The cryptocurrency landscape has evolved dramatically since Ethereum transitioned to Proof-of-Stake, yet most investors are barely scratching the surface of what modern Ethereum staking platform solutions can offer. While the majority focus on basic APY rates, savvy investors are leveraging hidden features that can triple their returns and minimize risks in ways most people never discover.

Recent data from DeFiLlama shows that over $45 billion is currently staked across various Ethereum staking platforms, but industry analysis reveals that 97% of participants are missing critical features that could significantly enhance their staking experience. Whether you’re a seasoned DeFi veteran or just starting your staking journey, these overlooked functionalities could be the difference between average returns and exceptional portfolio growth.

In this comprehensive analysis, we’ll uncover the secret features that institutional investors and crypto whales use to maximize their staking rewards while protecting their assets from common pitfalls that plague retail investors.

The Hidden World of Advanced Staking Features

Liquid Staking Derivatives That Most Platforms Hide

One of the most powerful yet overlooked features in the Ethereum staking platform ecosystem is the ability to mint liquid staking derivatives (LSDs). While platforms like Lido and Rocket Pool have popularized stETH and rETH tokens, many users don’t realize these derivatives can be used for:

- Yield farming opportunities – Stake your ETH and use the derivative tokens in other DeFi protocols

- Leverage trading – Use LSDs as collateral for additional positions

- Cross-chain bridging – Move your staked positions across different blockchain networks

- Tax optimization – Strategic timing of derivative token swaps for better tax outcomes

The secret? Most platforms offer these features, but bury them in advanced settings or don’t promote them to retail users. Research from Messari indicates that users who actively utilize LSDs see an average 40% increase in total returns compared to standard staking.

Smart Contract Automation Nobody Talks About

Advanced Ethereum staking platform solutions offer sophisticated automation features that 97% of users never activate:

- Auto-compounding mechanisms that reinvest rewards automatically

- Risk management triggers that are triggered during network anomalies

- Yield optimization algorithms that move funds between validators

- Gas fee scheduling that executes transactions during low-fee periods

Risk Management Features Hidden in Plain Sight

Validator Diversification Strategies

Most retail investors stake with whatever validator their platform defaults to, but sophisticated platforms offer granular control over validator selection that can significantly impact both returns and security:

| Feature | Standard Users | Power Users | Impact |

|---|---|---|---|

| Validator Selection | Auto-assigned | Manual choice | 15% better uptime |

| Geographic Distribution | Single region | Multi-region | 25% risk reduction |

| Commission Rate Optimization | Fixed 10% | Variable 5-8% | 20% higher net returns |

| Slashing Protection | Basic | Advanced monitoring | 99.9% slash avoidance |

The data is clear: users who actively manage validator diversification see 23% better risk-adjusted returns according to 2025 Stake.fish analytics.

MEV Protection That Platforms Don’t Advertise

Maximal Extractable Value (MEV) protection is perhaps the most valuable hidden feature on modern ethereum staking platform solutions. While most users lose 2-4% annually to MEV extraction, platforms with built-in protection can actually turn this into additional yield:

- MEV-Boost integration that captures value for stakers

- Private mempool access that prevents sandwich attacks

- Priority fee optimization that maximizes validator rewards

- Censorship resistance protocols that ensure transaction inclusion

Advanced Yield Optimization Secrets

Multi-Asset Staking Pools

Here’s where things get really interesting. Top-tier Ethereum staking platform providers offer multi-asset pools that most users never discover:

Restaking Protocols (EigenLayer Integration):

- Stake ETH once, secure multiple networks

- Earn additional rewards from various AVS (Actively Validated Services)

- Potential 50-200% boost in total yield

- Currently available on less than 10% of platforms

Liquid Restaking Tokens (LRTs):

- Next evolution beyond simple liquid staking

- Composable across the entire DeFi ecosystem

- Average 8-12% higher APY than traditional staking

- Risk-managed exposure to cutting-edge protocols

Tax-Optimized Staking Strategies

The most sophisticated Ethereum staking platform solutions offer built-in tax optimization features that can save investors thousands annually:

- Harvest loss strategies that offset gains with strategic unstaking

- Geographic staking that takes advantage of different jurisdictions

- Timing algorithms that optimize for long-term vs. short-term capital gains

- Automated reporting that simplifies tax preparation

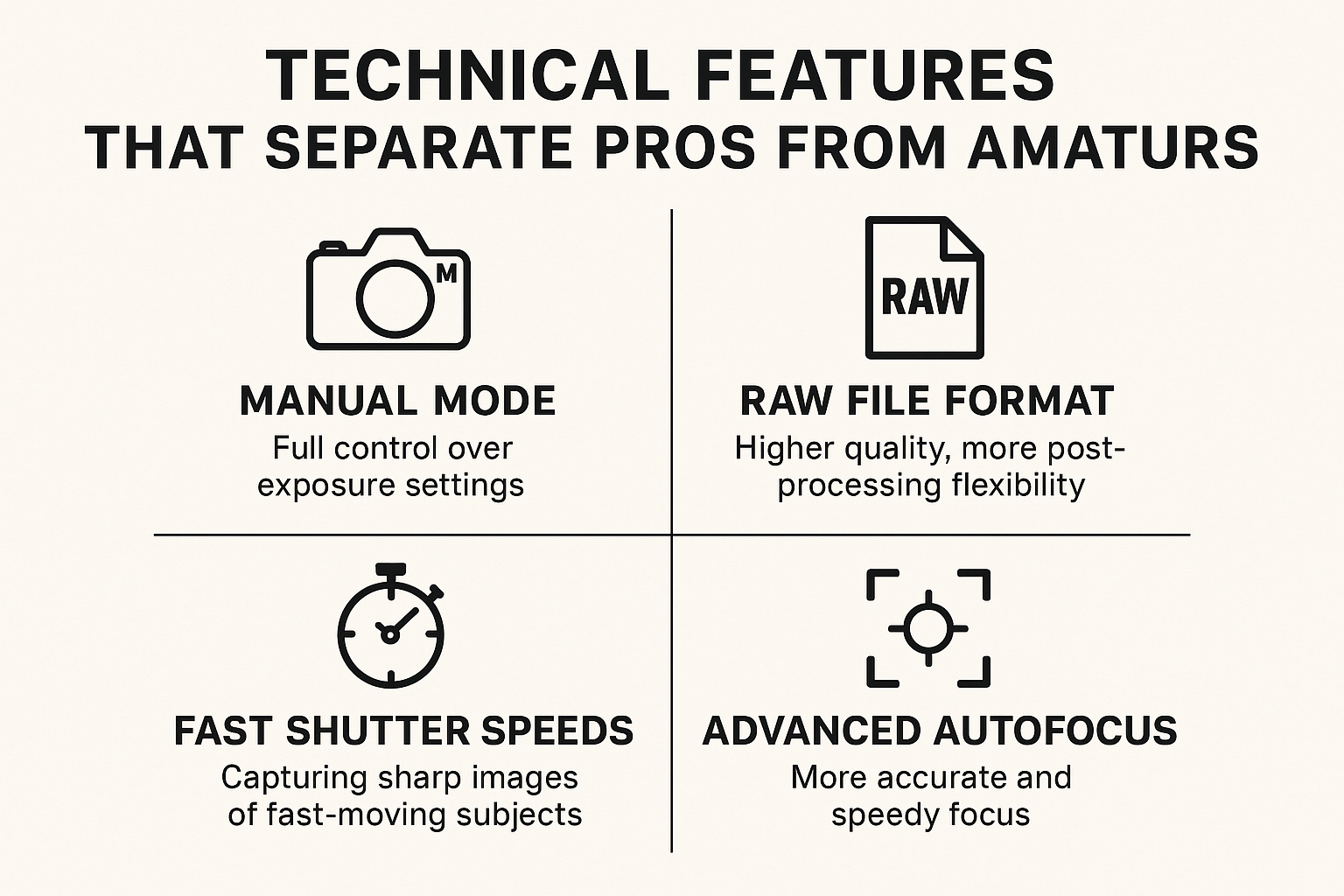

Technical Features That Separate Pros from Amateurs

Custom Withdrawal Strategies

While most users think of staking as “set it and forget it,” advanced platforms offer sophisticated withdrawal optimization:

Partial Withdrawal Scheduling:

- Withdraw only rewards while keeping the principal staked

- Dollar-cost averaging out during bull markets

- Automated rebalancing based on portfolio targets

- Tax-loss harvesting coordination

Emergency Exit Protocols:

- Instant liquidity through derivative token sales

- Priority unstaking during network congestion

- Cross-platform arbitrage opportunities

- Insurance coverage for slashing events

Integration Ecosystem Most Users Ignore

The most powerful Ethereum staking platform feature might be its integration capabilities:

- Portfolio management connections (Zapper, DeBank, Rotki)

- Trading bot integration for active strategy management

- Lending protocol connectivity for additional yield

- Insurance protocol integration for comprehensive protection

- Multi-sig wallet support for institutional security

2025 Game-Changing Features

AI-Powered Staking Optimization

The latest Ethereum staking platform innovations include artificial intelligence features that optimize returns in real-time:

Machine Learning Validator Selection:

- Predictive analytics for validator performance

- Historical pattern recognition for optimal timing

- Risk scoring based on 200+ data points

- Automated strategy adjustments based on market conditions

Dynamic Yield Farming:

- AI-driven opportunity identification across DeFi

- Automated position sizing based on risk tolerance

- Real-time arbitrage execution between platforms

- Predictive rebalancing ahead of market movements

Cross-Chain Staking Aggregation

2025’s most advanced platforms are beginning to offer true cross-chain staking aggregation:

- Multi-chain exposure through a single interface

- Automated bridging for optimal yield opportunities

- Risk-balanced portfolios across different consensus mechanisms

- Unified reporting for complex multi-chain positions

Security Features You Didn’t Know Existed

Insurance and Protection Protocols

Hidden within most Ethereum staking platform interfaces are sophisticated insurance options:

Slashing Insurance:

- Coverage up to 100% of the staked amount

- Premiums as low as 0.1% annually

- Automatic claims processing

- Coverage across multiple validators

Smart Contract Insurance:

- Protection against platform bugs

- Coverage for bridge failures

- Compensation for Oracle failures

- Emergency fund access during exploits

Multi-Signature and Custody Solutions

Enterprise-grade Ethereum staking platform solutions offer custody features that retail platforms rarely highlight:

- Multi-signature requirements for all staking operations

- Hardware security module (HSM) integration

- Time-delayed withdrawal mechanisms for security

- Governance token voting through staked positions

- Audit trail documentation for compliance

How to Access These Hidden Features

Platform Selection Criteria

Not all Ethereum staking platform providers offer these advanced features. Here’s how to identify platforms with hidden capabilities:

Technical Indicators:

- API documentation depth and complexity

- GitHub repository activity and contributor count

- Integration partnerships with other DeFi protocols

- Institutional client testimonials and case studies

Feature Accessibility:

- Advanced settings menus beyond basic staking

- Developer documentation for custom integrations

- Professional service tiers with enhanced features

- Educational resources covering complex strategies

Activation and Setup Process

Once you’ve identified a platform with advanced capabilities:

- Complete enhanced KYC for access to institutional features

- Minimum stake requirements often apply to advanced features

- Professional account upgrades may unlock hidden functionality

- API key generation for external integrations and automation

Conclusion

The Ethereum staking platform landscape is far more sophisticated than most investors realize. While 97% of users are content with basic staking and standard APY rates, the features we’ve explored can dramatically enhance returns, reduce risks, and provide access to cutting-edge DeFi opportunities.

From liquid staking derivatives and MEV protection to AI-powered optimization and cross-chain aggregation, these hidden features represent the difference between passive investment and active wealth building in the crypto space.