Bitcoin price today hovers near $87,000, marking one of the most significant corrections in recent memory. After reaching an all-time high above $126,000 in early October, the leading digital asset has plummeted more than 30%, erasing nearly $1 trillion from the entire crypto market capitalization. As traders and investors watch anxiously, a critical question emerges: has the Bitcoin November crash finally found its floor, or will further declines push BTC even lower?

The dramatic sell-off has transformed market sentiment from euphoric optimism to extreme fear, with leveraged positions liquidated en masse and institutional investors reassessing their crypto allocations. On 26 November 2025, Bitcoin’s price action remains volatile, fluctuating between $85,000 and $88,800 throughout the day, as market participants attempt to determine whether this correction represents a temporary setback or the beginning of a prolonged bear market.

Bitcoin November Crash: What Triggered the Massive Sell-Off?

Macroeconomic Headwinds and Federal Reserve Policy Shifts

The Bitcoin November crash didn’t occur in isolation. Multiple converging factors created a perfect storm that sent cryptocurrency prices tumbling. The price of bitcoin has plummeted by nearly a third since a recent peak in October, driven primarily by shifting expectations around Federal Reserve monetary policy.

December Federal Reserve rate cut odds collapsed from 97% to just 52%, dramatically altering the risk appetite across financial markets. As hopes for continued monetary easing faded, investors rotated away from speculative assets like cryptocurrencies into safer havens. The prospect of an interest-rate cut typically boosts asset prices, since the promise of cheaper borrowing means a potential boon for firms and their investors, but the opposite also holds.

Rising U.S. Treasury yields further pressured Bitcoin and other risk assets. Bitcoin is falling due to rising US yields, reduced risk appetite, and a break below the key $92,000 support level. When traditional bonds offer more attractive returns with lower volatility, institutional capital naturally flows away from higher-risk investments.

Technical Breakdown and Forced Liquidations

The Bitcoin price crash accelerated dramatically when BTC broke critical support levels. Bitcoin’s price falling below the $92,000 support triggered a series of forced liquidations in leveraged positions. This mechanical selling created a cascading effect, where automatic stop-losses and liquidations pushed prices even lower.

The sharp selloff accelerated as optimism from the U.S. government reopening faded, triggering over $1.3 billion in forced liquidations across cryptocurrency markets. As leveraged long positions were wiped out, the selling pressure intensified, creating a vicious cycle that drove the Bitcoin price today to multi-month lows.

ETF Outflows and Institutional Retreat

One of the most concerning aspects of the current downturn is the reversal in Bitcoin exchange-traded fund (ETF) flows. After months of robust institutional demand through spot Bitcoin ETFs, roughly $4.7 billion has flowed out of crypto-related ETFs during November.

These outflows signal that institutional investors—who were key drivers of Bitcoin’s rally to six-figure prices—are reducing their exposure to cryptocurrency. Individual investors may not be buying the dip as much as in the past, suggesting that the retail buying pressure that historically supported Bitcoin during corrections may be weakening.

Bitcoin Price Analysis: Current Support and Resistance Levels

Critical Support Zones to Watch

As the Bitcoin price today struggles near $87,000, technical analysts have identified several key support levels that could determine the asset’s near-term trajectory. The main zones are $88K–$90K for support and $92K for recovery.

The $80,000-$83,000 range represents a crucial accumulation zone that has historically attracted long-term holders. Technical analysts warn that a breakdown below the $94,000-$92,000 zone opens the door to much deeper declines toward April’s lows around $74,000. Some bearish scenarios even suggest the 200-week moving average near $70,000 could be tested if current support fails to hold.

Resistance Levels Blocking Recovery

For Bitcoin to mount a meaningful recovery from the November crash, it must reclaim several key resistance levels. The immediate barrier lies at $92,000—the same level that acted as support before the breakdown. Beyond that, Bitcoin must reclaim $100,000-$101,285 to preserve bullish market structure and potentially challenge the October all-time high.

The psychological $100,000 level represents not just a technical barrier but also a critical sentiment marker. Bitcoin plunged below $100,000 for the first time in more than four months, and reclaiming this threshold would signal that the worst of the correction may be behind us.

Comparing Bitcoin to Traditional Assets: Is BTC Still Digital Gold?

Underperformance Against Gold and Bonds

The Bitcoin November crash has reignited debates about the cryptocurrency’s role as a store of value. Bitcoin has fallen nearly 30% from its 2025 peak, lagging behind everything from tech stocks to T-bills. This underperformance is particularly striking given Bitcoin’s narrative as “digital gold.”

Gold — often dismissed by Bitcoin believers as outdated — is easily outperforming the token throughout 2025. While physical gold has provided steady returns with lower volatility, Bitcoin has delivered disappointing performance for those who allocated capital based on its inflation-hedge narrative.

Correlation with Tech Stocks and Risk Assets

Rather than behaving as an independent store of value, Bitcoin has demonstrated high correlation with technology stocks and other risk assets. The leading cryptocurrencies attract many of the same investors as artificial intelligence stocks, linking the two trades when one goes bad.

Crypto traded not as a hedge, but as the most leveraged expression of macro tightening, according to digital asset analysts. This correlation undermines Bitcoin’s value proposition as a portfolio diversifier and inflation hedge, raising questions about its fundamental investment thesis.

Altcoin Bloodbath: Ethereum, Solana, and Others Hit Harder

Ethereum’s Steep Decline

While Bitcoin price today dominates headlines, alternative cryptocurrencies have suffered even steeper losses during the November correction. Ethereum, the second-largest cryptocurrency, has plunged even further, dropping 40% since last month.

By mid-November, Bitcoin had plunged to around $95,000, while Ethereum slid below $3,200. The second-largest cryptocurrency by market cap has proven more vulnerable to selling pressure, as investors flee from higher-risk altcoins toward Bitcoin as a relative haven.

Broad Market Capitalization Collapse

The damage extends far beyond the top two cryptocurrencies. The total crypto market capitalization had fallen from over $4.3 trillion in early October to around $3.27 trillion, marking a loss of more than $1 trillion in just over a month.

Blue-chip altcoins—like Ethereum, Solana, Cardano, and Avalanche—faced double-digit drawdowns, some shedding 30–40% from their recent highs. Meme coins and lower-liquidity tokens experienced even more dramatic collapses, with some projects losing 70-80% of their value.

Market Sentiment: From Extreme Greed to Extreme Fear

Fear & Greed Index Signals Capitulation

Market sentiment indicators have swung dramatically during the Bitcoin November crash. The Crypto Fear & Greed Index crashed into “Extreme Fear,” and liquidations soared as leveraged long positions were wiped out.

According to the latest technical indicators, the current sentiment is Bearish while the Fear & Greed Index is showing 20 (Extreme Fear). Historically, extreme fear readings have often coincided with attractive entry points for long-term investors, though timing the exact bottom remains challenging.

Investor Psychology and Panic Selling

The emotional toll on crypto holders has been significant. Holders, staring at a 24% three-month drawdown and persistent relative underperformance, feel a bit foolish. This psychological pressure drives capitulation, as frustrated investors exit positions at losses rather than holding through volatility.

However, experienced market observers note that Bitcoin’s bear markets have involved much more serious damage than anything we are seeing today, with peak-to-trough declines commonly in the ballpark of 80%. This historical context suggests the current correction, while painful, may not represent a catastrophic collapse.

Will Bitcoin Find a Bottom? Expert Price Predictions for Late 2025

Short-Term Outlook: Recovery or Further Decline?

Analysts are divided on whether the Bitcoin price today represents a buying opportunity or a prelude to further losses. According to our Bitcoin forecast, the price of Bitcoin will increase by 7.44% over the next month and reach $94,036 by December 25, 2025.

More conservative projections suggest continued consolidation. For December 2025, the maximum trading value will be around $97,412, with a possibility of dropping to a minimum of $96,225.63. These forecasts imply relatively modest gains from current levels, with significant volatility expected.

Bearish Scenarios and Downside Risks

Some technical analysts warn of potentially deeper corrections ahead. Technical analyst TraderJonesy warns of an additional 30% decline to $70,000, stating “Bitcoin is about to crash 30% and nobody sees it”, based on SuperTrend indicators that flipped bearish at higher levels.

The average for the month is $97,627, with Bitcoin price forecast at the end of the month at $90,513, reflecting a change of -16.4% for November according to some forecasting models. These bearish scenarios would bring Bitcoin down to levels not seen since early spring 2025.

Optimistic Long-Term Targets

Despite near-term uncertainty, many analysts maintain bullish long-term views. Considering that the halving impact is already priced in and institutional accumulation is expected to grow, Bitcoin price prediction models suggest an 18–22% increase, putting BTC at $112,000–$118,000 by November 2025.

For those with longer investment horizons, Cathie Wood of Ark Invest offers one of the most ambitious forecasts, predicting Bitcoin could reach $1 million within five years. Such projections rest on assumptions about continued institutional adoption, regulatory clarity, and Bitcoin’s evolving role in the global financial system.

On-Chain Data: What Bitcoin Metrics Reveal About Market Health

Exchange Reserves and Accumulation Patterns

On-chain metrics provide valuable insights into investor behavior during the Bitcoin November crash. Exchange reserves—the amount of Bitcoin held on trading platforms—serve as a key indicator of selling pressure versus accumulation.

Long-term holder behavior has been mixed during this correction. While some retail investors have capitulated, Harvard University tripled its Bitcoin ETF holdings to $443M via BlackRock’s IBIT, reflecting institutional confidence. This suggests that sophisticated institutions view current price levels as attractive, even as retail sentiment remains fearful.

Realized Losses and Capitulation Signals

Realized loss metrics—which measure the actual losses locked in when investors sell below their purchase price—can signal capitulation phases. Technical and behavioral indicators will be critical; on-chain metrics like exchange reserves, funding rates, and realized losses can signal when capitulation truly gives way to accumulation.

Historically, periods of peak realized losses have often marked market bottoms, as the last wave of discouraged holders exit their positions, clearing the way for a new accumulation phase.

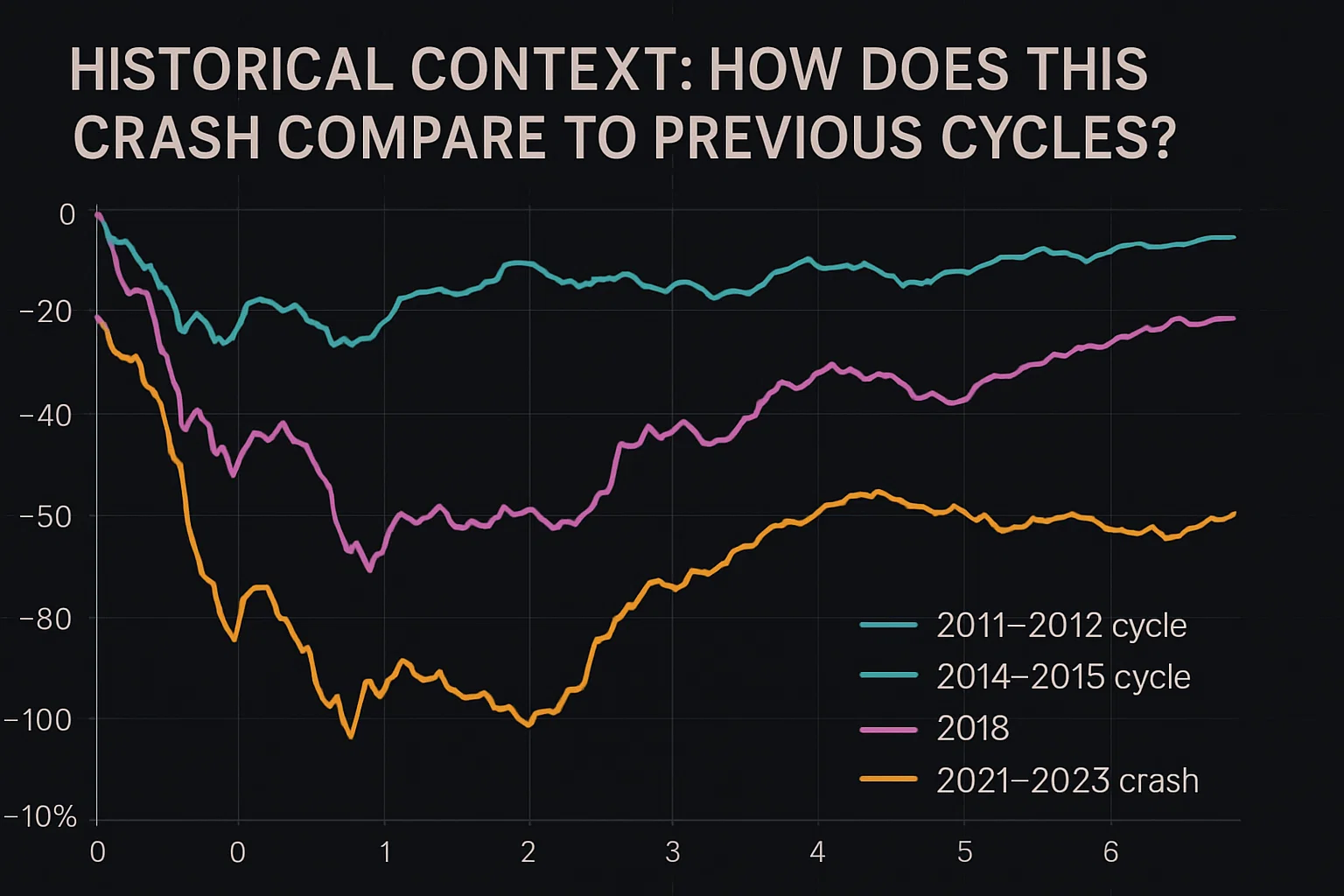

Historical Context: How Does This Crash Compare to Previous Cycles?

2022 Bear Market Comparison

Context matters when evaluating the severity of the current correction. Bitcoin suffered a downturn that cut its value by more than 60% during the 2022 bear market, with the bottom occurring after a drawdown of approximately 77% from the peak.

In that light, a fairly slow 24% decline from recent highs appears more like a typical correction than a once-in-a-decade catastrophe worthy of being called a crash. This perspective suggests that while the current Bitcoin November crash feels dramatic, it remains within the normal range of crypto market volatility.

Post-Halving Year Patterns

Bitcoin’s four-year halving cycle provides another framework for understanding current price action. November is historically one of Bitcoin’s stronger months, though performance has been weaker in post-halving years.

The 2024 halving, which occurred in April, reduced Bitcoin’s block rewards and new supply issuance. Historically, the 12-18 months following halvings have seen strong bull markets, though corrections along the way are common. If historical patterns repeat, the current weakness could set the stage for renewed strength in 2026.

Investment Strategies During the Bitcoin Crash: Should You Buy the Dip?

Dollar-Cost Averaging vs. Lump Sum Investing

For investors wondering whether to increase their Bitcoin exposure at current prices, strategy matters as much as timing. A 25-30% drop from recent highs puts Bitcoin in price ranges that long-term investors frequently monitor for accumulation.

Dollar-cost averaging—investing fixed amounts at regular intervals—removes the need to time the exact bottom. This approach allows investors to build positions gradually, reducing the risk of deploying all capital before further declines.

Risk Management and Portfolio Diversification

Prudent risk management becomes crucial during volatile periods. Avoid excessive leverage, use stop-loss mechanisms when needed, and maintain portfolio diversification. The forced liquidations that accelerated the Bitcoin November crash serve as a stark reminder of leverage risks.

Diversification across asset classes—including traditional equities, bonds, and commodities—can help cushion the impact of cryptocurrency volatility on overall portfolio performance. Bitcoin now faces the prospect of ending the year in the red — without fulfilling any of those roles as a hedge or diversifier, underscoring the importance of not over-allocating to crypto.

Long-Term vs. Short-Term Perspectives

Investment horizon dramatically influences optimal strategy. Reassess strategy: Define whether your approach is long-term accumulation or short-term trading. Short-term traders might prioritize capital preservation and wait for clearer trend confirmation before re-entering positions.

Long-term investors, however, may view corrections as opportunities. Historically, Bitcoin’s major recoveries have followed phases of sharp corrections, especially when leverage resets and markets stabilize. For believers in Bitcoin’s long-term value proposition, periods of extreme fear potentially offer attractive entry points.

Regulatory Developments and Their Impact on Bitcoin Price

Global Regulatory Landscape Shifts

Regulatory clarity continues to evolve across major jurisdictions, influencing investor confidence and institutional participation. Kenya is already seeing Bitcoin ATMs installed in major Nairobi malls after passing the Virtual Asset Service Providers Act of 2025, demonstrating that regulatory experimentation continues even during market downturns.

In developed markets, the approval and adoption of spot Bitcoin ETFs represented a major regulatory milestone. However, recent outflows from these vehicles suggest that regulatory approval alone doesn’t guarantee sustained institutional demand during challenging market conditions.

Political Support and Policy Uncertainty

Political developments also play a role in Bitcoin’s price trajectory. President Trump’s continued public support for cryptocurrency and blockchain technology provides a favorable political backdrop for the industry. However, this support hasn’t been sufficient to prevent the Bitcoin November crash, highlighting that macro factors often override political sentiment.

Technical Analysis: Chart Patterns and Indicator Signals

Moving Averages and Trend Analysis

Technical indicators provide mixed signals about the Bitcoin price today. On the four-hour time frame, Bitcoin is currently trending bullish with the 50-day moving average currently sloping up, suggesting some shorter-term strength.

However, on the 1-day time frame, Bitcoin is currently trending bearish with the 50-day moving average currently sloping down and below the current Bitcoin price. This divergence between timeframes reflects the market’s current indecision and choppy price action.

RSI and Momentum Indicators

Relative Strength Index (RSI) readings provide insights into whether Bitcoin is oversold or overbought. Currently, the RSI is within the 30-70 neutral zone, which indicates the price is trending neutral, neither extremely oversold nor overbought.

From a momentum perspective, the lack of strong oversold readings suggests that further downside may be possible before a meaningful reversal occurs. Traders often watch for RSI to enter deeply oversold territory (below 30) as potential signs of capitulation and reversal.

Volume Analysis and Liquidity Concerns

Trading volume provides important context for price movements. The increase in Bitcoin’s 24-hour trading volume by 52% was a clear sign that the market was very active during recent volatility, indicating that the price movements reflect genuine market participation rather than thin liquidity conditions.

However, liquidity fragmentation across exchanges and derivative markets can exacerbate volatility. A specific exchange’s stablecoin price varied from other exchanges, dropping to $0.65 due to liquidity issues, triggering cascading liquidations. Such technical glitches underscore the infrastructure challenges that can amplify market movements.

What Needs to Happen for Bitcoin to Recover?

Macro Conditions and Fed Policy

The path to recovery for Bitcoin depends heavily on macroeconomic conditions. 70% odds of a December Fed rate cut boosted risk assets according to recent forecasts, though these odds have fluctuated significantly.

A return to more dovish Federal Reserve policy—including resumption of rate cuts—would likely provide significant tailwinds for cryptocurrency prices. Lower rates reduce the opportunity cost of holding non-yielding assets like Bitcoin and generally support risk asset valuations.

Resumption of ETF Inflows

Institutional demand through Bitcoin ETFs must stabilize and reverse for a sustained recovery. Sustained ETF flow monitoring will help gauge institutional appetite—sustained inflows could restore confidence, while persistent outflows may suggest deeper fragility.

The early success of spot Bitcoin ETFs was a major driver of the rally to $126,000. Renewed institutional buying through these vehicles would signal that sophisticated investors view current valuations as attractive, potentially catalyzing a broader recovery.

Technical Level Reclamation

From a purely technical perspective,the Bitcoin price today must reclaim key levels to shift sentiment from bearish to bullish. Bitcoin price today sits near $88,000, precariously balanced between deep support in the $80K–$83K accumulation zone, and stiff resistance in the $92K–$96K band and above.

A decisive break above $92,000-$96,000 would suggest that selling pressure has exhausted and accumulation is beginning. Conversely, failure to hold current support levels could trigger another leg down toward the $70,000-$80,000 range.

Alternative Scenarios: Bull Case vs. Bear Case for December

Optimistic Recovery Scenario

In the bullish scenario, Bitcoin finds firm support in the $85,000-$90,000 range and gradually rebuilds momentum through December. December may see a continuation of post-halving bullish momentum, with Bitcoin price extending its rally by another 25–30% from today’s levels by Christmas 2025.

This scenario assumes that the current fear represents a capitulation phase, with the last wave of weak hands exiting positions. Institutional buyers would step in at attractive valuations, ETF inflows would resume, and improved macro conditions would support risk assets broadly.

The estimated price range is $120,000–$125,000 by December 2025, driven by a combination of factors, including supply shortage, less pressure from the sell side, and growing trust among long-term investors.

Bearish Extended Correction Scenario

The pessimistic scenario involves continued weakness through year-end, with Bitcoin price potentially retesting significantly lower levels. Bitcoin dropping below $90,000 is a realistic possibility if the current support at $94,000-$92,000 fails to hold.

In this case, the breakdown would trigger another wave of forced liquidations, pushing prices toward the April 2025 lows around $74,000 or even lower. The high price reaches $100,122, while the low price could be $59,146 according to some extreme bearish forecasts for December.

This scenario would likely coincide with broader risk-asset weakness, continued ETF outflows, and deteriorating macro conditions such as persistent inflation or economic recession concerns.

Lessons from the Bitcoin November Crash: What Investors Should Remember

Volatility Remains a Core Feature

The Bitcoin November crash serves as a powerful reminder that cryptocurrency remains an inherently volatile asset class. Volatility is not a disruption; it is a characteristic of the crypto market. Investors must size positions appropriately relative to their risk tolerance and financial situations.

Sharp corrections are normal in Bitcoin’s history, even during broader bull markets. Corrections are common in Bitcoin cycles and often reset leverage for healthier long-term growth. Understanding this cyclical nature helps investors maintain perspective during difficult periods.

Importance of Risk Management

The speed and severity of recent losses highlight the dangers of excessive leverage. Over $1.3 billion in forced liquidations across cryptocurrency markets occurred as leveraged positions were unwound. Many investors learned painful lessons about position sizing and the risks of trading with borrowed capital.

Manage risk proactively: avoid excessive leverage, use stop-loss mechanisms when needed, and maintain portfolio diversification. These risk management fundamentals become critically important during periods of extreme volatility.

Market Cycles and Patience

Long-term success in cryptocurrency investing requires understanding and accepting market cycles. Understand market cycles: volatility is essential for long-term participation. Bear markets, corrections, and periods of consolidation are normal phases that set the stage for subsequent rallies.

For now, the November crash serves as a stark reminder: crypto doesn’t exist in a vacuum. Macro forces, sentiment, and structure all matter—and being prepared for volatility is the price of admission.

Conclusion

As the Bitcoin price today stabilizes near $87,000 on 26 November 2025, the cryptocurrency stands at a critical juncture. The Bitcoin November crash has wiped out months of gains, tested investor conviction, and raised fundamental questions about Bitcoin’s role in modern portfolios. Yet history suggests that such corrections, however painful in the moment, are often necessary phases within longer-term uptrends.

Whether Bitcoin has found its bottom or faces further declines depends on multiple converging factors: Federal Reserve policy decisions, institutional ETF flows, technical support level defense, and broader macroeconomic conditions. The current sentiment is Bearish while the Fear & Greed Index is showing 20 (Extreme Fear), suggesting significant pessimism has already been priced in.

Read More: Federal Bitcoin Policy Decisions Face Data Shutdown Crisis