Bitcoin treasury boom shakeout movements reshape how corporations manage their digital assets. With over $150 billion in Bitcoin holdings now concentrated across institutional investors and major corporations, we’re witnessing a pivotal moment in cryptocurrency adoption. This massive accumulation of Bitcoin treasury reserves marks a fundamental change in how businesses view cryptocurrency as a store of value, moving it from fringe investment to mainstream corporate strategy.

The Bitcoin treasury boom shakeout phenomenon represents more than just market volatility; it symbolizes the maturation of cryptocurrency markets. Major corporations, from tech giants to financial institutions, have begun treating Bitcoin as a legitimate asset class worthy of significant capital allocation. This trend gained tremendous momentum following the approval of Bitcoin spot ETFs and increased institutional participation, fundamentally altering the landscape of corporate Bitcoin treasury management.

Understanding the Bitcoin treasury boom shakeout is crucial for investors, business leaders, and cryptocurrency enthusiasts alike. The shakeout phase we’re experiencing today will likely determine the long-term viability of corporate Bitcoin treasury strategies and establish best practices for digital asset management at scale. As market conditions shift and regulatory frameworks evolve, companies must navigate this complex landscape strategically.

Bitcoin Treasury Boom Shakeout

The Bitcoin treasury boom shakeout emerged from a perfect storm of market conditions and institutional recognition. During 2023-2024, we witnessed an explosive growth in corporate adoption of Bitcoin holdings. The driving forces behind this phenomenon include increased regulatory clarity, institutional-grade custody solutions, and Bitcoin’s proven track record as a long-term value store.

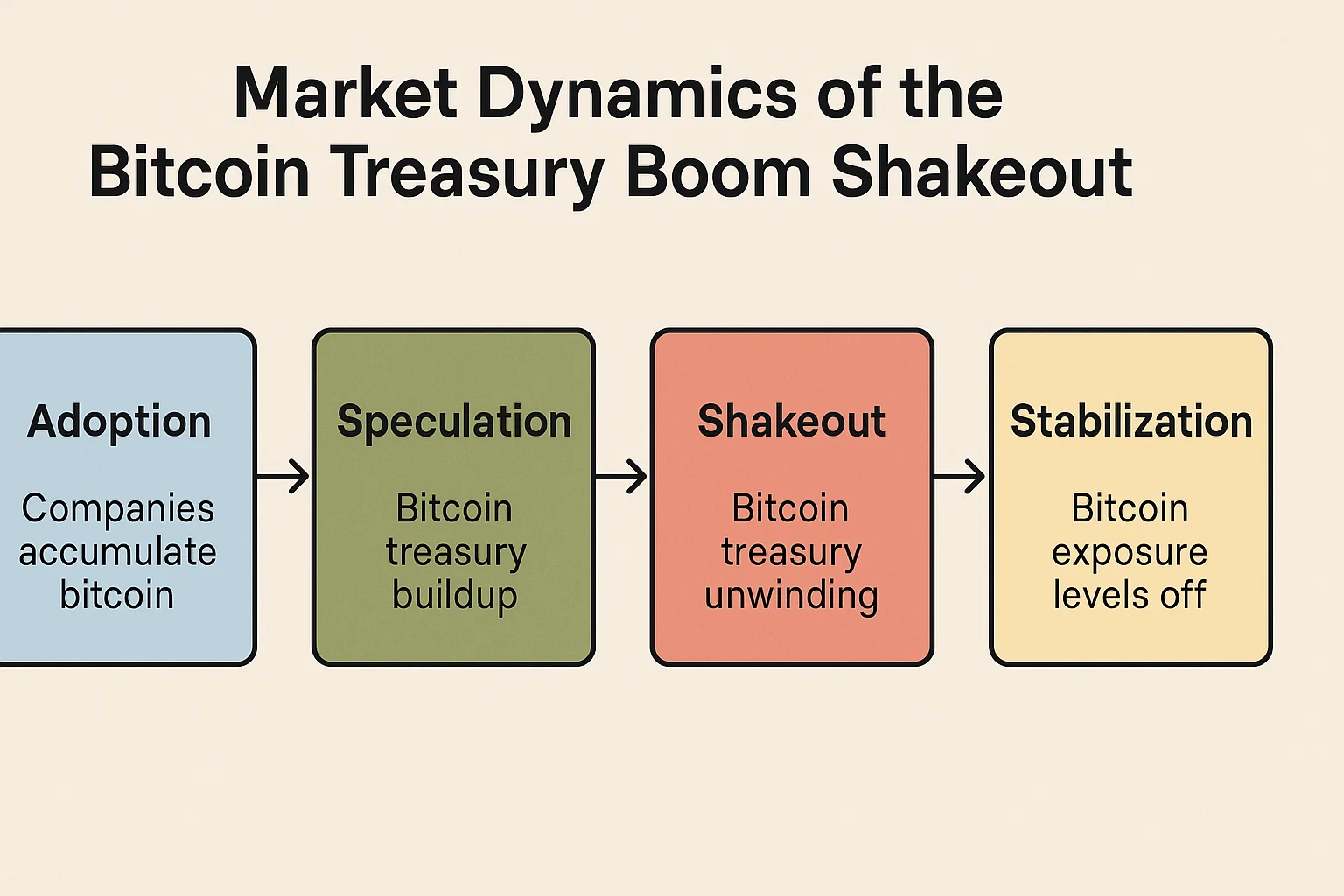

The shakeout component of this trend refers to the natural market correction and consolidation that follows rapid growth. After years of explosive gains and increased adoption, the Bitcoin corporate treasury sector is experiencing a period of maturation. This phase separates serious, well-capitalized institutions from speculative investors, ultimately strengthening the market’s foundation.

Large corporations began accumulating Bitcoin at an accelerated pace, leading to the $150 billion milestone. This concentration of wealth in Bitcoin treasury holdings demonstrates institutional confidence but also creates potential volatility triggers. When major holders make strategic moves—whether adding or reducing positions—the market responds dramatically, creating the “shakeout” effect we observe today.

The $150 Billion Corporate Bitcoin Treasury Landscape

The accumulation of $150 billion in Bitcoin treasury assets across corporate portfolios represents a watershed moment for digital finance. This figure includes holdings from publicly traded companies, institutional investors, government entities, and investment funds that have collectively positioned Bitcoin as a strategic asset.

Major Corporate Bitcoin Holdings

Several Fortune 500 companies and prominent investment firms now hold substantial Bitcoin treasury positions. These holdings range from companies in technology, finance, and industrial sectors, each viewing cryptocurrency through a different lens. Some corporations use Bitcoin as a treasury reserve asset, similar to gold holdings, while others treat it as a growth investment positioned for portfolio appreciation.

The strategic rationale behind corporate Bitcoin treasury adoption centers on several compelling factors:

First, Bitcoin serves as an inflation hedge in times of monetary expansion. Companies concerned about currency devaluation have increased their Bitcoin holdings in the treasury as a defensive measure against erosion of cash reserves. Second, the institutional infrastructure supporting Bitcoin has matured significantly, offering secure custody, insurance, and trading infrastructure comparable to traditional assets.

Third, the approval of Bitcoin spot exchange-traded funds (ETFs) simplified access for corporate treasurers, eliminating previous complexity and custody concerns. This regulatory breakthrough directly enabled the acceleration of the Bitcoin treasury boom shakeout, as institutions could now hold Bitcoin through familiar financial vehicles.

Market Dynamics of the Bitcoin Treasury Boom Shakeout

The Bitcoin treasury boom shakeout operates according to predictable market dynamics that mirror cycles seen in traditional asset classes. Understanding these dynamics helps investors and corporate treasurers make informed decisions about their digital asset treasury strategies.

Price Volatility and Institutional Response

Bitcoin treasury holdings introduce significant volatility considerations for corporate balance sheets. When Bitcoin prices surge, companies benefit from unrealized gains, which can positively impact financial statements and investor sentiment. However, sharp corrections create pressure for accounting adjustments and potential margin calls on leveraged positions.

The shakeout phase intensifies during periods of macroeconomic uncertainty. When broader markets decline, institutional investors often reassess their Bitcoin corporate treasury allocations, leading to forced selling and accelerated price declines. This cyclical pattern creates opportunities for companies with conviction and available capital to acquire Bitcoin at attractive valuations.

Institutional Capital Movements

Large-scale institutional movements drive significant portions of the Bitcoin treasury market activity. When major funds or corporations announce new Bitcoin purchases, it signals confidence in the asset class and typically attracts additional capital. Conversely, well-publicized sales or reductions in Bitcoin holdings in the treasury can trigger broader market pessimism.

The $150 billion figure continues to grow as more corporations recognize the strategic advantages of holding Bitcoin. However, this concentration creates potential systemic risk if major holders coordinate selling or if unexpected regulatory changes trigger mass liquidations. This risk of coordinated action represents the core concern during a Bitcoin treasury boom shakeout phase.

Corporate Strategy: Why Companies Are Building Bitcoin Treasury Reserves

The expansion of Bitcoin treasury portfolios reflects fundamental shifts in how corporations think about asset management and value preservation. Companies pursuing this strategy operate from several strategic imperatives that transcend simple speculation.

Diversification Beyond Traditional Assets

Modern corporate treasurers recognize that traditional diversification—spreading investments across stocks, bonds, and cash—no longer provides adequate protection against currency devaluation and inflation. Bitcoin offers proper diversification because its value derives from an entirely different mechanism than stocks or bonds. The Bitcoin corporate treasury strategy complements rather than replaces traditional holdings.

Companies holding Bitcoin in their treasury holdings benefit from an asset that moves independently of traditional markets during many economic cycles. This uncorrelated nature provides genuine portfolio protection when stock markets decline or bond yields collapse. The strategic value of Bitcoin treasury allocations extends beyond short-term speculation to long-term wealth preservation.

Inflation Hedging in an Era of Monetary Expansion

Central banks worldwide have engaged in unprecedented monetary expansion, leading corporate treasurers to seek protection against currency erosion. Bitcoin, with its fixed 21-million-coin supply, offers absolute scarcity—a characteristic absent from government-issued currencies. As companies accumulate Bitcoin treasury reserves, they’re essentially betting on continued monetary expansion and subsequent inflation.

The inflation-hedging property of Bitcoin in corporate treasury strategies has attracted extreme interest from companies operating in high-inflation environments or those with long-term pension obligations. These entities recognize that Bitcoin’s scarcity provides better protection than traditional reserves composed primarily of fiat currency.

Risks and Challenges in the Bitcoin Treasury Boom Shakeout

The Bitcoin treasury boom shakeout introduces significant challenges that corporate treasurers and investors must carefully navigate. Understanding these risks is essential for any organization considering substantial Bitcoin treasury exposure.

Regulatory Uncertainty

Perhaps the most significant risk facing the Bitcoin corporate treasury sector involves regulatory uncertainty. Governments and central banks worldwide are still formulating comprehensive frameworks for cryptocurrency oversight. Sudden regulatory changes could dramatically impact Bitcoin’s value and the viability of corporate Bitcoin holdings and treasury strategies.

The regulatory landscape varies significantly across jurisdictions. Some countries embrace Bitcoin and cryptocurrency innovation, creating favorable conditions for Bitcoin treasury accumulation. Others impose strict restrictions or actively discourage digital asset adoption. Multinational corporations must navigate this patchwork of regulations carefully when managing corporate Bitcoin treasury positions.

Accounting and Tax Complexity

Corporate accountants and tax professionals face substantial challenges in managing Bitcoin treasury holdings. The tax treatment of cryptocurrency remains inconsistent across jurisdictions, and accounting standards continue to evolve. Companies must ensure proper valuation, income recognition, and tax reporting for their Bitcoin holdings and treasury positions.

Impairment testing represents another accounting challenge for Bitcoin corporate treasury holdings. Under generally accepted accounting principles (GAAP), companies must regularly evaluate whether their Bitcoin holdings have declined below cost basis, potentially requiring impairment charges that impact reported earnings.

The Future of Bitcoin Treasury Holdings

The trajectory of the Bitcoin treasury boom shakeout will likely determine cryptocurrency’s role in corporate finance for decades to come. Several emerging trends suggest how the Bitcoin corporate treasury landscape may evolve.

Integration with Traditional Finance

We’re witnessing increasing integration between Bitcoin treasury strategies and traditional corporate finance. More banks, fund managers, and financial institutions are offering custody, insurance, and valuation services for corporate Bitcoin holdings. This growing infrastructure supports the continued expansion of the Bitcoin corporate treasury sector.

The approval and subsequent success of Bitcoin spot ETFs demonstrate that traditional financial institutions can successfully offer Bitcoin exposure to corporate and institutional investors. As these vehicles mature and adoption grows, corporate Bitcoin holdings and treasury allocations will likely become more routine and less controversial.

Regulatory Clarity and Institutional Adoption

As regulatory frameworks mature and become more clearly defined, we should expect accelerated adoption of Bitcoin treasury strategies among corporations previously hesitant due to legal uncertainty. Clear rules enable treasurers to confidently allocate capital to Bitcoin without fears of sudden regulatory crackdowns.

Enhanced regulatory clarity will likely transform the Bitcoin corporate treasury sector from a frontier investment strategy into a mainstream asset allocation decision. This normalization would further increase the $150 billion Bitcoin holdings figure as thousands of additional companies enter the space.

Investment Considerations for Bitcoin Treasury Participation

Companies and investors interested in participating in the Bitcoin treasury boom shakeout opportunity must consider several critical factors before committing capital.

Time Horizon and Risk Tolerance

The Bitcoin corporate treasury strategy requires a long-term perspective and substantial risk tolerance. Bitcoin’s price can fluctuate dramatically in the short term, and companies uncomfortable with significant volatility should either avoid Bitcoin entirely or maintain only modest allocations. Corporate treasurers must honestly assess their organization’s ability to withstand 20-30% price declines without panic selling.

The most successful Bitcoin treasury investors demonstrate conviction and patience, remaining committed to their holdings even during severe market downturns. This psychological fortitude distinguishes successful corporate treasurers from those who succumb to market emotions and make reactive decisions.

Custody and Security

Proper custody arrangements are essential for any corporate Bitcoin holdings treasury strategy. Bitcoin held in unauthorized custodial arrangements faces significant theft and loss risks. Companies should only work with institutional-grade custody providers offering comprehensive insurance coverage and proven security protocols.

Professional custodians provide segregated storage, meaning your Bitcoin corporate treasury holdings remain distinctly separate from their own assets and from holdings of other clients. This separation is crucial for legal protection and recovery in the unlikely event of custodian insolvency.

Bitcoin Treasury Boom Shakeout: Key Metrics to Monitor

Investors tracking the Bitcoin treasury boom shakeout should monitor several key indicators that reveal market health and institutional commitment.

On-Chain Analytics and Holdings

On-chain analytics provide real-time visibility into Bitcoin ownership patterns and movement. Monitoring how major institutional holders accumulate or distribute their Bitcoin treasury positions reveals sentiment and confidence levels. Significant institutional purchases typically precede price appreciation, while large sales often correlate with market declines.

The concentration of Bitcoin holdings in fewer hands creates potential vulnerability, as large holders possess significant price impact capability. When analyzing the Bitcoin corporate treasury sector, diversification of ownership across multiple institutions and corporations provides greater market stability than concentrated holdings.

Macroeconomic Indicators

Bitcoin’s performance correlates increasingly with macroeconomic conditions, particularly inflation expectations and monetary policy. Companies evaluating their Bitcoin treasury strategies should monitor central bank policy, inflation data, currency valuations, and real interest rates. These factors significantly influence Bitcoin’s attractiveness relative to traditional reserve assets.

The inflation-hedging properties of Bitcoin corporate treasury holdings become increasingly valuable during periods of rising prices and monetary expansion. Conversely, deflationary environments may reduce Bitcoin’s appeal as a portfolio component.

Conclusion

The Bitcoin treasury boom shakeout represents a defining moment for cryptocurrency’s integration into corporate finance. With $150 billion in institutional Bitcoin holdings already accumulated, we’ve moved well beyond the experimental phase into genuine mainstream adoption. The shakeout phase we’re experiencing today will likely establish the foundation for Bitcoin’s long-term role as a strategic corporate asset.

Companies considering participation in the Bitcoin corporate treasury trend should approach the decision strategically, with apparent conviction about their organization’s risk tolerance, time horizon, and long-term vision. Those that successfully navigate the Bitcoin treasury boom shakeout will likely emerge with strengthened balance sheets and improved long-term value preservation.