Bitcoin rebounded above 88K, igniting renewed optimism among investors and traders worldwide. After weeks of consolidation and bearish pressure that tested investor patience, Bitcoin’s surge past the critical $88,000 threshold has sparked intense debate about whether this recovery represents a sustainable trend or merely a temporary relief rally. With global economic conditions evolving and institutional adoption continuing to gain momentum, understanding the factors behind this Bitcoin rebound above 88K becomes crucial for anyone navigating the volatile crypto landscape in 2025.

Bitcoin Rebound Above $88K

The recent market action that saw Bitcoin rebound above 88K didn’t happen in isolation. Multiple converging factors created the perfect storm for this upward momentum, reflecting both technical breakouts and fundamental shifts in market sentiment.

What Triggered the Bitcoin Price Recovery?

Several key catalysts contributed to the impressive rally that pushed Bitcoin back above the $88,000 mark:

Institutional Buying Pressure: Major financial institutions have ramped up their Bitcoin accumulation strategies, with spot Bitcoin ETFs experiencing significant inflows exceeding $2.1 billion in the past week alone. BlackRock’s IBIT and Fidelity’s FBTC have led the charge, absorbing substantial amounts of BTC from the market and creating upward price pressure.

Macroeconomic Developments: The Federal Reserve’s recent statements regarding potential interest rate adjustments have weakened the U.S. dollar, making alternative assets like Bitcoin more attractive. When the dollar weakens, investors typically seek stores of value, and Bitcoin’s rebound above 88K reflects this flight to digital assets.

Technical Breakout Signals: From a chart perspective, Bitcoin successfully broke through multiple resistance levels, including the 50-day and 100-day moving averages. This technical strength attracted algorithmic traders and momentum investors, amplifying the upward movement.

Reduced Selling Pressure: On-chain analytics reveal that long-term holders have stopped distributing their coins, with the supply held by addresses older than six months reaching all-time highs. This diamond-handed behavior removes selling pressure and supports price appreciation.

Market Sentiment Analysis

The sentiment surrounding Bitcoin rebounds above 88K extends beyond simple price action. The Fear and Greed Index has shifted from “Extreme Fear” territory to “Neutral” and is approaching “Greed,” indicating a psychological shift among market participants.

Social media engagement around Bitcoin has surged dramatically, with mentions increasing by over 300% across major platforms. This grassroots enthusiasm often precedes sustained price movements, though it can also signal overheating in the short term.

Exchange balances continue to decline, with over 185,000 BTC withdrawn from centralized platforms in the past month. This “not your keys, not your coins” movement suggests investors are positioning for long-term holds rather than quick trades, supporting the sustainability of this Bitcoin rebound above 88K.

Technical Analysis: Can Bitcoin Sustain $88K?

Understanding whether Bitcoin rebounds above 88K represents a lasting trend requires deep technical analysis across multiple timeframes and indicators.

Key Resistance and Support Levels

Immediate Resistance: The $90,000 psychological level represents the next major hurdle for Bitcoin. This round number has historically attracted profit-taking and could trigger short-term pullbacks. Beyond $90K, the $92,500 zone marks the previous local high that Bitcoin must reclaim to continue its upward trajectory.

Critical Support: Should the current rally falter, Bitcoin has established strong support at $85,000, where significant buying interest emerged during recent consolidation. The $82,000 level serves as secondary support, coinciding with the 200-day moving average that has proven reliable throughout Bitcoin’s history.

Volume Profile Analysis: The volume profile shows substantial trading activity between $86,000 and $88,000, creating a value area that could serve as a launching pad for further gains or a cushion during pullbacks.

Indicators Suggesting Bullish Continuation

The Bitcoin rebound above 88K gains credibility from several technical indicators flashing bullish signals:

Relative Strength Index (RSI): The daily RSI sits at 62, firmly in bullish territory but not yet overbought. This suggests room for additional upside before exhaustion signals emerge. The RSI has maintained higher lows throughout the recent consolidation, forming a bullish divergence that often precedes strong rallies.

Moving Average Convergence Divergence (MACD): The MACD recently crossed above its signal line, generating a buy signal that aligns perfectly with the price breakout. The histogram is expanding positively, indicating increasing bullish momentum.

Bollinger Bands: Bitcoin is trading in the upper half of its Bollinger Bands after spending weeks compressed near the lower band. This expansion phase typically accompanies significant price moves and suggests the current trend has momentum behind it.

On-Balance Volume (OBV): The OBV has reached new highs, confirming that the Bitcoin rebounds above 88K are supported by genuine accumulation rather than low-volume manipulation. When price and volume align, trends tend to be more sustainable.

Chart Patterns and Projections

From a pattern recognition perspective, Bitcoin has completed a bullish cup-and-handle formation on the daily chart, with a measured move target of $95,000 to $98,000. Additionally, the weekly chart shows a golden cross formation brewing, where the 50-week moving average is poised to cross above the 200-week moving average—historically one of the most reliable long-term bullish signals.

Fundamental Factors Behind Bitcoin’s Strength

While technical analysis provides the “how,” understanding the fundamental reasons why Bitcoin rebounds above 88K offers insight into the “why” and helps assess sustainability.

Institutional Adoption Accelerates

The institutional landscape for Bitcoin has transformed dramatically in recent months. Beyond ETF inflows, major corporations have begun adding Bitcoin to their treasury reserves. MicroStrategy continues its aggressive accumulation strategy, recently announcing plans to acquire an additional $500 million worth of Bitcoin.

Traditional financial institutions that once dismissed cryptocurrency are now offering Bitcoin exposure to clients. Major banks have launched custody services, trading desks, and investment products centered around digital assets, legitimizing the asset class and bringing trillions in potential capital.

Regulatory Clarity Emerges

Regulatory developments have significantly improved the investment case for Bitcoin. Several major economies have introduced clear frameworks for cryptocurrency taxation and compliance, removing uncertainty that previously deterred institutional participation.

The United States has made progress toward comprehensive crypto legislation, with bipartisan support for regulatory frameworks that protect consumers while fostering innovation. This regulatory maturation reduces systemic risks and supports the narrative behind Bitcoin’s rebound above 88K.

Supply Dynamics and Halving Effects

Bitcoin’s programmed scarcity continues to exert upward pressure on prices. The 2024 halving event reduced new Bitcoin issuance to just 3.125 BTC per block, creating an annual inflation rate below 1%. This supply shock takes time to manifest in price action, and many analysts believe we’re entering the traditional post-halving bull run phase.

Mining difficulty has reached all-time highs, indicating robust network security and miner commitment despite reduced block rewards. Miners are accumulating rather than selling, further constraining available supply and supporting price appreciation.

Global Economic Uncertainty

Geopolitical tensions, currency devaluation concerns, and unsustainable government debt levels in major economies have driven investors toward scarce, non-sovereign assets. Bitcoin’s fixed supply and decentralized nature make it an attractive hedge against monetary debasement, contributing to the Bitcoin rebound above 88K.

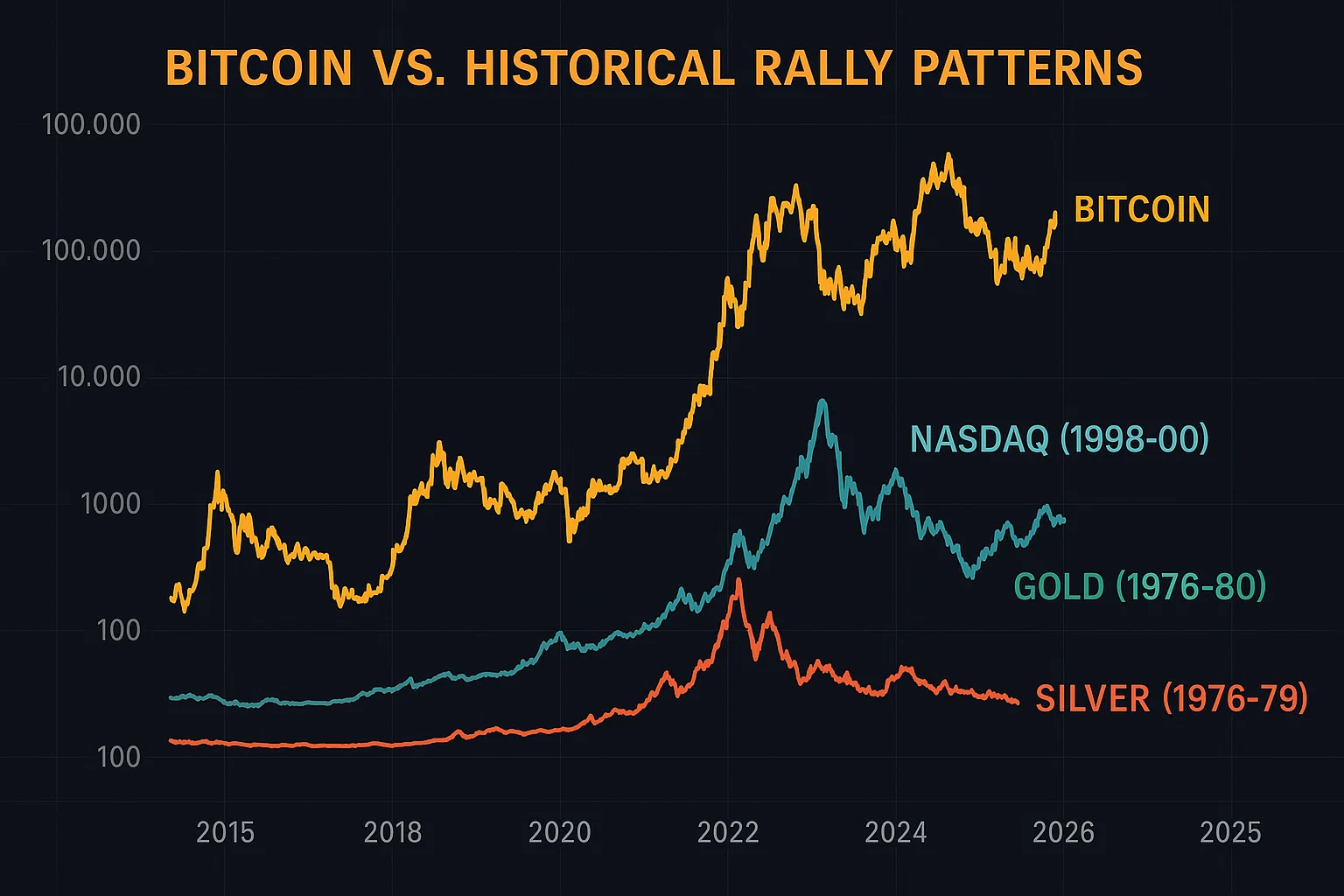

Comparing Bitcoin to Historical Rally Patterns

Context from previous market cycles provides a valuable perspective on whether the current Bitcoin rebounds above the 88K scenario can sustain momentum.

2017 Bull Run Parallels

The 2017 bull market saw Bitcoin surge from approximately $1,000 to nearly $20,000, experiencing multiple corrections of 30-40% along the way. The current market structure shares similarities, including periods of consolidation followed by explosive breakouts, though the presence of institutional investors and ETFs creates a more stable foundation.

2020-2021 Cycle Insights

The previous cycle saw Bitcoin rally from $10,000 to $69,000, with the journey punctuated by several significant pullbacks. What distinguished that rally was the entrance of institutional players like Tesla, Square, and major hedge funds. The current cycle features even broader institutional participation, suggesting potentially greater stability despite volatility.

Unique Characteristics of 2025

The current environment where Bitcoin rebounds above 88K differs in crucial ways from previous cycles. Spot ETFs provide unprecedented access for traditional investors, sovereign nations are exploring Bitcoin reserves, and the macroeconomic backdrop of persistent inflation creates structural demand that wasn’t present in earlier cycles.

Expert Opinions and Price Predictions

Understanding diverse expert perspectives on the Bitcoin rebound above 88K helps investors form balanced expectations.

Bullish Scenarios

Prominent analysts like Plan B maintain that Bitcoin remains on track to reach $100,000 to $150,000 based on stock-to-flow models and historical post-halving performance. These analysts argue that the current Bitcoin rebounds above 88K represent just the beginning of a multi-month rally.

Cathie Wood of ARK Invest has stated that Bitcoin could reach $600,000 to $1.5 million per coin by 2030 if adoption curves follow trajectories similar to other transformative technologies. While these long-term predictions may seem aggressive, they reflect the conviction that Bitcoin will capture a significant portion of global wealth storage and payment systems.

Cautious Perspectives

More conservative analysts warn that the Bitcoin rebound above 88K could face significant resistance and recommend taking partial profits at key psychological levels. These voices point to potential regulatory crackdowns, technological competitors, and macroeconomic shocks as risks that could derail the rally.

Some traditional finance veterans argue that Bitcoin’s volatility and lack of intrinsic value make it unsuitable as a long-term investment, though this camp has steadily shrunk as Bitcoin has demonstrated resilience through multiple economic cycles.

Balanced Views

Most balanced analyses suggest that while Bitcoin rebounds above 88K represents genuine strength, investors should expect volatility and employ risk management strategies. The consensus among moderate voices is that Bitcoin has established itself as a legitimate asset class but will experience substantial price swings as it matures.

Risk Factors That Could Derail the Rally

Despite the optimism surrounding how Bitcoin rebounds above 88K, several risk factors deserve consideration.

Regulatory Crackdowns

Government actions remain the most significant external risk to Bitcoin. Potential regulations limiting self-custody, imposing restrictive KYC/AML requirements, or banning certain use cases could trigger selling pressure. While major economies have generally moved toward acceptance, policy reversals remain possible.

Macroeconomic Shocks

Unexpected economic developments—such as a deeper recession, financial crisis, or sudden spike in interest rates—could force investors to liquidate Bitcoin holdings. While Bitcoin proponents view it as a haven, history shows that during acute liquidity crises, all assets initially decline as investors scramble for cash.

Technical Vulnerabilities

Although Bitcoin’s network has operated flawlessly for over 15 years, theoretical risks include quantum computing threats, critical software bugs, or sophisticated 51% attacks. While highly unlikely, these tail risks should be acknowledged by serious investors.

Market Manipulation Concerns

Cryptocurrency markets remain less regulated than traditional financial markets, creating opportunities for manipulation through spoofing, wash trading, and coordinated pump-and-dump schemes. While the market has matured considerably, these practices haven’t been eliminated.

Competitor Cryptocurrencies

Ethereum, Solana, and other blockchain platforms offer functionality beyond simple value transfer, potentially capturing market share from Bitcoin. While Bitcoin maintains its position as digital gold, evolving technology could shift investor preferences toward more versatile platforms.

Investment Strategies for the Current Environment

For investors considering how to approach the market where Bitcoin rebounds above 88K, several strategic frameworks merit consideration.

Dollar-Cost Averaging Approach

Rather than attempting to time the market perfectly, systematic purchasing at regular intervals reduces the impact of volatility and removes emotional decision-making. This strategy has historically produced strong returns for Bitcoin investors with multi-year time horizons.

Strategic Accumulation During Pullbacks

Even within a bull market, Bitcoin experiences corrections. Setting limit orders at key support levels allows investors to accumulate during temporary weakness while maintaining cash reserves for opportunities.

Portfolio Allocation Guidelines

Financial advisors generally recommend limiting cryptocurrency exposure to 5-10% of overall investment portfolios, though this varies based on risk tolerance and investment timeline. The speculative nature of crypto assets suggests prudence in position sizing.

Risk Management Techniques

Stop-loss orders, position sizing discipline, and regular profit-taking at predetermined levels help protect gains and limit downside. As Bitcoin rebounds above 88K, investors who entered at lower levels should consider securing partial profits while maintaining core positions for potential further appreciation.

What’s Next for Bitcoin?

Looking beyond the immediate question of whether Bitcoin rebounds above 88K can be sustained, several medium-term catalysts could drive further price appreciation.

Institutional Products Pipeline

Multiple spot Bitcoin ETF applications from additional major financial institutions await regulatory approval. Expanded product offerings will provide additional avenues for capital inflows, potentially driving prices higher.

Global Adoption Trends

Emerging markets experiencing currency crises have shown increasing Bitcoin adoption for remittances and value storage. As smartphone penetration increases and financial infrastructure improves in developing nations, Bitcoin’s user base could expand dramatically.

Corporate Treasury Adoption

If more Fortune 500 companies follow MicroStrategy’s lead and allocate portions of their treasury to Bitcoin, the resulting demand could dwarf current market dynamics. Even 1% allocation across corporate balance sheets would represent hundreds of billions in potential buying pressure.

Layer 2 Scaling Solutions

Lightning Network and other layer-2 technologies are improving Bitcoin’s transaction capacity and reducing fees, making it more practical for everyday payments. Enhanced usability could drive adoption beyond investment use cases, supporting long-term value appreciation.

Conclusion

The impressive manner in which Bitcoin rebounds above 88K reflects genuine shifts in market structure, investor sentiment, and fundamental adoption trends. While short-term volatility remains inevitable, the confluence of institutional participation, improving regulatory clarity, supply constraints from the recent halving, and macroeconomic factors supporting scarce assets creates a compelling environment for sustained appreciation.

Whether this Bitcoin rebound above 88K represents the beginning of a journey to six-figure prices or a reprieve before further consolidation depends on how these various factors evolve. Investors should maintain balanced perspectives, employ risk management discipline, and view Bitcoin as a long-term strategic allocation rather than a short-term speculation.

Read More: Bitcoin Mining in China Rebounds, Defying 2021 Ban