Bitcoin strategy buys BTC in massive quantities once again. In a bold move that underscores growing institutional confidence, the strategy has acquired another 525 Bitcoin for approximately $60 million, bringing its total holdings to an impressive 638,985 BTC. This substantial purchase represents more than just another transaction—it signals a deepening commitment to Bitcoin as a store of value and strategic asset. The acquisition timing comes amid market volatility, suggesting that sophisticated investors view current price levels as attractive entry points. As Bitcoin continues to mature as an asset class, these large-scale purchases by institutional players are reshaping the cryptocurrency landscape and providing crucial market liquidity.

Scale of Bitcoin Accumulation

The Magnitude of 638,985 BTC Holdings

When examining the sheer scale of these holdings, the numbers become staggering. With the Bitcoin strategy, it buys BTC consistently over time, and the accumulated 638,985 BTC represents approximately 3% of the total Bitcoin supply that will ever exist. At current market valuations, this position holds tremendous weight in the cryptocurrency ecosystem. The strategic accumulation pattern demonstrates a long-term vision that extends far beyond short-term price movements.

The recent purchase of 525 BTC for $60 million indicates an average price of approximately $114,286 per Bitcoin, suggesting the acquisition occurred during recent market conditions. This price point reflects the strategy’s conviction that Bitcoin’s long-term prospects justify current valuations, even as markets experience typical cryptocurrency volatility.

Strategic Timing and Market Conditions

The decision to execute this substantial purchase reveals sophisticated market timing considerations. Bitcoin strategy buys BTC during periods that many institutional investors consider opportune for accumulation. The $60 million investment demonstrates significant capital allocation toward digital assets, reflecting broader institutional adoption trends.

Market analysis suggests that these large-scale purchases often occur during consolidation phases, when trading volumes decrease and price volatility creates potential entry opportunities. The strategy’s consistent buying pattern indicates dollar-cost averaging principles, reducing the impact of short-term price fluctuations while building substantial long-term positions.

Impact on Bitcoin Markets and Price Dynamics

Supply Reduction Effects

Large-scale Bitcoin strategy buys BTC transactions significantly impact available supply dynamics. When institutional players remove substantial quantities from circulation through long-term holding strategies, the available floating supply decreases. This supply reduction creates potential upward pressure on prices, particularly during periods of increased retail or institutional demand.

The accumulation of 638,985 BTC represents a meaningful portion of daily trading volumes across major exchanges. This concentrated ownership pattern influences market structure, potentially reducing volatility during normal trading conditions while amplifying price movements during significant market events.

Institutional Adoption Momentum

The continued accumulation demonstrates growing institutional recognition of Bitcoin’s role in modern portfolio construction. Bitcoin strategy buys BTC consistently, signaling to other institutional investors that digital assets deserve serious consideration within diversified investment approaches.

This institutional momentum creates positive feedback loops, where successful Bitcoin adoption by major players encourages additional institutional participation. The transparency of these purchases provides market participants with clear signals about institutional sentiment and long-term conviction levels.

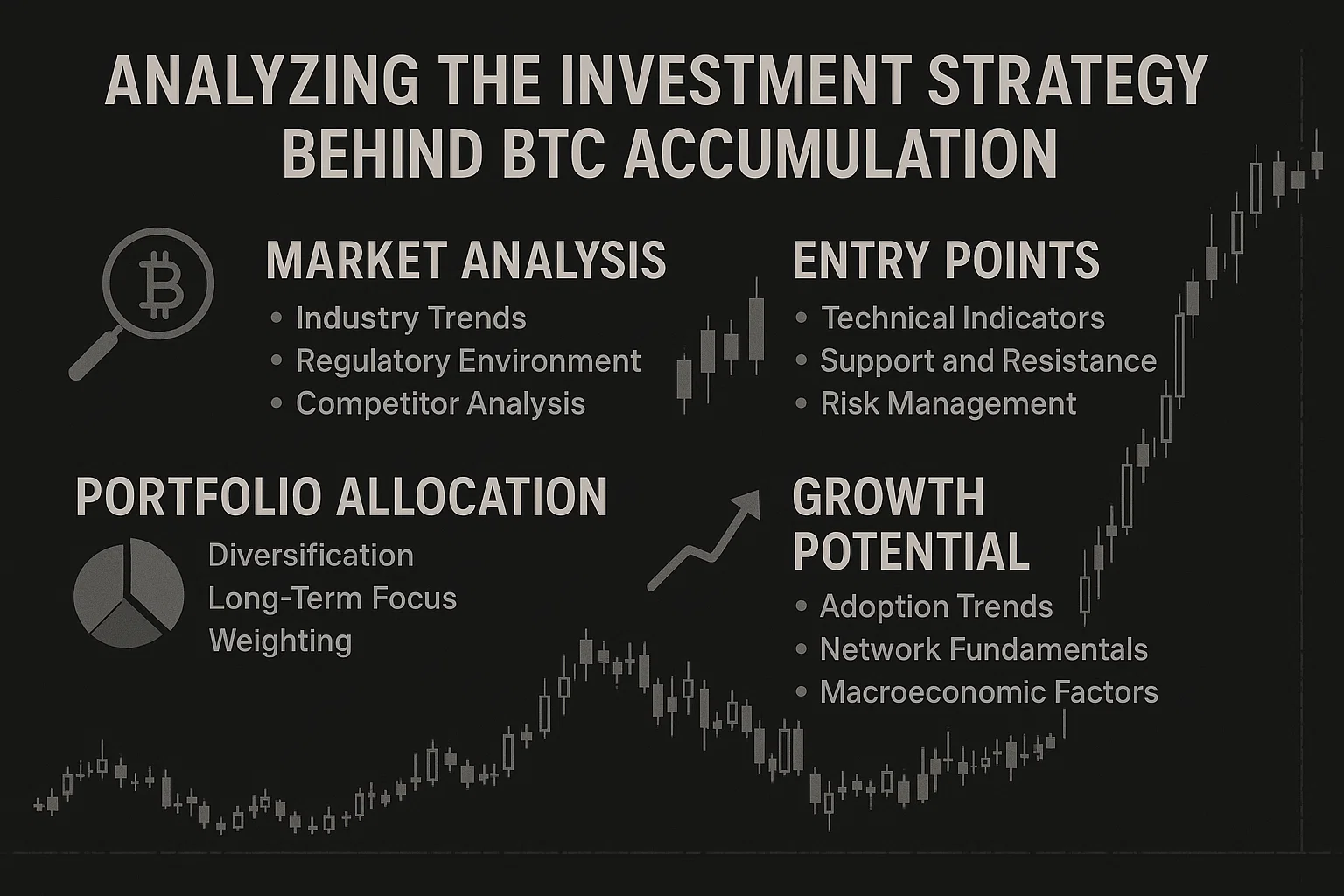

Analyzing the Investment Strategy Behind BTC Accumulation

Long-Term Value Proposition

The substantial Bitcoin strategy buys BTC consistently points to fundamental beliefs about Bitcoin’s long-term value proposition. Institutional investors typically conduct extensive due diligence before committing significant capital, suggesting confidence in Bitcoin’s future role as a store of value and potential inflation hedge.

The strategy appears focused on Bitcoin’s scarcity properties, with only 21 million Bitcoins ever to be created. This fixed supply mechanism, combined with growing demand from both institutional and retail investors, creates compelling long-term investment dynamics that sophisticated investors find attractive.

Risk Management and Portfolio Diversification

Professional investment strategies implement sophisticated risk management frameworks when a Bitcoin strategy buys BTC in large quantities. These frameworks typically include position sizing limits, volatility management protocols, and correlation analysis with traditional asset classes.

The gradual accumulation approach suggests systematic risk management, avoiding concentrated purchases that might create adverse market impact. Instead, the strategy employs methodical buying programs that build positions over time while maintaining portfolio diversification principles.

Market Reaction and Industry Implications

Cryptocurrency Market Response

When news breaks that a major Bitcoin strategy buys BTC in substantial quantities, cryptocurrency markets often respond positively. These purchases signal institutional confidence and can trigger additional buying from both retail and institutional participants who interpret the activity as validation of Bitcoin’s investment thesis.

The market response extends beyond immediate price movements, influencing longer-term sentiment and adoption patterns. Institutional purchases often precede increased interest from pension funds, endowments, and other large asset managers seeking exposure to digital assets.

Broader Financial Industry Impact

The consistent pattern where Bitcoin strategy buys BTC influences broader financial industry perspectives on cryptocurrency integration. Traditional financial institutions increasingly view these institutional adoption patterns as validation for developing their own digital asset capabilities and client offerings.

This institutional acceptance accelerates the development of cryptocurrency infrastructure, including custody solutions, trading platforms, and regulatory frameworks necessary for widespread adoption. The ripple effects extend throughout the financial services industry, creating opportunities for service providers and technology companies supporting digital asset ecosystems.

Technical Analysis and Market Positioning

Chart Patterns and Trading Implications

Large-scale purchases where a Bitcoin strategy buys BTC consistently create distinctive chart patterns that technical analysts monitor closely. These accumulation patterns often precede significant price movements, as the reduction in available supply creates conditions for potential breakouts during increased demand periods.

The systematic nature of these purchases creates support levels that technical traders incorporate into their analysis. When institutional buyers consistently enter the market at specific price ranges, these levels become significant reference points for future trading activity.

Volume Analysis and Market Structure

The impact of substantial Bitcoin strategy buys BTC transactions extends to trading volume analysis and overall market structure. These large purchases often occur through over-the-counter (OTC) markets to minimize immediate price impact, but their effects ripple through spot markets over time.

Volume analysis reveals how institutional accumulation influences market dynamics, with increased institutional participation generally leading to improved market efficiency and reduced volatility over longer time horizons.

Future Outlook and Strategic Implications

Continued Accumulation Trends

The pattern suggests that the Bitcoin strategy to buy BTC will likely continue as institutional adoption accelerates. With traditional monetary policy creating concerns about currency debasement and inflation, Bitcoin’s fixed supply properties become increasingly attractive to institutional portfolio managers.

Future accumulation patterns may intensify as more institutions develop comfort with Bitcoin’s volatility characteristics and regulatory clarity improves. The demonstration effect of successful institutional Bitcoin strategies encourages additional participation from previously hesitant institutional investors.

Regulatory and Compliance Considerations

As a Bitcoin strategy buys BTC in larger quantities, regulatory compliance becomes increasingly important. Institutional investors must navigate evolving regulatory frameworks while maintaining fiduciary responsibilities to their stakeholders.

The transparency and compliance demonstrated by major institutional Bitcoin holders help establish best practices for the industry, contributing to regulatory acceptance and framework development. This regulatory evolution supports continued institutional adoption and mainstream acceptance.

Investment Implications for Market Participants

Individual Investor Considerations

When institutional Bitcoin strategy buys BTC consistently, individual investors often reconsider their own cryptocurrency allocation strategies. The institutional validation provides confidence for retail investors while potentially reducing the available supply for smaller market participants.

Individual investors benefit from institutional adoption through improved market infrastructure, regulatory clarity, and reduced stigma associated with cryptocurrency investments. However, they also face increased competition for available Bitcoin supply as institutional demand grows.

Institutional Portfolio Management

The success of strategies where Bitcoin strategy buys BTC systematically influences other institutional portfolio management approaches. Asset managers study these strategies to understand optimal implementation methods for their own Bitcoin exposure goals.

Institutional portfolio managers must balance Bitcoin’s potential returns against its volatility characteristics, developing allocation models that complement traditional asset classes while managing overall portfolio risk profiles.

Technology and Infrastructure Development

Custody and Security Solutions

Large-scale operations where Bitcoin strategy buys BTC require sophisticated custody and security infrastructure. These institutional requirements drive the development of enterprise-grade custody solutions, insurance products, and security protocols that benefit the entire cryptocurrency ecosystem.

The institutional custody market continues expanding to meet growing demand from asset managers seeking secure Bitcoin storage solutions. These developments improve overall market infrastructure and reduce barriers to institutional adoption.

Trading and Execution Platforms

The need to execute large Bitcoin strategy buys BTC transactions efficiently drives innovation in trading platforms and execution algorithms. Institutional-grade trading infrastructure development benefits all market participants through improved liquidity and price discovery mechanisms.

Advanced trading platforms enable institutions to implement sophisticated execution strategies while minimizing market impact, supporting continued growth in institutional Bitcoin adoption and market participation.

Global Economic Context and Bitcoin Adoption

Macroeconomic Factors Driving Adoption

The environment where Bitcoin strategy buys BTC consistently reflects broader macroeconomic concerns about traditional monetary policy and currency stability. Institutional investors increasingly view Bitcoin as a hedge against currency debasement and potential inflation scenarios.

Global economic uncertainty, combined with unprecedented monetary expansion by central banks, creates conditions that favor alternative store-of-value assets like Bitcoin. Institutional adoption patterns reflect these macroeconomic considerations in portfolio construction decisions.

International Adoption Patterns

The trend where Bitcoin strategy buys BTC extends globally, with institutional adoption occurring across different regulatory jurisdictions and economic systems. This international adoption pattern reinforces Bitcoin’s potential role as a global store of value and medium of exchange.

Different regions approach Bitcoin adoption with varying regulatory frameworks and cultural perspectives, but the underlying institutional adoption trend remains consistent across major financial markets worldwide.

Conclusion

The recent acquisition, where the Bitcoin strategy buys BTC for $60 million, adding 525 Bitcoin to reach total holdings of 638,985 BTC, represents more than just another institutional purchase—it signals a fundamental shift in how sophisticated investors view digital assets. This strategic accumulation pattern demonstrates unwavering confidence in Bitcoin’s long-term value proposition and its role as a legitimate asset class within diversified investment portfolios.

The implications extend far beyond the immediate transaction, influencing market dynamics, regulatory development, and broader institutional adoption patterns. As more strategies follow this example and Bitcoin strategy buys BTC consistently, the cryptocurrency landscape continues evolving toward mainstream acceptance and integration within traditional financial systems.