Bitcoin’s worst month in 2022 comparisons dominate financial headlines. Digital asset investors are witnessing price volatility reminiscent of the devastating crypto winter that shook the industry nearly three years ago. As Bitcoin struggles to maintain its footing, market analysts are drawing parallels between current conditions and the collapse that saw major platforms fail and billions of dollars evaporate from the ecosystem. Understanding what’s driving this downturn and how it compares to historical crashes is crucial for anyone holding digital assets or considering entering the market during these uncertain times.

Current Bitcoin Market Decline

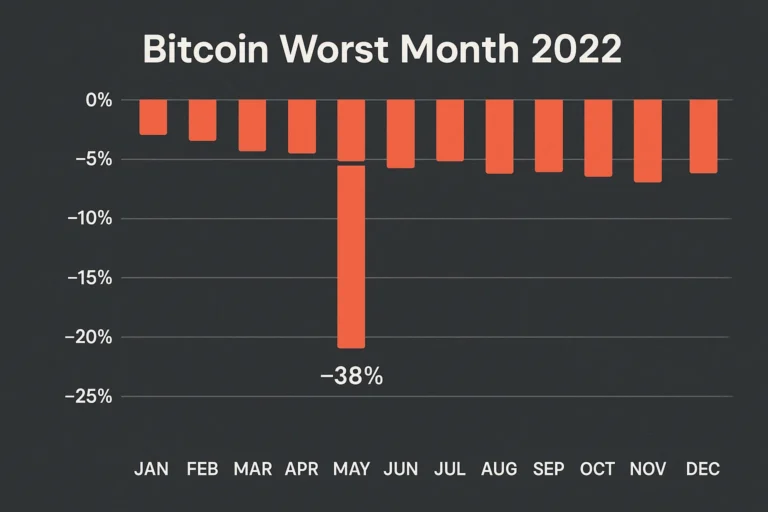

The current market conditions have sent shockwaves through the cryptocurrency community, with Bitcoin experiencing its most significant monthly decline since the dramatic events of 2022. During that period, the crypto market witnessed the collapse of major players, including FTX, Three Arrows Capital, and Celsius Network, triggering a cascade effect that erased trillions in market capitalization.

What’s Driving Bitcoin’s Recent Price Drop

Multiple factors are converging to create perfect storm conditions for Bitcoin’s worst month performance. Macroeconomic pressures, including persistent inflation concerns and central bank policies, continue to weigh heavily on risk assets. The Federal Reserve’s monetary stance remains a critical factor, as higher interest rates traditionally reduce appetite for speculative investments like cryptocurrencies.

Regulatory uncertainty has intensified across major markets, with governments worldwide tightening oversight of digital asset exchanges and cryptocurrency operations. This regulatory pressure creates additional selling pressure as institutional investors reassess their exposure to crypto assets.

Market liquidity has also deteriorated significantly, with trading volumes declining across major exchanges. This reduced liquidity amplifies price movements, creating more volatile conditions that can trigger cascading liquidations and margin calls.

Comparing Today’s Decline to the 2022 Crypto Collapse

The 2022 crypto collapse was characterized by systemic failures within the cryptocurrency ecosystem itself. Major lending platforms collapsed due to unsustainable business models and excessive leverage. FTX’s spectacular implosion revealed fraudulent practices and misuse of customer funds, while Terra/LUNA’s algorithmic stablecoin failure wiped out approximately $40 billion in value within days.

Today’s decline, while severe, differs in its origins. Rather than internal crypto ecosystem failures, current pressures stem primarily from external macroeconomic factors and shifting investor sentiment. The infrastructure supporting Bitcoin and other cryptocurrencies remains more robust than in 2022, with improved custody solutions, more sophisticated trading platforms, and better risk management practices across the industry.

However, the psychological impact on investors shows striking similarities. Fear and uncertainty dominate market sentiment, with the Crypto Fear & Greed Index registering extreme fear levels comparable to the darkest days of 2022. Social media sentiment analysis reveals widespread pessimism, with many retail investors questioning whether cryptocurrency markets can recover.

Key Factors Behind Bitcoin’s Worst Month Performance

Macroeconomic Headwinds Impacting Cryptocurrency Markets

The global economic landscape has become increasingly challenging for risk assets, and Bitcoin has not been immune to these pressures. Inflation remains stubbornly elevated in many major economies, forcing central banks to maintain restrictive monetary policies longer than markets initially anticipated.

The strength of the U.S. dollar has created additional headwinds for Bitcoin, which often moves inversely to dollar strength. As the dollar index reaches multi-month highs, dollar-denominated assets like cryptocurrency become less attractive to international investors and face technical selling pressure.

Corporate earnings reports and economic data releases have painted a picture of slowing economic growth, raising recession fears that typically drive investors toward traditional safe-haven assets like government bonds and gold rather than speculative digital currencies.

Institutional Investment Flows and Market Sentiment

Institutional participation in cryptocurrency markets has evolved dramatically since 2022, but recent months have seen significant outflows from Bitcoin investment products. Exchange-traded funds (ETFs) and institutional custody platforms report substantial redemptions, indicating that sophisticated investors are reducing their crypto exposure.

The approval of spot Bitcoin ETFs, which many hoped would usher in a new era of institutional adoption, has failed to generate the sustained buying pressure that optimistic analysts predicted. While these products attracted initial interest, flows have turned negative as broader market conditions deteriorated.

Hedge funds and family offices that increased cryptocurrency allocations during previous bull markets are now rebalancing portfolios, contributing to selling pressure. Risk management protocols at these institutions often mandate reducing exposure to volatile assets during periods of market stress, creating automatic selling that accelerates downward price movements.

Regulatory Developments and Government Actions

Regulatory scrutiny of cryptocurrency markets has intensified globally, creating uncertainty that weighs on Bitcoin’s worst month performance. The United States Securities and Exchange Commission continues aggressive enforcement actions against cryptocurrency exchanges and token issuers, arguing that many digital assets qualify as unregistered securities.

European Union implementation of the Markets in Crypto-Assets (MiCA) regulation introduces comprehensive rules for cryptocurrency operations, requiring significant compliance investments from exchanges and service providers. While regulatory clarity can ultimately benefit the industry, the transition period creates operational challenges and costs.

Asian markets have implemented varying approaches, with some jurisdictions tightening restrictions while others attempt to position themselves as crypto-friendly havens. This regulatory fragmentation creates compliance complexity for global cryptocurrency businesses and introduces additional uncertainty into market pricing.

Technical Analysis: Bitcoin’s Price Action and Support Levels

Critical Support and Resistance Zones

Technical analysts monitoring Bitcoin have identified several crucial price levels that could determine whether the current decline continues or reverses. The psychological support level at $25,000 has been tested multiple times, with each test weakening the buying interest that previously defended this area.

Historical volume analysis reveals that significant support exists around the $22,000-$23,000 range, where substantial buying occurred during previous accumulation phases. If Bitcoin breaks below current support levels decisively, this zone represents the next logical target for traders watching for potential reversal opportunities.

Resistance levels have proven formidable, with Bitcoin unable to reclaim previous support-turned-resistance around $28,000-$30,000. This technical pattern suggests that selling pressure remains intense, with each rally attempt met with renewed distribution from holders seeking to exit positions or reduce exposure.

Trading Volume and Market Depth Analysis

Trading volume patterns during Bitcoin’s worst month reveal concerning trends for bulls hoping for a quick recovery. Volume typically spikes during sharp declines, indicating capitulation selling, but has remained elevated even during brief rallies, suggesting that supply continues to overwhelm demand.

Order book depth analysis across major exchanges shows thinning liquidity, particularly on the bid side. Large buy orders that previously provided price support have been withdrawn or filled, leaving less protection against further declines. This reduced market depth means that relatively smaller sell orders can create disproportionately large price movements.

Derivative markets tell a complementary story, with funding rates for perpetual futures contracts remaining persistently negative. This indicates that short sellers are willing to pay for the privilege of maintaining bearish positions, reflecting widespread conviction that prices will continue declining.

Impact on the Broader Cryptocurrency Ecosystem

Altcoin Performance During Bitcoin’s Decline

While Bitcoin serves as the cryptocurrency market’s bellwether, altcoins have generally experienced even more severe declines during this worst month period. Ethereum, the second-largest cryptocurrency, has declined proportionally more than Bitcoin, reflecting its higher beta and greater sensitivity to overall market sentiment.

Smaller-cap altcoins face particularly challenging conditions, with many experiencing double-digit percentage declines that dwarf Bitcoin’s losses. Liquidity for these assets has evaporated, creating severe price discovery challenges and making it difficult for holders to exit positions without accepting substantial losses.

The correlation between Bitcoin and altcoins remains extremely high, suggesting that few cryptocurrencies offer genuine diversification benefits during market downturns. This synchronized decline reinforces the perception that cryptocurrency markets remain immature and heavily dependent on Bitcoin’s price action for directional cues.

Exchange Activity and Platform Stability

Cryptocurrency exchanges have faced increased operational pressures during Bitcoin’s worst month, with elevated trading volumes straining technical infrastructure. Several platforms reported brief outages during periods of peak volatility, raising concerns about their ability to handle extreme market conditions.

Withdrawal activity has increased significantly, with users moving assets from exchanges to self-custody solutions. This behavior mirrors patterns observed during the 2022 crypto collapse, when exchange solvency concerns prompted users to remove funds from platforms perceived as risky.

Major exchanges have responded by publishing proof-of-reserves audits and improving transparency around their financial condition. However, trust remains fragile, and any negative news regarding exchange operations could trigger additional panic withdrawals that stress the broader ecosystem.

Mining Industry Challenges and Hash Rate Implications

Bitcoin Mining Profitability Crisis

Bitcoin miners face severe profitability challenges as the combination of declining prices and relatively high energy costs squeezes margins. Many mining operations that remained viable at higher Bitcoin prices now face difficult decisions about whether to continue operations or temporarily shut down equipment.

The Bitcoin mining difficulty adjustment mechanism provides some relief by reducing computational requirements when hash rate declines, but this adjustment lags price movements, creating periods where mining becomes economically unviable for marginal operators.

Public mining companies have faced particularly intense pressure, with stock prices declining even more sharply than Bitcoin itself. These firms must balance the need to maintain operations with shareholder expectations and financing requirements, leading some to sell Bitcoin reserves to cover operational expenses.

Hash Rate Distribution and Network Security

Despite profitability challenges during Bitcoin’s worst month, the network’s hash rate has proven remarkably resilient. This robustness suggests that large, efficient mining operations with access to cheap energy continue operating even during unprofitable periods, potentially anticipating future price recovery.

Geographic distribution of mining activity continues evolving, with North American operations expanding while Chinese participation remains suppressed following that country’s mining ban. This redistribution has implications for network decentralization and resilience against regulatory actions.

Network security metrics remain strong despite market turmoil, with the Bitcoin blockchain continuing to process transactions reliably. This operational stability contrasts with the price volatility and demonstrates the underlying technology’s robustness even during severe market stress.

Investor Behavior and Sentiment Analysis

Retail vs. Institutional Investor Responses

Retail investors have exhibited divergent behaviors during Bitcoin’s worst month, with some viewing the decline as a buying opportunity while others capitulate and exit positions. Social media analysis reveals intense debate within crypto communities about whether current prices represent attractive entry points or indicate further downside ahead.

Long-term holders, often called “diamond hands” within the crypto community, have generally maintained their positions despite significant paper losses. On-chain analysis shows that addresses holding Bitcoin for more than one year have not engaged in significant selling, suggesting conviction among this cohort remains intact.

Institutional investors have taken a more cautious approach, with many reducing exposure while maintaining some allocation to preserve optionality on future recovery. This measured response reflects institutional risk management frameworks that prioritize capital preservation during uncertain periods.

On-Chain Metrics and Holder Behavior

Blockchain analysis during Bitcoin’s worst month reveals fascinating patterns in holder behavior. The supply held by long-term holders has actually increased, indicating that experienced investors are accumulating during weakness rather than selling into panic.

Exchange balance metrics show sustained outflows, with Bitcoin moving from centralized exchanges to personal wallets and cold storage solutions. This behavior suggests that many holders are reducing exchange counterparty risk and taking custody of their assets, potentially indicating preparation for long-term holding.

The realized price—representing the average price at which all Bitcoins were last moved—remains significantly above current market prices. This metric indicates that many holders are underwater on their positions, creating potential selling pressure if prices recover to levels where holders can exit near breakeven.

Historical Context: Learning from Previous Bitcoin Crashes

Patterns from the 2018 Bear Market

The 2022 crypto collapse was not Bitcoin’s first severe decline, and examining previous bear markets provides valuable context for current conditions. The 2018 bear market saw Bitcoin decline approximately 85% from its all-time high, a drawdown that exceeded even the dramatic losses of 2022.

Recovery from the 2018 bottom proved slow and grinding, with Bitcoin taking nearly three years to establish new all-time highs. This historical pattern suggests that investors expecting rapid V-shaped recoveries may face disappointment, as cryptocurrency markets typically require extended consolidation periods following major crashes.

The 2018 experience also demonstrated Bitcoin’s resilience, as the network continued operating flawlessly despite catastrophic price declines and widespread predictions of cryptocurrency’s demise. This operational continuity during extreme stress provides some reassurance that Bitcoin’s fundamental value proposition remains intact regardless of price volatility.

Recovery Timelines and Market Cycles

Cryptocurrency market cycles typically follow recognizable patterns, with explosive bull markets followed by prolonged bear markets that shake out weak hands and reset market valuations. Bitcoin’s worst month performance fits within this cyclical framework, potentially representing a necessary correction that sets the stage for future growth.

Historical analysis suggests that Bitcoin bottoms typically occur when sentiment reaches extreme pessimism and capitulation becomes widespread. Various indicators attempting to identify market bottoms—including the Puell Multiple, MVRV ratio, and Fear & Greed Index—are approaching levels associated with previous cycle bottoms.

However, each cycle exhibits unique characteristics, and past performance never guarantees future results. The cryptocurrency market has matured significantly since previous bear markets, with greater institutional participation, improved infrastructure, and broader mainstream awareness potentially altering traditional cycle patterns.

Strategies for Navigating Bitcoin’s Volatile Market

Risk Management for Current Market Conditions

Investors navigating Bitcoin’s worst month must prioritize risk management above all else. Position sizing becomes critical during volatile periods, with many advisors recommending that cryptocurrency allocations represent only a small percentage of overall portfolios—typically 1-5% depending on individual risk tolerance.

Dollar-cost averaging provides an alternative to attempting to time the market bottom. This strategy involves purchasing fixed dollar amounts at regular intervals regardless of price, reducing the impact of volatility and eliminating the emotional stress of trying to identify optimal entry points.

Stop-loss orders and other risk management tools can protect capital during declining markets, though cryptocurrency volatility sometimes triggers stops prematurely. Investors must carefully calibrate these tools to their risk tolerance and investment timeline, recognizing that tight stops may result in selling near local bottoms.

Long-Term Investment Perspectives

Despite near-term challenges during Bitcoin’s worst month, long-term oriented investors may view current conditions as an opportunity rather than a crisis. Bitcoin’s fixed supply cap and decentralized nature remain unchanged regardless of price volatility, and these fundamental characteristics continue attracting believers in the cryptocurrency’s long-term value proposition.

Institutional infrastructure surrounding Bitcoin has improved dramatically since the 2022 crypto collapse, with major financial institutions now offering custody, trading, and investment products that increase accessibility and legitimacy. This institutional embrace suggests that Bitcoin has secured a permanent place in the financial ecosystem despite periodic price crashes.

The adoption of Bitcoin as legal tender in some jurisdictions, growing corporate treasury allocations, and development of Lightning Network scaling solutions demonstrate continued real-world utility beyond speculative trading. These developments support the bull case for long-term value appreciation despite short-term market turmoil.

Expert Predictions and Market Outlook

Analyst Forecasts for Bitcoin’s Near-Term Future

Market analysts offer widely divergent predictions for Bitcoin following its worst month of performance. Bearish analysts point to deteriorating macroeconomic conditions, regulatory pressures, and technical breakdown as evidence that further declines lie ahead, with some predicting tests of $20,000 or lower.

Bullish analysts counter that current prices already reflect substantial pessimism and that risk/reward ratios favor long positions at current levels. These optimists highlight Bitcoin’s historical resilience, improving fundamentals, and the likelihood that central banks will eventually pivot toward easier monetary policy as inflation moderates.

More measured analysts acknowledge significant uncertainty and recommend that investors avoid overleveraging while maintaining some exposure to preserve optionality on various outcome scenarios. This balanced approach recognizes both the risks of further decline and the potential for sudden reversals that characterize cryptocurrency markets.

Potential Catalysts for Recovery or Further Decline

Several potential catalysts could dramatically impact Bitcoin’s trajectory following its worst month. Positive catalysts include clearer regulatory frameworks that reduce uncertainty, institutional adoption announcements from major corporations or financial institutions, and macroeconomic improvements such as central bank policy pivots.

Negative catalysts that could extend the decline include additional exchange failures or security breaches that undermine confidence, unexpectedly aggressive regulatory actions from major jurisdictions, or macroeconomic deterioration such as recession or financial system stress that triggers risk-off behavior across all assets.

Bitcoin halving events—when mining rewards are cut in half—have historically preceded major bull markets, with the next halving currently scheduled for 2024. Some analysts view this supply reduction as a potential catalyst for recovery, though others caution that halvings are well-anticipated events that may already be priced into current valuations.

Conclusion

As Bitcoin endures its worst month since the 2022 crypto collapse, investors face challenging decisions about how to respond to extreme volatility and uncertain market conditions. While current price action appears alarming and reminds many of the devastating losses experienced during previous crashes, maintaining perspective remains essential.

The cryptocurrency market has weathered numerous predicted “death spirals” throughout Bitcoin’s fifteen-year history, yet the network continues operating, innovation persists, and new use cases emerge. Whether current conditions represent a buying opportunity or a warning sign depends largely on individual risk tolerance, investment timeline, and conviction in cryptocurrency’s long-term value proposition.

Read More: Bitcoin 20% Slide: Market Structure, Whales, or Psychology?