The Bitcoin price dropped dramatically, pushing the world’s largest digital asset below the psychologically crucial $96,000 threshold. This represents Bitcoin’s lowest valuation in six months, sending shockwaves through the crypto community and raising concerns about the sustainability of the recent bull run. The catalyst behind this sharp decline centers on diminishing expectations for a Federal Reserve interest rate cut in December, fundamentally altering investor sentiment across risk assets. As traders reassess their positions and market dynamics shift, understanding the factors driving this Bitcoin price drop becomes essential for investors navigating these turbulent waters.

Recent Bitcoin Price Drop

The cryptocurrency landscape experienced a seismic shift as Bitcoin’s value plummeted through critical support levels, marking one of the most significant downturns in recent months. The Bitcoin price drop didn’t occur in isolation—it reflected broader macroeconomic concerns that have been building throughout the quarter. Market analysts point to multiple converging factors that created the perfect storm for this decline, with Federal Reserve monetary policy expectations taking center stage.

Bitcoin’s fall below $96,000 represents more than just a numerical milestone; it signals a fundamental shift in market psychology. Investors who had anticipated continued bullish momentum found themselves caught off guard as selling pressure intensified. The speed and magnitude of the decline suggest institutional participation, as large holders moved to de-risk their portfolios amid uncertainty about future monetary policy direction.

The Role of Federal Reserve Rate Cut Expectations

Federal Reserve policy decisions have become increasingly influential in determining cryptocurrency valuations, and the latest developments have not favored Bitcoin bulls. Market participants had priced in a strong probability of a December rate cut, with futures markets suggesting odds exceeding 70% just weeks ago. However, recent economic data releases painted a different picture, showing resilient inflation figures and robust employment numbers that gave the Fed little reason to ease monetary conditions.

The central bank’s hawkish pivot caught many investors by surprise, triggering widespread reassessment of risk asset allocations. When rate cut expectations fade, the opportunity cost of holding non-yielding assets like Bitcoin increases relative to interest-bearing alternatives. This dynamic creates selling pressure as capital flows rotate toward traditional fixed-income securities offering attractive yields without the volatility inherent in cryptocurrency markets.

Jerome Powell’s recent statements emphasized the Fed’s commitment to maintaining restrictive monetary policy until inflation demonstrates sustained movement toward the 2% target. This messaging effectively extinguished hopes for near-term rate relief, contributing directly to the Bitcoin price drop and broader cryptocurrency market weakness.

Technical Analysis of Bitcoin’s Six-Month Low

From a technical perspective, Bitcoin’s breach of the $96,000 level carries significant implications for future price action. This support level had held firm through multiple testing attempts over the previous weeks, and its violation suggests weakening buyer conviction. Technical traders often view such breakdowns as confirmation of trend reversals, potentially triggering additional selling as stop-loss orders activate and momentum strategies flip bearish.

The Relative Strength Index (RSI) for Bitcoin has declined into oversold territory, typically indicating extreme selling pressure and potential exhaustion. However, in strong downtrends, assets can remain oversold for extended periods, making timing any reversal attempt particularly challenging. Moving average configurations have also deteriorated, with the 50-day moving average crossing below the 200-day—a pattern technical analysts call a “death cross” that historically precedes extended bearish periods.

Key Support and Resistance Levels

Following the Bitcoin price drop below $96,000, market participants are closely monitoring several critical price zones. The next major support level sits near $92,000, where significant buying interest emerged during previous corrections. Should that level fail to hold, technical analysts point to the $88,000-$90,000 range as the subsequent area where buyers might step in aggressively.

On the upside, Bitcoin now faces resistance at the recently broken $96,000 level, with additional overhead supply likely concentrated around $98,500 and $100,000. The psychological importance of reclaiming six-figure territory cannot be overstated—such a move would likely reinvigorate bullish sentiment and attract renewed buying interest from retail and institutional participants alike.

Volume analysis reveals that the recent selling occurred on elevated transaction counts, confirming genuine distribution rather than low-liquidity manipulation. This participation breadth suggests conviction behind the selling pressure, making any near-term recovery attempt face significant headwinds from newly established short positions and sidelined capital waiting for clearer directional signals.

Macroeconomic Factors Driving Cryptocurrency Volatility

The intersection of traditional finance and cryptocurrency markets has never been more apparent than in recent months. Bitcoin’s correlation with equity markets, particularly technology stocks, has strengthened considerably, meaning that factors affecting traditional risk assets increasingly impact cryptocurrency valuations. The fading December rate cut bets that triggered the Bitcoin price drop simultaneously pressured stock indices, demonstrating how interconnected these markets have become.

Inflation dynamics continue playing a pivotal role in shaping Federal Reserve policy and, by extension, cryptocurrency market sentiment. Recent Consumer Price Index (CPI) and Producer Price Index (PPI) releases showed inflation proving more persistent than economists anticipated, particularly in the services sector. This stickiness gives the Fed justification to maintain higher interest rates for longer, creating an environment where speculative assets like Bitcoin face sustained headwinds.

Global Economic Uncertainty and Safe Haven Dynamics

Paradoxically, while Bitcoin advocates have long promoted the cryptocurrency as digital gold and an inflation hedge, market behavior during this latest decline suggests investors view it primarily as a risk asset rather than a haven. During periods of economic uncertainty and monetary tightening, capital typically flows toward established stores of value like U.S. Treasury securities and physical gold rather than cryptocurrencies.

The U.S. dollar’s strength has also contributed to Bitcoin’s weakness, as the inverse correlation between the greenback and cryptocurrencies generally holds during risk-off periods. Dollar Index (DXY) strength reflects global capital seeking safety and yield in American assets, competing directly with cryptocurrency investments for investor dollars.

Geopolitical tensions and banking sector stability concerns add additional complexity to the investment landscape. While previous banking crises sometimes benefited Bitcoin as investors sought alternatives to traditional financial systems, the current environment’s combination of factors has proven net negative for cryptocurrency valuations.

Impact on the Broader Cryptocurrency Market

The Bitcoin price drop reverberated throughout the entire cryptocurrency ecosystem, with alternative coins (altcoins) experiencing even more severe declines. This pattern is typical during Bitcoin corrections, as market participants liquidate smaller, more speculative positions first before potentially reducing Bitcoin holdings. Ethereum, the second-largest cryptocurrency by market capitalization, fell proportionally more than Bitcoin, while smaller-cap tokens suffered double-digit percentage losses.

Total cryptocurrency market capitalization declined by hundreds of billions of dollars within days, evaporating paper wealth and triggering margin calls across leveraged positions. Derivatives markets experienced extreme volatility, with funding rates turning deeply negative as short positions proliferated. Liquidation cascades affected both perpetual futures and options markets, amplifying the downside move and contributing to the market’s dramatic repricing.

Institutional Investor Response

Institutional participation in cryptocurrency markets has grown substantially in recent years, and their response to this Bitcoin price drop provides insights into evolving market dynamics. Some institutions view corrections as accumulation opportunities, implementing dollar-cost averaging strategies during periods of weakness. However, others may face redemption pressures or risk management requirements that compel selling regardless of long-term conviction.

Bitcoin exchange-traded fund (ETF) flows offer a window into institutional sentiment, and recent data shows mixed signals. While some days have seen net outflows as investors reduced exposure, others have recorded modest inflows, suggesting bargain hunting. The launch of spot Bitcoin ETFs earlier this year fundamentally changed how institutions access cryptocurrency exposure, making their trading activity more transparent and influential in price discovery.

Corporate treasuries holding Bitcoin face scrutiny during significant price declines, as shareholders and board members question the wisdom of maintaining volatile assets on balance sheets. Companies like MicroStrategy, with substantial Bitcoin holdings, see their stock prices move in sympathy with cryptocurrency markets, creating feedback loops that can amplify volatility in both directions.

Mining Industry Implications

Bitcoin miners face particularly acute challenges when prices decline significantly, as their revenue depends directly on Bitcoin valuations while their costs remain largely fixed. The Bitcoin price dropping below $96,000 pressures mining economics, especially for operations with higher electricity costs or older, less efficient equipment. This dynamic can trigger a capitulation phase where marginal miners shut down operations, reducing network hash rate temporarily until difficulty adjustments compensate.

The upcoming Bitcoin halving event, which reduces block rewards by 50%, adds another dimension to mining economics. While still months away, miners are already preparing for the dramatic revenue reduction that accompanies each halving cycle. A prolonged period of depressed prices heading into the halving could force industry consolidation, with well-capitalized operations acquiring distressed competitors.

Network Hash Rate and Security Considerations

Despite price volatility, Bitcoin’s network hash rate has demonstrated remarkable resilience, remaining near all-time highs even as prices declined. This reflects continued investment in mining infrastructure and the game-theory dynamics that incentivize securing the network. However, sustained price weakness could eventually lead to hash rate declines if mining becomes unprofitable for significant portions of the industry.

Mining difficulty adjustments occur every 2,016 blocks (approximately two weeks), providing automatic stabilization mechanisms. If the hash rate drops due to miner capitulation, the difficulty decreases, making mining more profitable for the remaining participants. This self-regulating system has proven robust through multiple market cycles, though extreme scenarios could test its limits.

Energy costs represent the primary variable expense for mining operations, and miners with access to cheap, preferably renewable energy sources maintain competitive advantages during price downturns. Geographic diversification has also become a strategic priority following regulatory crackdowns in certain jurisdictions, with North American and Scandinavian operations gaining market share.

Regulatory Developments and Market Sentiment

Regulatory clarity (or lack thereof) continues influencing cryptocurrency market dynamics significantly. The Bitcoin price drop coincided with ongoing debates about cryptocurrency regulation in major jurisdictions, adding uncertainty to an already volatile environment. United States Securities and Exchange Commission (SEC) actions regarding cryptocurrency exchanges, staking services, and token classifications create a persistent overhang that can suppress valuations.

The evolving regulatory landscape in Europe, where the Markets in Crypto-Assets (MiCA) regulation is being implemented, provides a contrasting approach to U.S. regulation-by-enforcement. While comprehensive frameworks offer clarity, they also impose compliance costs and operational restrictions that some market participants find burdensome. How different regulatory approaches affect cryptocurrency adoption and innovation remains an ongoing experiment with significant implications for future valuations.

Central Bank Digital Currencies (CBDCs) Competition

Central banks globally are advancing their own digital currency initiatives, creating potential competition for cryptocurrencies. While CBDCs differ fundamentally from decentralized cryptocurrencies in their architecture and philosophy, their emergence could satisfy some use cases currently served by crypto assets. The Federal Reserve’s exploration of a digital dollar, though proceeding cautiously, represents a potential long-term headwind for cryptocurrency adoption in payments.

However, Bitcoin advocates argue that CBDCs actually validate the underlying technology while highlighting the value of permissionless, censorship-resistant alternatives. This philosophical debate plays out against the backdrop of practical market dynamics, where regulatory developments and institutional adoption continue shaping cryptocurrency’s evolution.

Historical Context: Comparing Previous Bitcoin Corrections

Placing the current Bitcoin price drop in historical context provides perspective for investors evaluating whether this represents a temporary correction or the beginning of a prolonged bear market. Bitcoin has experienced numerous drawdowns exceeding 50% throughout its history, with each cycle bringing predictions of its demise followed by eventual recovery to new all-time highs.

The 2017-2018 bear market saw Bitcoin decline approximately 84% from peak to trough, while the 2021-2022 correction resulted in a 77% drawdown. These historical precedents remind investors that significant volatility remains inherent to cryptocurrency markets despite growing institutional participation and market maturity. However, each cycle has also exhibited unique characteristics, making direct comparisons imperfect guides for predicting future outcomes.

Market Maturation and Volatility Trends

One notable trend across Bitcoin cycles is gradually decreasing volatility amplitude, though this remains substantially higher than traditional asset classes. The current correction, while painful for recent buyers, has thus far remained modest compared to previous bear markets. Whether this reflects genuine market maturation or simply represents an early stage of a deeper correction remains to be seen.

Institutional participation has theoretically increased market efficiency and reduced extreme volatility, as professional traders employ sophisticated risk management and arbitrage strategies. However, institutional involvement can also amplify downside moves when risk-off sentiment prevails, as large positions get unwound systematically rather than through gradual retail capitulation.

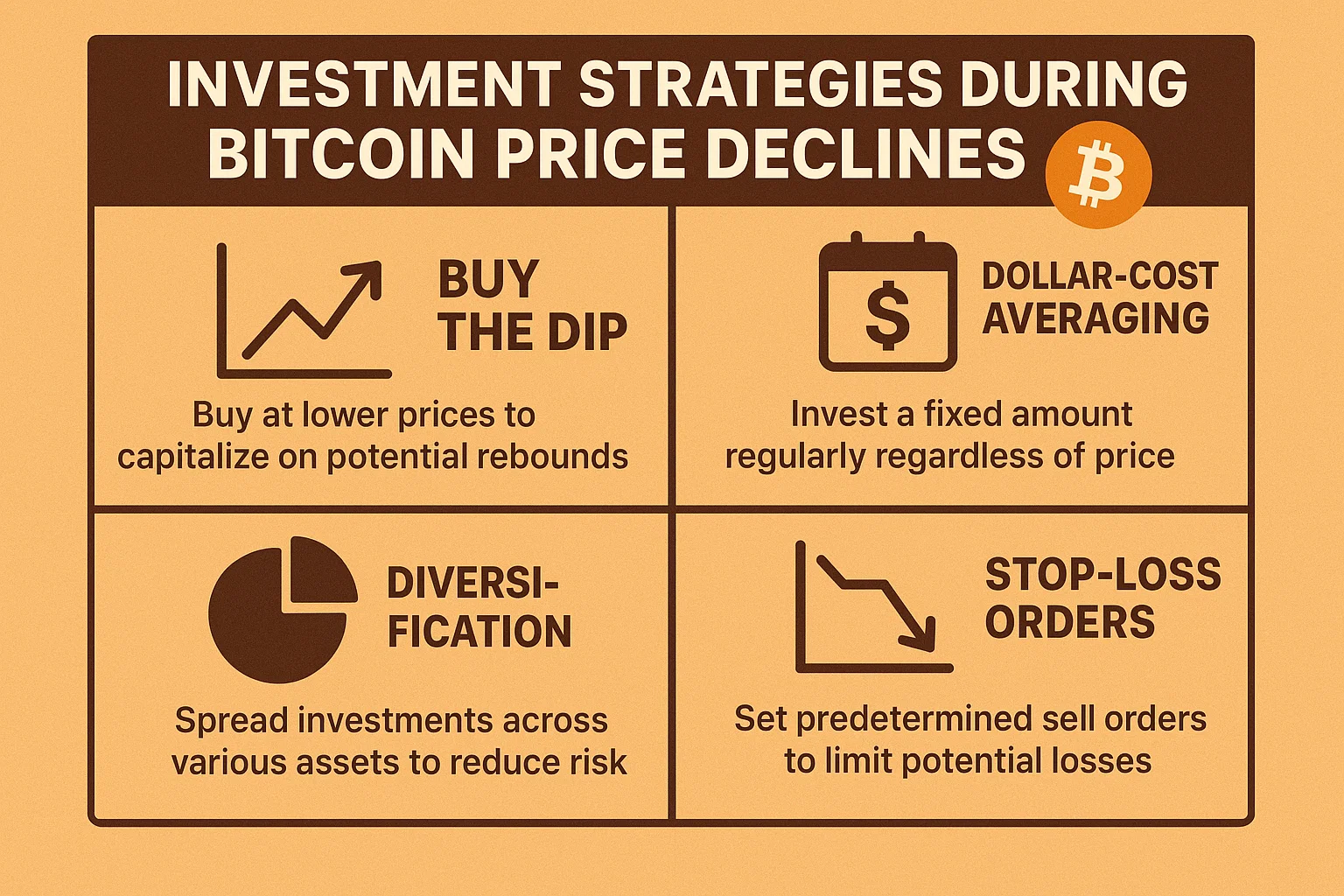

Investment Strategies During Bitcoin Price Declines

For investors navigating the current Bitcoin price drop, several strategic approaches merit consideration based on individual risk tolerance and investment horizons. Dollar-cost averaging (DCA) continues to be popular among long-term believers, as it removes timing pressure and builds positions gradually regardless of short-term volatility. This approach has historically performed well during Bitcoin’s cyclical nature, though it requires conviction and patience during extended downturns.

Alternatively, tactical traders may view the decline as an opportunity to implement defined-risk strategies using options or structured products. Selling put options at lower strike prices, for example, allows investors to potentially acquire Bitcoin at discounted levels while generating premium income if prices stabilize above those strikes. However, such strategies require a sophisticated understanding of derivatives markets and carry their own risks.

Portfolio Rebalancing Considerations

For investors with diversified portfolios including cryptocurrency allocations, significant price movements create rebalancing opportunities. If Bitcoin’s portfolio weighting has fallen below target allocations due to the price decline, systematic rebalancing would dictate increasing exposure. Conversely, investors who view the correction as potentially deepening might temporarily reduce allocations below target levels, accepting tracking error in exchange for capital preservation.

Tax-loss harvesting represents another consideration for taxable accounts experiencing unrealized losses. Selling positions to realize losses for tax purposes, then potentially repurchasing after the required wash-sale period, can create tax benefits while maintaining long-term exposure. However, this strategy requires careful execution and consideration of each investor’s unique tax situation.

Expert Predictions and Market Outlook

Market analysts offer divergent views on Bitcoin’s trajectory following the Bitcoin price drop, with predictions ranging from imminent recovery to further significant declines. Bulls argue that fundamental adoption continues growing despite price volatility, pointing to increasing institutional custody solutions, payment network developments, and emerging market adoption as long-term positive catalysts.

Prominent cryptocurrency analysts suggest the $92,000-$94,000 range represents strong support where aggressive buyers might emerge. They point to on-chain metrics showing long-term holders accumulating during weakness, historically a bullish indicator that precedes market bottoms. Additionally, the historically strong performance of Bitcoin during the fourth quarter provides optimism for year-end recovery.

Conversely, bearish analysts warn that macroeconomic headwinds remain unresolved, with Federal Reserve policy likely staying restrictive well into the following year. They argue that cryptocurrency markets have yet to fully price in a prolonged higher-interest-rate environment, suggesting additional downside potential before sustainable bottoms form. Some bears point to $85,000 or even $80,000 as more realistic downside targets given current macro conditions.

Technical Indicator Signals

Technical analysts examining various indicators report mixed signals that reflect market uncertainty. While RSI readings suggest oversold conditions that could support near-term bounces, momentum indicators remain negative, and trend-following signals point to continued weakness. Elliott Wave theorists debate whether the current decline represents a corrective wave within an ongoing bull market or the beginning of a new impulse wave lower.

Volume profile analysis identifies significant support zones below current prices where substantial historical trading occurred. These areas often act as magnets during declines, as market participants remember previous price acceptance levels and perceive them as value opportunities. However, technical analysis provides probabilities rather than certainties, and unexpected developments can quickly invalidate even well-supported technical scenarios.

Long-Term Bitcoin Adoption Trends

Despite near-term volatility and the current Bitcoin price drop, long-term adoption metrics continue showing positive trends that support the bull case for cryptocurrency. Lightning Network capacity has grown substantially, enabling faster and cheaper Bitcoin transactions that enhance its utility for payments. Second-layer solutions address scalability concerns that previously limited Bitcoin’s transaction throughput, potentially enabling broader adoption.

Corporate treasury adoption, while pausing during price weakness, has established Bitcoin as a legitimate reserve asset consideration for forward-thinking companies. The precedent set by early adopters creates a pathway for others to follow once market conditions stabilize. Similarly, sovereign wealth funds and pension funds have begun exploring cryptocurrency allocations, though typically in small percentages relative to total assets under management.

Emerging Market Use Cases

Bitcoin’s value proposition as censorship-resistant money resonates particularly strongly in emerging markets experiencing currency instability or authoritarian governance. Countries facing hyperinflation or capital controls have seen grassroots Bitcoin adoption accelerate, providing real-world use cases beyond speculative investment. While these applications represent relatively small transaction volumes currently, they demonstrate Bitcoin’s potential utility in financial systems that fail to serve their populations adequately.

Educational initiatives and improved user interfaces continue to reduce barriers to cryptocurrency adoption. As wallet security improves and on-ramps simplify, the technical knowledge required to use Bitcoin safely decreases, potentially expanding the addressable market beyond early adopters and technologically sophisticated users.

Conclusion

The recent Bitcoin price drop below $96,000 represents a significant test for cryptocurrency markets, challenging investor conviction and forcing reassessment of near-term expectations. Fading December Federal Reserve rate cut bets have fundamentally altered the risk-reward calculus for Bitcoin and broader crypto assets, creating an environment where caution predominates over exuberance. However, this volatility is not unprecedented in Bitcoin’s history, and previous corrections have ultimately resolved with new all-time highs, rewarding patient long-term holders.

Investors must balance legitimate macroeconomic concerns against Bitcoin’s long-term value proposition and adoption trajectory. The current Bitcoin price drop creates opportunities for those with conviction and capital to deploy, while simultaneously serving as a reminder of the risks inherent in cryptocurrency markets. Risk management, appropriate position sizing, and realistic expectations remain essential for successfully navigating these turbulent waters.

Read More: Bitcoin to $75K or $125K: Price Prediction Analysis