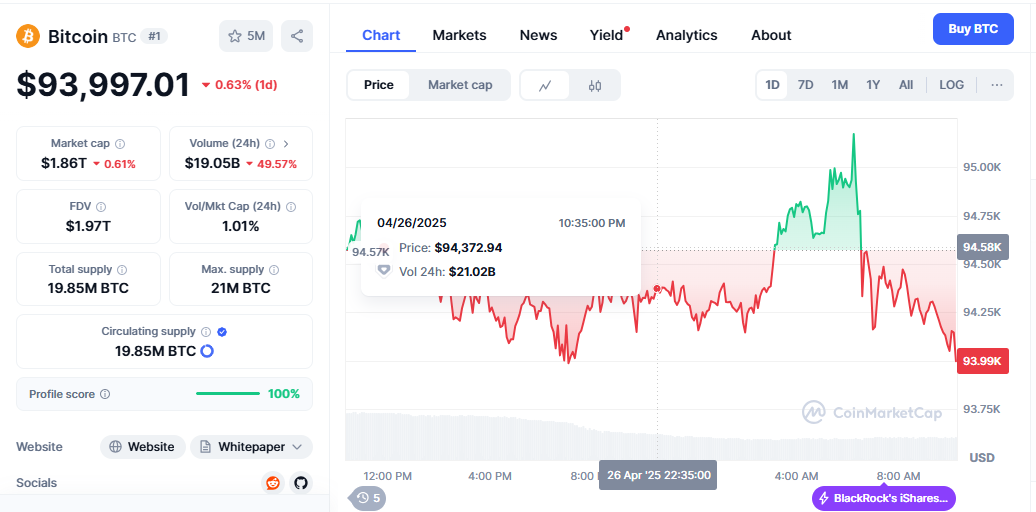

As of April 26, 2025, Bitcoin was trading at $94,317; its market capitalisation is $1.87 trillion, and its 24-hour trading volume is $21.12 billion. Off $94,033 and $95,857, Bitcoin Price Rally Faces fluctuated throughout the last day, showing. The careful mix of rising market resistance and upward momentum.

Bitcoin Rally Faces Mixed Signals

Bitcoin Surges Above The daily chart shows a steady rally starting from a trough of bout $74,434. Rising trade volume has helped support the ascent toward the $95,000 mark. They, which is sometimes considered a strong indication of genuine buyer commitment. Technically, support on the daily timeframe falls between the $88,000 and $90,000 range; immediate resistance falls close to the intraday high of $95,857.

Oscillator readings produce conflicting signals. With a relative strength index (RSI) of 68 and an average directional index (ADX) of 25, both indicators suggest a trend that is still strong but not in an overheated area. However, as Bitcoin tests significant resistance levels. The Commodity Channel Index (CCI) at 146 and the Stochastic Oscillator at 92 both indicate caution.

Bitcoin Forms Rising Wedge Near Key Levels

When one focuses on the 4-hour chart, the movement of Bitcoin shows a consistent stair-step rally marked by brief intervals of consolidation following every upward climb. They will, along with a drop in volume, which can be an early warning sign of approaching volatility. The market is currently showing a slight decline from its peak of $95,857.A support zone of around $93,500 has become significant; resistance remains near $95,800.

Price action is starting to compress into a rising wedge pattern, while technical indicators on shorter periods show symptoms of decreasing momentum. Typically, this type of organisation occurs before a breakdown or a breakout. Should Bitcoin rise above $93,500 and pass cleanly past $95,800, a fresh drive into the $97,000 zone could develop. Conversely, should $93,500 prove insufficient, a retracing into the $90,000 to $92,000 range might quicken.

Bitcoin Outlook Bullish Trend with Caution Signs

From a broader perspective, indicators across multiple time frames continue to show a favourable outlook. Reflecting fresh optimistic momentum, the moving average convergence divergence (MACD) has turned to a buy signal with a value of 2,659. Furthermore, buy indications are primarily based on exponential moving averages (EMAS) and simple moving averages (SMAS, ranges) that range from the 10-period to the 200-period.

This general agreement among trend-following indicators implies that the longer-term structure of Bitcoin’s market stays optimistic despite transient pressures. Given the strength of the existing trend, any retreat into the $90,000 to $92,000 support level could create an attractive entry point for those with a longer-term perspective.

Though the background is generally favourable, one should take some precautions. Several oscillators are indicating possible tiredness on a daily and 4-hour timescale. While the MACD and moving averages suggest more rises, signals from CCI and Stochastic caution that Bitcoin might be nearing a temporary top. Should sellers gain momentum and Bitcoin fall below critical support levels, a more thorough correction may occur before the market attempts to move upward once more.

Bitcoin Breakout or Pullback?

Regarding Bitcoin, the optimistic scenario is extreme. A clean breakout above $95,800 might open the path for a move above $97,000 or possibly $98,000 in the following sessions, given strong support from moving averages and the MACD indicating a continuation of the uptrend. Rising volume during the trend’s rise supports the underlying strength of the trend, providing more assurance to optimistic traders.

On the other hand, the bearish situation advises restraint. The indicators of tiredness and the development of a rising wedge on the lower period suggest that the current surge of Bitcoin might be beginning to fade. Should $93,500 be compromised by volume, a more acute sell-off could occur, potentially leading to a drop. The $90,000–$92,000 range, where more robust support is located. Such a pullback could cause a brief period of short-term weakness that traders must be prepared for, even if it does not always mark the end of the larger upward trend.

Bitcoin’s Short-Term Outlook

Bitcoin’s future in the near term depends on its behaviour between the $93,500 and $95,800 thresholds. Targeting new highs near $97,000, a decisive breakout may provide fresh optimistic momentum for the market. However, a lack of support could see Bitcoin return to lower levels as the market tries to balance out recent gains.

From a longer perspective, especially since Bitcoin’s market still generally leans toward the optimistic side. Still, there is an increasing likelihood of a modest retreat or near-term consolidation. Investors and traders should be disciplined and patient, closely monitoring key price levels and adhering to sound risk management principles. Staying vigilant in the following few days will be crucial, whether your intended purchase is on a downturn or you trade the breakout.

Although technically, your Bitcoin’s structure still leans toward continuity, short-term prudence is advisable. This is the moment to monitor key resistances and supports and stay current with the latest Bitcoin price fluctuations. Don’t miss out; stay informed and be prepared to act as Bitcoin determines its next significant direction.