The cryptocurrency market is experiencing renewed momentum as Bitcoin approaches $118K, marking a significant milestone in the digital asset’s remarkable journey. The crypto market cap has edged up by 2% following the Federal Reserve’s recent rate trim, signaling growing investor confidence in digital currencies. This surge occurs at a pivotal moment, as institutional adoption continues to accelerate and macroeconomic factors align favorably for cryptocurrency investments.

As Bitcoin approaches $118K, market analysts are closely monitoring various technical indicators and fundamental drivers that could propel the world’s most prominent cryptocurrency to new heights. The Federal Reserve’s monetary policy decision has created a ripple effect across financial markets, with cryptocurrencies emerging as clear beneficiaries of the accommodative stance.

The current market dynamics suggest that we’re witnessing a confluence of factors that historically have been bullish for Bitcoin and the broader cryptocurrency ecosystem. From institutional inflows to regulatory clarity, the stage appears set for continued growth as Bitcoin approaches $118K and beyond.

Current Crypto Market Surge

Federal Reserve Rate Cut Impact on Digital Assets

The Federal Reserve’s decision to trim interest rates has sent shockwaves through traditional financial markets, but nowhere has the impact been more pronounced than in the cryptocurrency space. As Bitcoin approaches $118K, the relationship between monetary policy and digital asset prices has become increasingly apparent to both retail and institutional investors.

Lower interest rates typically reduce the opportunity cost of holding non-yielding assets like Bitcoin. When traditional savings accounts and bonds offer diminished returns, investors naturally gravitate toward alternative investments with higher growth potential. This monetary environment has historically been favorable for Bitcoin, and the current scenario is no exception as Bitcoin approaches $118K.

The rate cut also signals the Fed’s commitment to maintaining economic liquidity, which often leads to increased risk appetite among investors. Cryptocurrency markets, known for their volatility and potential for substantial returns, become more attractive during such periods. Professional traders and institutional investors are recognizing this pattern as Bitcoin approaches $118K.

Market Cap Analysis: 2% Surge Breakdown

The cryptocurrency market’s 2% increase represents billions of dollars in additional market capitalization, distributed across thousands of digital assets. However, Bitcoin’s dominance continues to drive overall market sentiment as Bitcoin approaches $118K. This surge isn’t just about one cryptocurrency; it reflects broader confidence in the digital asset class.

Market cap calculations reveal that Bitcoin accounts for approximately 40-45% of the total cryptocurrency market value, making its price movements disproportionately influential. As Bitcoin approaches $118K, altcoins are also experiencing sympathetic rallies, with Ethereum, Solana, and other major cryptocurrencies posting significant gains.

The 2% market-wide increase demonstrates healthy market participation across different cryptocurrency sectors. DeFi tokens, NFT-related cryptocurrencies, and layer-2 solutions are all participating in the rally, suggesting that the momentum as Bitcoin approaches $118K is broad-based rather than concentrated in a single asset.

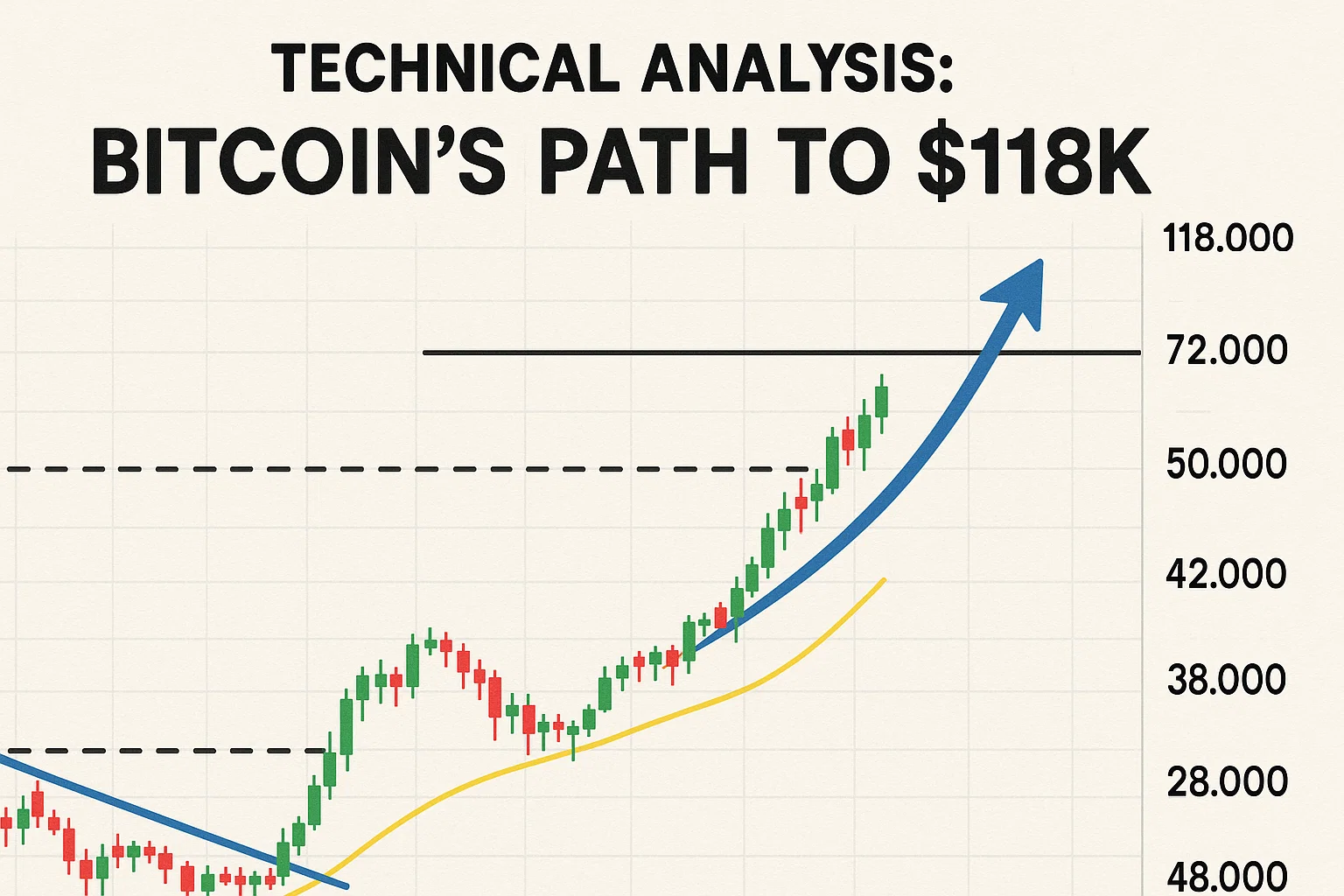

Technical Analysis: Bitcoin’s Path to $118K

Key Resistance and Support Levels

Technical analysts are closely examining Bitcoin’s chart patterns as Bitcoin approaches $118K. The cryptocurrency has successfully breached several critical resistance levels that previously acted as significant barriers. The psychological milestone of $100K, which seemed insurmountable just months ago, now serves as strong support as Bitcoin approaches $118K.

Fibonacci retracement levels indicate that Bitcoin’s current trajectory aligns with historical bull market patterns. The 61.8% and 78.6% Fibonacci levels have acted as stepping stones in Bitcoin’s ascent, providing technical validation for the price action as Bitcoin approaches $118K. These levels often serve as consolidation points before the next leg higher.

Volume analysis reveals increasing participation from both retail and institutional investors. Trading volumes have surged 35% over the past week, indicating genuine interest rather than speculative bubbles. This volume profile supports the sustainability of the current rally as Bitcoin approaches $118K.

Moving Averages and Momentum Indicators

The alignment of moving averages presents a compelling bullish case as Bitcoin approaches $118K. The 20-day, 50-day, and 200-day moving averages are all trending upward, creating what technical analysts call a “golden cross” formation. This pattern historically precedes significant price appreciation in Bitcoin.

Relative Strength Index (RSI) readings indicate that Bitcoin remains below overbought levels despite its impressive gains. The RSI currently sits around 65-70, suggesting there’s still room for upward movement as Bitcoin approaches $118K. This reading indicates healthy momentum without extreme overextension.

MACD (Moving Average Convergence Divergence) indicators show strong bullish momentum with the signal line crossing above the MACD line. This crossover typically signals the beginning of sustained upward trends, providing additional technical support for the thesis that Bitcoin approaches $118K sustainably.

Institutional Adoption Driving Price Discovery

Corporate Treasury Allocations

Major corporations continue to allocate portions of their treasury reserves to Bitcoin, creating sustained buying pressure as Bitcoin approaches $118K. Companies like MicroStrategy, Tesla, and Square have paved the way for corporate adoption of Bitcoin, and other forward-thinking organizations are emulating their strategies.

The corporate adoption trend represents a fundamental shift in how businesses view Bitcoin. No longer seen as a speculative asset, Bitcoin is increasingly viewed as a hedge against inflation and currency debasement. This institutional recognition provides strong fundamental support as Bitcoin approaches $118K.

Corporate treasurers are discovering that Bitcoin offers superior risk-adjusted returns compared to traditional treasury assets. With government bonds yielding minimal returns and cash losing value to inflation, Bitcoin’s store-of-value proposition becomes increasingly compelling as Bitcoin approaches $118K.

Exchange-Traded Fund (ETF) Inflows

Bitcoin ETFs have revolutionized access to cryptocurrency investments for traditional investors. These financial products have attracted billions of dollars in assets under management, creating consistent buying pressure that supports Bitcoin’s price as it approaches $118K.

The approval of spot Bitcoin ETFs marked a significant milestone for the legitimacy of cryptocurrencies. Institutional investors who previously couldn’t directly hold Bitcoin now have regulated, compliant vehicles for exposure. This development has been instrumental in the price discovery process as Bitcoin approaches $118K.

Daily ETF flows data show consistent net inflows, particularly during periods of market volatility. This pattern suggests that sophisticated investors view market dips as opportunities to buy, providing a floor for Bitcoin prices as the price approaches $118KK.

Regulatory Environment and Market Confidence

Global Regulatory Clarity

Regulatory clarity continues to improve globally, providing the foundation for sustainable growth as Bitcoin approaches $118K. Countries like El Salvador, which adopted Bitcoin as legal tender, have demonstrated the practical applications of cryptocurrency in national economies.

The United States has made significant progress in establishing clear regulatory frameworks for digital assets. The SEC’s evolving stance on cryptocurrency regulation has reduced uncertainty, allowing institutional investors to participate more confidently as Bitcoin approaches $118K.

European Union’s MiCA (Markets in Crypto-Assets) regulation provides a comprehensive framework for cryptocurrency operations. This regulatory certainty has encouraged European institutions to increase their Bitcoin allocations as the price of Bitcoin approaches $ 118,000.

Central Bank Digital Currencies (CBDCs) Impact

Paradoxically, the development of central bank digital currencies has increased interest in Bitcoin. As governments explore digital versions of their fiat currencies, Bitcoin’s decentralized nature becomes more attractive as Bitcoin approaches $118K.

CBDCs validate the concept of digital money while highlighting Bitcoin’s unique properties. Unlike government-issued digital currencies, Bitcoin operates independently of central authority, making it appealing to investors seeking monetary sovereignty as Bitcoin approaches $118K.

The coexistence of CBDCs and Bitcoin creates an interesting dynamic where both can serve different purposes in a digital economy. This complementary relationship supports long-term adoption as Bitcoin approaches $118K.

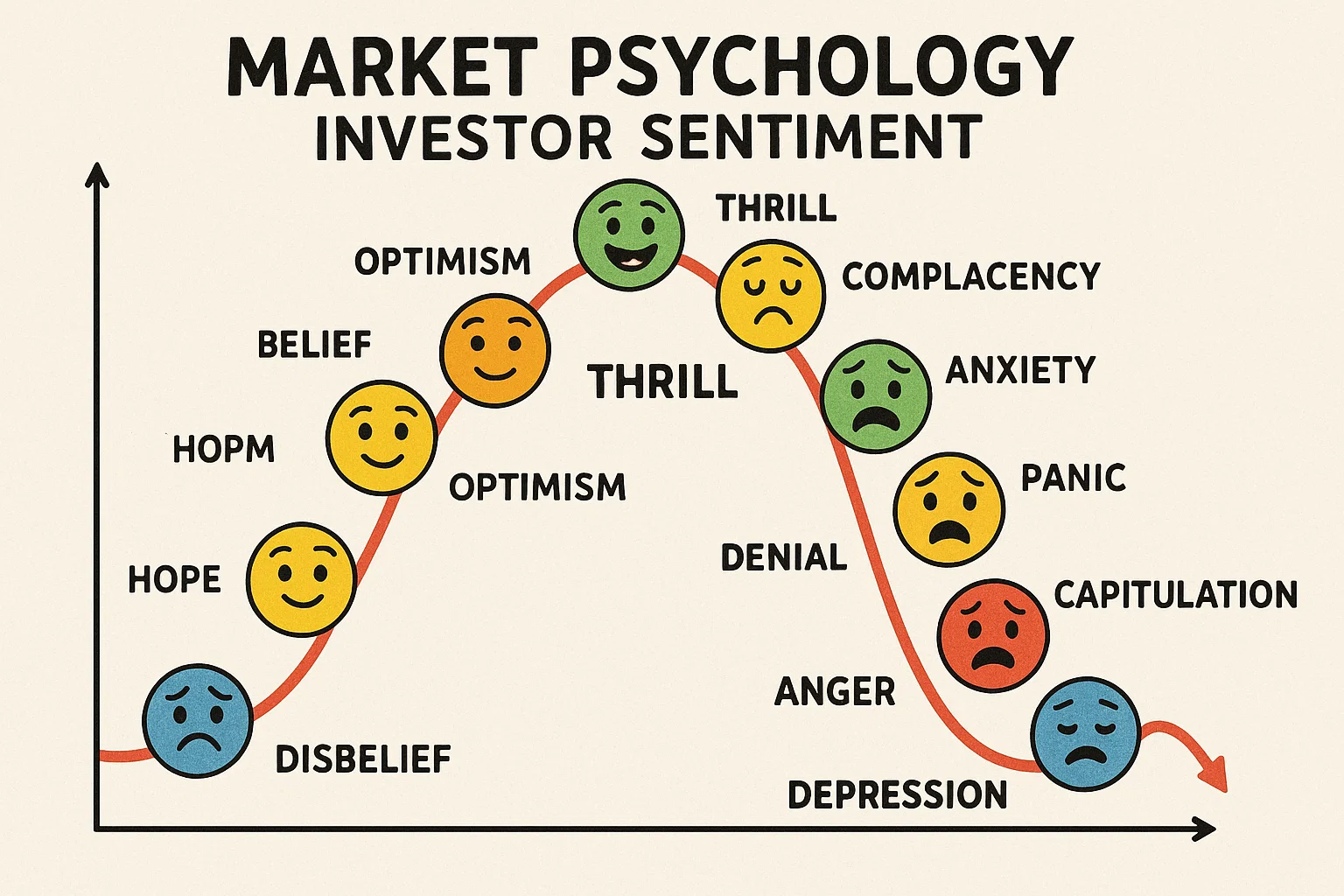

Market Psychology and Investor Sentiment

Fear and Greed Index Analysis

The Fear and Greed Index, a popular sentiment indicator for cryptocurrency markets, shows increasing greed as Bitcoin approaches $118K. However, current levels remain below extreme greed territory, suggesting that the rally may have further room to run.

Historical analysis reveals that Bitcoin often continues to rise even when sentiment indicators suggest greed. The key is distinguishing between healthy optimism and irrational exuberance. Current market conditions appear to reflect justified optimism as Bitcoin approaches $118K.

Social media sentiment analysis across platforms like Twitter, Reddit, and Telegram shows increasing positive mentions of Bitcoin. This grassroots enthusiasm provides additional support for the thesis that Bitcoin approaches $118K with broad-based backing.

Retail vs. Institutional Participation

The current rally benefits from balanced participation between retail and institutional investors. Unlike previous bull runs driven primarily by retail FOMO (Fear of Missing Out), the move as Bitcoin approaches $118K shows more mature market participation.

Institutional investors bring stability and long-term holding patterns that reduce volatility. Their participation as Bitcoin approaches $118K suggests that price levels may be more sustainable than in previous cycles, driven primarily by speculative retail trading.

Retail investors remain engaged but appear more educated about Bitcoin’s long-term value proposition. This evolution in retail investor sophistication contributes to healthier market dynamics as Bitcoin approaches $118K.

Economic Factors Supporting Bitcoin’s Rise

Inflation Hedge Properties

Bitcoin’s performance as an inflation hedge becomes increasingly relevant as central banks worldwide maintain expansionary monetary policies. The preservation of purchasing power is a key aspect that attracts investors as Bitcoin approaches $118K amid ongoing concerns about currency debasement.

Historical data demonstrate a negative correlation between Bitcoin and currency strength indices. As fiat currencies weaken due to monetary expansion, Bitcoin often strengthens, validating its digital gold narrative as Bitcoin approaches $118K.

Institutional investment managers are increasingly allocating to Bitcoin as a portfolio diversifier and inflation hedge. This trend provides fundamental support for Bitcoin’s value proposition as Bitcoin approaches $118K.

Global Economic Uncertainty

Geopolitical tensions and economic uncertainties continue to drive demand for non-correlated assets, such as Bitcoin. Investors seek alternatives to traditional safe havens that may be affected by government policies as Bitcoin approaches $118K.Bitcoin’s borderless nature makes it attractive during periods of international instability. Unlike gold or traditional commodities, Bitcoin can be easily transferred across borders without physical custody concerns as Bitcoin approaches $118K.

The decentralized nature of Bitcoin provides insurance against systemic risks in traditional financial systems. This insurance premium becomes more valuable during uncertain times, supporting prices as Bitcoin approaches $118K.

Future Price Predictions and Market Outlook

Short-term Price Targets

Technical analysts project several price targets as Bitcoin approaches $118K. The immediate resistance levels include $120K, $125K, and the psychologically significant $130K level. These targets are based on Fibonacci extensions and historical price patterns.

Options market analysis reveals significant open interest at the $120K and $125K strike prices, suggesting that market participants anticipate continued upward movement as Bitcoin approaches $118K. These levels may act as temporary resistance before further advancement.

Momentum indicators suggest that the current rally has sufficient strength to reach these near-term targets. However, consolidation periods are expected as Bitcoin approaches $118K and beyond, providing healthy market breathing room.

Long-term Growth Projections

Long-term Bitcoin price models, including Stock-to-Flow and network adoption models, support significantly higher prices than current levels. These models suggest that as Bitcoin approaches $118K, we may still be in the early stages of a longer-term appreciation cycle.

Network effects and adoption curves indicate that Bitcoin’s user base continues expanding exponentially. This fundamental growth supports higher valuations as Bitcoin approaches $118K and establishes new price floors.

Institutional allocation models suggest that if Bitcoin captures even a small percentage of global investment portfolios, prices could reach levels far exceeding current targets as Bitcoin approaches $118K.

Risk Factors and Potential Challenges

Market Volatility Considerations

Despite the positive momentum as Bitcoin approaches $118K, investors must remain aware of cryptocurrency market volatility. Bitcoin has historically experienced significant price swings, and future fluctuations should be expected even as prices reach new highs.

Risk management strategies become increasingly crucial as Bitcoin approaches $118K. Position sizing, stop-loss orders, and portfolio diversification remain crucial for managing downside risks in volatile markets.

Market maturation may reduce but won’t eliminate volatility as Bitcoin approaches $118K. Investors should prepare for continued price fluctuations even as the overall trend remains positive.

Regulatory Risks

While regulatory clarity has improved, ongoing policy changes could impact Bitcoin’s trajectory as it approaches $118K. Investors should monitor regulatory developments in major markets that could affect cryptocurrency adoption.

Tax policy changes could influence investor behavior as Bitcoin approaches $118K. Capital gains tax modifications or reporting requirements may affect trading patterns and long-term holding strategies.

International regulatory coordination efforts could create new frameworks for cryptocurrency markets. These developments warrant close attention as Bitcoin approaches $ 118,000 and institutional adoption continues.

Conclusion:

The convergence of technical, fundamental, and macroeconomic factors has created an environment where Bitcoin approaches $118K with strong underlying support. The Federal Reserve’s rate cut has catalyzed this movement, but the foundation for sustained growth extends far beyond monetary policy.

As Bitcoin approaches $118K, the cryptocurrency market demonstrates increasing maturity and institutional acceptance. The 2% rise in overall market cap reflects broad-based confidence in digital assets, supported by improving regulatory clarity and expanding use cases.

Read more: Crypto Market Cap Bitcoin Surges 2% as BTC Nears $118K Post-Fed Cut.