In an unprecedented cryptocurrency catastrophe, PayPal’s blockchain partner minted stablecoins totaling an incomprehensible $300 trillion—an amount that dwarfs the entire global economy. This shocking incident occurred when the technical infrastructure provider managing PayPal’s digital currency operations experienced a critical system failure that bypassed every security checkpoint designed to prevent unauthorized token creation. The moment when this blockchain partner minted stablecoins without proper authorization sent shockwaves throughout the financial technology sector and raised urgent questions about the readiness of traditional payment companies to safely navigate the complex world of digital assets.

The scale of this error is difficult to comprehend: $300 trillion represents roughly 300 times the annual GDP of the United States. When the blockchain partner minted stablecoins in such astronomical quantities, it exposed fundamental weaknesses in how even sophisticated financial institutions implement cryptocurrency infrastructure. This article examines every aspect of this historic failure, from the technical mechanics to the broader implications for cryptocurrency adoption.

How the Blockchain Partner Minted Stablecoins

The Technical Infrastructure Behind Stablecoin Creation

When a blockchain partner minted stablecoins for PayPal, the process should have involved multiple layers of verification and authorization. Stablecoin minting typically requires smart contract functions that check reserve balances, verify authorized signers, and implement rate limits to prevent exactly this type of catastrophic error. The fact that PayPal’s blockchain partner minted stablecoins worth $300 trillion indicates a complete breakdown of these fundamental safeguards.

Modern stablecoin protocols utilize what developers call “permissioned minting,” where only specific wallet addresses controlled by authorized personnel can trigger token creation. These systems implement multi-signature requirements, meaning multiple parties must approve each minting transaction. However, when this blockchain partner minted stablecoins without proper checks, it revealed that their implementation either lacked these security features or had vulnerabilities that completely bypassed them.

The smart contracts governing how a blockchain partner minted stablecoins should include hard-coded maximum limits per transaction. Industry best practices suggest no single minting operation should exceed amounts that could destabilize the broader ecosystem. The fact that the blockchain partner minted stablecoins in such quantities without triggering automated circuit breakers demonstrates either negligent system design or inadequate testing before production deployment.

The Moment of Discovery

The discovery that a blockchain partner minted stablecoins worth $300 trillion occurred during routine blockchain monitoring activities. On-chain analytics tools that track stablecoin supply noticed an impossible spike in total tokens outstanding. Within minutes, blockchain security researchers confirmed that PayPal’s blockchain partner minted stablecoins through what appeared to be a smart contract malfunction rather than a deliberate attack.

The speed at which the blockchain partner minted stablecoins suggests an automated process gone wrong rather than manual intervention. Blockchain transaction logs showed the minting events occurred within a compressed timeframe, indicating the smart contract executed repeatedly without human oversight. This automated failure mode made the situation even more alarming because it demonstrated how quickly cryptocurrency systems can spiral out of control when safeguards fail.

PayPal’s Relationship With Its Blockchain Infrastructure Partner

Why PayPal Outsourced Stablecoin Operations

PayPal’s decision to work with an external partner that ultimately minted stablecoins incorrectly reflects common industry practices. Traditional financial institutions often lack in-house expertise in blockchain development and cryptocurrency operations. By partnering with specialized firms, companies like PayPal can accelerate their entry into digital asset markets while leveraging external technical knowledge.

The company that blockchain partner minted stablecoins for PayPal was presumably selected through a rigorous vetting process examining technical capabilities, security track record, and regulatory compliance. However, this incident reveals that even carefully selected partners can experience catastrophic failures. When this blockchain partner minted stablecoins without authorization, it raised questions about whether PayPal conducted adequate ongoing oversight of its partner’s operations.

The Division of Responsibilities

In arrangements where a blockchain partner minted stablecoins on behalf of major corporations, responsibilities typically divide between technical operations and business management. The blockchain partner handles smart contract development, node operation, and transaction processing, while the primary company focuses on user experience, regulatory compliance, and customer service.

This division of labor creates potential blind spots. When the blockchain partner minted stablecoins incorrectly, did PayPal have real-time visibility into minting operations? Were there automated alerts that should have flagged the anomalous activity? The incident suggests the oversight mechanisms connecting PayPal to its partner may have been insufficient to detect and prevent such a massive error before it occurred.

The Immediate Fallout From the Minting Error

Emergency Response Protocols Activated

The moment PayPal discovered its blockchain partner minted stablecoins improperly, emergency response teams mobilized across multiple organizations. Smart contract developers initiated emergency pause functions to freeze all minting and redemption activities. Blockchain forensics teams analyzed transaction logs to understand exactly how the blockchain partner minted stablecoins and whether the erroneous tokens had entered circulation.

Cryptocurrency exchanges received urgent notifications about the incident. If the stablecoins that the blockchain partner minted had reached trading platforms, they could have caused massive disruptions across cryptocurrency markets. Fortunately, rapid containment prevented the unauthorized tokens from propagating beyond the partner’s immediate control systems.

The technical team addressing the issue after the blockchain partner minted stablecoins faced unprecedented challenges. They needed to understand the root cause, implement fixes, verify those fixes wouldn’t create new vulnerabilities, and restore normal operations—all while maintaining transparency with regulators and stakeholders who were demanding immediate answers about how such a catastrophic failure occurred.

Market Impact and Price Volatility

News that a blockchain partner minted stablecoins worth $300 trillion created immediate turbulence in cryptocurrency markets. Bitcoin experienced sudden price swings as traders processed the implications. Ethereum, which hosts many stablecoin implementations, saw increased volatility as market participants questioned whether similar vulnerabilities existed in other protocols.

The broader stablecoin market reacted with particular sensitivity. Competitors to PayPal’s offering saw both increased scrutiny and potential opportunities. Some stablecoin providers experienced capital inflows as users sought alternatives they perceived as safer after learning that PayPal’s blockchain partner minted stablecoins so carelessly. Others faced skepticism as investors questioned whether the entire stablecoin sector had adequate security controls.

Decentralized finance (DeFi) protocols that might have integrated PayPal’s stablecoin acted quickly to isolate potential risks. When a blockchain partner minted stablecoins in unauthorized quantities, it could have cascading effects across interconnected DeFi systems that use stablecoins as collateral, liquidity, and medium of exchange.

Technical Deep Dive: How Smart Contracts Failed

The Architecture of Stablecoin Minting Contracts

Understanding how a blockchain partner minted stablecoins requires examining the smart contract architecture that governs token creation. Properly designed contracts implement multiple validation layers: checking that the caller address has minting privileges, verifying sufficient reserves back the new tokens, confirming the minting amount doesn’t exceed predetermined limits, and recording the transaction in immutable blockchain logs.

The contract code where the blockchain partner minted stablecoins apparently contained logic errors or missing validation checks. Blockchain security experts who reviewed similar incidents suggest possible causes including integer overflow vulnerabilities, missing access control modifiers, inadequate input sanitization, or flawed state management that allowed repeated execution of minting functions.

When a blockchain partner minted stablecoins through faulty smart contracts, the blockchain faithfully recorded every transaction. This immutability proved valuable for forensic analysis but also highlighted how blockchain systems lack the safeguards traditional banking systems employ—there’s no central authority that can reverse transactions or halt operations without pre-programmed controls.

Security Auditing Failures

The fact that a blockchain partner minted stablecoins in such quantities suggests either inadequate security auditing or failure to address identified vulnerabilities. Professional smart contract audits cost substantial amounts but provide crucial verification that code functions as intended without exploitable weaknesses.

Leading audit firms examine not just the code itself but also the entire ecosystem where a blockchain partner minted stablecoins. They test edge cases, attempt to exploit potential vulnerabilities, and verify that operational procedures match security requirements. The auditing process for the system where the blockchain partner minted stablecoins either didn’t occur, wasn’t comprehensive enough, or produced findings that weren’t properly addressed before production deployment.

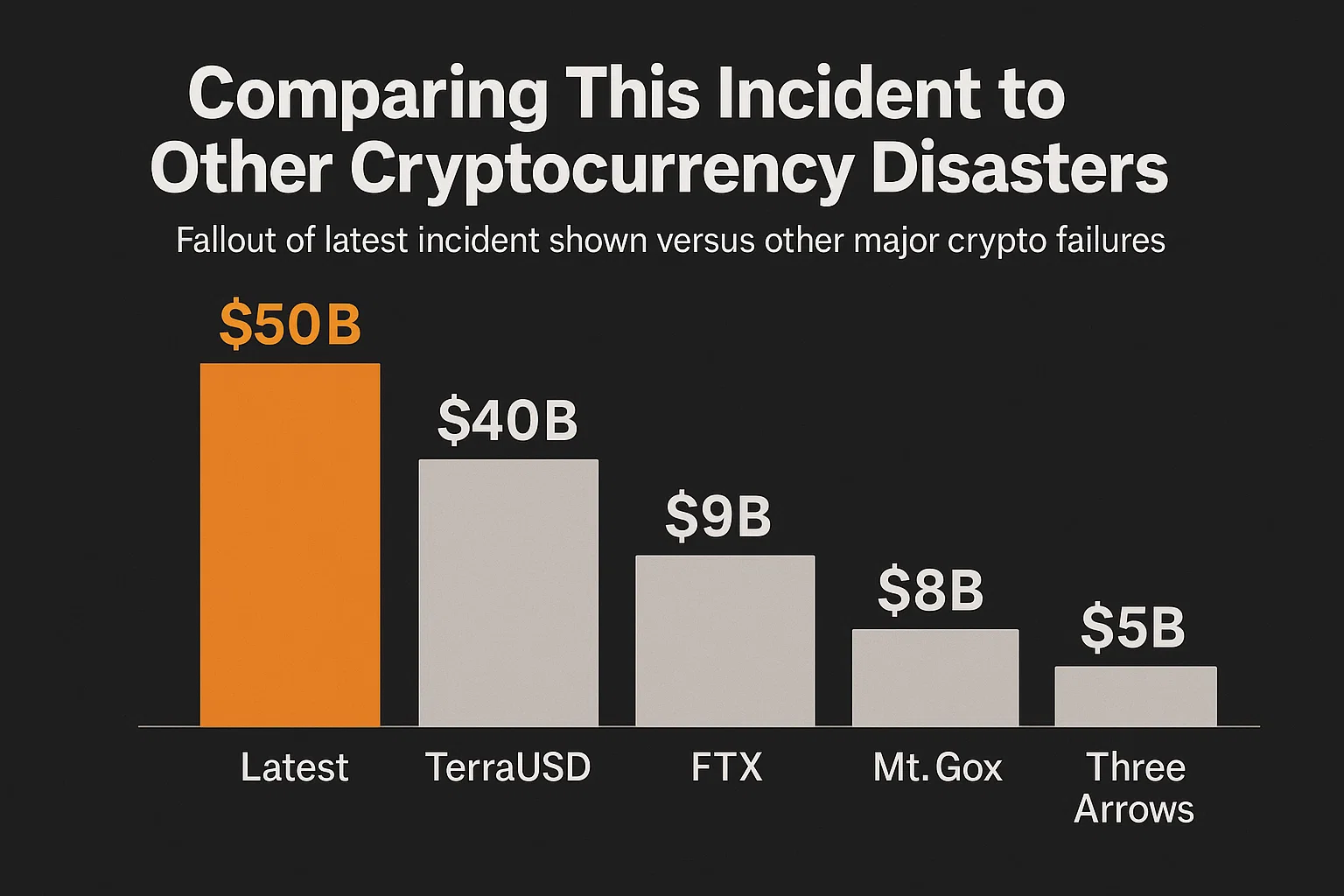

Comparing This Incident to Other Cryptocurrency Disasters

Historical Context of Crypto Failures

The incident where PayPal’s blockchain partner minted stablecoins incorrectly joins a troubling history of cryptocurrency infrastructure failures. The Mt. Gox exchange lost 850,000 Bitcoin to hackers in 2014. The DAO hack in 2016 resulted in stolen Ethereum worth $60 million. The Terra/Luna collapse in 2022 wiped out $40 billion in value. Each disaster revealed different vulnerabilities in cryptocurrency systems.

What distinguishes the moment when this blockchain partner minted stablecoins is the involvement of a mainstream payment company. Previous major cryptocurrency failures primarily affected crypto-native companies and their users. When PayPal’s blockchain partner minted stablecoins incorrectly, it brought cryptocurrency risk directly to a platform serving hundreds of millions of mainstream consumers who might never have encountered digital assets otherwise.

Lessons From Past Minting Errors

Other, smaller incidents where cryptocurrency systems incorrectly minted stablecoins or other tokens provide valuable context. In 2021, a DeFi protocol accidentally minted billions of governance tokens due to a smart contract bug. In 2020, another project experienced unauthorized token creation that temporarily crashed its value to zero. These precedents show that minting errors, while rare, represent a recurring vulnerability class in cryptocurrency systems.

However, the scale when PayPal’s blockchain partner minted stablecoins dwarfs these previous incidents combined. The $300 trillion amount represents not just a technical failure but a comprehensive breakdown of every safety mechanism that should have prevented such an error. This scale suggests the vulnerability was fundamental rather than a subtle edge case that security auditors might reasonably miss.

Regulatory Implications and Government Response

How Regulators View the Incident

Financial regulators monitoring the cryptocurrency sector took immediate interest when they learned a blockchain partner minted stablecoins worth $300 trillion for a major payment processor. The U.S. Securities and Exchange Commission, Commodity Futures Trading Commission, and Office of the Comptroller of the Currency all opened inquiries examining whether existing regulatory frameworks adequately address such incidents.

The moment when the blockchain partner minted stablecoins without authorization reinforced regulatory concerns about stablecoin systemic risk. Policymakers had already expressed worries that stablecoins, now representing hundreds of billions in market capitalization, could threaten financial stability if major issuers failed. This incident where a blockchain partner minted stablecoins incorrectly provided concrete evidence supporting arguments for comprehensive stablecoin regulation.

Proposed Regulatory Frameworks

Several regulatory proposals pending before the incident where the blockchain partner minted stablecoins may now advance more quickly. Legislative frameworks requiring stablecoin issuers to maintain specific reserve compositions, undergo regular audits, implement minimum security standards, and maintain insurance against technical failures could become mandatory rather than voluntary best practices.

International coordination on cryptocurrency regulation may accelerate after this blockchain partner minted stablecoins disaster. Since blockchain operates globally, vulnerabilities in one jurisdiction can affect users worldwide. Regulators from multiple countries are discussing standardized requirements for any entity that mints stablecoins or provides related infrastructure services.

Impact on PayPal’s Cryptocurrency Strategy

Rebuilding Consumer Confidence

PayPal faces significant challenges rebuilding trust after its blockchain partner minted stablecoins so catastrophically. The company had positioned itself as a safe, regulated bridge between traditional finance and cryptocurrency. This massive technical failure undermines that value proposition and forces PayPal to demonstrate concrete security improvements before consumers will trust its cryptocurrency services again.

The path forward after the blockchain partner minted stablecoins incorrectly requires transparency about what failed, how it was fixed, and what prevents recurrence. PayPal must balance providing sufficient detail to restore confidence without revealing information that could help malicious actors exploit other vulnerabilities in cryptocurrency infrastructure.

Reconsidering Partnership Strategy

PayPal may fundamentally reconsider its approach to blockchain partnerships after learning how its partner <strong>minted stablecoins without authorization. Options include bringing more blockchain operations in-house, diversifying across multiple infrastructure providers to reduce single points of failure, implementing more rigorous ongoing monitoring of partner activities, or potentially exiting certain cryptocurrency services if risks prove unmanageable.

The decision process following the incident where the blockchain partner minted stablecoins will influence how other traditional financial institutions approach cryptocurrency. If PayPal concludes that external partnerships create unacceptable risks, other banks and payment processors planning similar strategies may reconsider their approaches to digital asset services.

What Cryptocurrency Users Should Learn

Evaluating Stablecoin Security

Cryptocurrency users should now ask critical questions about any stablecoin they use: Who manages the infrastructure where the provider mints stablecoins? What security audits have been conducted? Are there public bug bounty programs? What insurance or guarantees protect users from technical failures?

The transparency principle becomes crucial after seeing how a blockchain partner minted stablecoins incorrectly. Users deserve to know the complete technical architecture supporting their digital assets, including details about smart contract security, reserve management, and operational controls that prevent unauthorized minting.

Diversification and Risk Management

The incident where PayPal’s blockchain partner minted stablecoins reinforces fundamental risk management principles for cryptocurrency users. Never concentrating holdings with a single stablecoin provider, maintaining exposure across multiple asset types, and only investing amounts you can afford to lose all apply regardless of whether a provider is a established brand or crypto-native startup.

Understanding that even major corporations can experience catastrophic failures when their blockchain partner minted stablecoins incorrectly should inform user behavior. Brand recognition provides no guarantee of technical competence in cryptocurrency operations. Users must independently verify security practices rather than relying solely on reputation.

The Future of Stablecoin Technology

Engineering Better Security Standards

The cryptocurrency industry must develop better security standards after this blockchain partner minted stablecoins disaster. Proposed improvements include mandatory security certifications for stablecoin infrastructure providers, standardized smart contract templates with proven security properties, automated monitoring systems that detect anomalous minting activity, and industry-wide information sharing about vulnerabilities and incidents.

Creating systems where no blockchain partner minted stablecoins incorrectly requires multi-layered defense strategies. Single security measures inevitably fail; robust systems need redundant controls ensuring that multiple independent mechanisms must all fail simultaneously before catastrophic errors occur.

Innovation in Blockchain Governance

The incident where the blockchain partner minted stablecoins without authorization highlights governance challenges in blockchain systems. While decentralization offers benefits, it can complicate emergency response when technical failures occur. Finding the right balance between decentralized control and ability to respond quickly to crises remains an open challenge for blockchain developers.

Some blockchain projects are exploring governance models where emergency actions require rapid consensus among distributed stakeholders rather than unilateral control by a single party. These approaches might have detected and halted the situation where the blockchain partner minted stablecoins more quickly than centralized systems while maintaining decentralization’s security benefits.

Industry Response and Collaborative Solutions

How Competitors Reacted

Competing stablecoin providers responded quickly after learning that PayPal’s blockchain partner minted stablecoins incorrectly. Many published transparency reports detailing their own security practices, attempting to differentiate themselves from PayPal’s failed implementation. Some conducted emergency security reviews of their own systems, concerned that similar vulnerabilities might exist in their infrastructure.

The collaborative nature of the blockchain development community meant that information about how the blockchain partner minted stablecoins circulated quickly through security channels. Developers working on unrelated projects examined whether their systems could experience analogous failures and implemented additional safeguards where necessary.

Open Source Security Initiatives

The moment when the may accelerate open-source security initiatives in the blockchain space. Open-source smart contract libraries allow many developers to examine code for potential vulnerabilities. Projects using battle-tested, community-audited contract code may prove more resilient than proprietary implementations where the partner that minted stablecoins kept their code closed and therefore unavailable for independent security review.

Bug bounty programs offering substantial rewards for discovering vulnerabilities before they’re exploited represent another industry response. If the system where the had maintained an active bug bounty program, security researchers might have identified and reported the vulnerability before it caused such massive damage.

Conclusion

The unprecedented incident where PayPal’s blockchain partner minted stablecoins worth $300 trillion stands as a defining moment in cryptocurrency’s evolution from niche technology to mainstream financial infrastructure. This catastrophic failure exposed critical vulnerabilities not just in one company’s implementation but in the broader approach traditional finance takes when adopting blockchain technology. The moment when this without authorization will influence cryptocurrency development, regulation, and adoption for years to come.

The path forward requires unprecedented collaboration between traditional finance, blockchain developers, security researchers, and regulatory authorities. Systems where any blockchain partner minted stablecoins must implement multiple redundant safeguards, undergo continuous security monitoring, and maintain transparency about their operations and security practices. Only through comprehensive reforms addressing the technical, operational, and governance failures that allowed this blockchain partner minted stablecoins incorrectly can the industry rebuild trust and demonstrate readiness for mainstream adoption.