The Bitcoin seizure is the largest US-UK operation in history, confiscating approximately $14 billion worth of cryptocurrency from alleged scammers. This massive crackdown represents a watershed moment in the fight against digital currency fraud and signals a new era of aggressive enforcement against cryptocurrency-related crimes. The joint operation between American and British authorities demonstrates that even in the decentralized world of blockchain technology, criminals cannot escape justice. As regulatory bodies worldwide intensify their scrutiny of digital assets, this landmark case serves as a stark warning to those exploiting cryptocurrency networks for illicit purposes.

Magnitude of the Bitcoin Seizure: UK Operation

The Scale of the Cryptocurrency Confiscation

The recent Bitcoin seizure, a US-UK collaboration, has shattered previous records for cryptocurrency confiscations worldwide. With approximately $14 billion in digital assets now under government control, this operation dwarfs earlier enforcement actions and highlights the growing sophistication of law enforcement agencies in tracking blockchain transactions. The seized assets include not only Bitcoin but also various other cryptocurrencies, demonstrating the comprehensive nature of the investigation.

This massive confiscation represents months, if not years, of meticulous investigative work. Blockchain forensics experts worked alongside traditional law enforcement officers to trace the movement of funds across multiple wallets and exchanges. The complexity of tracking cryptocurrency transactions requires specialized knowledge of blockchain technology, cryptographic protocols, and the various techniques criminals use to obfuscate their digital footprints.

The $14 billion figure places this operation among the most significant financial seizures in history, comparable to major money laundering busts involving traditional banking systems. However, the Bitcoin seizure case involving the US and UK is particularly noteworthy because it involves purely digital assets, requiring entirely different investigative techniques and legal frameworks than conventional financial crimes.

How International Cooperation Made This Possible

The success of this Bitcoin seizure US-UK operation hinged on unprecedented cooperation between American and British law enforcement agencies. The Federal Bureau of Investigation (FBI), the Internal Revenue Service Criminal Investigation Division (IRS-CI), and the UK’s National Crime Agency (NCA) pooled their resources, expertise, and jurisdictional authority to pursue the alleged scammers across international borders.

This collaborative approach reflects a growing recognition that cryptocurrency crimes transcend national boundaries. Digital currencies operate on global networks, allowing criminals to move funds across jurisdictions instantaneously. Traditional law enforcement structures, which often operate within strict territorial limits, have had to adapt rapidly to this borderless criminal landscape.

The Bitcoin seizure US UK case involved synchronized raids, simultaneous asset freezes, and coordinated legal actions across multiple time zones. Intelligence sharing between agencies proved crucial, as investigators pieced together evidence from blockchain analysis, traditional financial records, digital communications, and witness testimonies. This multifaceted approach enabled authorities to build comprehensive cases against the alleged perpetrators while preventing them from dissipating assets before seizure orders could be executed.

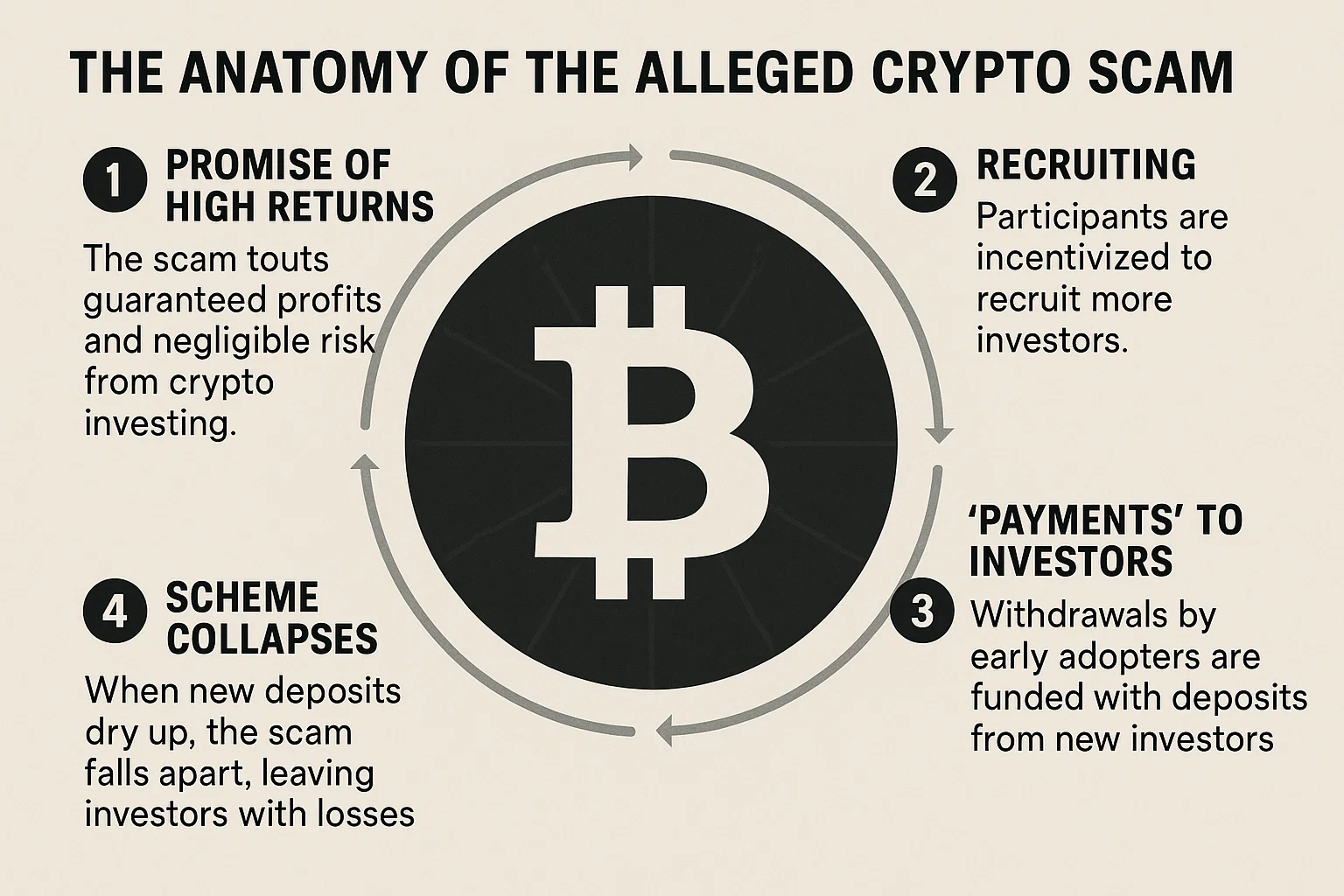

The Anatomy of the Alleged Crypto Scam

How the Fraudulent Scheme Operated

According to law enforcement sources, the alleged scammers behind this Bitcoin seizure case involving the US and UK operated a sophisticated fraud network that victimized thousands of investors across multiple countries. The scheme reportedly involved various tactics commonly associated with cryptocurrency fraud, such as fake investment platforms, Ponzi schemes, and romance scams, ultimately directing victims to invest in fraudulent crypto ventures.

Investigators believe the criminal network created elaborate websites mimicking legitimate cryptocurrency exchanges and investment platforms. These fraudulent sites promised unrealistic returns on crypto investments, exploiting the general public’s limited understanding of blockchain technology and the volatility of digital asset markets. Victims were lured by testimonials, fabricated profit charts, and aggressive marketing campaigns that leveraged social media platforms and targeted advertising.

The sophistication of the operation extended to customer service infrastructure, with call centers staffed by individuals trained to reassure worried investors and encourage additional deposits. Some victims reported being able to make small initial withdrawals, a classic tactic designed to build trust before the scammers disappeared with larger sums. The Bitcoin seizure US UK investigation revealed that the network had been operating for several years, continuously evolving its tactics to evade detection and exploit new victims.

The Role of Blockchain Analysis in Cracking the Case

Blockchain technology, often praised for its transparency, ultimately became the undoing of the alleged scammers. Every transaction on the Bitcoin network is recorded on a public ledger, creating a permanent trail that sophisticated investigators can follow. The Bitcoin seizure US UK operation relied heavily on blockchain forensics specialists who employed cutting-edge analytical tools to trace the flow of stolen funds.

These experts used cluster analysis techniques to group related wallet addresses and identify patterns in transaction timing and amounts. By analyzing on-chain data, investigators could link seemingly anonymous wallets to specific individuals and organizations. The process involved examining millions of transactions, identifying mixing services and tumblers used to obscure fund origins, and ultimately connecting digital wallets to real-world identities through exchanges that comply with Know Your Customer (KYC) regulations.

The breakthrough in the Bitcoin seizure US UK case came when investigators identified several critical wallet addresses that served as central collection points for the fraudulent proceeds. By monitoring these wallets and the transactions flowing through them, authorities could map the entire criminal network, identify key players, and determine the optimal moment to execute seizure warrants before the criminals could move their assets beyond reach.

Legal Framework Supporting the Bitcoin Seizure: US-UK Action

Cryptocurrency Seizure Laws and Regulations

The legal foundation for the Bitcoin seizure US UK operation rests on evolving frameworks that treat cryptocurrencies as property subject to forfeiture under criminal and civil asset seizure laws. In the United States, authorities invoke statutes including the Bank Secrecy Act, wire fraud statutes, and money laundering provisions to pursue cryptocurrency-related crimes. Similarly, the United Kingdom applies the Proceeds of Crime Act and other financial crime legislation to digital assets.

Courts in both jurisdictions have increasingly recognized cryptocurrencies as valuable property that can be seized, forfeited, and redistributed to victims. The Bitcoin seizure case involving the US and UK required prosecutors to obtain multiple court orders authorizing the confiscation of specific digital wallets and the assets they contained. These legal proceedings often involve complex technical evidence, which explains blockchain technology to judges who may have limited familiarity with cryptocurrency systems.

One significant challenge in cryptocurrency seizures involves the actual mechanics of taking control of digital assets. Unlike traditional bank accounts, which can be frozen through court orders served on financial institutions, cryptocurrency wallets are controlled by private keys—essentially long strings of alphanumeric characters. The Bitcoin seizure US UK operation required investigators to either obtain these private keys through cooperation, legal compulsion, or technical means, or to convince exchanges holding the assets to freeze accounts pending legal resolution.

International Treaties and Cooperation Mechanisms

The cross-border nature of the Bitcoin seizure US-UK case necessitated invoking various international legal cooperation mechanisms. Mutual Legal Assistance Treaties (MLATs) between the United States and the United Kingdom facilitated the exchange of evidence, coordination of investigations, and execution of seizure warrants across jurisdictions. These formal channels enable law enforcement agencies to request assistance from foreign counterparts while respecting sovereignty and legal protections in each country.

Beyond traditional MLATs, informal cooperation networks have explicitly emerged to address cryptocurrency crimes. The Joint Chiefs of Global Tax Enforcement (J5), comprising tax and financial crime agencies from five countries, including the US and UK, has become a crucial platform for sharing intelligence about crypto-related fraud. The Bitcoin seizure US UK operation benefited from these enhanced cooperation mechanisms, allowing investigators to act swiftly before alleged criminals could move assets to less cooperative jurisdictions.

International standards set by organizations like the Financial Action Task Force (FATF) have also played a crucial role in combating cryptocurrency crime. These standards require countries to extend anti-money laundering and counter-terrorist financing regulations to virtual asset service providers, creating a more uniform global regulatory environment that supports operations like the Bitcoin seizure and the US-UK crackdown.

Impact on the Cryptocurrency Industry

Market Reactions to the Major Seizure

The announcement of the US-UK operation to seize Bitcoin sent immediate ripples through cryptocurrency markets. While Bitcoin’s price showed relatively modest volatility in the immediate aftermath, the news sparked renewed debates about regulatory risk and the potential for government intervention in crypto markets. Some analysts argued that large-scale law enforcement actions validate cryptocurrency’s importance as a financial system worth policing, while critics pointed to the seizure as evidence of systemic vulnerability.

The confiscation of $14 billion worth of digital assets raises intriguing questions about how authorities will manage these holdings. Historical precedents from previous cryptocurrency seizures show that governments typically liquidate confiscated crypto through specialized auctions or negotiate private sales through authorized dealers. The disposition of assets from this Bitcoin seizure case involving the US and UK could significantly impact market liquidity and prices, depending on the timing and method of any eventual sales.

For legitimate cryptocurrency businesses, the operation demonstrates both opportunity and risk. Companies operating compliant exchanges and wallet services increasingly position themselves as partners with law enforcement, implementing robust KYC and anti-money laundering procedures. This Bitcoin seizure success story between the US and UK validates investments in compliance infrastructure and may accelerate the industry’s transition toward regulated, institutional-grade services that can coexist with traditional financial systems.

Regulatory Implications for Crypto Exchanges

The Bitcoin seizure US UK case has intensified regulatory scrutiny of cryptocurrency exchanges and service providers. Authorities are increasingly demanding that platforms implement stronger customer identification processes, transaction monitoring systems, and suspicious activity reporting mechanisms. Exchanges that facilitated transactions for the alleged scammers may face their own legal consequences, including fines, license revocations, or criminal charges if they knowingly enabled illicit activity.

This heightened regulatory environment creates compliance challenges, particularly for smaller exchanges and decentralized platforms that operate on different technological and philosophical principles than traditional financial institutions. The Bitcoin seizure US UK operation demonstrates that regulatory authorities have developed sophisticated capabilities to track cryptocurrency flows even across platforms that promise enhanced privacy or anonymity.

Looking forward, the success of this investigation may accelerate regulatory proposals requiring comprehensive transaction reporting for cryptocurrency businesses, similar to the reporting obligations imposed on traditional banks. Some jurisdictions are considering rules that would require exchanges to verify recipients’ identities before processing withdrawals, effectively eliminating truly anonymous transactions. While these measures would aid law enforcement efforts like the Bitcoin seizure and the US-UK crackdown, they remain controversial within the cryptocurrency community, where many participants value financial privacy and resist government oversight.

Victim Impact and Asset Recovery

The Human Cost of Cryptocurrency Scams

Behind the staggering $14 billion figure of the Bitcoin seizure US UK operation lie thousands of individual victims whose life savings, retirement funds, and investment capital were stolen through elaborate frauds. Cryptocurrency scams often target financially vulnerable populations, including retirees seeking high-yield investments, immigrants pursuing economic opportunity, and individuals in developing countries hoping to access global financial markets.

The psychological impact on victims extends beyond financial losses. Many individuals report feelings of shame and embarrassment, having been convinced by persuasive scammers to ignore warnings from family members and financial advisors. The technological complexity of cryptocurrency can leave victims feeling foolish for not understanding the red flags that, in retrospect, seem obvious. This emotional toll often prevents victims from reporting crimes promptly, allowing scammers additional time to expand their operations and victimize others.

The Bitcoin seizure case involving the US and UK has brought renewed attention to victim support services and the need for financial literacy education around cryptocurrency investments. Advocacy groups argue that while law enforcement actions are crucial, preventing future victimization requires public education campaigns that help potential investors recognize common scam tactics and understand the realistic expectations for cryptocurrency returns.

Prospects for Victim Compensation

One of the most significant questions surrounding the Bitcoin seizure US UK operation concerns whether victims will recover their losses. The $14 billion in seized assets theoretically provides substantial resources for compensation, but the actual distribution process involves complex legal proceedings that can take years to resolve. Victims typically must prove their claims through documentation showing they transferred funds to the fraudulent scheme and suffered quantifiable losses.

Historical cryptocurrency seizure cases provide mixed precedents for victim compensation. In some instances, authorities have successfully established victim compensation funds and distributed recovered assets proportionally to proven claims. However, the process invariably involves administrative costs, legal expenses, and potential competing claims from other creditors or parties with interests in the seized assets. Victims of the scam behind this Bitcoin seizure, a US-UK case, should prepare for a lengthy claims process requiring patience and thorough documentation.

The volatility of cryptocurrency prices introduces additional complications. The $14 billion valuation of seized assets reflects cryptocurrency prices at the time of seizure. Still, the actual value when assets are liquidated and distributed to victims could be substantially higher or lower. Some legal frameworks require converting cryptocurrency to fiat currency at seizure, potentially locking in values that may seem inadequate if prices subsequently rise. These complexities highlight the unique challenges of administering victim compensation in cases involving digital assets rather than traditional currency or property.

Lessons for Cryptocurrency Investors

Red Flags to Watch for in Crypto Investments

The Bitcoin seizure case involving the US and UK offers valuable lessons for anyone considering cryptocurrency investments. Several warning signs consistently appear in fraudulent schemes, and recognizing these red flags can help investors protect themselves. Unrealistic return promises represent perhaps the most obvious indicator—any investment opportunity guaranteeing consistent high returns with little or no risk should trigger immediate skepticism, particularly in the volatile cryptocurrency market.

Pressure tactics constitute another common red flag. Legitimate investment opportunities allow potential investors time to conduct due diligence, consult with financial advisors, and make informed decisions. Scammers, by contrast, create artificial urgency through limited-time offers, claims of exclusive opportunities, or warnings that hesitating will result in missing out on exceptional returns. The fraudulent schemes behind the Bitcoin seizure reportedly involved the US-UK investigation employing high-pressure sales tactics extensively.

Investors should also scrutinize the regulatory status and transparency of any cryptocurrency platform. Legitimate exchanges and investment services obtain appropriate licenses, disclose ownership and management information, publish audited financial statements, and maintain clear terms of service. Platforms that operate anonymously, refuse to disclose corporate structures, or claim regulatory exemptions warrant extreme caution. The Bitcoin seizure case involving the US and UK demonstrates that scammers often create elaborate facades of legitimacy, but careful investigation typically reveals inconsistencies and evasions that distinguish fraudulent operations from genuine services.

Best Practices for Secure Crypto Transactions

Beyond avoiding scams, cryptocurrency investors can adopt several best practices to enhance the security of their digital assets. Using hardware wallets for long-term storage keeps private keys offline and protected from hackers targeting internet-connected devices. The Bitcoin seizure US UK investigation revealed that many victims kept funds on the scammers’ platforms rather than transferring them to personal wallets, making it easier for fraudsters to abscond with the assets.

Investors should diversify storage solutions, avoiding concentration of all holdings on a single platform or wallet. This approach limits potential losses from any single point of failure, whether caused by hacking, platform insolvency, or fraudulent operators. Reputable exchanges offer insurance and security measures, but the cryptocurrency principle of “not your keys, not your coins” reminds users that ultimate security comes from personal control of private keys.

Conducting thorough due diligence before making any cryptocurrency investment is essential. This includes researching the team behind a project, examining whitepapers and technical documentation, assessing real-world utility and adoption, and seeking independent verification of claims made by promoters. The massive scale of the Bitcoin seizure in the US-UK case illustrates how neglecting basic due diligence can result in devastating financial losses, even for individuals who consider themselves financially sophisticated.

The Future of Cryptocurrency Law Enforcement

Emerging Technologies in Blockchain Forensics

The success of the Bitcoin seizure US-UK operation showcases the rapidly advancing state of blockchain forensics technology. Specialized firms now offer sophisticated analytical tools that can trace cryptocurrency flows across multiple blockchains, identify patterns in transaction behavior, and link on-chain activity to real-world identities. These capabilities are becoming increasingly powerful, challenging the notion that cryptocurrency transactions offer anonymity or protection from law enforcement.

Machine learning algorithms now assist investigators in identifying suspicious transaction patterns and clustering related wallet addresses. These artificial intelligence systems can process vast amounts of blockchain data far more efficiently than manual analysis, flagging potentially fraudulent activity for human investigators to examine more closely. Future Bitcoin seizure operations, modeled after US-UK-style methods, will likely leverage even more advanced AI capabilities, potentially including predictive analytics that identify emerging scams before they grow to massive scale.

Privacy-focused cryptocurrencies that employ advanced cryptographic techniques to obscure transaction details present ongoing challenges for law enforcement. However, even these supposedly untraceable coins have proven vulnerable to sophisticated analysis techniques. The Bitcoin seizure US UK case involved primarily Bitcoin and other transparent blockchain cryptocurrencies, but authorities are developing capabilities to address privacy coins as well. The ongoing technological arms race between privacy advocates and law enforcement will significantly shape the future cryptocurrency landscape.

Policy Debates Around Cryptocurrency Regulation

The Bitcoin seizure and the US-UK crackdown have reinvigorated debates about appropriate regulatory frameworks for cryptocurrencies. Advocates for stricter regulation argue that comprehensive oversight is necessary to protect consumers, prevent criminal activity, and ensure financial system stability. They point to cases like this massive seizure as evidence that cryptocurrency’s decentralized nature facilitates fraud and requires government intervention.

Cryptocurrency proponents counter that excessive regulation threatens innovation, financial privacy, and the fundamental principles of decentralized systems. They argue that existing laws already cover fraud, theft, and money laundering, making cryptocurrency-specific regulations unnecessary and potentially counterproductive. The Bitcoin seizure US UK operation’s success, they note, demonstrates that current legal frameworks provide adequate tools for pursuing cryptocurrency criminals without additional regulatory burden.

Finding the appropriate balance remains challenging. Regulatory approaches vary significantly across jurisdictions, creating opportunities for regulatory arbitrage as businesses and individuals relocate to more favorable environments. International coordination efforts, exemplified by the cooperation underlying the Bitcoin seizure US-UK case, may prove more effective than unilateral national regulations in addressing the global nature of cryptocurrency markets. However, achieving international consensus on appropriate regulatory frameworks faces significant political, legal, and practical obstacles.

Conclusion

The Bitcoin seizure US UK operation marks a decisive moment in the ongoing evolution of cryptocurrency law enforcement. The $14 billion confiscation demonstrates that even in the seemingly anonymous world of blockchain technology, sophisticated criminal networks can be identified, disrupted, and brought to justice through international cooperation and advanced investigative techniques. This landmark case should reassure legitimate cryptocurrency users and investors that authorities possess both the capability and determination to pursue bad actors, while simultaneously serving as a stark warning to those who would exploit digital currency systems for fraudulent purposes.

As the cryptocurrency industry matures, the lessons from this massive Bitcoin seizure and the US-UK crackdown will influence regulatory development, law enforcement practices, and investor behavior for years to come. Victims await compensation, regulators contemplate appropriate policy responses, and the broader crypto community grapples with the implications of increasingly effective government oversight. Whether you’re a cryptocurrency investor, blockchain entrepreneur, or simply an observer of financial innovation, staying informed about developments in crypto law enforcement is crucial for navigating this dynamic landscape.