Ethereum today stands as one of the most discussed digital assets among investors, developers, and blockchain enthusiasts worldwide. As the second-largest cryptocurrency by market capitalization, Ethereum continues to evolve beyond its initial vision, transforming from a simple smart contract platform into a comprehensive decentralized ecosystem. Whether you’re a seasoned crypto investor or someone curious about blockchain technology, understanding Ethereum today requires examining multiple factors, including price movements, technological developments, the regulatory landscape, and overall market sentiment.

The question “How do you feel about Ethereum today?” resonates across trading floors, social media platforms, and investment forums. This comprehensive analysis explores the current state of Ethereum, dissecting the factors that influence investor sentiment and providing actionable insights for anyone interested in this revolutionary blockchain platform.

Ethereum’s Current Market Position

What Makes Ethereum Unique in Today’s Crypto Landscape

Ethereum today represents far more than just another cryptocurrency. While Bitcoin established itself as digital gold, Ethereum created an entirely new paradigm by introducing smart contracts—self-executing agreements with terms directly written into code. This fundamental innovation has spawned an entire ecosystem of decentralized applications (dApps), decentralized finance (DeFi) protocols, and non-fungible tokens (NFTs).

The Ethereum blockchain currently hosts thousands of decentralized applications, processing millions of transactions daily. From lending platforms like Aave and Compound to decentralized exchanges like Uniswap, the Ethereum network has become the backbone of decentralized finance. This utility distinguishes Ethereum from purely speculative cryptocurrencies, providing tangible use cases that drive real-world value.

Smart contract functionality allows developers to create programmable money, automated market makers, and complex financial instruments without traditional intermediaries. This technological foundation has attracted developers, entrepreneurs, and institutional investors, creating a robust ecosystem that continues expanding despite market volatility.

Ethereum Price Analysis and Market Performance

When examining Ethereum today, price action remains a primary concern for most investors. The ETH price fluctuates based on numerous factors, including Bitcoin’s performance, regulatory news, technological upgrades, and overall market sentiment. Understanding these price drivers helps investors make informed decisions about their Ethereum holdings.

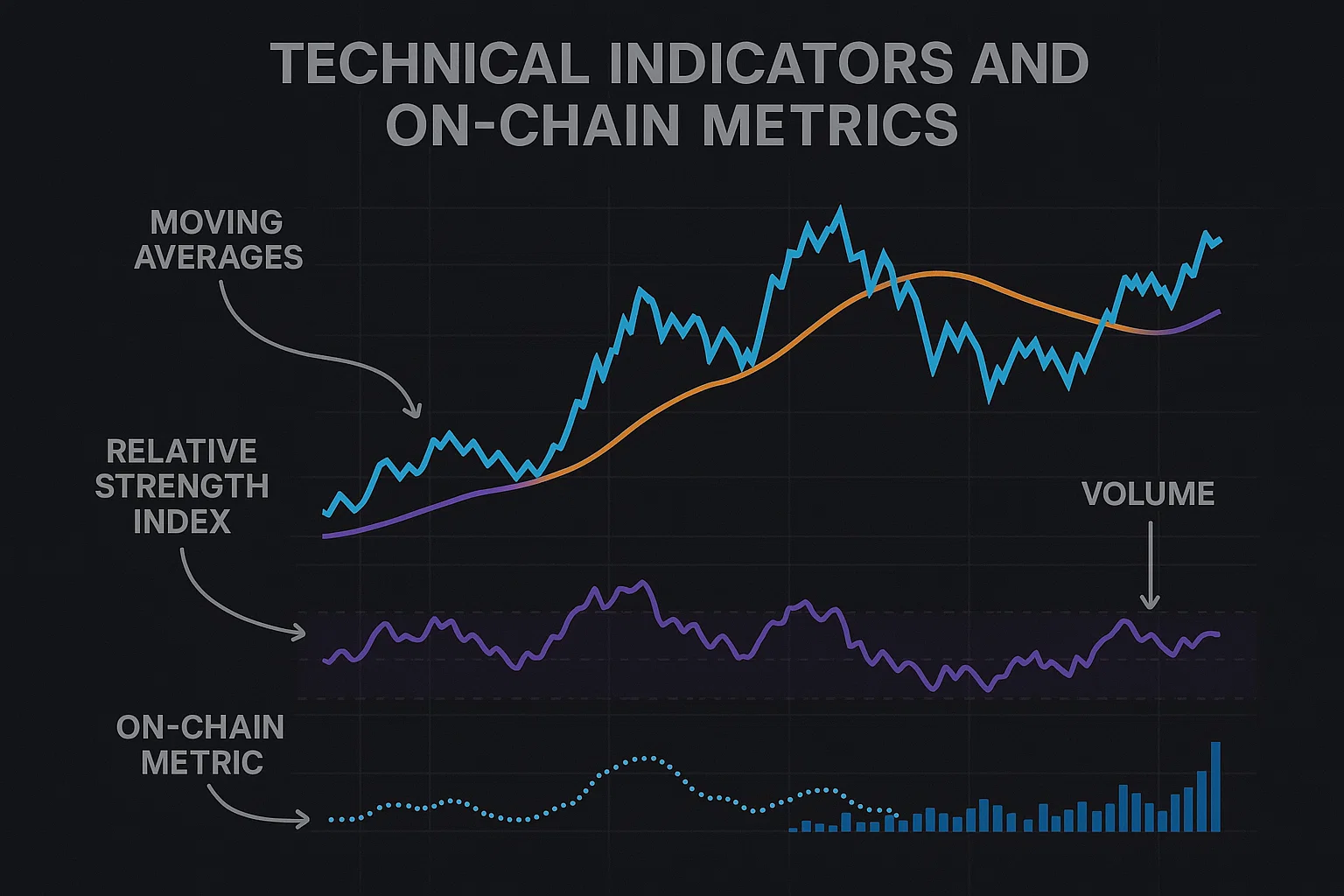

Current market dynamics show Ethereum trading within established support and resistance levels. Technical analysts closely monitor key indicators, including moving averages, relative strength index (RSI), and trading volume, to predict future price movements. The correlation between Ethereum and Bitcoin remains significant, with ETH often following BTC’s lead during major market moves.

However, Ethereum increasingly demonstrates independent price action during periods of significant network upgrades or ecosystem developments. The successful transition to the proof-of-stake consensus mechanism, known as “The Merge,” marked a pivotal moment that differentiated Ethereum’s narrative from Bitcoin’s, attracting environmentally-conscious investors and institutions.

Market capitalization comparisons reveal Ethereum today commanding substantial value, typically maintaining its position as the second-largest cryptocurrency. This dominance reflects investor confidence in Ethereum’s long-term viability and its established position as the leading smart contract platform.

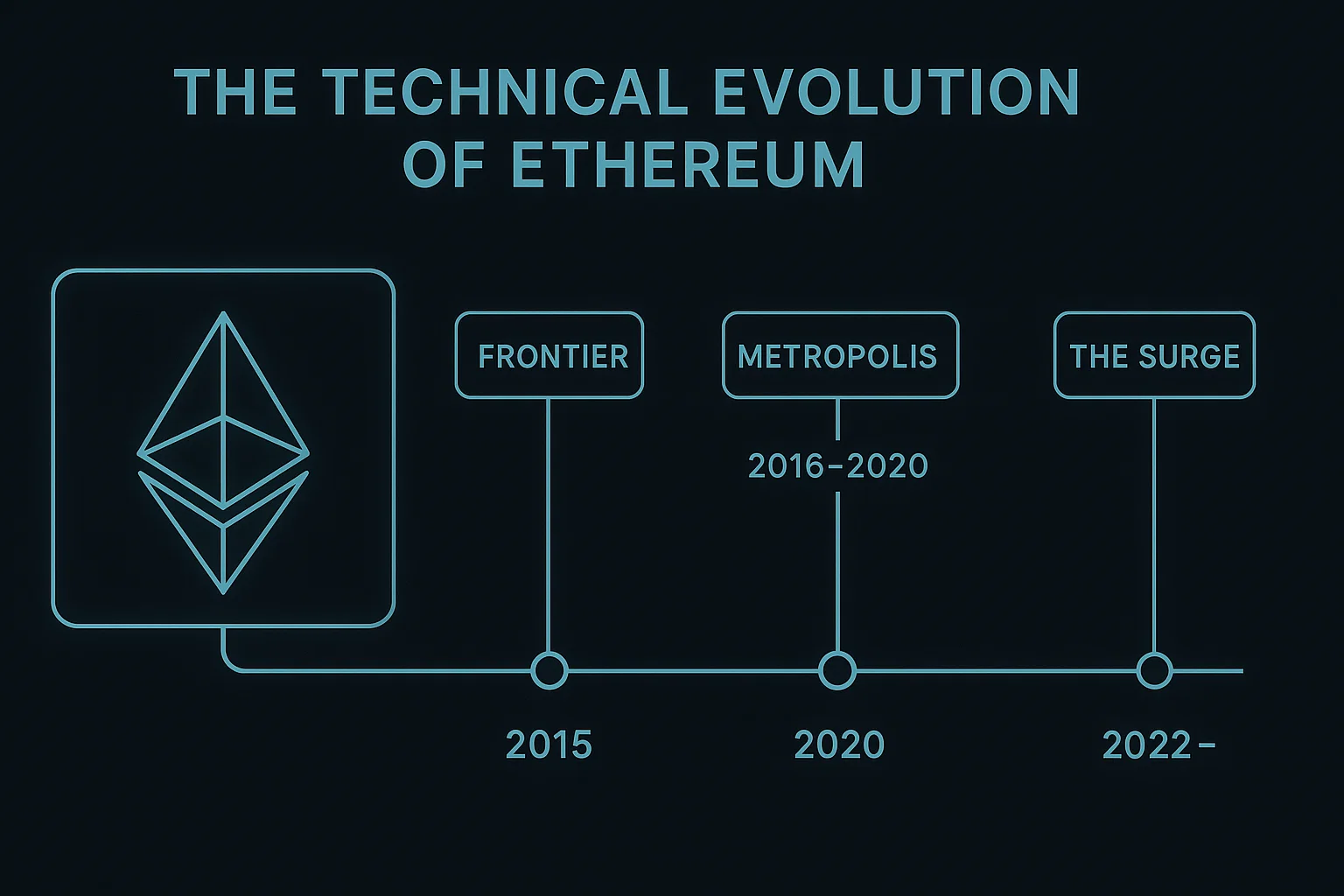

The Technical Evolution of Ethereum Today

Ethereum 2.0 and the Proof-of-Stake Transition

The most significant development affecting Ethereum today is the completed transition to proof-of-stake consensus. This monumental upgrade reduced Ethereum’s energy consumption by approximately 99.95%, addressing one of the primary criticisms leveled against blockchain technology. The environmental benefits cannot be overstated, positioning Ethereum favorably against competing blockchains and making it more attractive to ESG-focused institutional investors.

Proof-of-stake introduces a new economic model where validators stake 32 ETH to participate in network security and transaction validation. This mechanism creates deflationary pressure on the ETH supply while generating passive income opportunities for holders. Staking rewards typically range between 3-7% annually, providing an alternative to traditional savings accounts and bonds.

The transition also laid the groundwork for future scalability improvements. While Ethereum’s base layer continues processing approximately 15-30 transactions per second, upcoming upgrades promise significant throughput increases. Layer-2 solutions already complement the mainnet, processing thousands of transactions per second with minimal fees.

Layer-2 Solutions and Scalability Improvements

Discussing Ethereum today requires acknowledging the critical role of Layer-2 scaling solutions. Technologies like Optimistic Rollups and Zero-Knowledge Rollups bundle multiple transactions before settling on Ethereum’s mainnet, dramatically reducing costs and increasing speed. Platforms including Arbitrum, Optimism, Polygon, and zkSync have emerged as essential infrastructure for Ethereum’s scaling strategy.

These Layer-2 networks maintain Ethereum’s security guarantees while providing near-instantaneous transactions at fraction-of-a-cent costs. This hybrid approach allows Ethereum to compete with newer, faster blockchains without sacrificing decentralization or security. Users can seamlessly bridge assets between mainnet and Layer-2 networks, accessing the same dApps and protocols with improved performance.

The growing adoption of Layer-2 solutions demonstrates Ethereum’s pragmatic approach to scalability challenges. Rather than compromising core principles, the Ethereum community has embraced a modular architecture where specialized networks handle different use cases while the base layer provides security and settlement.

Ethereum’s Role in Decentralized Finance

DeFi Dominance and Total Value Locked

Ethereum today remains the undisputed leader in decentralized finance, hosting the majority of DeFi protocols and commanding the largest total value locked (TVL). Billions of dollars flow through Ethereum-based DeFi platforms daily, facilitating lending, borrowing, trading, and yield farming without traditional financial intermediaries.

Popular DeFi protocols like MakerDAO, Aave, Curve Finance, and Uniswap have processed trillions of dollars in cumulative volume, demonstrating the viability of decentralized financial services. These platforms offer services previously exclusive to banks and financial institutions, democratizing access to sophisticated financial instruments.

The composability of Ethereum smart contracts creates a “money lego” effect, where protocols can integrate seamlessly, creating increasingly complex financial products. This interoperability distinguishes Ethereum from competitors, fostering innovation and attracting developer talent from traditional finance and technology sectors.

NFTs and Digital Ownership

Non-fungible tokens represent another major use case driving Ethereum today. Despite market fluctuations, NFTs have established themselves as legitimate vehicles for digital ownership, spanning art, collectibles, gaming assets, and intellectual property. Ethereum hosts the most valuable NFT collections, including Bored Ape Yacht Club, CryptoPunks, and Art Blocks.

Beyond digital art, NFTs are revolutionizing ticketing, supply chain management, real estate, and identity verification. Smart contracts enable royalty payments to creators on secondary sales, creating sustainable income streams for artists and content creators. This functionality has attracted mainstream attention from the entertainment, fashion, and sports industries.

The NFT infrastructure built on Ethereum includes marketplaces, minting platforms, and metadata storage solutions, creating a comprehensive ecosystem supporting digital ownership. While trading volumes fluctuate with market cycles, the underlying technology continues improving, addressing concerns about energy consumption, transaction costs, and user experience.

Investment Sentiment and Market Psychology

Institutional Adoption and Corporate Interest

Examining how investors feel about Ethereum today reveals growing institutional interest. Major corporations, including Microsoft, JPMorgan, and Visa, have explored or implemented Ethereum-based solutions. The launch of Ethereum futures, options, and exchange-traded products has provided traditional investors with regulated exposure to ETH.

Institutional custody solutions from providers like Coinbase Custody, Fidelity Digital Assets, and BitGo have addressed security concerns, enabling pension funds, endowments, and family offices to allocate capital to Ethereum. This institutional infrastructure development signals the maturation of the cryptocurrency market and increased legitimacy for Ethereum specifically.

Corporate treasuries have begun diversifying into cryptocurrency, with some companies allocating portions of their reserves to Ethereum. This trend, while less pronounced than Bitcoin corporate adoption, demonstrates growing recognition of Ethereum’s value proposition beyond speculative investment.

Retail Investor Perspectives on Ethereum Today

Retail investors view Ethereum today through various lenses depending on their investment horizons, risk tolerance, and understanding of blockchain technology. Social media sentiment analysis reveals mixed emotions, ranging from enthusiastic bullishness to cautious skepticism, influenced heavily by recent price action and news cycles.

Long-term holders, often called “HODLers,” maintain conviction in Ethereum’s fundamental value proposition despite short-term volatility. These investors focus on network growth metrics, developer activity, and ecosystem expansion rather than daily price movements. Their diamond-hands approach reflects belief in Ethereum’s revolutionary potential.

Conversely, traders approach Ethereum today as a volatile asset offering profit opportunities through price fluctuations. Technical analysis, chart patterns, and momentum indicators guide their decision-making, with positions ranging from minutes to months. This group contributes significant trading volume and liquidity to Ethereum markets.

New investors often experience emotional rollercoasters, particularly during bear markets when prices decline substantially from all-time highs. Education about market cycles, risk management, and proper position sizing becomes crucial for this demographic to avoid panic selling or overleveraging.

Regulatory Landscape and Legal Considerations

Global Regulatory Developments Affecting Ethereum

The regulatory environment significantly impacts sentiment about Ethereum today. Governments worldwide are developing frameworks for cryptocurrency regulation, with approaches ranging from progressive to restrictive. The classification of Ethereum as a commodity rather than a security by U.S. regulators provides important clarity for American investors and exchanges.

European Union’s Markets in Crypto-Assets (MiCA) regulation establishes comprehensive rules for cryptocurrency businesses, potentially benefiting Ethereum through increased institutional participation and consumer protection. Asian markets demonstrate varied approaches, with some embracing blockchain innovation while others maintain strict capital controls.

Regulatory uncertainty remains a concern for investors evaluating Ethereum today. Potential changes to tax treatment, staking regulations, or DeFi oversight could significantly impact Ethereum’s value proposition and ecosystem growth. Staying informed about regulatory developments becomes essential for responsible investment decisions.

Compliance and the Future of Decentralized Systems

The tension between decentralization and regulatory compliance shapes discussions about Ethereum today. While the base protocol remains censorship-resistant and permissionless, applications built on Ethereum increasingly implement compliance measures, including know-your-customer (KYC) procedures and transaction monitoring.

This evolution reflects pragmatic recognition that mainstream adoption requires satisfying regulatory requirements. However, it also raises philosophical questions about preserving Ethereum’s core principles while achieving mass adoption. The community continues debating the optimal balance between compliance and decentralization.

Smart contract developers now incorporate compliance features, creating protocols that can operate legally in multiple jurisdictions. This development demonstrates Ethereum’s flexibility and the ecosystem’s commitment to sustainable growth within existing legal frameworks.

Technical Indicators and On-Chain Metrics

Analyzing Ethereum’s Network Health

When assessing Ethereum today, on-chain metrics provide objective data about network activity and health. Active addresses, daily transactions, gas fees, and network hash rate offer insights beyond price speculation. These fundamentals help investors distinguish between hype-driven rallies and sustainable growth.

The number of Ethereum addresses holding substantial amounts has grown consistently, indicating accumulation by long-term investors. Whale movements, large transactions by major holders, can signal impending volatility and often attract attention from analysts and traders.

Gas fees, the transaction costs on Ethereum, reflect network demand and congestion. High gas fees indicate strong usage but can price out smaller users, highlighting the importance of Layer-2 solutions. Monitoring fee trends helps investors understand user activity and ecosystem health.

Developer Activity and Ecosystem Growth

Developer activity remains a critical indicator when evaluating Ethereum today. GitHub commits, new project launches, and development community growth demonstrate the ecosystem’s vitality. Ethereum consistently maintains the largest developer community in cryptocurrency, attracting talent from Silicon Valley, traditional finance, and academic institutions.

Regular protocol upgrades, improvement proposals (EIPs), and core developer meetings showcase Ethereum’s active development and commitment to continuous improvement. This ongoing innovation ensures Ethereum remains competitive against newer blockchain platforms, promising faster speeds or lower costs.

The breadth of development spans infrastructure, application layer, developer tools, and user experience improvements. This comprehensive approach addresses Ethereum’s challenges systematically while maintaining backward compatibility and network stability.

Comparing Ethereum to Alternative Blockchains

Ethereum Versus Competing Smart Contract Platforms

Understanding Ethereum today requires examining the competitive landscape. Platforms like Solana, Cardano, Avalanche, and Polkadot compete for developer mindshare and user adoption, each offering unique approaches to blockchain trilemma challenges of scalability, security, and decentralization.

Solana emphasizes speed and low costs through innovative consensus mechanisms but has faced criticism regarding decentralization and network stability. Cardano takes a research-driven approach, prioritizing peer-reviewed development but facing criticism for the slower deployment of features. Avalanche offers sub-second finality and custom blockchain creation, attracting DeFi applications seeking performance.

Despite competition, Ethereum maintains significant advantages, including network effects, established security, extensive documentation, and the largest pool of developers and users. The switching costs for projects built on Ethereum remain high, providing a moat against competitors.

Ethereum’s Sustainable Competitive Advantages

Ethereum today benefits from a first-mover advantage in smart contracts, creating deep liquidity, robust infrastructure, and widespread integration. Major cryptocurrency exchanges, wallet providers, and financial services platforms prioritize Ethereum support, ensuring accessibility for users worldwide.

The Ethereum Virtual Machine (EVM) has become an industry standard, with many competing blockchains implementing EVM compatibility to attract developers and users. This compatibility actually strengthens Ethereum’s position, as developers can deploy applications across multiple chains while maintaining Ethereum as the primary network.

Brand recognition and trust accumulated over years of operation provide intangible but valuable advantages. Institutional investors and conservative users prefer Ethereum’s proven track record over newer platforms with uncertain longevity.

Risk Factors and Investment Considerations

Volatility and Market Risk

Investors examining Ethereum today must acknowledge the significant volatility inherent in cryptocurrency markets. Price swings of 10-20% within single days occur regularly, challenging emotional discipline and risk management strategies. This volatility stems from relatively small market capitalization compared to traditional assets, regulatory uncertainty, and speculative trading behavior.

Bear markets can reduce Ethereum’s value by 70-90% from all-time highs, testing investor conviction and financial stability. Historical patterns show multi-year cycles alternating between euphoric bull runs and extended bear markets. Understanding these cycles helps investors maintain perspective during extreme market conditions.

Leverage and derivative products amplify both gains and losses, creating additional risk for inexperienced traders. The availability of high-leverage trading platforms has contributed to spectacular liquidation events where billions of dollars in positions get closed forcibly, creating cascading price movements.

Technology and Security Risks

While Ethereum’s base layer maintains robust security, applications built on Ethereum face various vulnerabilities. Smart contract bugs, economic exploits, and governance attacks have resulted in hundreds of millions of dollars in losses. Due diligence regarding specific protocols and applications becomes essential for users and investors.

The complexity of Ethereum’s technology creates barriers to understanding for average users. This knowledge gap can lead to mistakes like sending funds to the wrong addresses, falling for phishing scams, or failing to properly secure private keys. Education and improved user interfaces continue addressing these challenges.

Future protocol changes, while carefully researched and tested, carry inherent risks of unforeseen consequences. The Ethereum community’s conservative approach to upgrades mitigates but doesn’t eliminate these risks.

Future Outlook and Upcoming Developments

Roadmap for Ethereum’s Continued Evolution

Looking at Ethereum today requires understanding the roadmap ahead. Planned upgrades focus on scalability, security, and sustainability. Sharding, expected in future updates, will distribute network load across multiple chains, dramatically increasing throughput while maintaining decentralization.

Proto-danksharding and full danksharding represent intermediate steps toward this vision, introducing data availability sampling that reduces Layer-2 costs further. These improvements will make Ethereum competitive with centralized payment processors while preserving decentralization.

Other developments include account abstraction, making wallets more user-friendly and programmable, and continued optimization of validator mechanisms. Each upgrade builds upon previous improvements, creating compounding benefits for users and developers.

Potential Catalysts for Price Appreciation

Several factors could drive positive sentiment about Ethereum today and future price appreciation. Ethereum ETF approvals in major markets would provide convenient access for traditional investors, potentially channeling billions of dollars into ETH. Historical precedent from Bitcoin ETF launches suggests significant price impacts from such developments.

Increased adoption of Ethereum-based stablecoins, already commanding hundreds of billions in market capitalization, drives transaction demand and reinforces Ethereum’s position as a settlement layer for digital dollars. Central bank digital currency (CBDC) experiments using Ethereum technology could further legitimize the platform.

The ongoing tokenization of real-world assets, including stocks, bonds, and real estate, could make Ethereum the backbone of future financial markets. Major financial institutions exploring blockchain integration typically choose Ethereum, positioning it favorably for institutional adoption waves.

Practical Strategies for Ethereum Investment

Dollar-Cost Averaging and Long-Term Holding

For those optimistic about Ethereum today, dollar-cost averaging provides a disciplined investment approach that reduces timing risk. By investing fixed amounts regularly regardless of price, investors accumulate more ETH during downturns and less during peaks, averaging out entry costs over time.

Long-term holding strategies focus on Ethereum’s fundamental value rather than short-term price movements. Staking purchased ETH generates passive income while supporting network security, creating compound returns over the years. This approach suits investors with strong conviction and patience to weather market cycles.

Tax considerations vary by jurisdiction, but many countries offer favorable treatment for long-term capital gains compared to short-term trading profits. Consulting tax professionals helps optimize investment strategies while maintaining compliance.

Active Trading and Portfolio Management

Traders viewing Ethereum today as a trading vehicle employ technical analysis, momentum strategies, and risk management techniques. Setting stop losses, taking profits at predetermined levels, and maintaining position size discipline prevent emotional decision-making during volatile periods.

Portfolio allocation depends on individual risk tolerance and financial goals. Conservative investors might allocate 1-5% of portfolios to Ethereum, while aggressive investors comfortable with volatility might hold 10-30%. Diversification across cryptocurrencies and traditional assets reduces concentration risk.

Rebalancing portfolios periodically maintains target allocations as prices fluctuate. This disciplined approach forces selling appreciated assets and buying undervalued ones, potentially improving long-term returns.

Community Sentiment and Social Dynamics

The Role of Social Media in Shaping Opinions

Social media platforms significantly influence how people feel about Ethereum today. Twitter (X), Reddit, Discord, and Telegram host active Ethereum communities sharing analysis, news, and opinions. This constant information flow creates both opportunities and challenges for investors seeking accurate information.

Influencers with large followings can move markets through endorsements or criticism, though their track records vary widely. Critical evaluation of sources, checking credentials, and verifying claims through multiple channels becomes essential for making informed decisions.

Fear of missing out (FOMO) and fear, uncertainty, and doubt (FUD) propagate rapidly through social networks, creating emotional volatility that sometimes exceeds price volatility. Maintaining emotional discipline and focusing on fundamental analysis helps investors avoid reactionary decisions based on trending topics.

Building Knowledge and Staying Informed

Continuous education about Ethereum today and blockchain technology improves investment decisions and risk management. Resources, including Ethereum Foundation documentation, developer forums, research papers, and educational platforms, provide varying depths of information suitable for different knowledge levels.

Participating in community discussions, attending virtual conferences, and following core developers on social media provides insights into technical developments and community priorities. This engagement transforms passive investment into active participation in a revolutionary technology.

Critical thinking and skepticism balance enthusiasm, helping investors avoid scams, unrealistic promises, and projects lacking substance. The cryptocurrency space attracts both visionaries building the future and opportunists exploiting hype.

Conclusion

After examining technical developments, market dynamics, regulatory landscape, and competitive positioning, how should you feel about Ethereum today? The answer depends on your investment goals, risk tolerance, and conviction in blockchain technology’s transformative potential.

Ethereum today stands as the most developed smart contract platform with robust infrastructure, the largest developer community, and an established position in decentralized finance and digital ownership. The successful proof-of-stake transition addressed environmental concerns while creating new economic incentives for holders. Ongoing development promises continued improvements in scalability, security, and user experience.

Read More: Ethereum LTH Selling In October Hits 3-Month High — Price Impact