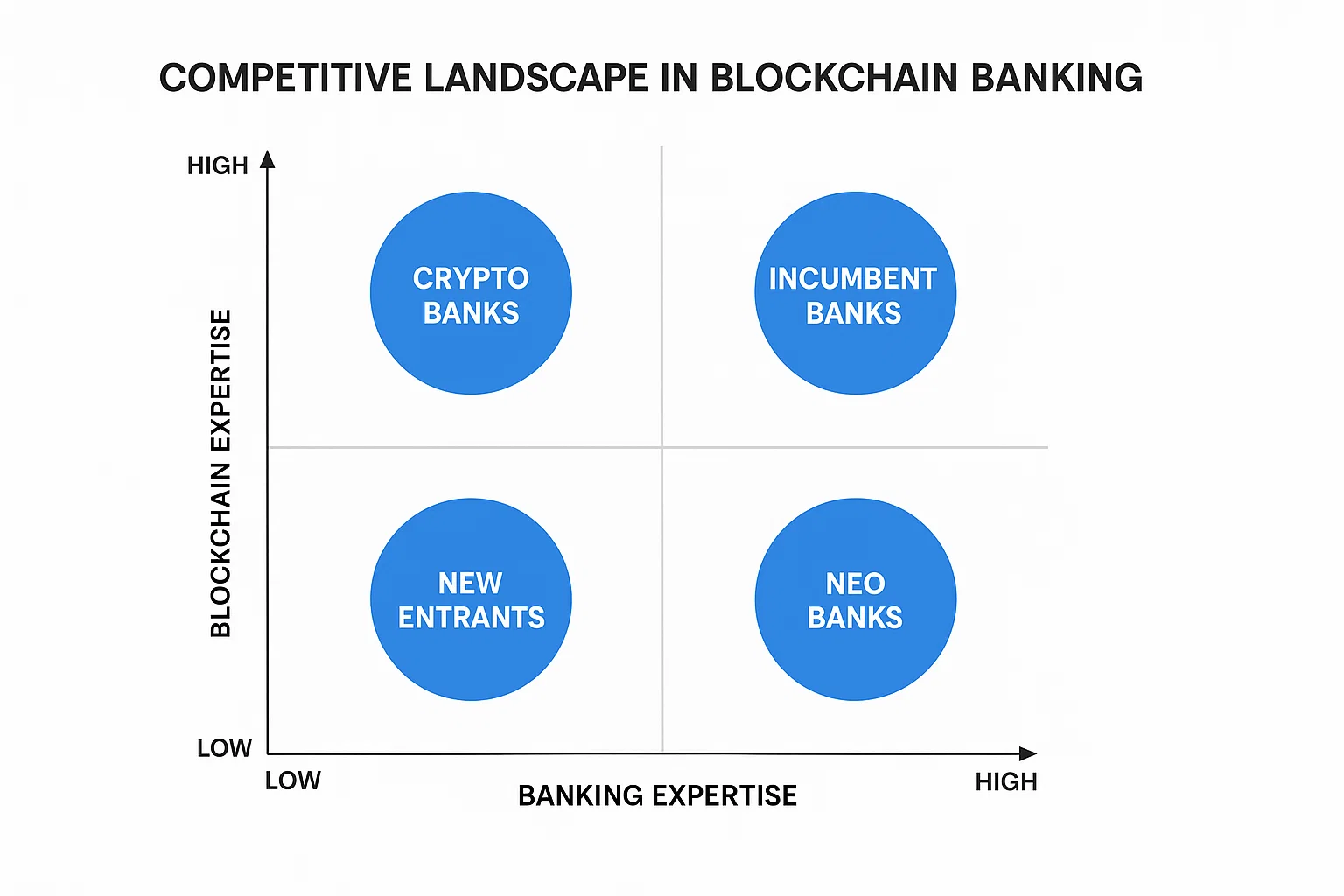

Standard Chartered faces competition from both traditional banks and cryptocurrency-native institutions. HSBC, DBS Bank, and Bank of China have announced blockchain initiatives targeting similar client segments. However, Standard Chartered Hong Kong’s blockchain strategy differentiates through aggressive product development timelines and comprehensive service integration.

Cryptocurrency exchanges like Binance and Coinbase have applied for Hong Kong licenses, threatening to capture market share through superior user experiences and broader asset coverage. Traditional banks counter with regulatory compliance, established client relationships, and integration with conventional banking services. The competitive dynamic will likely produce hybrid models combining fintech innovation with banking stability.

Digital asset banks like Sygnum and SEBA have pioneered full-service blockchain banking in Switzerland and Singapore. These specialized institutions demonstrate market viability but lack the global distribution networks and balance sheet capacity of multinational banks. Standard Chartered’s Hong Kong blockchain platform leverages existing infrastructure while incorporating best practices from digital-native competitors.

Partnership Strategy and Ecosystem Development

Strategic partnerships accelerate blockchain capability development without requiring complete in-house technology builds. Standard Chartered collaborates with blockchain infrastructure providers for custody technology, trading platforms, and compliance tools. These partnerships enable rapid deployment while maintaining operational control and risk management oversight.

The bank participates in industry consortia developing blockchain standards for trade finance, securities settlement, and regulatory reporting. Collective industry efforts reduce duplicative development costs and promote interoperability between competing blockchain platforms. Standard Chartered Hong Kong blockchain teams actively contribute to technical standards that will govern future digital asset markets.

Fintech accelerators and venture capital investments expose the bank to emerging technologies and potential acquisition targets. Early-stage investments provide strategic insights into blockchain innovation trends while generating financial returns if portfolio companies achieve success.

Technical Infrastructure and Security Measures

Blockchain banking requires enterprise-grade infrastructure combining distributed ledger technology with traditional banking security protocols. Standard Chartered Hong Kong blockchain operations utilize hybrid cloud architectures, separating public blockchain interactions from sensitive customer data systems. This architectural approach maintains regulatory compliance while enabling participation in decentralized networks.

Cybersecurity measures exceed typical banking standards, given the irreversible nature of blockchain transactions. Multi-factor authentication, hardware security modules, and behavioral analytics protect against unauthorized access. The bank maintains comprehensive insurance coverage for digital asset custody, addressing residual risks despite extensive security controls.

Disaster recovery and business continuity planning account for blockchain-specific scenarios, including network forks, smart contract vulnerabilities, and oracle failures. Standard Chartered’s Hong Kong blockchain infrastructure incorporates redundant node operators, transaction monitoring systems, and emergency response procedures addressing digital asset-specific risks.

Blockchain Technology Selection

The bank utilizes multiple blockchain protocols depending on use case requirements. Public blockchains like Ethereum provide transparency and interoperability for tokenized securities and DeFi integrations. Permissioned networks like Hyperledger Fabric offer enhanced privacy for institutional clients requiring confidential transaction processing.

Layer-2 scaling solutions address public blockchain limitations around transaction throughput and cost. Standard Chartered implements Polygon, Arbitrum, and other scaling technologies, enabling cost-effective smart contract execution without sacrificing security guarantees of underlying base layers.

Interoperability protocols facilitate asset transfers across disparate blockchain networks. Standard Chartered Hong Kong’s blockchain platform supports cross-chain bridges, enabling clients to move assets between Ethereum, Binance Smart Chain, and other major ecosystems according to optimal execution requirements.

Regulatory Compliance and Risk Management

Anti-money laundering compliance presents unique challenges in blockchain banking due to pseudonymous addresses and decentralized protocols. Standard Chartered implements blockchain analytics tools tracking cryptocurrency flows and identifying suspicious transaction patterns. These monitoring systems integrate with traditional AML platforms, creating comprehensive oversight across fiat and digital asset operations.

Know-your-customer verification applies uniformly across blockchain services, with enhanced due diligence for high-risk client segments and transaction types. Standard Chartered Hong Kong blockchain onboarding processes verify ultimate beneficial ownership, source of funds, and intended cryptocurrency usage before activating digital asset accounts.

Market risk management addresses cryptocurrency volatility through position limits, margin requirements, and hedging strategies. The bank’s risk frameworks incorporate digital asset correlations, liquidity constraints, and settlement risks specific to blockchain markets. Stress testing scenarios model extreme price movements and liquidity crises to ensure capital adequacy under adverse conditions.

Governance and Oversight Structure

Board-level oversight ensures blockchain initiatives align with overall strategic objectives and risk appetite. Standard Chartered’s blockchain governance committee includes representatives from technology, compliance, risk management, and business units, fostering cross-functional collaboration and accountability.

Internal audit functions conduct regular assessments of blockchain operations, evaluating control effectiveness and regulatory compliance. Standard Chartered Hong Kong’s blockchain audit programs address smart contract code reviews, custody procedures, and operational resilience testing. External auditors validate financial reporting accuracy for digital asset positions and revenue recognition from blockchain services.

Future Roadmap and Strategic Vision

Standard Chartered’s blockchain ambitions extend well beyond current product offerings. The bank envisions comprehensive digital asset investment banking services, including cryptocurrency initial public offerings, tokenized debt issuances, and blockchain-based merger advisory. These capital markets capabilities would position Standard Chartered Hong Kong’s blockchain division as a full-service digital investment bank.

Central bank digital currencies represent a potential transformation of monetary systems. Standard Chartered participates in CBDC pilot programs, positioning itself as a commercial bank distributor when retail and wholesale CBDCs achieve widespread deployment. Hong Kong’s e-HKD initiative provides testing grounds for digital currency integration with existing banking infrastructure.

Decentralized finance integration offers opportunities to earn yield on client deposits and access alternative lending markets. Standard Chartered’s Hong Kong blockchain teams explore DeFi protocols offering institutional-grade security and regulatory compliance, potentially channeling bank liquidity into decentralized lending pools and automated market makers.

Artificial Intelligence and Blockchain Convergence

AI-powered trading algorithms could optimize cryptocurrency portfolio management and execution strategies. Standard Chartered’s quantitative research teams develop machine learning models analyzing blockchain data, sentiment indicators, and macroeconomic factors to generate alpha in digital asset markets.

Natural language processing applications extract insights from blockchain governance forums, developer communications, and social media discourse. These alternative data sources supplement traditional financial analysis, providing early warning signals about protocol upgrades, security vulnerabilities, and market sentiment shifts.

Economic Impact and Industry Transformation

Blockchain technology promises to reshape global finance by reducing intermediation costs, improving transparency, and expanding financial inclusion. Standard Chartered Hong Kong’s blockchain initiatives contribute to this transformation by legitimizing cryptocurrency markets through banking participation and institutional adoption.

Cross-border payment efficiency improvements benefit international trade by reducing transaction costs and settlement delays. Small and medium enterprises gain access to global markets previously limited to large corporations with established banking relationships. Blockchain-enabled supply chain finance democratizes working capital access across diverse business sizes and geographies.

Financial asset tokenization unlocks trillions of dollars in illiquid assets, including real estate, fine art, and private company equity. Fractional ownership models enable retail investors to participate in asset classes historically reserved for ultra-wealthy individuals and institutional investors. Standard Chartered’s Hong Kong blockchain tokenization platform facilitates this democratization while maintaining regulatory safeguards.

Employment and Skills Development

Blockchain banking creates new employment categories, including digital asset analysts, blockchain developers, cryptocurrency traders, and compliance specialists. Standard Chartered invests in employee training programs, developing blockchain literacy across the organization. These workforce development initiatives prepare traditional bankers for digital finance careers while attracting technology talent from fintech and cryptocurrency industries.

Hong Kong benefits from Standard Chartered’s blockchain expansion through high-value job creation and knowledge economy development. The city’s universities collaborate with financial institutions on blockchain research, curriculum development, and graduate recruitment programs. This ecosystem approach strengthens Hong Kong’s position as a leading blockchain innovation center.

Challenges and Obstacles Ahead

Regulatory uncertainty remains a persistent challenge despite Hong Kong’s progressive framework. Global regulatory coordination lags behind technology development, creating compliance complexity for banks operating across multiple jurisdictions. Standard Chartered Hong Kong blockchain operations must navigate divergent regulatory approaches in Europe, the United States, Singapore, and Middle Eastern markets.

Technology risks, including smart contract vulnerabilities, blockchain network congestion, and quantum computinthreatsats require continuous monitoring and mitigation. The bank invests heavily in cybersecurity talent and infrastructure to maintain robust defenses against evolving threat landscapes.

Market volatility and speculative excesses periodically undermine cryptocurrency credibility. Banking involvement in digital assets exposes institutions to reputational risks if crypto markets experience severe crashes or high-profile fraud scandals. Standard Chartered’s Hong Kong blockchain risk management protocols aim to insulate core banking operations from cryptocurrency market turbulence.

Customer Education Requirements

Retail and institutional clients require extensive education about digital asset risks, custody responsibilities, and tax implications. Standard Chartered develops comprehensive educational resources, including webinars, white papers, and personalized advisory services. Informed clients make better investment decisions and maintain realistic expectations about cryptocurrency performance and volatility.

Conclusion

The banking industry stands at an inflection point where blockchain technology transitions from experimental novelty to core financial infrastructure. Standard Chartered Hong Kong’s blockchain strategy positions the institution at the forefront of this transformation, leveraging Hong Kong’s regulatory clarity and strategic location to build comprehensive digital asset capabilities.

Success in blockchain banking requires balancing innovation with risk management, regulatory compliance, and customer protection. Standard Chartered’s measured approach combines institutional credibility with progressive technology adoption, creating sustainable competitive advantages in emerging digital finance markets.

Read More: IBM Digital Asset Haven Platform Enterprise Blockchain Solution