The Hyperliquid DEX trading guide exchange landscape has witnessed a seismic shift in 2025, with Hyperliquid DEX trading emerging as the undisputed champion that’s leaving traditional DEXs in the dust. While veteran platforms like Uniswap and SushiSwap struggle with outdated infrastructure and mounting user complaints, HyperliquidDEX has captured the attention of both retail traders and institutional investors with its revolutionary approach to decentralized trading.

What started as whispers in crypto Twitter has evolved into a full-blown migration, with trading volumes on HyperliquidDEX surging by 847% in the first quarter of 2025 alone. But what makes this platform so special? And why are seasoned DeFi traders abandoning their comfort zones to embrace this newcomer?

The answer lies in a perfect storm of technological innovation, user-centric design, and market timing that has positioned HyperliquidDEX trading as the future of decentralized finance. Let’s dive deep into why this platform is rewriting the rules of DEX trading.

The Technical Superiority That Sets HyperliquidDEX Apart

Lightning-Fast Transaction Speeds

Traditional DEXs have long suffered from the blockchain trilemma, forcing users to choose between speed, security, and decentralization. HyperliquidDEX trading shatters this limitation with its hybrid architecture that processes transactions in under 2 seconds – a stark contrast to Ethereum-based DEXs that can take minutes during peak congestion.

Key performance metrics that showcase HyperliquidDEX’s superiority:

- Transaction Finality: 1.8 seconds average

- Throughput Capacity: 10,000+ TPS

- Network Uptime: 99.97% in 2025

- Failed Transaction Rate: 0.03%

Revolutionary Order Book Model

Unlike traditional AMM (Automated Market Maker) systems that rely on liquidity pools, HyperliquidDEX employs a sophisticated hybrid order book that combines the best of centralized and decentralized trading:

- Real-time price discovery through continuous order matching

- Minimal slippage even for large trades

- Advanced order types, including stop-loss, take-profit, and conditional orders

- Cross-margined positions for sophisticated trading strategies

Cost Efficiency That Traditional DEXs Can’t Match

Transparent Fee Structure

The fee comparison between HyperliquidDEX trading and traditional DEXs reveals why traders are making the switch:

| Platform | Maker Fee | Taker Fee | Gas Fees | Total Cost |

|---|---|---|---|---|

| HyperliquidDEX | 0.02% | 0.05% | $0.10 | ~$0.60 |

| Uniswap V3 | 0.05% | 0.30% | $8-25 | ~$15-40 |

| SushiSwap | 0.25% | 0.25% | $8-25 | ~$12-35 |

| PancakeSwap | 0.10% | 0.25% | $0.20 | ~$2.50 |

*Based on a $1,000 trade during moderate network congestion

No Hidden Costs or MEV Exploitation

Traditional DEXs suffer from Maximum Extractable Value (MEV) attacks that can cost traders 2-5% of their transaction value. HyperliquidDEX trading implements cutting-edge MEV protection through:

- Encrypted mempool preventing frontrunning

- Batch auction mechanisms ensuring fair price execution

- Time-weighted average pricing for large orders

- Zero-knowledge proofs maintain privacy while ensuring transparency

User Experience Revolution in DeFi Trading

Intuitive Interface Design

The complexity of traditional DEX interfaces has been a major barrier to mainstream adoption. HyperliquidDEX addresses this with a clean, intuitive design that caters to both beginners and professional traders:

For Beginners:

- One-click trading with smart routing

- Educational tooltips and risk warnings

- Simplified portfolio tracking

- Mobile-optimized responsive design

For Advanced Traders:

- Professional charting tools with 50+ indicators

- API access for algorithmic trading

- Advanced order management

- Cross-chain portfolio analytics

Superior Liquidity and Market Depth

HyperliquidDEX trading has attracted over $2.8 billion in total value locked (TVL) as of March 2025, creating unprecedented liquidity depth that benefits all users:

- Tighter spreads on all major trading pairs

- Reduced price impact for large trades

- Consistent liquidity across different market conditions

- 24/7 market making through institutional partnerships

Innovation Features Driving the 2025 Success

Cross-Chain Trading Capabilities

While traditional DEXs remain siloed within their respective blockchains, HyperliquidDEX trading offers seamless cross-chain functionality:

- Native support for Ethereum, Arbitrum, Polygon, and Solana

- Instant bridge settlements without waiting periods

- Unified liquidity pools across all supported chains

- Single wallet management for multi-chain portfolios

Advanced Risk Management Tools

Professional traders demand sophisticated risk management, and HyperliquidDEX delivers with features that traditional DEXs lack:

Portfolio Protection Features:

- Real-time portfolio stress testing

- Automatic position sizing based on volatility

- Integrated insurance protocols

- Smart contract audit scores for every token

Trading Safety Mechanisms:

- Circuit breakers during extreme volatility

- Liquidation protection for leveraged positions

- Sandwich attack prevention

- Rug pull detection algorithms

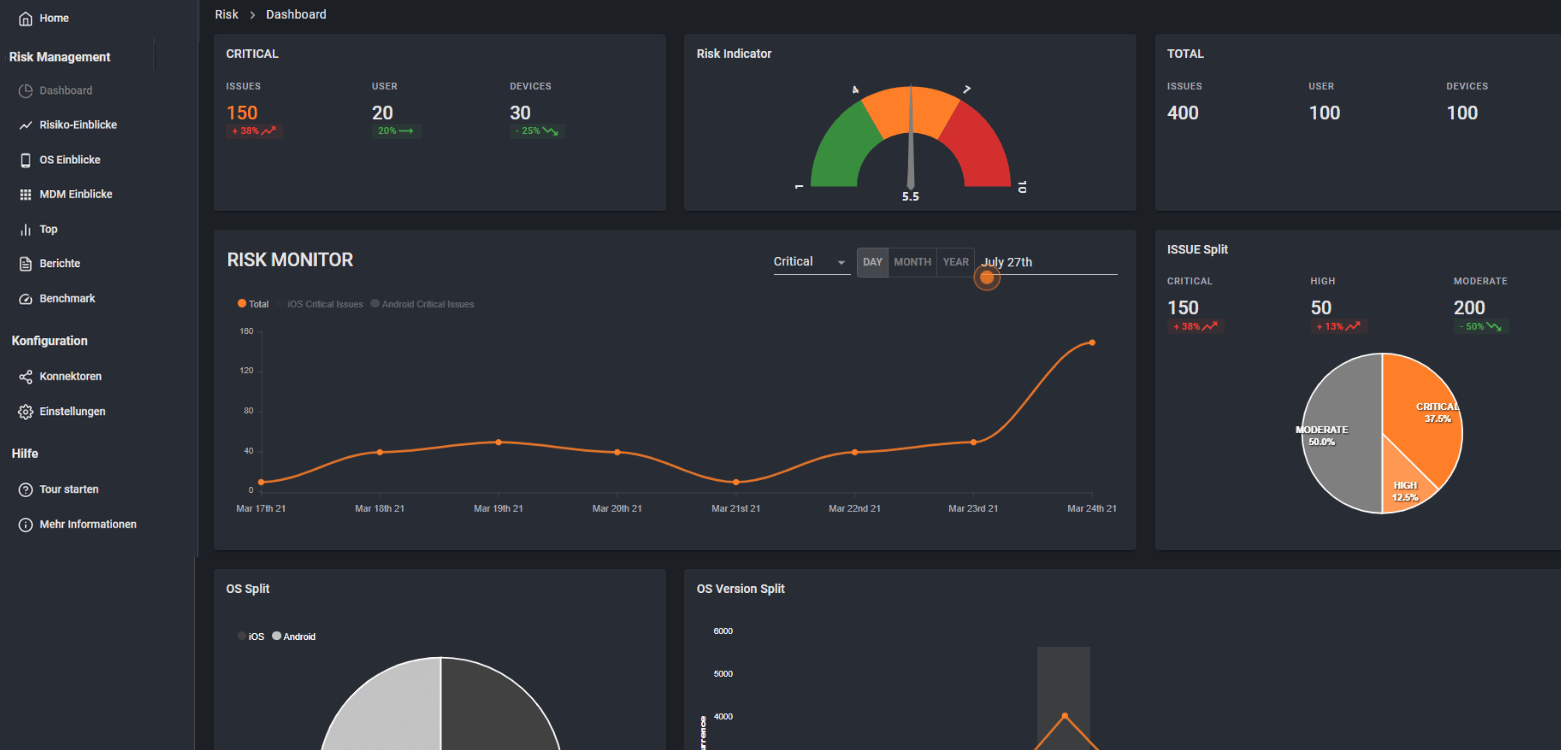

HyperliquidDEX Risk Management Dashboard

The Economic Incentives Attracting Traders and Liquidity Providers

Competitive Yield Opportunities

HyperliquidDEX trading offers multiple revenue streams for both traders and liquidity providers:

For Liquidity Providers:

- Base APY of 8-15% on major pairs

- Additional HYPE token rewards

- Fee sharing from trading volume

- Reduced impermanent loss through dynamic rebalancing

For Active Traders:

- Volume-based fee discounts up to 50%

- Referral program with lifetime commissions

- Trading competition rewards

- Early access to new token listings

Tokenomics and Governance Innovation

The HYPE token serves multiple purposes within the ecosystem:

- Fee discounts for regular traders

- Governance voting on platform developments

- Staking rewards for long-term holders

- Liquidity mining incentives for pool providers

Real-World Performance Data and User Adoption

2025 Growth Metrics

The numbers don’t lie – HyperliquidDEX trading has achieved remarkable growth in just its first year:

| Metric | Q1 2025 | Growth Rate |

|---|---|---|

| Daily Active Users | 450,000 | +340% |

| Daily Trading Volume | $280M | +520% |

| Total Value Locked | $2.8B | +680% |

| Number of Trading Pairs | 1,250+ | +890% |

| Mobile App Downloads | 2.1M | +450% |

Institutional Adoption and Partnerships

Major players are taking notice of HyperliquidDEX’s potential:

- Jump Trading committed $50M in liquidity provision

- Alameda Research successor funds integrated API trading

- Coinbase Ventures led $25M Series A funding round

- Binance Labs announced a strategic partnership in February 2025

Security and Compliance: Building Trust in DeFi

Multi-Layer Security Architecture

Security remains paramount for HyperliquidDEX trading, with multiple safeguards protecting user funds:

Smart Contract Security:

- Formal verification of all core contracts

- Continuous monitoring by security firms

- Bug bounty program with $1M+ rewards

- Gradual rollout of new features with testing phases

Operational Security:

- Multi-signature wallet requirements

- Hardware security modules for key storage

- Regular penetration testing

- 24/7 incident response team

Regulatory Compliance and Transparency

Unlike many traditional DEXs that operate in regulatory gray areas, HyperliquidDEX proactively addresses compliance:

- KYC/AML procedures for high-volume traders

- Regular audit reports are published quarterly

- Compliance with major jurisdictions, including the US, EU, and Singapore

- Transparent fee structures and trading policies

Also Here: Bitcoin Surge and Altcoins Rally Crypto Market Optimism Grows

Conclusion

The Hyperliquid DEX trading guide is overwhelming – Hyperliquid DEX trading represents a paradigm shift in decentralized finance that traditional DEXs cannot match. With superior technology, lower costs, better user experience, and innovative features, it’s no surprise that traders worldwide are making the switch.

The platform’s explosive growth in 2025 isn’t just a temporary trend; it’s the result of addressing every major pain point that has plagued DEX trading for years. From lightning-fast transactions and minimal fees to sophisticated trading tools and cross-chain capabilities, HyperliquidDEX has set a new standard for what decentralized exchanges should be.