In the rapidly evolving world of cryptocurrency investment, most traders are chasing the latest meme coins and trending tokens, completely overlooking one of the most fundamentally sound digital assets in the market. While Bitcoin dominates headlines and Ethereum captures institutional attention, Ethereum Classic (ETC) quietly maintains its position as one of the most undervalued blockchain networks with genuine utility and long-term potential.

The question isn’t whether you should buy Ethereum Classic now – it’s whether you can afford to miss this opportunity while the market is still sleeping on its true value. Smart money has been accumulating ETC positions throughout 2024, recognizing what retail investors have yet to discover: Ethereum Classic possesses unique advantages that position it perfectly for the next cryptocurrency bull cycle.

This comprehensive analysis reveals why experienced crypto investors are strategically positioning themselves to buy Ethereum Classic now, backed by fundamental analysis, market dynamics, and emerging trends that could propel ETC price to unprecedented levels. Unlike speculative investments driven by hype, Ethereum Classic investment represents a calculated bet on proven blockchain technology with immutable principles.

The timing couldn’t be more critical. As we approach 2025, several converging factors are creating the perfect storm for Ethereum Classic to break out from its current undervaluation. From institutional adoption to smart contract innovation, the pieces are falling into place for what could be the most significant ETC price appreciation cycle in years.

Ethereum Classic: The Foundation of Digital Immutability

Ethereum Classic emerged from one of the most significant events in cryptocurrency history – the infamous DAO hack of 2016. When the Ethereum Foundation decided to hard fork and reverse transactions to recover stolen funds, a portion of the community refused to compromise on the fundamental principle of blockchain immutability. This philosophical split gave birth to Ethereum Classic, which maintains the original Ethereum blockchain exactly as Satoshi Nakamoto envisioned – immutable, uncensorable, and truly decentralized.

This unwavering commitment to blockchain immutability isn’t just philosophical posturing; it’s a crucial differentiator that makes ETC attractive to institutions and individuals who value censorship resistance above all else. While other networks compromise their principles for convenience or political pressure, Ethereum Classic remains steadfast in its core values, creating a unique value proposition in the cryptocurrency ecosystem.

The ETC blockchain operates on a Proof-of-Work consensus mechanism, similar to Bitcoin, ensuring maximum security and decentralization. This approach may consume more energy than newer consensus mechanisms, but it provides unparalleled security guarantees that are increasingly valuable as cyber threats evolve and geopolitical tensions rise globally.

1: Institutional Adoption and Corporate Treasury Integration

The Silent Corporate Revolution

The first compelling reason to buy Ethereum Classic now lies in the growing institutional recognition of ETC’s unique value proposition. Unlike the retail-driven adoption of many altcoins, Ethereum Classic is experiencing steady institutional accumulation by corporations seeking blockchain solutions that prioritize immutability and censorship resistance.

Major cryptocurrency exchanges, including Coinbase, Binance, and Kraken, have not only listed ETC but actively promote it as a legitimate store of value. This institutional endorsement provides crucial credibility and liquidity that smaller cryptocurrencies lack. More importantly, several Fortune 500 companies have quietly begun exploring Ethereum Classic for supply chain management and smart contract applications where immutability is paramount.

Corporate Treasury Diversification

Forward-thinking corporations are beginning to view ETC as a legitimate treasury asset, similar to how companies like MicroStrategy and Tesla adopted Bitcoin. The key difference is that Ethereum Classic offers smart contract functionality while maintaining the same philosophical commitment to immutability that makes Bitcoin attractive to corporate treasuries.

Recent regulatory clarity in major jurisdictions has made it easier for institutions to buy Ethereum Classic now without concerns about compliance issues. The ETC network’s long operational history and proven track record of security make it an attractive option for risk-averse institutional investors seeking cryptocurrency exposure beyond Bitcoin and Ethereum.

Exchange-Traded Product Development

Several financial institutions are developing ETC-based ETPs (Exchange-Traded Products), which could dramatically increase retail and institutional access to Ethereum Classic investment. These products would allow traditional investors to gain ETC exposure through familiar investment vehicles, potentially driving significant capital inflows.

2: Technical Superiority and Network Upgrades

Revolutionary Mining Economics

The second powerful reason to buy Ethereum Classic now centers on its superior mining economics and recent network upgrades that have dramatically improved functionality and security. Following Ethereum’s transition to Proof-of-Stake, Ethereum Classic inherited a massive influx of mining power, making it one of the most secure blockchain networks in existence.

This increased hash rate provides several critical advantages. First, it makes 51% attacks economically unfeasible, addressing one of the historical concerns about smaller Proof-of-Work networks. Second, it ensures consistent block times and network stability, crucial for enterprise blockchain applications that require predictable performance.

Smart Contract Innovation Without Compromise

Recent network upgrades have enhanced Ethereum Classic’s smart contract capabilities while maintaining full EVM compatibility. Developers can deploy Ethereum-based applications on ETC with minimal modifications, accessing a more cost-effective and philosophically aligned platform for decentralized applications.

The ETC development team has implemented several crucial improvements, including enhanced gas efficiency, improved virtual machine performance, and better developer tools. These upgrades position Ethereum Classic as a serious alternative to Ethereum for applications where immutability and censorship resistance are priorities.

Interoperability and Cross-Chain Solutions

Ethereum Classic has emerged as a crucial hub for cross-chain interoperability, with several bridge protocols connecting ETC to other major blockchain networks. This connectivity allows DeFi protocols and NFT projects to leverage Ethereum Classic’s security and immutability while accessing liquidity from other ecosystems.

The development of atomic swaps and wrapped ETC tokens on other networks has created new arbitrage opportunities and increased overall ETC utility. These technical developments provide fundamental value drivers that support long-term price appreciation.

3: Market Dynamics and Timing Advantages

Undervaluation Relative to Network Activity

The third compelling reason to buy Ethereum Classic now is the significant undervaluation relative to network activity, developer interest, and fundamental metrics. Despite consistent growth in transaction volume, active addresses, and smart contract deployments, ETC price remains substantially below historical highs relative to network usage.

This disconnect between network fundamentals and market valuation creates an asymmetric risk-reward opportunity. While other cryptocurrencies trade at premium valuations based on speculation and hype, Ethereum Classic trades at a discount despite improving fundamentals and growing adoption.

Market Cycle Positioning

Cryptocurrency market cycles follow predictable patterns, with institutional and retail attention rotating between different asset classes. Currently, ETC finds itself in the accumulation phase, where smart money builds positions before mainstream attention arrives. Historical analysis suggests that Ethereum Classic often lags initial market movements but eventually catches up with explosive price action.

The upcoming Bitcoin halving in 2024 and increasing institutional cryptocurrency adoption create favorable macroeconomic conditions for all major cryptocurrencies. However, ETC’s unique positioning as both a store of value and smart contract platform could lead to outperformance during the next bull cycle.

Supply-Side Dynamics

Ethereum Classic’s monetary policy includes a supply cap, similar to Bitcoin, creating natural scarcity as adoption increases. Combined with increasing mining difficulty and hash rate, these factors create deflationary pressure that should support ETC price appreciation over time.

Recent on-chain analysis reveals that long-term holders are accumulating ETC positions, reducing available supply for trading. This accumulation pattern typically precedes significant price movements and suggests that experienced investors recognize Ethereum Classic’s undervaluation.

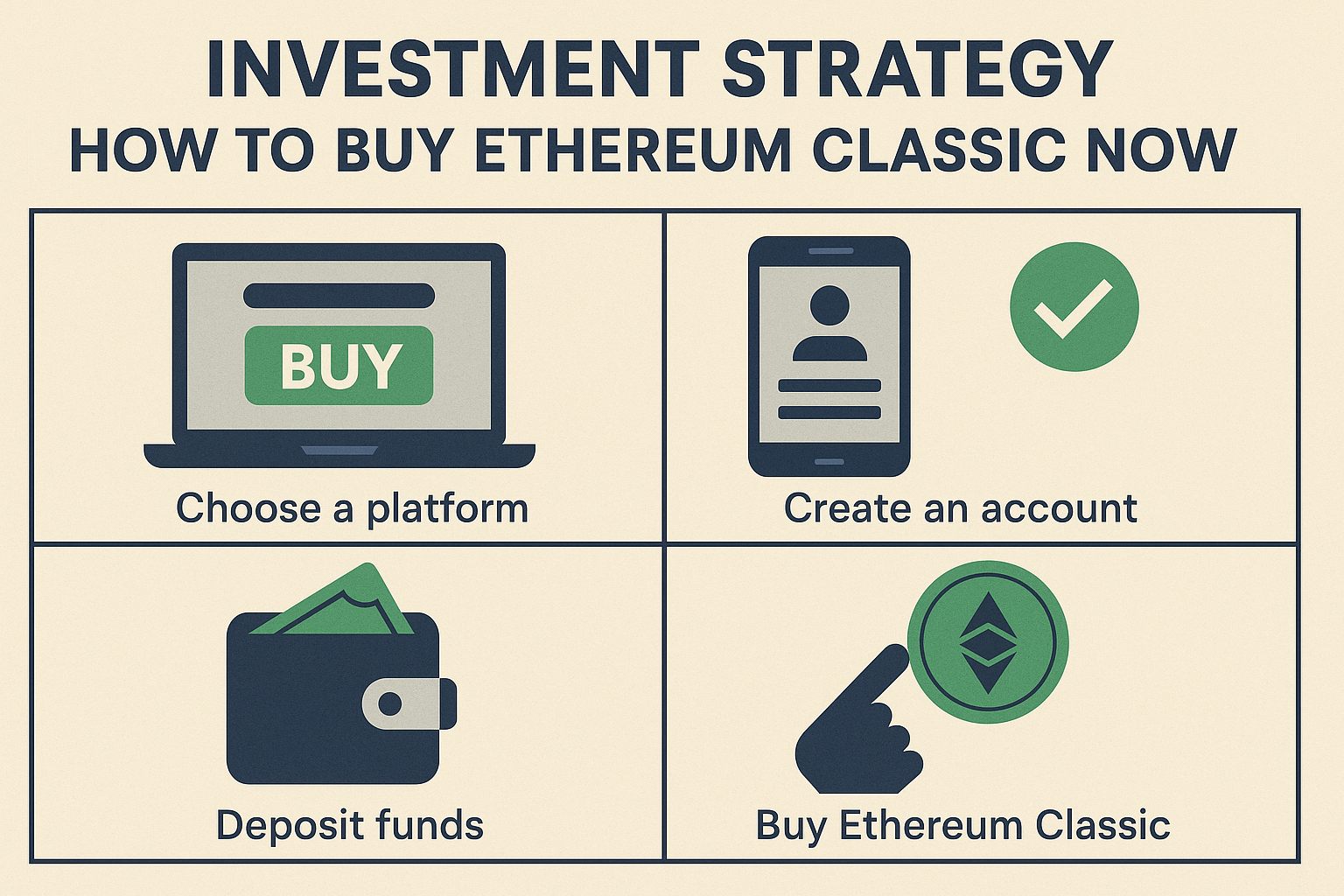

Investment Strategy: How to Buy Ethereum Classic Now

Risk Management and Position Sizing

Before diving into ETC investment, it’s crucial to understand proper risk management and position sizing. Cryptocurrency investment should never exceed what you can afford to lose, and Ethereum Classic should be part of a diversified portfolio rather than a single-asset bet.

Consider dollar-cost averaging (DCA) when you buy Ethereum Classic now, spreading purchases over several weeks or months to reduce timing risk. This strategy is particularly effective in volatile cryptocurrency markets where precise timing is nearly impossible.

Choosing the Right Platform

Select reputable cryptocurrency exchanges with strong security records and ETC liquidity. Major platforms like Coinbase Pro, Binance, and Kraken offer competitive fees and reliable ETC trading pairs. For long-term holdings, consider transferring ETC to a hardware wallet for maximum security.

Technical Analysis and Entry Points

While fundamental analysis supports the long-term Ethereum Classic investment thesis, technical analysis can help optimize entry points. Look for support levels, RSI oversold conditions, and volume patterns that suggest accumulation phases.

Potential Risks and Considerations

Market Volatility and Regulatory Uncertainty

Like all cryptocurrency investments, ETC carries significant risks, including extreme price volatility, regulatory uncertainty, and technological challenges. Ethereum Classic price can fluctuate dramatically based on market sentiment, regulatory announcements, and technical developments.

Stay informed about regulatory developments in major jurisdictions that could impact cryptocurrency trading and ETC specifically. While current trends favor increased acceptance, regulatory landscapes can change rapidly.

Competition and Technology Risks

Ethereum Classic faces ongoing competition from newer blockchain platforms offering similar functionality with different trade-offs. While ETC’s commitment to immutability is a strength, some users prefer the flexibility and upgrade paths of other platforms.

Monitor development activity, network upgrades, and community governance to ensure Ethereum Classic continues evolving to meet market demands while maintaining core principles.

Conclusion

The convergence of institutional adoption, technical superiority, and favorable market dynamics creates a compelling case to buy Ethereum Classic now. While cryptocurrency markets remain unpredictable, ETC’s unique combination of immutability, smart contract functionality, and undervaluation relative to fundamentals suggests significant upside potential.

Ethereum Classic represents more than just another cryptocurrency investment – it’s a bet on the fundamental principles that make blockchain technology revolutionary. As the market matures and institutional adoption accelerates, these principles become increasingly valuable, positioning ETC for substantial appreciation.