Bitcoin price levels to watch have become paramount for anyone looking to navigate this historic moment in digital asset history. As institutional adoption accelerates and retail enthusiasm reaches fever pitch, identifying key support and resistance zones will determine the success of your investment decisions in the coming weeks and months.

Bitcoin’s Historic Rally to $125,000

Bitcoin’s ascent to over $125,000 represents more than just a numerical milestone—it signifies a fundamental shift in how global markets perceive digital currencies. The journey to this Bitcoin price level has been marked by increasing institutional participation, favourable regulatory developments, and growing acceptance of cryptocurrency as a legitimate asset class.

Factors Driving Bitcoin’s Record-Breaking Performance

Several interconnected factors have propelled Bitcoin to unprecedented heights. Institutional investors have dramatically increased their exposure to digital assets, with major corporations and investment funds allocating significant portions of their portfolios to Bitcoin. The approval of multiple spot Bitcoin ETFs has provided traditional investors with easier access to cryptocurrency markets, creating sustained buying pressure.

Macroeconomic conditions have also played a crucial role. Concerns about currency devaluation, persistent inflation in major economies, and geopolitical tensions have driven investors toward Bitcoin as a hedge against vulnerabilities in the traditional financial system. Central bank policies and government debt levels have reinforced Bitcoin’s narrative as “digital gold,” attracting capital from investors seeking portfolio diversification.

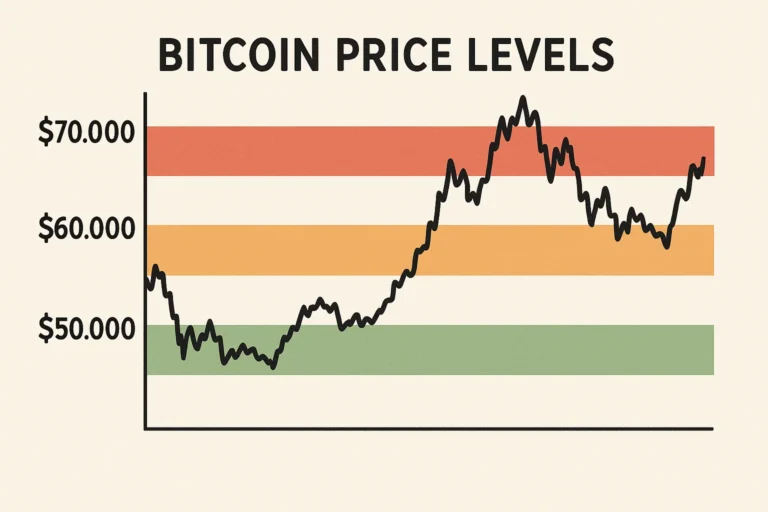

Critical Bitcoin Price Levels to Watch: Support Zones

Identifying potential support levels during pullbacks is essential for developing effective trading strategies. These support levels represent price points where buying pressure historically overwhelms selling pressure, creating a floor that prevents further declines.

Primary Support Level: $120,000

The $120,000 support level represents the first significant psychological and technical barrier below the current record high. This price point has already demonstrated its significance as a consolidation zone during Bitcoin’s initial attempts to break through the $20,000 mark. If Bitcoin experiences profit-taking or a market correction, this level is likely to attract substantial buying interest from investors who missed the initial rally.

Historical volume analysis suggests that the $120,000 zone accumulated significant trading activity during Bitcoin’s ascent, indicating firm buyer conviction. Technical indicators suggest that this level aligns with the 0.236 Fibonacci retracement of Bitcoin’s recent surge, reinforcing its potential as a bounce point.

Secondary Support Level: $115,000

Should Bitcoin face more substantial selling pressure, the $115,000 support zone represents the next critical level where buyers are expected to defend. This price point corresponds to a previous Resistance Level that has now transformed into support—a classic technical pattern that often provides a reliable price floor.

Market structure analysis reveals that $115,000 served as a central accumulation zone before Bitcoin’s explosive move higher. Large holders and institutional investors established positions around this level, suggesting they would likely defend their investment by adding to positions if prices revisit this area.

Significant Support Level: $110,000

The $110,000 level represents a significant support zone, indicating a deeper correction while maintaining Bitcoin’s bullish structure. This price point aligns with the 0.382 Fibonacci retracement level and represents roughly a 12% correction from the all-time high—a normal pullback within strong uptrends.

This support level gains additional significance due to its proximity to the 20-day moving average, a technical indicator that often provides dynamic support during trending markets. Experienced traders recognise that healthy bull markets typically maintain prices above this moving average, making $110,000 a critical level for maintaining bullish momentum.

Key Bitcoin Price Levels to Watch: Resistance Zones

While Bitcoin has already achieved record highs, identifying potential resistance levels helps traders understand where the cryptocurrency might face selling pressure or consolidation during continued advances.

PsyResistance Resistance: $130,000

The $130,000 psychological resistance level represents the next primary target for Bitcoin bulls. Round numbers often create psychological barriers in financial markets, and this level is no exception. Traders and investors frequently place profit-taking orders at these significant figures, creating natural resistance zones.

Technical projections based on measured move analysis suggest $130,000 as a logical next target, given Bitcoin’s recent price action patterns. Additionally, this level represents an attractive risk-reward ratio for traders establishing new positions on pullbacks to identified support zones.

Extended Target: $135,000-$140,000

Looking further ahead, the $135,000 to $140,000 range emerges as an extended resistance zone based on Fibonacci extension analysis and Elliott Wave theory projections. This price range would represent approximately an 8-12% gain from current levels and aligns with several technical forecasting models.

Market sentiment indicators suggest that achieving these levels would require sustained institutional buying and continued positive momentum from favourable regulatory developments or macroeconomic catalysts. Volume profile analysis indicates lower liquidity in this price range, meaning moves through this zone could be more volatile in either direction.

Long-Term Projection: $150,000

The $150,000 Bitcoin price level represents an ambitious yet achievable target, based on historical bull market behaviour and current market dynamics. This level would mark a 20% gain from the recent record high and align with optimistic analyst predictions for this market cycle.

Achieving $150,000 would likely require a combination of factors, including sustained institutional accumulation, continued retail participation, favourable regulatory clarity, and potential supply shocks from long-term holders refusing to sell at current prices. On-chain metrics tracking Bitcoin held in cold storage suggest that supply available for sale remains constrained, supporting the possibility of continued price appreciation.

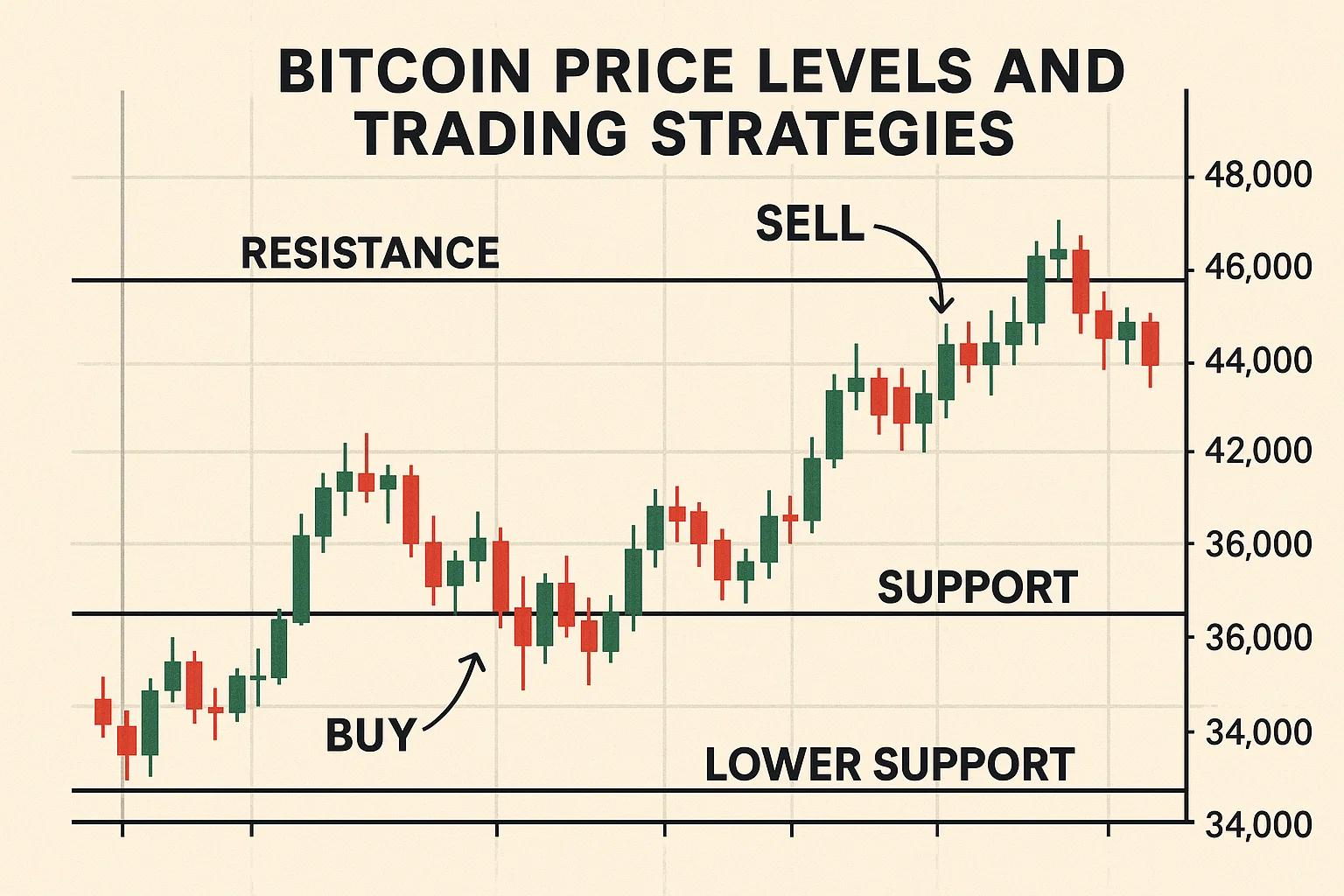

Technical Analysis: Bitcoin Price Levels and Trading Strategies

Successful navigation of Bitcoin price levels to watch requires an understanding of technical analysis principles and the development of appropriate trading strategies for different market scenarios.

Moving Average Analysis

Bitcoin’s relationship with key moving averages provides crucial insight into trend strength and potential reversal points. The 50-day moving average currently sits near $112,000, offering dynamic support during pullbacks. As long as Bitcoin maintains prices above this level, the intermediate-term uptrend remains intact.

The 200-day moving average, positioned around $95,000, represents a significant long-term support level that defines the broader bull market. A decline to this level would constitute a significant correction, but wouldn’t necessarily invalidate the overall bullish structure. The substantial gap between current prices and the 200-day moving average indicates the aggressive nature of Bitcoin’s recent rally and the potential for volatility.

Relative Strength Index (RSI) Considerations

The RSI indicator provides valuable context for understanding whether Bitcoin is overbought or oversold at current price levels. Following the surge above $125,000, Bitcoin’s RSI on daily timeframes entered overbought territory, exceeding 70, suggesting the possibility of a near-term consolidation or pullback.

However, experienced traders recognise that strong uptrends can persist even with overbought RSI readings for extended periods. The key is monitoring for bearish divergence—when price makes new highs but RSI fails to confirm—which often signals exhaustion and potential reversals.

Volume Profile and Market Structure

Volume profile analysis reveals significant trading activity concentrated between $115,000 and $120,000, creating a high-volume node that typically acts as strong support during corrections. Understanding where heavy trading occurred helps identify Bitcoin price levels that will attract renewed interest during future price discovery.

Market structure shows Bitcoin establishing a clear pattern of higher highs and higher lows—the hallmark of a healthy uptrend. Maintaining this structure requires that any pullbacks find support above previous swing lows, with the most recent significant low around $110,000 serving as a critical level for preserving bullish momentum.

On-Chain Metrics and Bitcoin Price Levels

Beyond traditional technical analysis, blockchain-specific metrics provide unique insights into Bitcoin price levels to watch and potential future movements.

Exchange Flow Analysis

Monitoring Bitcoin flows to and from cryptocurrency exchanges provides insights into the behaviour of market participants. Recent data shows significant Bitcoin outflows from exchanges following the rally above $125,000, suggesting long-term holders are moving coins to cold storage rather than selling—a bullish signal indicating conviction in higher future prices.

Conversely, substantial inflows to exchanges typically precede increased selling pressure as holders prepare to liquidate positions. Tracking these flows helps anticipate potential supply hitting the market at various price levels, allowing traders to position accordingly.

MVRV Ratio Considerations

The Market Value to Realised Value (MVRV) ratio compares Bitcoin’s market capitalisation to its realised capitalisation, providing insight into whether the cryptocurrency is overvalued or undervalued relative to its cost basis. At current Bitcoin price levels above $125,000, the MVRV ratio has reached historically elevated levels, suggesting potential for profit-taking.

However, during strong bull markets, MVRV can remain elevated for extended periods before meaningful corrections occur. The ratio should be considered in conjunction with other metrics rather than as a standalone timing indicator.

Hold Behaviour and Supply Dynamics

Analysis of long-term holder behaviour reveals that accumulating Bitcoin for more than one year has continued despite record prices, demonstrating firm conviction. This “HODLing” behaviour reduces available supply and creates conditions for continued price appreciation when demand remains strong.

Meanwhile, short-term holder supply has increased as new investors enter the market at elevated prices. These participants typically have weaker hands and may sell during volatility, creating temporary selling pressure at key Bitcoin price levels.

Institutional Impact on Bitcoin Price Levels

Institutional participation has fundamentally altered Bitcoin’s price dynamics and the significance of various price levels to watch.

Spot Bitcoin ETF Influence

The approval and trading of spot Bitcoin ETFs have created consistent buying pressure as these funds purchase Bitcoin to back their shares. Daily inflows into these products have averaged hundreds of millions of dollars, providing a steady bid under Bitcoin prices and helping establish support at higher price levels. As these ETFs attract more assets under management, their impact on Bitcoin’s price structure will likely increase, potentially reducing volatility and creating more defined support and resistance zones based on institutional accumulation patterns.

Corporate Treasury Adoption

Major corporations adding Bitcoin to their treasury reserves represent a new category of long-term holders unlikely to sell during normal market volatility. These strategic allocations typically occur at various Bitcoin price levels, creating support zones where corporate buyers entered positions and have vested interest in defending. Companies like MicroStrategy, Tesla, and others have established Bitcoin positions ranging from tens of thousands to hundreds of thousands of coins, representing substantial capital that reinforces support at their entry prices.

Traditional Finance Integration

As Bitcoin becomes increasingly integrated into traditional finance through derivatives markets, lending platforms, and custodial services, the price levels that matter to institutional participants gain enhanced significance. Options strikes, futures settlement prices, and lending collateral thresholds create technical levels that may not be apparent from simple chart analysis but significantly influence price action.

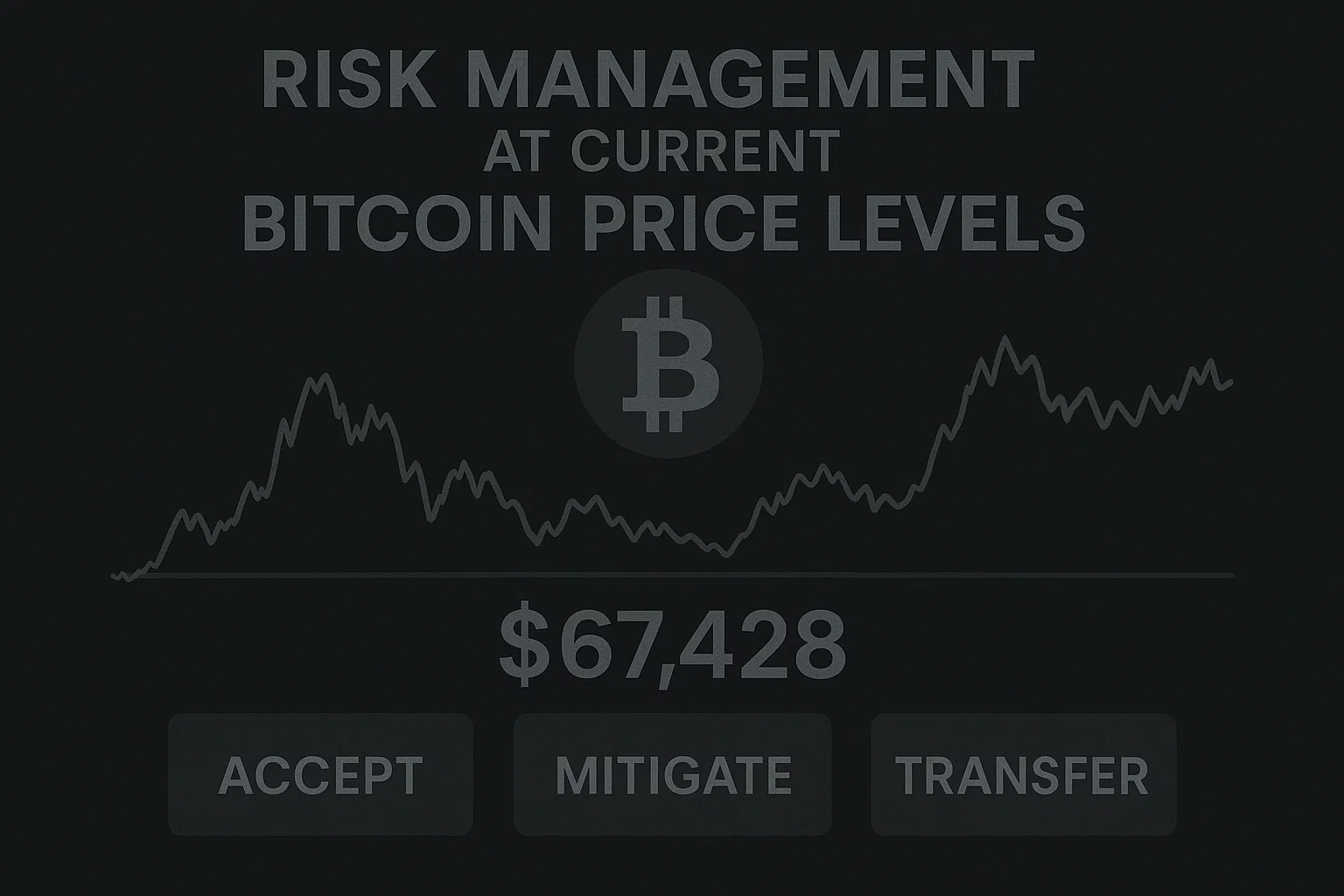

Risk Management at Current Bitcoin Price Level

Understanding how to manage risk while trading Bitcoin price levels near all-time highs is crucial for capital preservation and long-term success.

Position Sizing Strategies

At record Bitcoin price levels above $125,000, the potential for volatility increases due to a lack of historical price action for reference. Conservative position sizing becomes essential, with many experienced traders recommending limiting exposure to amounts that allow comfortable tolerance of 20-30% drawdowns without panic selling. Dollar-cost averaging strategies offer an alternative to attempting perfect market timing, enabling investors to build positions gradually across multiple price levels while mitigating the impact of short-term volatility.

Stop-Loss Placement Considerations

Setting appropriate stop-loss levels requires balancing protection against catastrophic losses with avoiding premature exits from positions during normal volatility. Placing stops below identified support zones—such as the $115,000 or $110,000 levels to watch—provides room for natural price fluctuation while limiting downside risk.

Trailing stop strategies allow traders to lock in profits as Bitcoin advances to new highs while maintaining exposure to continued upside potential. These should be adjusted as Bitcoin establishes new support levels during its ascent.

Portfolio Diversification

Despite Bitcoin’s impressive performance, maintaining diversified exposure across multiple asset classes remains prudent risk management. The cryptocurrency’s historical volatility means that positions should be sized relative to the overall portfolio’s risk tolerance, regardless of conviction in higher future Bitcoin price levels.

Diversification within cryptocurrency holdings—including exposure to Ethereum, other large-cap digital assets, and potentially emerging projects—can reduce portfolio-specific risk while maintaining exposure to the broader crypto market thesis.

Macroeconomic Factors Influencing Bitcoin Price Levels

The broader economic context helps interpret the sustainability of current Bitcoin price levels and anticipate future movements.

Federal Reserve Policy Impact

Central bank policies, particularly those of the U.S. Federal Reserve, have a significant influence on Bitcoin’s price dynamics. Interest rate decisions, measures, and quantitative easing measures, as well as tightening measures, and forward guidance, all impact investor risk appetite and capital flows into alternative assets, such as Bitcoin.

Current monetary policy conditions have created an environment where investors seek alternatives to traditional fixed-income investments, driving capital toward Bitcoin and other cryptocurrencies. Changes in this policy stance could substantially impact support and resistance levels to watch.

Global Economic Uncertainty

Geopolitical tensions, trade disputes, and economic uncertainty in major economies often drive interest in Bitcoin as a non-correlated asset and potential haven. Recent global developments have contributed to Bitcoin’s rally, and continued uncertainty would likely support higher price levels. Conversely, resolution of major geopolitical concerns or unexpected economic stability could reduce some of the fear-driven demand supporting current Bitcoin valuations.

Inflation and Currency Devaluation Concerns

Persistent concerns about inflation and currency devaluation in various countries continue to drive the adoption as a store of value. These fundamental drivers support the thesis for sustained higher Bitcoin price levels independent of short-term technical factors.

As more investors worldwide recognise Bitcoin’s fixed supply and decentralised nature as protection against monetary debasement, the baseline demand for Bitcoin at any price level increases, potentially establishing higher long-term support levels.

Altcoin Market Response to Bitcoin Price Levels

Bitcoin’s movement through various price levels has a significant impact on the broader cryptocurrency market, creating opportunities and risks in altcoin trading.

Bitcoin Dominance Considerations

As Bitcoin reaches new all-time highs, its market dominance—the percentage of total cryptocurrency market capitalisation represented by Bitcoin—typically increases as capital flows into the perceived safety of the largest and most established digital asset. Understanding this dynamic helps traders anticipate shifts in demand between alternative cryptocurrencies, also known as Altcoins.

When Bitcoin consolidates after reaching significant price levels, capital often flows into alternative cryptocurrencies, creating altcoin seasons where smaller tokens outperform. Monitoring Bitcoin’s price action at key support and resistance zones helps anticipate these rotations.

Correlation Analysis

Most cryptocurrencies maintain high correlation with Bitcoin, meaning movements in Bitcoin price levels drive corresponding moves across the broader market. However, correlation strength varies, with primary tokens like Ethereum maintaining stronger correlation than smaller-cap projects.

Understanding these correlation dynamics helps traders develop portfolio strategies that capitalise on Bitcoin’s movements while potentially reducing risk through strategic exposure to altcoins during periods when correlations weaken.

Trading Psychology at Record Bitcoin Price Levels

Managing emotions and maintaining disciplined decision-making becomes increasingly challenging as Bitcoin reaches unprecedented price levels.

Fear of Missing Out (FOMO)

The surge above $125,000 inevitably creates FOMO among investors who missed earlier entry points. This emotion-driven buying often occurs near local tops as late entrants chase performance, creating the final push before corrections. Recognising FOMO in yourself and others helps you avoid poorly timed entries. Successful traders maintain predetermined strategies for entering positions at identified support levels to watch rather than chasing prices during explosive moves higher.

Greed and Profit-Taking Discipline

Conversely, investors holding Bitcoin through its rally to $125,000 may struggle with greed, always expecting higher prices and failing to take partial profits at significant resistance levels. Establishing profit-taking plans before positions become significantly profitable helps overcome this bias. Many experienced traders use a scaling approach, taking partial profits at predetermined Bitcoin price levels while maintaining core positions for potential continued appreciation.

Recency Bias and Risk Perception

Extended uptrends, such as Bitcoin’s current rally, can create recency bias, where traders extrapolate recent performance indefinitely into the future and underestimate downside risks. This bias leads to an underestimation of how quickly Bitcoin can reverse from elevated price levels, resulting in insufficient risk management. Studying Bitcoin’s historical volatility and previous correction patterns helps maintain realistic expectations about potential drawdowns even during strong bull markets.

Expert Predictions for Bitcoin Price Levels

While no one can predict future Bitcoin price levels with certainty, examining various expert perspectives provides context for developing your own market outlook.

Bullish Analyst Targets

Prominent Bitcoin bulls have raised their targets following the breakthrough above $125,000, with some analysts projecting prices between $150,000 and $200,000 within the current market cycle. These optimistic forecasts typically cite continued institutional adoption, supply constraints, and favourable macroeconomic conditions.

Stock-to-flow models, while controversial, project significantly higher fair values for Bitcoin based on its supply schedule, suggesting current price levels remain undervalued despite record highs. However, these models have shown significant deviations from actual prices during various periods.

Preparing for Different Bitcoin Price Scenarios

Successful investors prepare strategies for multiple potential outcomes rather than betting everything on a single scenario.

Continued Bull Market Strategy

If Bitcoin continues to advance from current price levels, maintaining core positions while adding to pullbacks to identified support zones maximises participation in further upside. Using trailing stops protects against sudden reversals while allowing positions to run during strong momentum. This scenario involves monitoring for signs of weakening momentum—such as declining volume on new highs or negative divergences in momentum indicators—that might signal an approaching top.

Consolidation and Resistance Trading

Bitcoin may consolidate within a range of $115,000 $135,000, creating opportunities for range-bound trading strategies. This scenario involves buying near support levels and selling near resistance, with tight risk management using stops that are positioned beyond the defined range boundaries. Range-bound markets can persist for extended periods as markets digest rapid advances, allowing patient traders to capitalise on predictable oscillations between established Bitcoin price levels.

Bear Market Preparation

While less probable given current momentum, preparing for potential bear market scenarios protects capital if conditions deteriorate unexpectedly. This preparation involves identifying primary support levels to watch—such as $100,000, $90,000, and $80,000—where significant buyers might emerge during a deeper correction. Maintaining capital reserves to deploy at substantially lower price levels positions investors to capitalise on potential corrections while avoiding the risk of being fully invested if markets reverse.

Conclusion

Bitcoin’s historic surge above $125,000 represents both an extraordinary opportunity and a significant risk for market participants. Successfully navigating the Bitcoin price levels to watch in the coming weeks and months requires combining technical analysis metrics, macroeconomic awareness, and disciplined risk management.

The key support zones at $120,000, $115,000, and $110,000 provide critical levels where buyers are expected to defend positions during any pullbacks, while resistance at $130,000 and beyond represents targets for continued upside. Understanding these Bitcoin price levels and their significance helps inform entry and exit decisions regardless of your trading timeframe.