The Bitcoin weekly forecast reveals a concerning trend for investors hoping for year-end gains. Bitcoin (BTC) has slipped below the crucial $90,000 psychological support level, dashing expectations of a traditional Santa Claus rally that typically brings holiday cheer to crypto markets. This dramatic price movement has left traders questioning whether the digital asset can regain momentum before 2025 or if further downside awaits.

As we analyze the current Bitcoin weekly forecast, multiple factors are converging to create a perfect storm of selling pressure. From macroeconomic headwinds to technical breakdown patterns, understanding these dynamics is essential for anyone holding or considering investing in the world’s largest cryptocurrency. This comprehensive analysis will examine the key drivers behind Bitcoin’s recent decline, what experts are predicting for the coming weeks, and strategies investors can employ during this volatile period.

Current Bitcoin Price Decline

The recent drop in Bitcoin’s price below $90K represents more than just a temporary pullback—it signals a potential shift in market sentiment that could persist into early 2025. After reaching impressive highs earlier in the year, Bitcoin has faced mounting resistance as both institutional and retail investors reassess their positions amid changing market conditions.

Several interconnected factors have contributed to this bearish momentum. The strengthening US dollar has put pressure on risk assets across the board, with Bitcoin being no exception. Additionally, profit-taking by long-term holders who accumulated Bitcoin at lower prices has added to the selling pressure. The absence of fresh capital inflows, particularly from institutional investors who typically drive major bull runs, has left the market vulnerable to downward price action.

Market analysts point to the breakdown of key technical support levels as a critical development in this Bitcoin weekly forecast. When BTC failed to hold the $95,000 support zone, it triggered a cascade of stop-loss orders and algorithmic selling, accelerating the descent toward current levels. This technical deterioration has raised concerns about whether Bitcoin can establish a new base or if further losses are inevitable.

Why There’s No Santa Rally in Sight for Bitcoin

Historically, the cryptocurrency market has experienced what traders call a “Santa Claus rally”—a tendency for prices to rise during the final weeks of December. However, the current Bitcoin weekly forecast suggests this seasonal pattern may not materialize in 2024, leaving many investors disappointed.

The traditional drivers of holiday season rallies are conspicuously absent this year. Year-end bonuses that often flow into crypto markets are being redirected toward more conservative investments as economic uncertainty persists. Furthermore, the typical low-volume trading environment of the holiday season can actually amplify downward price movements when selling pressure exists, rather than providing the foundation for gains.

Institutional investment flows, which have become increasingly important for Bitcoin price movements, show signs of caution rather than enthusiasm. Major cryptocurrency funds have reported net outflows in recent weeks, indicating that sophisticated investors are reducing exposure rather than adding to positions. This institutional retreat removes a significant source of buying power that would be necessary to fuel a year-end rally.

Regulatory uncertainty continues to cast a shadow over the market as well. Despite progress in some jurisdictions, the global regulatory landscape for cryptocurrencies remains fragmented and unpredictable. This uncertainty makes institutional investors particularly cautious during year-end planning periods, further diminishing the prospects for a Santa Claus rally in Bitcoin.

Technical Analysis: Key Levels to Watch

From a technical perspective, the Bitcoin weekly forecast reveals several critical price levels that will determine the cryptocurrency’s near-term trajectory. Understanding these levels is essential for traders looking to navigate the current volatility.

The immediate support zone sits around $88,000-$89,000, where previous consolidation occurred during Bitcoin’s ascent. A sustained break below this level could open the door to even deeper corrections, potentially targeting the $82,000-$85,000 range where stronger support structures exist. These lower levels represent approximately 20-25% additional downside from current prices, which would be significant but not unprecedented in Bitcoin’s volatile history.

On the resistance side, Bitcoin must reclaim the $95,000 level to invalidate the current bearish setup. Beyond that, the psychologically important $100,000 mark remains a major obstacle that has proven difficult to overcome. Only a decisive break above $100,000 with sustained volume would signal a return to bullish momentum and potentially revive hopes of a late-year rally.

Technical indicators paint a mixed picture in this Bitcoin weekly forecast. The Relative Strength Index (RSI) on weekly timeframes has dipped into oversold territory, which historically has preceded rebounds. However, moving average convergences show bearish crossovers that typically persist for several weeks before reversing. The MACD histogram continues to print lower lows, confirming the strength of the current downtrend.

Fundamental Factors Impacting Bitcoin’s Performance

Beyond technical patterns, fundamental developments are shaping the Bitcoin weekly forecast in meaningful ways. The macroeconomic environment remains challenging for risk assets, with central banks maintaining restrictive monetary policies to combat persistent inflation.

The Federal Reserve’s messaging has been particularly influential on Bitcoin price action. Recent statements suggesting that interest rates may remain elevated for longer than previously anticipated have strengthened the US dollar and reduced appetite for speculative investments. Bitcoin, often viewed as a risk-on asset despite its “digital gold” narrative, has suffered alongside equities and other growth-oriented investments.

Mining economics also factor into the fundamental picture for Bitcoin. The network hashrate remains near all-time highs, indicating robust participation from miners despite recent price weakness. However, miners’ profitability has compressed significantly, and some operations are being forced to sell their Bitcoin holdings to cover operational costs. This miner selling represents consistent downward pressure that must be absorbed by the market.

The regulatory landscape continues evolving, with both positive and negative developments. While the approval of spot Bitcoin ETFs earlier in the year was celebrated as a watershed moment, the anticipated massive inflows have yet to fully materialize. Meanwhile, ongoing scrutiny from regulators worldwide keeps some institutional investors on the sidelines, limiting the pool of potential buyers during this Bitcoin weekly forecast period.

Expert Predictions and Market Sentiment

Cryptocurrency analysts are divided in their Bitcoin weekly forecast assessments, with opinions ranging from cautiously optimistic to decidedly bearish for the near term. This divergence reflects the genuine uncertainty surrounding Bitcoin’s path forward.

Prominent analysts who remain bullish on Bitcoin’s long-term prospects acknowledge the current weakness but frame it as a healthy correction within a longer-term bull market. They point to on-chain metrics showing that long-term holders are not panicking, and accumulation patterns suggest sophisticated investors are using this dip to add to positions. These bulls argue that once macroeconomic conditions stabilize, Bitcoin is well-positioned to resume its upward trajectory.

Conversely, bearish analysts warn that the breakdown below $90,000 could be the beginning of a more substantial correction. They cite historical patterns showing that Bitcoin often experiences deeper pullbacks than initially expected once key support levels fail. Some forecasts suggest Bitcoin price could test the $75,000-$80,000 range before finding a solid footing, representing a significant drawdown from recent highs.

Market sentiment indicators provide additional context for the Bitcoin weekly forecast. The Crypto Fear & Greed Index has shifted decisively into “fear” territory, indicating that pessimism currently dominates trader psychology. Social media sentiment analysis shows a marked decrease in bullish posts and an increase in defensive positioning discussions. Google search trends for “sell Bitcoin” have spiked, suggesting retail investor concern is mounting.

Impact of Global Economic Conditions on Bitcoin

The intersection of global economics and cryptocurrency markets plays a crucial role in shaping the Bitcoin weekly forecast. Current macroeconomic conditions present significant headwinds that cannot be ignored.

Inflation dynamics continue to influence central bank policies worldwide, with most major economies maintaining tight monetary conditions. This reduces liquidity in financial markets overall, which disproportionately impacts speculative assets like Bitcoin. The correlation between Bitcoin and traditional risk assets, particularly technology stocks, has strengthened in recent months, undermining the narrative of Bitcoin as an uncorrelated inflation hedge.

Geopolitical tensions add another layer of complexity to the Bitcoin price outlook. While some argue that global uncertainties should drive investors toward decentralized assets like Bitcoin, the reality has been more nuanced. During periods of acute geopolitical stress, investors often flee to traditional safe havens like US Treasury bonds and gold, with Bitcoin experiencing selling pressure alongside other risk assets.

Currency market dynamics also influence this Bitcoin weekly forecast. The strong US dollar has created challenging conditions for dollar-denominated assets, including Bitcoin. International investors face unfavorable exchange rates when purchasing BTC, reducing demand from non-US markets. Until the dollar begins to weaken significantly, this headwind is likely to persist.

Institutional vs. Retail Investor Behavior

Understanding the divergent behaviors of institutional and retail participants provides important insights into the Bitcoin weekly forecast. These two groups often act with different timeframes and motivations, creating complex market dynamics.

Institutional investors have adopted a more measured approach to Bitcoin following the initial enthusiasm around ETF approvals. While some institutions continue to allocate capital to cryptocurrency exposure, many are taking a wait-and-see stance amid the current volatility. The institutional mindset typically favors buying weakness in assets they believe in long-term, which could provide support at lower levels, but aggressive buying has yet to materialize.

Retail investors, meanwhile, display the emotional volatility characteristic of less experienced market participants. The slip below $90,000 has triggered panic selling among some retail holders who entered positions at higher prices. Social media channels reflect this anxiety, with discussions increasingly focused on cutting losses rather than accumulating more Bitcoin. This retail capitulation, while painful for those involved, historically marks stages of major corrections that eventually give way to recovery.

The distribution of Bitcoin holdings between these groups has shifted over time, with institutions now controlling a larger percentage of the total supply. This institutional dominance means that retail sentiment, while emotionally charged, may have less impact on price than the strategic decisions of large holders. For the Bitcoin weekly forecast to turn decisively bullish, renewed institutional buying would be essential.

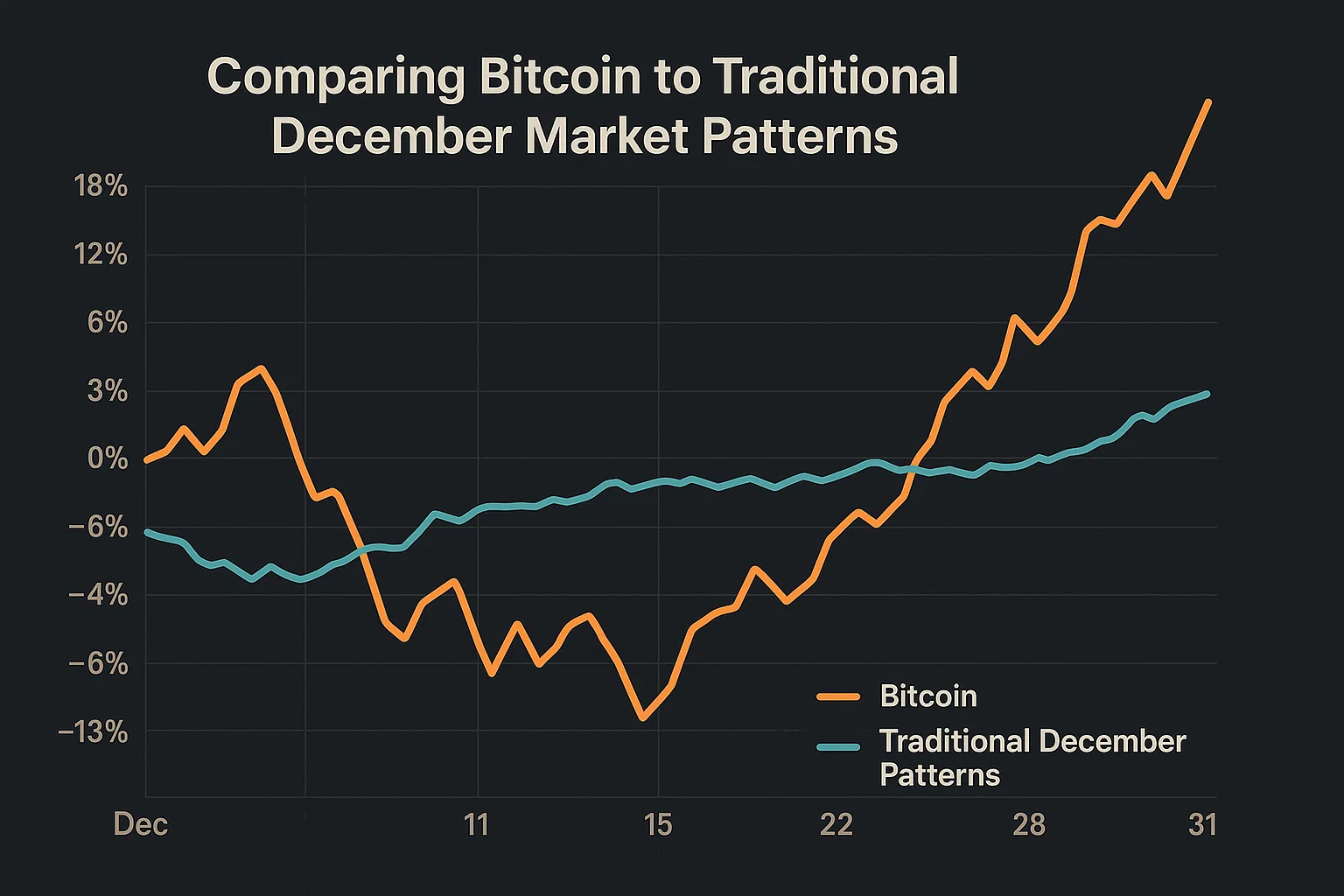

Comparing Bitcoin to Traditional December Market Patterns

The absence of a Santa Claus rally in Bitcoin stands in contrast to traditional market patterns, making this Bitcoin weekly forecast particularly noteworthy from a historical perspective.

In traditional equity markets, the period between Christmas and New Year typically sees positive returns, driven by optimism, low volume, and year-end portfolio adjustments. Cryptocurrency markets have occasionally mirrored this pattern, with December 2020 and December 2017 both seeing substantial Bitcoin price gains during the holiday season.

However, December 2024 appears to be following a different script. Instead of the anticipated rally, Bitcoin has experienced selling pressure that intensified as the month progressed. This deviation from seasonal patterns suggests that deeper structural factors are at play, overriding the typically supportive year-end dynamics.

Historical analysis of Bitcoin’s December performance shows mixed results, with roughly equal numbers of positive and negative years. What distinguishes this particular December in the Bitcoin weekly forecast is the combination of technical breakdown, fundamental headwinds, and sentiment deterioration occurring simultaneously. Such alignments of negative factors tend to override seasonal tendencies.

Alternative Cryptocurrency Performance During Bitcoin’s Decline

The performance of alternative cryptocurrencies during Bitcoin’s weakness provides additional context for the broader market forecast. Typically, when Bitcoin price declines, altcoins experience even sharper losses due to their higher risk profiles.

This pattern has held during the current downturn, with major altcoins like Ethereum, Solana, and Cardano posting percentage losses exceeding Bitcoin’s decline. The “Bitcoin dominance” metric, which measures BTC’s share of total cryptocurrency market capitalization, has increased slightly, indicating that capital is flowing toward Bitcoin as a relatively safe haven within crypto during the correction.

Some analysts view this altcoin weakness as a positive sign for the Bitcoin weekly forecast. The theory suggests that when the market eventually stabilizes, capital will first flow back into Bitcoin before rotating into higher-risk alternatives. This could set the stage for Bitcoin to outperform during the recovery phase, even if absolute prices remain depressed.

However, the synchronized decline across the entire cryptocurrency sector also demonstrates that macroeconomic forces are the primary driver rather than Bitcoin-specific issues. This means that any sustained recovery in Bitcoin price will likely require broader improvements in risk appetite and market conditions rather than cryptocurrency-specific catalysts.

Trading Strategies During Market Uncertainty

For traders navigating the current Bitcoin weekly forecast, several strategies can help manage risk while maintaining exposure to potential upside.

Dollar-cost averaging (DCA) remains one of the most effective approaches during volatile periods. Rather than attempting to time the exact bottom, DCA involves making regular purchases at predetermined intervals. This strategy reduces the impact of short-term Bitcoin price fluctuations and takes advantage of lower average entry points during corrections. For long-term believers in Bitcoin, current prices may represent attractive accumulation opportunities.

Setting clear stop-loss levels and adhering to them rigorously is essential for active traders. The volatility inherent in Bitcoin can quickly turn manageable losses into devastating ones if proper risk management isn’t maintained. Traders should determine in advance how much they’re willing to lose on any position and exit automatically when that threshold is reached.

For more conservative investors, reducing position sizes during uncertain times makes sense. The Bitcoin weekly forecast suggests continued volatility, which means that preserving capital should be prioritized over maximizing gains. Investors can maintain some exposure to participate in any recovery while limiting downside risk if the correction deepens.

Options strategies, including protective puts or collar strategies, offer sophisticated ways to maintain Bitcoin exposure while hedging downside risk. While these instruments require more knowledge to implement effectively, they can provide valuable insurance during periods when the Bitcoin price outlook remains uncertain.

Long-Term Perspective: Looking Beyond Current Weakness

While the immediate Bitcoin weekly forecast appears challenging, maintaining perspective on Bitcoin’s longer-term trajectory is important for investors with extended time horizons.

Bitcoin’s historical pattern involves significant drawdowns followed by explosive rallies that reach new all-time highs. Previous bull cycles have seen corrections of 30-40% or more without derailing the overall upward trend. Current weakness, while uncomfortable, fits within these historical patterns and doesn’t necessarily indicate the end of Bitcoin’s growth story.

The fundamental value propositions that attracted investors to Bitcoin remain intact: limited supply, decentralized architecture, increasing institutional adoption, and potential as a hedge against monetary inflation. These factors haven’t changed due to recent price weakness. As global central banks continue expanding money supplies over time, Bitcoin’s fixed supply cap of 21 million coins provides a compelling counter-narrative.

Infrastructure development in the cryptocurrency ecosystem continues regardless of short-term Bitcoin price movements. The Lightning Network is processing more transactions, custody solutions are becoming more robust, and regulatory frameworks are gradually becoming clearer. These developments lay the groundwork for future adoption that could drive the next major bull cycle.

For investors willing to look beyond the current Bitcoin weekly forecast, periods of pessimism and price weakness have historically provided the best entry opportunities. The key is distinguishing between temporary corrections within ongoing bull markets and the beginning of prolonged bear markets—a distinction that only becomes clear in retrospect.

Potential Catalysts for Recovery

Despite the bearish Bitcoin weekly forecast for the immediate term, several potential catalysts could trigger a reversal and renewed upward momentum.

A shift in Federal Reserve policy would be the most significant catalyst for Bitcoin. If inflation data continues improving and the Fed signals upcoming rate cuts, risk assets, including cryptocurrencies, could experience sharp rallies. The anticipation of easier monetary policy would weaken the dollar and improve conditions for Bitcoin investment.

Increased institutional adoption beyond current levels could provide the buying power necessary to absorb selling pressure and push the Bitcoin price higher. Major corporate treasury allocations to Bitcoin, additional ETF launches in other jurisdictions, or pension fund approvals for cryptocurrency exposure would represent game-changing developments.

Technical catalysts also deserve consideration in the Bitcoin weekly forecast. If Bitcoin can establish a clear bottom and begin forming a base, technical traders will recognize bullish reversal patterns that could attract momentum-based buying. A decisive reclaim of the $95,000-$100,000 zone would invalidate the bearish setup and potentially trigger short covering from bearish speculators.

Geopolitical developments could paradoxically benefit Bitcoin despite recent correlations with risk assets. If confidence in traditional financial systems or fiat currencies erodes significantly, Bitcoin’s decentralized nature and limited supply could drive increased adoption as a store of value.

Risk Factors to Monitor

Several risk factors could extend the downward pressure on Bitcoin beyond what the current weekly forecast suggests, and investors should remain vigilant.

Further deterioration in macroeconomic conditions represents the primary risk to Bitcoin price stability. A global recession would likely trigger aggressive risk-off positioning across all asset classes, with Bitcoin experiencing substantial selling pressure. Corporate bankruptcies, banking system stress, or sovereign debt concerns could all create environments hostile to cryptocurrency investment.

Regulatory crackdowns in major markets could undermine Bitcoin’s growth trajectory. While the regulatory landscape has generally improved, sudden policy reversals or unexpected enforcement actions could trigger panic selling. Particular attention should be paid to developments in the United States, Europe, and Asia, where regulatory decisions have an outsized impact on global Bitcoin markets.

Technical breakdown risks persist if Bitcoin fails to hold key support levels. A drop below $85,000 would likely trigger another wave of stop-loss selling and could create a self-fulfilling prophecy of further declines. The Bitcoin weekly forecast would need a significant revision if such technical failures occur.

Competition from other cryptocurrencies or emerging technologies could theoretically undermine Bitcoin’s dominance, though this remains a longer-term consideration. If alternative platforms demonstrate superior technology or adoption, some capital could flow away from Bitcoin toward these competitors.

Conclusion

The current Bitcoin weekly forecast presents a challenging picture for investors hoping for year-end gains, with BTC slipping below $90,000 and no Santa Claus rally materializing. Multiple headwinds—including macroeconomic uncertainty, technical breakdowns, and cautious institutional sentiment—have converged to create sustained downward pressure on the Bitcoin price.

However, this period of weakness also represents a potential opportunity for long-term investors. Bitcoin’s fundamental value propositions remain intact, and historical patterns suggest that significant corrections often precede major rallies. The key is maintaining appropriate risk management, avoiding emotional decision-making, and staying informed about the evolving factors that influence cryptocurrency markets.

Read More: Bitcoin Breaches $100,000 Amid Selling Pressure & Shutdown