The financial technology landscape has witnessed another groundbreaking milestone as London-based blockchain startup Fnality raises $136 million in a Series C funding round, marking one of the most significant investments in wholesale payment infrastructure this year. This substantial funding injection demonstrates the growing confidence major financial institutions have in blockchain-powered payment systems and their potential to revolutionize traditional banking infrastructure.

Heavyweight financial institutions, including Bank of America, Citigroup, WisdomTree, KBC Group, Temasek Holdings, and Tradeweb Markets, led the impressive funding round. Bank of America Corp., Citigroup Inc., KBC Group NV, as well as Tradeweb Markets Inc., Temasek Holdings Pte, and WisdomTree Inc. were the lead investors, Fnality said on Tuesday. Existing backers, including Goldman Sachs Group Inc., UBS Group AG, and Banco Santander SA, among others, joined them.

This significant capital infusion positions Fnality at the forefront of the digital transformation sweeping through global financial markets, where traditional payment rails are being challenged by innovative blockchain solutions that promise faster, more efficient, and more secure transaction processing.

Fnality’s Revolutionary Blockchain Payment System

Fnality has emerged as a pioneering force in the wholesale payment sector, developing what many consider to be the next generation of financial infrastructure. The company operates regulated payment systems that leverage distributed ledger technology (DLT) to facilitate instantaneous settlements with central bank money, effectively addressing many of the inefficiencies and risks associated with traditional payment networks.

The Sterling Fnality Payment System (£FnPS) is the world’s first fully regulated, distributed ledger technology-based payment system. This groundbreaking achievement marks a significant shift in how financial institutions process wholesale transactions, transitioning from traditional multi-day settlement cycles to real-time processing capabilities.

The company’s innovative approach combines the security and backing of central bank money with the efficiency and transparency of blockchain technology. This hybrid model enables participating financial institutions to maintain regulatory compliance while reaping the technological benefits that distributed ledger systems offer.

How Fnality’s Technology Transforms Traditional Banking

Fnality’s blockchain-based infrastructure addresses several critical pain points in the current financial ecosystem. Traditional wholesale payment systems often require multiple intermediaries, lengthy settlement periods, and significant operational overhead. The company’s solution streamlines these processes by creating direct, peer-to-peer connections between financial institutions on a secure, regulated network.

The firm’s settlement infrastructure is built on distributed ledger technology, enabling sterling payments to be processed on-chain with central bank money. This ensures that transactions maintain the safety and regulatory compliance expected in wholesale banking, while delivering the speed and efficiency of modern blockchain technology.

The system operates 24/7, unlike traditional payment rails that often have limited operating hours and are subject to banking holidays. This continuous availability is particularly valuable for global financial institutions that need to manage liquidity and settlements across different time zones and jurisdictions.

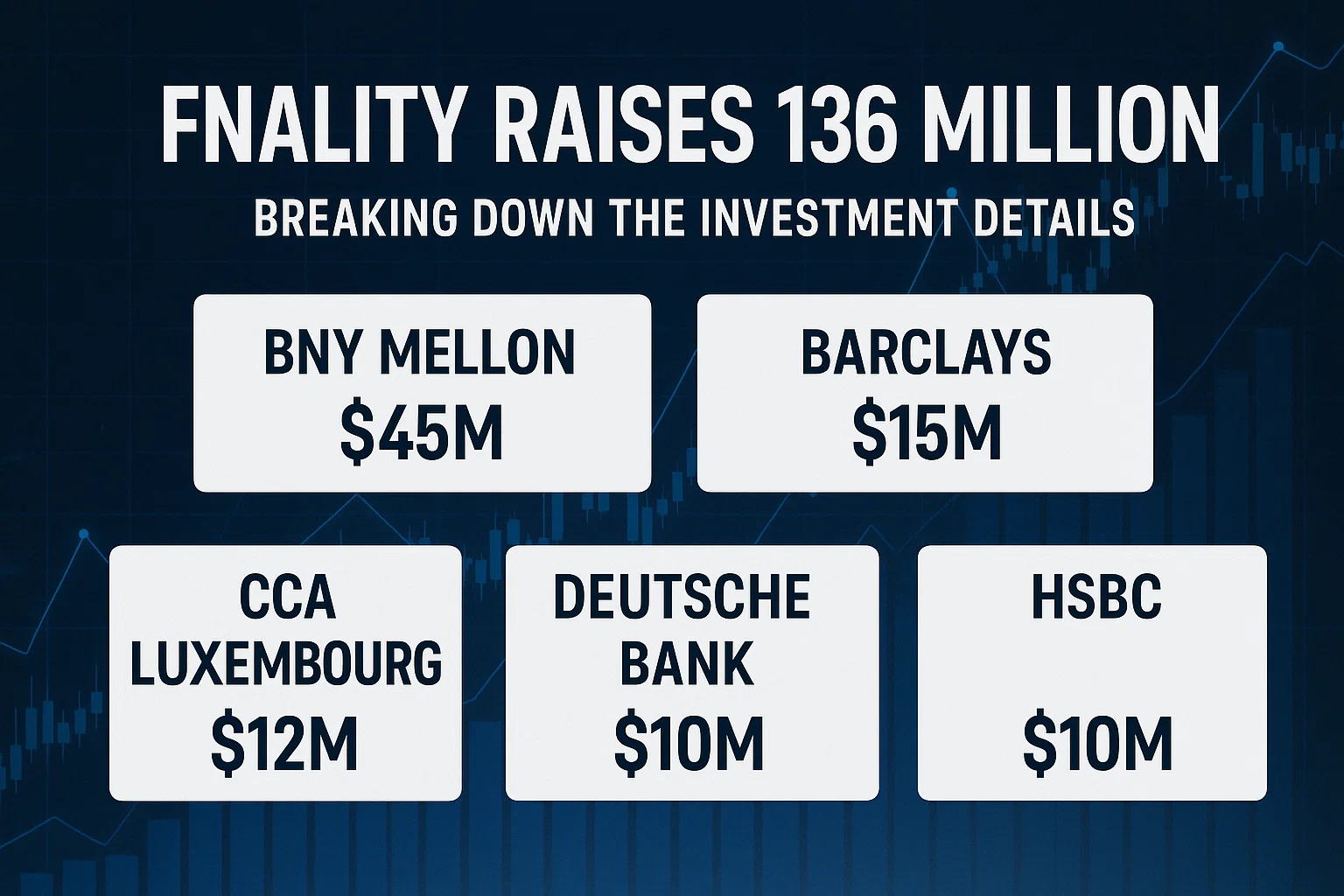

Fnality Raises $136 Million: Breaking Down the Investment Details.

The recent funding round that saw Fnality raise $136 million represents more than just capital injection—it signifies a vote of confidence from some of the world’s most prestigious financial institutions in the future of blockchain-powered payment infrastructure. Fnality, the operator of next generation wholesale payment systems regulated by central banks, today announced that it has raised $136 million (£99.7 million) in a Series C funding round led by WisdomTree, Bank of America, Citi, KBC Group, Temasek and Tradeweb.

This substantial investment builds upon Fnality’s previous funding success. In 2023, Fnality raised $95 million in a funding round led by Goldman Sachs and BNP Paribas, demonstrating the consistent interest and support from major financial institutions over time. The progression from $95 million to $136 million in less than two years illustrates the rapid growth and market validation of Fnality’s technology platform.

Strategic Investor Participation and Market Validation

The caliber of investors participating in this funding round speaks volumes about Fnality’s market position and growth potential. Each of these institutions brings not only financial resources but also strategic value through their extensive networks, regulatory expertise, and deep understanding of wholesale payment markets.

Bank of America’s participation is particularly significant, as Citi’s head of digital strategy, Deepak Mehra, said that Fnality aligns with the bank’s strategy to build more efficient, interoperable payment systems for digital assets. This alignment suggests that major banks are not just investing in Fnality as a financial opportunity but as a strategic technology partner that can help them navigate the digital transformation of financial services.

The involvement of asset managers like WisdomTree and trading platforms like Tradeweb indicates that Fnality’s technology has applications beyond traditional banking, potentially serving the broader financial services ecosystem, including capital markets, asset management, and trading operations.

The Technology Behind Fnality’s Success

Fnality’s competitive advantage lies in its sophisticated approach to combining traditional financial regulation with cutting-edge blockchain technology. The company has successfully navigated the complex regulatory landscape that has historically been a barrier to blockchain adoption in wholesale finance.

The Sterling Fnality Payment System serves as the flagship example of this approach. The Sterling Fnality Payment System combines central bank fund safety with blockchain technology resilience. This combination ensures that participants can enjoy the benefits of modern technology without sacrificing the regulatory protections and financial guarantees that are essential in wholesale banking.

Distributed Ledger Technology Implementation

Fnality’s implementation of distributed ledger technology represents a careful balance between innovation and regulatory compliance. Unlike many blockchain projects that operate outside traditional regulatory frameworks, Fnality has worked closely with central banks and financial regulators to ensure its systems meet all necessary requirements for handling institutional-grade transactions.

Fnality uses distributed ledger technology to simplify institutional settlements, enabling real-time repo, tokenized securities settlement and cross-currency payments. This comprehensive approach to settlement infrastructure positions the company to serve multiple aspects of the financial markets, from basic payment processing to complex derivative settlements.

The technology platform supports various financial instruments and transaction types, making it a versatile solution for institutions with diverse operational requirements. This flexibility has been crucial in attracting a broad range of financial institutions that have invested in and partnered with Fnality.

Market Impact and Industry Transformation

The success of Fnality’s $136 million funding round reflects broader trends in the financial services industry toward digitization and the adoption of blockchain technology. Traditional financial institutions are increasingly recognizing that blockchain technology offers significant advantages over legacy systems, particularly in areas like settlement speed, operational transparency, and cost efficiency.

“Systems like Fnality will help eliminate settlement risk and make wholesale payments instant and 24/7,” said John Whelan, Managing Director of Digital Assets at Banco Santander. This endorsement from a major global bank illustrates the practical benefits that financial institutions expect to realize from Fnality’s technology.

The shift toward blockchain-based payment infrastructure is not just about technological advancement—it represents a fundamental change in how financial institutions manage risk, liquidity, and operational efficiency. Fnality’s regulated approach provides a bridge between the traditional financial system and the emerging blockchain ecosystem.

Competitive Landscape and Market Position

Fnality operates in a competitive landscape that includes both traditional payment processors and emerging blockchain-based solutions. However, the company’s unique position as a regulated, central bank-backed blockchain payment system differentiates it from many competitors who either lack regulatory approval or don’t have central bank support.

London-based fintech Fnality raises $136 million Series C to expand its blockchain-powered wholesale payment system, aiming to replace SWIFT with instant, central bank-backed settlements across major currencies. The ambition to challenge and potentially replace SWIFT, the dominant global financial messaging system, represents a significant market opportunity given SWIFT’s central role in international finance.

This positioning against SWIFT is particularly relevant given recent geopolitical tensions and the increasing desire for more resilient, diverse payment infrastructure. Financial institutions are seeking alternatives that can provide similar reliability and global reach while offering improved speed and functionality.

Future Expansion Plans and Growth Strategy

With the successful completion of its $136 million funding round, Fnality is well-positioned to execute an aggressive expansion strategy that could reshape wholesale payment infrastructure across multiple currencies and jurisdictions. The substantial capital injection provides the resources necessary to scale operations, expand into new markets, and enhance technological capabilities.

The company’s growth strategy likely includes expanding beyond the Sterling Fnality Payment System to support additional currencies and jurisdictions. This multi-currency approach would create a comprehensive global payment network that could serve as a genuine alternative to existing cross-border payment systems.

International Expansion and Regulatory Partnerships

Fnality’s success in obtaining regulatory approval for its Sterling system provides a template for expansion into other markets. Each new jurisdiction requires careful navigation of local regulatory requirements and establishment of relationships with relevant central banks and financial authorities.

The participation of international investors, such as Temasek Holdings, suggests that Fnality has global ambitions and the support necessary to pursue international expansion. Temasek’s involvement, in particular, could facilitate entry into Asian markets, which represent significant opportunities for blockchain-based payment infrastructure.

Implications for the Financial Technology Sector

The success of Fnality’s funding round has broader implications for the financial technology sector and the adoption of blockchain technology in the traditional finance industry. The significant investment from major banks and financial institutions signals a shift in sentiment toward blockchain technology in institutional settings.

This trend toward institutional blockchain adoption is creating new opportunities for fintech companies that can successfully navigate the regulatory and technical challenges of serving wholesale financial markets. Fnality’s success serves as a roadmap for other companies seeking to integrate blockchain innovation into traditional finance.

Industry Validation and Technology Adoption

The backing of major financial institutions provides valuable validation for blockchain technology in wholesale finance. This validation is particularly important, given the historically conservative approach that banks have taken toward adopting new technology, especially in areas involving significant regulatory oversight.

Funding round backed by Bank of America, Citi, WisdomTree, and others highlights institutional push into tokenized finance. This institutional push represents a significant development in the broader adoption of digital assets and blockchain technology in mainstream finance.

Risk Factors and Market Challenges

Despite the positive momentum demonstrated by Fnality’s successful $136 million raise, the company faces several challenges and risk factors that could impact its future growth and market success. Understanding these challenges is crucial for assessing the long-term prospects of blockchain-based payment infrastructure.

Regulatory changes represent one of the most significant risks facing Fnality and similar companies. While the company has successfully navigated current regulatory requirements, changes in financial regulations or central bank policies could impact its operations or require significant adaptations to its technology platform.

Technical and Operational Challenges

Scaling blockchain-based payment systems to handle the volume and complexity of global wholesale financial transactions presents ongoing technical challenges. While Fnality has demonstrated success with its Sterling system, expanding to support multiple currencies and higher transaction volumes will require continued technological innovation.

The integration of blockchain-based systems with existing financial infrastructure also presents operational challenges. Financial institutions must adapt their internal processes and systems to work with new payment rails while maintaining compliance with existing regulations and operational requirements.

The Broader Context: Digital Finance Evolution

Fnality’s $136 million funding success occurs within the broader context of digital finance evolution, where new technologies, including blockchain, artificial intelligence, and digital assets are transforming traditional financial services. This transformation is creating new opportunities and challenges for both established financial institutions and emerging fintech companies.

The growth of tokenized assets and digital securities markets also creates demand for sophisticated settlement infrastructure that can handle both traditional and digital asset transactions. Fnality’s technology platform appears well-positioned to serve this emerging market segment.

Integration with Emerging Financial Technologies

The future success of blockchain payment infrastructure will likely depend on its ability to integrate with other emerging financial technologies. This includes artificial intelligence for fraud detection and risk management, Internet of Things (IoT) devices for automated payments, and advanced analytics for real-time transaction monitoring.

Fnality’s substantial funding provides the resources necessary to invest in these complementary technologies and maintain its competitive position as the financial services landscape continues to evolve. The company’s partnerships with major financial institutions also provide valuable insights into market needs and technological requirements.

Investment Analysis and Market Outlook

From an investment perspective, Fnality’s successful $136 million raise represents both the maturation of blockchain technology in financial services and the growing confidence of institutional investors in regulated blockchain applications. The participation of major banks and financial institutions suggests that blockchain payment infrastructure has moved beyond experimental phases to become a viable commercial technology.

Market analysis indicates a strong demand for more efficient payment infrastructure, particularly in wholesale markets, where settlement delays and operational inefficiencies result in significant costs for financial institutions. Fnality’s position as a regulated provider of blockchain-based solutions addresses this market need while maintaining necessary regulatory compliance.

Long-term Market Potential

The long-term market potential for blockchain-based payment infrastructure appears substantial, particularly as digital assets become more mainstream and cross-border payment needs continue to grow. Fnality’s early mover advantage in regulated blockchain payments could provide significant competitive benefits as the market develops.

The company’s relationship with central banks and regulatory authorities creates valuable barriers to entry for potential competitors. Replicating Fnality’s regulatory approvals and central bank partnerships would require significant time and resources, providing the company with a protected market position.

Conclusion: Fnality’s Path Forward

The successful completion of Fnality’s $136 million funding round marks a significant milestone in the evolution of blockchain technology within the financial services sector. With backing from some of the world’s most prestigious financial institutions, Fnality is well-positioned to lead the transformation of wholesale payment infrastructure and challenge traditional systems, such as SWIFT.

The company’s regulated approach to blockchain implementation provides a sustainable path for mainstream adoption of distributed ledger technology in financial services. By working within existing regulatory frameworks and partnering with central banks, Fnality has created a model that other blockchain companies can follow to achieve similar success.