Bitcoin buyers are going all-in at a pace never seen before in the digital asset’s history. Market analytics from multiple blockchain intelligence firms indicate that both institutional and retail investors are dramatically increasing their Bitcoin exposure, with many choosing to allocate substantial portions of their portfolios to the leading cryptocurrency. This aggressive accumulation pattern suggests a fundamental shift in investor sentiment, as market participants demonstrate unprecedented confidence in Bitcoin’s long-term value proposition despite ongoing macroeconomic uncertainties.

Bitcoin Buying Frenzy

What Does “Going All-In” Mean for Bitcoin Investors?

When we discuss Bitcoin buyers going all-in, we’re referring to investors who are allocating disproportionately large percentages of their investment capital into Bitcoin. Unlike traditional diversified portfolio strategies that might recommend 5-10% allocation to alternative assets, these aggressive buyers are committing 30%, 50%, or even higher percentages of their wealth to BTC. This Bitcoin investment surge represents a significant departure from conventional wisdom about portfolio diversification and risk management.

The current data shows that wallet addresses containing significant Bitcoin balances have increased by 23% over the past quarter alone. Cryptocurrency accumulation patterns reveal that investors aren’t simply testing the waters—they’re diving in headfirst with conviction-driven purchases that demonstrate remarkable faith in Bitcoin’s future trajectory.

Key Metrics Behind the Record Pace

Blockchain analytics platforms have identified several compelling metrics that confirm Bitcoin buyers going all-in at unprecedented rates:

Exchange outflows have reached multi-year highs, with over 45,000 BTC leaving centralized exchanges weekly. This withdrawal pattern typically indicates long-term holding intentions rather than short-term trading activity. When investors move Bitcoin off exchanges and into cold storage wallets, they’re signaling confidence in extended price appreciation.

Accumulation addresses have surged dramatically. Wallets holding between 100 and 10,000 BTC—often associated with high-net-worth individuals and smaller institutions—have increased their combined holdings by approximately 8.7% in recent months. This BTC purchasing trend suggests that sophisticated investors are aggressively building positions.

Retail participation metrics show that average purchase sizes have increased by 41% compared to the previous year, indicating that even smaller investors are committing larger amounts per transaction. This shift in crypto investor behavior demonstrates growing conviction across all market segments.

The Psychology Behind All-In Bitcoin Strategies

Fear of Missing Out Meets Financial Conviction

The phenomenon of Bitcoin buyers going all-in isn’t driven by reckless speculation alone. Many investors have developed sophisticated theses based on macroeconomic conditions, monetary policy trajectories, and Bitcoin’s proven resilience through multiple market cycles. The digital scarcity narrative has gained substantial traction, particularly as traditional fiat currencies face inflationary pressures worldwide.

Psychological factors play a crucial role in this Bitcoin market momentum. Investors who witnessed Bitcoin’s recovery from previous bear markets have developed pattern recognition that reinforces buying conviction. Those who accumulated during the 2022-2023 bear market and experienced substantial gains have often reinvested profits back into Bitcoin, creating a self-reinforcing cycle of accumulation.

Institutional Validation Fueling Retail Confidence

The approval of spot Bitcoin ETFs in early 2024 fundamentally changed the investment landscape. As traditional financial institutions embraced Bitcoin through regulated products, retail investors gained confidence that previously eluded them. This institutional validation has encouraged cryptocurrency accumulation strategies among investors who previously considered Bitcoin too risky or speculative.

Major corporations adding Bitcoin to their treasury reserves have provided additional social proof. When publicly traded companies allocate shareholder capital to Bitcoin, it sends a powerful signal that legitimizes aggressive digital asset allocation strategies for individual investors.

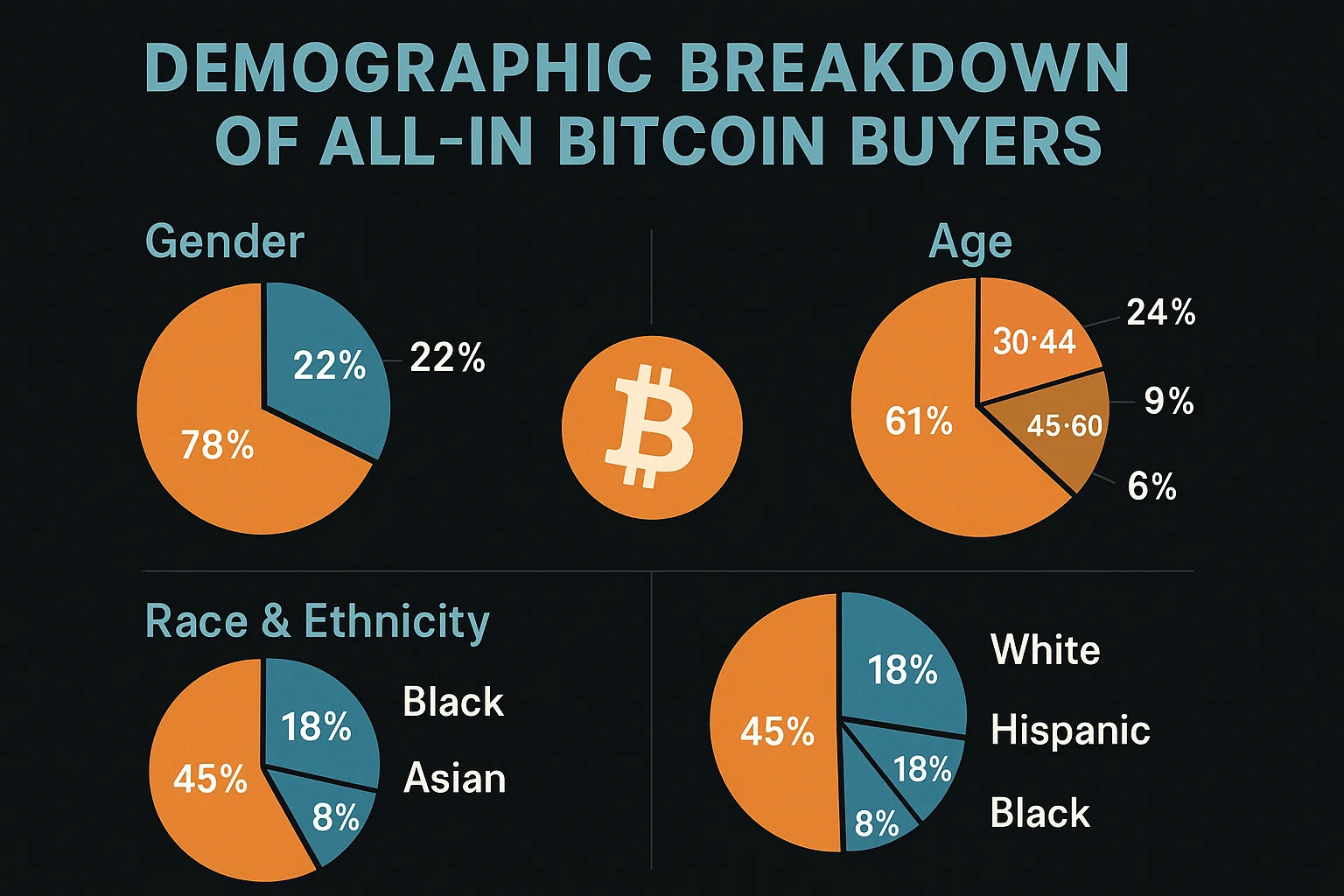

Demographic Breakdown of All-In Bitcoin Buyers

Millennial and Gen Z Investment Patterns

Younger demographics represent a disproportionate share of investors exhibiting Bitcoin buying patterns that could be characterized as “all-in” approaches. Millennials and Gen Z investors, having experienced limited financial success through traditional investment vehicles during periods of quantitative easing and asset inflation, view Bitcoin as a potential wealth equalizer.

Research indicates that investors aged 25-40 are three times more likely than older demographics to hold more than 25% of their investment portfolio in cryptocurrency, with Bitcoin representing the dominant holding. This BTC purchasing trend reflects both higher risk tolerance and a fundamental distrust of traditional financial systems among younger generations.

High-Net-Worth Individuals Increasing Exposure

Surprisingly, ultra-high-net-worth individuals have joined the ranks of Bitcoin buyers going all-in, though their definition of “all-in” typically means allocating 10-20% of liquid net worth rather than absolute portfolio dominance. Family offices have increasingly dedicated resources to cryptocurrency investment strategies, with Bitcoin serving as the anchor asset in most crypto portfolios.

These sophisticated investors approach Bitcoin investment surge opportunities with detailed risk management frameworks, viewing Bitcoin as a non-correlated asset that provides portfolio insurance against monetary debasement and systemic financial risks.

On-Chain Data Revealing Accumulation Trends

Long-Term Holder Supply Reaching New Heights

One of the most compelling indicators that Bitcoin buyers going all-in represents a sustainable trend is the behavior of long-term holders. On-chain metrics show that Bitcoin held in wallets for more than 155 days—the technical definition of long-term holder supply—has reached all-time highs, representing approximately 76% of circulating supply.

This cryptocurrency accumulation pattern demonstrates that current buyers aren’t flipping positions for short-term gains. Instead, they’re adopting hodling strategies that remove supply from liquid markets, potentially setting the stage for supply squeezes during demand surges.

Wallet Size Distribution Changes

Analysis of wallet size distribution reveals fascinating insights into Bitcoin buying patterns. The number of addresses holding at least 0.1 BTC has increased by 18% year-over-year, while addresses holding 1 BTC or more have grown by 12%. This distribution suggests that accumulation is occurring across all investment tiers simultaneously.

Mid-sized wallets (10-100 BTC) have shown particularly aggressive growth, increasing by 15% over recent quarters. These wallets often represent successful entrepreneurs, professional investors, and early Bitcoin adopters who are dramatically increasing their positions based on conviction in Bitcoin’s long-term value proposition.

Factors Driving the All-In Mentality

Macroeconomic Uncertainty and Currency Devaluation

The aggressive Bitcoin investment surge correlates strongly with growing concerns about fiat currency stability. With major central banks maintaining expansionary monetary policies and government debt levels reaching unprecedented heights, investors increasingly view Bitcoin as a hedge against monetary debasement.

Countries experiencing high inflation or currency crises have seen particularly dramatic increases in Bitcoin adoption, validating the use case that Bitcoin advocates have promoted for years. This real-world utility has reinforced conviction among Bitcoin buyers going all-in on their investment theses.

Limited Supply Meeting Growing Demand

Bitcoin’s programmatic supply schedule—with only 21 million coins that will ever exist—creates a fundamental scarcity that becomes more pronounced as adoption increases. The 2024 halving event reduced new Bitcoin issuance to just 3.125 BTC per block, cutting the inflation rate to approximately 0.85% annually.

This supply constraint, combined with growing demand from diverse market segments, creates mathematical pressure that supports aggressive BTC purchasing trends. Investors who understand these supply dynamics are front-running anticipated demand by accumulating aggressively today.

Technological Maturation and Network Effects

Bitcoin’s network has matured significantly over its 16-year history. Hash rate has reached all-time highs, providing unprecedented security. Lightning Network adoption has expanded, addressing scalability concerns. These technological improvements have reduced perceived risks and encouraged cryptocurrency accumulation among formerly skeptical investors.

Network effects continue strengthening as each new user, merchant, and institutional participant increases Bitcoin’s utility and value proposition. This positive feedback loop reinforces the conviction of Bitcoin buyers going all-in on their investment positions.

Risk Considerations for All-In Bitcoin Strategies

Volatility and Portfolio Concentration Risks

While data shows Bitcoin buyers going all-in at record rates, financial advisors caution about the risks inherent in concentrated positions. Bitcoin remains significantly more volatile than traditional assets, with drawdowns of 50-80% occurring during bear market cycles. Investors with highly concentrated Bitcoin positions may face psychological challenges in maintaining conviction during severe downturns.

Proper digital asset allocation requires an honest assessment of individual risk tolerance, investment timeline, and financial obligations. What works for a 28-year-old with no dependents differs dramatically from appropriate strategies for someone approaching retirement.

Regulatory and Systemic Risks

Despite growing mainstream acceptance, Bitcoin still faces regulatory uncertainties in many jurisdictions. Government actions regarding taxation, legal status, or trading restrictions could impact valuations significantly. Investors pursuing aggressive Bitcoin buying patterns should maintain awareness of regulatory developments and potential policy shifts.

Security and Custody Considerations

Self-custody of significant Bitcoin holdings requires technical knowledge and security practices that many investors lack. Hardware wallets, multi-signature setups, and secure backup procedures become critical when Bitcoin investment surge activities result in substantial holdings. Loss or theft of private keys means permanent loss of Bitcoin—a risk that doesn’t exist with traditional financial assets protected by institutional safeguards.

Comparing Current Trends to Historical Cycles

How This Accumulation Differs from Previous Bull Markets

The current pattern of Bitcoin buyers going all-in exhibits characteristics distinct from previous bull market cycles. Unlike the 2017 retail FOMO or the 2021 institutional awakening, the current accumulation phase demonstrates more measured, strategic positioning despite aggressive allocation percentages.

On-chain data reveals that current accumulation is occurring at relatively high price levels compared to previous cycles, suggesting that investors have developed higher conviction about Bitcoin’s long-term value. This BTC purchasing trend at elevated prices indicates that market participants view current levels as attractive entry points despite Bitcoin already appreciating substantially from cycle lows.

Lessons from Past Market Cycles

Historical analysis of cryptocurrency accumulation patterns shows that aggressive buyers during bear markets and early bull phases typically achieved superior returns. However, those who pursued all-in strategies near cycle peaks often experienced significant drawdowns requiring years of patience to recover.

Smart investors studying the Bitcoin market momentum recognize that timing matters enormously for concentrated position strategies. Dollar-cost averaging approaches that gradually build positions have historically provided better risk-adjusted returns than lump-sum all-in purchases, particularly for those with limited experience navigating Bitcoin’s volatility.

Expert Perspectives on All-In Bitcoin Investment

What Analysts Say About Current Trends

Leading cryptocurrency analysts have offered varied perspectives on the Bitcoin buyers going all-in phenomenon. Optimistic analysts point to improving fundamentals, increasing institutional adoption, and favorable macroeconomic conditions as justification for aggressive accumulation strategies.

Michael Saylor, whose company MicroStrategy has pioneered corporate Bitcoin treasury strategies, advocates for maximum reasonable allocation to Bitcoin, arguing that it represents the best long-term store of value available. His influence has inspired countless investors to pursue similar digital asset allocation strategies.

Conversely, traditional financial advisors typically recommend more conservative approaches, suggesting that cryptocurrency should represent only a small percentage of diversified portfolios. They emphasize the importance of maintaining adequate liquidity, emergency funds, and diversification across asset classes despite Bitcoin’s compelling characteristics.

Strategies for Participating in Bitcoin Accumulation

Dollar-Cost Averaging vs. Lump-Sum Investment

Investors interested in joining Bitcoin buyers going all-in must decide between accumulation strategies. Dollar-cost averaging—making regular, fixed-size purchases regardless of price—reduces timing risk and emotional decision-making. This methodical approach to cryptocurrency accumulation helps investors build positions without attempting to predict short-term price movements.

Lump-sum investment involves deploying substantial capital in a single or a few transactions. This approach maximizes position size quickly but exposes investors to timing risk. Historical analysis shows that lump-sum investment has outperformed dollar-cost averaging approximately 68% of the time, but with significantly higher volatility and emotional challenges.

Building Position While Managing Risk

Sophisticated investors pursuing Bitcoin investment surge opportunities often employ hybrid strategies. They might allocate a core position immediately while reserving capital for potential drawdowns. This approach allows participation in upside momentum while maintaining purchasing power for attractive buying opportunities during corrections.

Setting predetermined purchase levels, using stop-losses (though controversial in Bitcoin circles), and maintaining diversification across other assets can help investors manage the inherent risks of aggressive BTC purchasing trends.

The Role of Bitcoin ETFs in Acceleration

How Spot ETFs Changed the Game

The launch of spot Bitcoin ETFs in January 2024 fundamentally altered accessibility for traditional investors. These regulated products eliminated custody concerns, simplified tax reporting, and provided exposure through familiar brokerage accounts. The impact on Bitcoin buying patterns has been profound, with billions of dollars flowing into these products within months of launch.

ETF structures allow investors to achieve Bitcoin exposure within tax-advantaged retirement accounts, a feature that has encouraged Bitcoin buyers to go all-in within the context of long-term savings strategies. This development has brought Bitcoin investment opportunities to millions who previously lacked access or understanding of direct Bitcoin ownership.

Institutional Capital Flows

Spot Bitcoin ETFs have facilitated institutional capital deployment at scales previously impossible. Financial advisors who faced compliance obstacles when recommending direct Bitcoin ownership can now allocate client capital to regulated Bitcoin products. This development has accelerated cryptocurrency accumulation by traditional wealth management firms managing trillions in assets.

Global Perspective on Bitcoin Adoption Trends

Regional Differences in All-In Behavior

The phenomenon of Bitcoin buyers going all-in varies significantly across geographic regions. Emerging markets with unstable currencies or capital controls often show the highest percentage of population owning Bitcoin, though absolute amounts may be smaller due to economic conditions.

Developed markets show different digital asset allocation patterns, with investors treating Bitcoin as a growth asset or inflation hedge rather than a currency alternative. North American and European investors typically hold Bitcoin alongside traditional portfolios, while investors in countries like Argentina, Turkey, and Nigeria often view Bitcoin as a superior alternative to local currency.

Cultural Attitudes Toward Risk and Innovation

Cultural factors significantly influence BTC purchasing trends and willingness to pursue concentrated Bitcoin strategies. Societies with higher risk tolerance and technological adoption rates show greater enthusiasm for aggressive Bitcoin accumulation. Asian markets, particularly South Korea and Singapore, have demonstrated remarkable retail participation in cryptocurrency markets.

Future Projections and Potential Scenarios

Supply Shock Scenarios

If Bitcoin buyers going all-in continues at current rates while available supply on exchanges continues declining, fundamental supply-demand dynamics suggest potential for significant price appreciation. With only approximately 2 million Bitcoin remaining to be mined over the next 120 years, and millions already lost permanently, the available supply for new buyers becomes increasingly constrained.

Mathematical modeling suggests that if just 2% of global investment capital were allocated to Bitcoin, demand would far exceed available supply at current prices. This potential supply shock represents the core thesis driving many Bitcoin investment surge strategies.

Regulatory Evolution Impact

Future cryptocurrency accumulation trends will be substantially influenced by regulatory developments. Clear, favorable regulations could accelerate institutional adoption and mainstream acceptance. Conversely, restrictive policies could temporarily dampen enthusiasm, though Bitcoin’s decentralized nature limits the effectiveness of regional restrictions.

Technological Developments

Continued innovation in Bitcoin infrastructure—including Lightning Network expansion, improved custody solutions, and enhanced privacy features—will likely support continued Bitcoin buying patterns among increasingly sophisticated users. Technological improvements that enhance usability without compromising security or decentralization strengthen Bitcoin’s fundamental value proposition.

Conclusion

The data conclusively demonstrates that Bitcoin buyers are going all-in at unprecedented rates, reflecting a fundamental shift in how diverse market participants view the leading cryptocurrency. From retail investors allocating majority portions of savings to institutional players adding meaningful exposure, Bitcoin has transcended its early speculative phase to become a legitimate component of investment strategies worldwide.

This Bitcoin investment surge isn’t occurring in a vacuum—it reflects rational responses to macroeconomic conditions, technological maturation, and growing mainstream acceptance. However, investors must approach aggressive cryptocurrency accumulation strategies with a clear understanding of risks, appropriate position sizing based on individual circumstances, and long-term conviction necessary to weather Bitcoin’s inevitable volatility.