The financial landscape is experiencing a seismic shift as a major $316 billion asset management giant has officially signed a Memorandum of Understanding (MOU) with Ava Labs, the innovative blockchain technology company behind the Avalanche ecosystem. This groundbreaking partnership aims to develop cutting-edge blockchain-based fund solutions that will revolutionize how institutional investors manage and deploy capital in the digital age.

The collaboration represents one of the most significant endorsements of blockchain technology by traditional financial institutions to date. With blockchain-based fund solutions becoming increasingly crucial for modern portfolio management, this partnership positions both companies at the forefront of the digital transformation sweeping through asset management. The MOU outlines a comprehensive framework for developing innovative financial products that leverage blockchain technology’s transparency, efficiency, and security features.

This strategic alliance comes at a time when institutional demand for digital asset infrastructure is reaching unprecedented levels. The blockchain-based fund solutions developed through this partnership are expected to address key challenges in traditional fund management, including settlement times, operational costs, and regulatory compliance requirements.

The Strategic Partnership: A Game-Changer for Institutional Finance

Understanding the $316B Giant’s Vision

The unnamed financial giant, managing over $316 billion in assets under management (AUM), has been quietly exploring blockchain technology applications for several years. Industry sources suggest this institution has been evaluating various blockchain-based fund solutions to enhance their operational efficiency and provide clients with next-generation investment products.

This partnership with Ava Labs represents a significant acceleration of their blockchain adoption strategy. The institution’s decision to work with Ava Labs specifically highlights the growing recognition of Avalanche’s technical capabilities and its potential to support enterprise-grade financial applications.

The collaboration will focus on developing institutional blockchain adoption frameworks that can be seamlessly integrated into existing fund management operations. This approach ensures that the transition to blockchain-based systems doesn’t disrupt current client services while providing enhanced capabilities for future growth.

Ava Labs: Pioneering Blockchain Infrastructure

Ava Labs has established itself as a leader in developing scalable blockchain solutions for enterprise applications. The company’s Avalanche platform offers unique advantages for blockchain-based fund solutions, including high throughput, low latency, and energy-efficient consensus mechanisms.

The partnership leverages Ava Labs’ expertise in creating customizable blockchain networks that can meet the specific requirements of institutional fund management. Their technology enables the development of digital asset management platforms that maintain the security and compliance standards required by traditional financial institutions.

Through this collaboration, Ava Labs gains access to real-world testing environments and feedback from one of the industry’s largest asset managers. This relationship provides invaluable insights that will help refine their technology for broader institutional adoption.

Blockchain-Based Fund Solutions: Transforming Asset Management

Key Features and Benefits

The blockchain-based fund solutions being developed through this partnership will incorporate several revolutionary features that address longstanding challenges in traditional fund management:

Transparent Operations: Blockchain technology provides immutable records of all transactions and fund operations, enabling unprecedented transparency for investors and regulators. This transparency helps build trust and reduces operational risks associated with manual reconciliation processes.

Enhanced Liquidity Management: Smart contracts will automate various aspects of liquidity management, including rebalancing, distribution calculations, and settlement processes. This automation reduces the time and cost associated with fund operations while minimizing human error.

Real-Time Reporting: Investors will have access to real-time portfolio valuations and performance metrics through blockchain-based reporting systems. This capability represents a significant improvement over traditional quarterly reporting cycles.

Reduced Settlement Times: Traditional fund transactions often require multiple days for settlement. Blockchain-based fund solutions can reduce settlement times to near-instantaneous, improving capital efficiency and reducing counterparty risk.

Digital Asset Management Innovation

The partnership will explore innovative approaches to digital asset management that combine traditional investment strategies with blockchain technology capabilities. This includes developing hybrid products that can manage both traditional assets and digital currencies within a single fund structure.

Tokenized Asset Management represents another key focus area, where traditional assets are represented as digital tokens on the blockchain. This approach enables fractional ownership, improved liquidity, and more efficient trading mechanisms.

The collaboration will also investigate decentralized finance solutions that can be adapted for institutional use. While DeFi protocols have primarily served retail investors, this partnership aims to create enterprise-grade versions that meet institutional compliance and risk management requirements.

Market Impact and Industry Implications

Institutional Blockchain Adoption Acceleration

This partnership signals a broader trend toward institutional blockchain adoption across the asset management industry. As one of the largest firms to publicly embrace blockchain technology for fund management, this move is likely to encourage other institutions to accelerate their own digital transformation initiatives.

The collaboration addresses several barriers that have historically prevented widespread institutional adoption of blockchain technology. By working with an established technology partner like Ava Labs, the asset management giant can access proven blockchain infrastructure while focusing on product development and client integration.

Crypto fund management capabilities developed through this partnership will likely influence industry standards and best practices. The solutions created may serve as templates for other institutions looking to integrate blockchain technology into their operations.

Competitive Landscape Evolution

The announcement has immediate implications for the competitive landscape in asset management. Firms that fail to develop comparable blockchain-based fund solutions may find themselves at a disadvantage as clients increasingly demand digital-first investment products.

This partnership also highlights the importance of choosing the right blockchain platform for institutional applications. Ava Labs’ selection over other blockchain providers demonstrates the critical factors institutions consider when evaluating technology partners, including scalability, security, and regulatory compliance capabilities.

The collaboration may accelerate mergers and acquisitions activity as traditional asset managers seek to acquire blockchain expertise or partner with technology companies to remain competitive.

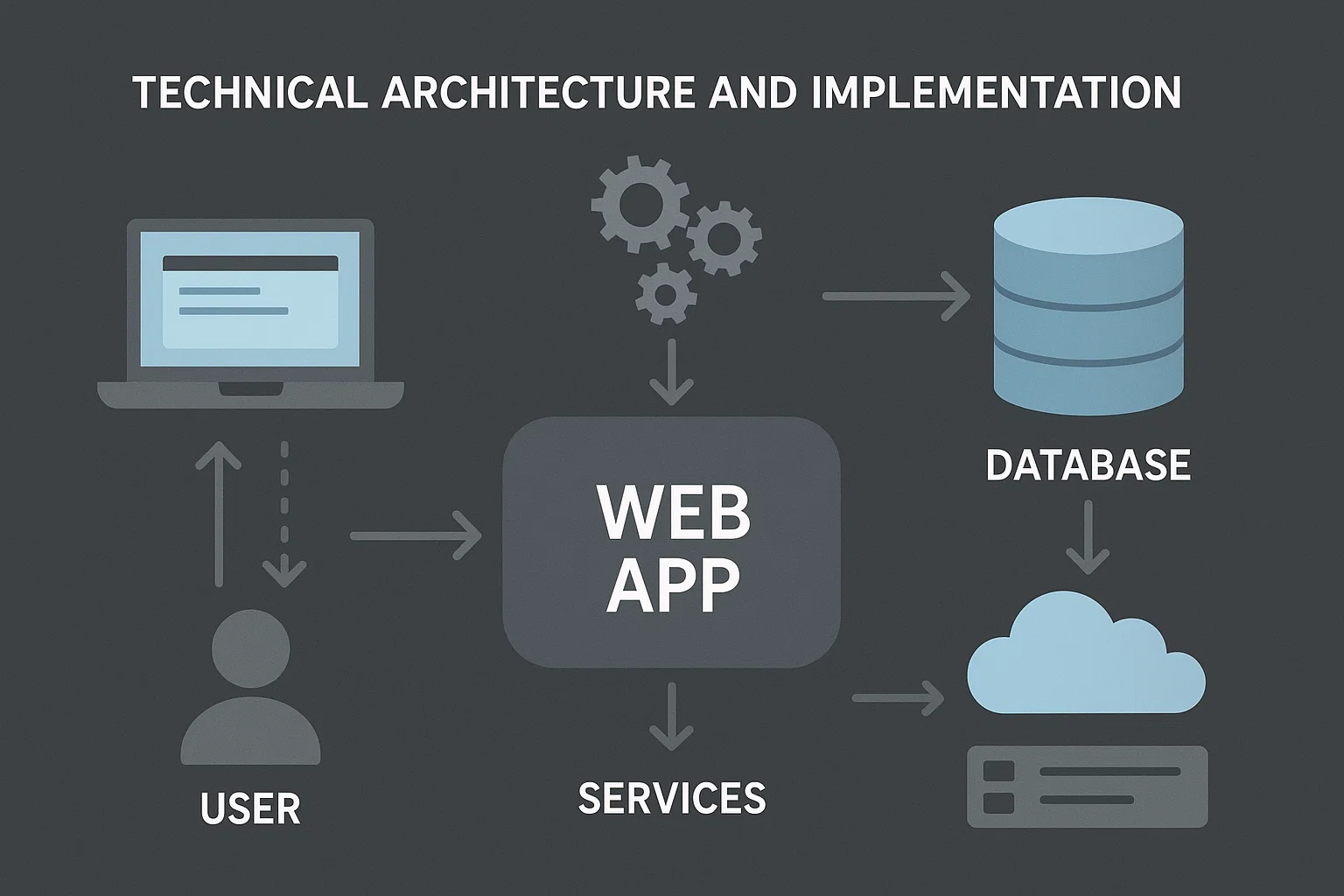

Technical Architecture and Implementation

Blockchain Investment Platforms Development

The technical implementation of blockchain investment platforms requires careful consideration of various factors including security, scalability, and regulatory compliance. The partnership will develop modular solutions that can be customized for different types of funds and investment strategies.

Digital fund infrastructure will be built on Avalanche’s subnet architecture, allowing for customized blockchain networks that can meet specific regulatory and operational requirements. This approach provides the flexibility needed to serve different markets and client types while maintaining high performance standards.

The platform will incorporate advanced security features including multi-signature wallets, hardware security modules, and comprehensive audit trails. These security measures ensure that blockchain-based fund solutions meet or exceed the security standards of traditional financial systems.

Integration with Legacy Systems

A critical aspect of the partnership involves developing integration capabilities that allow blockchain-based fund solutions to work seamlessly with existing fund management systems. This hybrid approach enables institutions to gradually transition to blockchain-based operations without disrupting current client services.

The integration framework will include APIs and middleware solutions that facilitate data exchange between blockchain and traditional systems. This capability is essential for maintaining operational continuity during the transition period.

DeFi institutional solutions developed through this partnership will also include bridges to traditional financial markets, enabling funds to access both decentralized and centralized liquidity sources as needed.

Regulatory Considerations and Compliance

Navigating the Regulatory Landscape

The development of blockchain-based fund solutions must navigate a complex and evolving regulatory landscape. The partnership benefits from the asset management giant’s extensive regulatory expertise and established relationships with financial authorities worldwide.

Compliance frameworks being developed will address key regulatory requirements including investor protection, anti-money laundering (AML), and know-your-customer (KYC) obligations. These frameworks ensure that blockchain-based solutions meet the same regulatory standards as traditional fund management operations.

The collaboration includes ongoing engagement with regulatory authorities to ensure that new digital asset management products comply with current regulations while also informing future regulatory development in this rapidly evolving space.

Risk Management and Governance

Institutional-grade blockchain-based fund solutions require sophisticated risk management capabilities that address both traditional investment risks and technology-specific risks. The partnership will develop comprehensive risk frameworks that cover cybersecurity, operational resilience, and technology risks.

Governance structures for blockchain-based funds will incorporate both traditional fund governance practices and new governance mechanisms enabled by blockchain technology, such as token-based voting systems and automated compliance monitoring.

Future Prospects and Market Opportunities

Scaling Blockchain-Based Fund Solutions

The initial phase of the partnership focuses on developing pilot programs and proof-of-concept implementations. However, the long-term vision includes scaling blockchain-based fund solutions across the institution’s entire product lineup and potentially licensing the technology to other asset managers.

Market research suggests that demand for digital asset management solutions will continue growing rapidly as institutional investors become more comfortable with blockchain technology. This partnership positions both companies to capture a significant share of this expanding market.

International expansion represents another key opportunity, as blockchain-based fund solutions can more easily serve global markets due to their digital nature and standardized infrastructure requirements.

Innovation Pipeline

Beyond the initial focus on fund management, the partnership may expand to explore other blockchain applications in asset management including custodial services, trade finance, and alternative investment platforms.

The collaboration will also investigate emerging technologies such as artificial intelligence and machine learning integration with blockchain investment platforms to create more sophisticated investment management capabilities.

Tokenized asset management will likely expand to include a broader range of asset classes as regulatory clarity improves and market infrastructure develops to support these new investment vehicles.

Industry Expert Perspectives

Market Analyst Views

Leading financial analysts have praised the partnership as a significant step forward for institutional blockchain adoption. Many experts believe this collaboration will serve as a catalyst for broader industry transformation, encouraging other major asset managers to accelerate their blockchain initiatives.

The partnership addresses several key concerns that have prevented widespread adoption of blockchain-based fund solutions, including scalability, security, and regulatory compliance. By working with an established blockchain platform like Avalanche, the asset management giant can leverage proven technology while focusing on product development and market implementation.

Industry observers expect this collaboration to influence regulatory discussions around digital asset management as authorities see how blockchain technology can enhance rather than replace traditional financial oversight mechanisms.

Technology Community Response

The blockchain technology community has responded positively to the partnership, viewing it as validation of enterprise blockchain applications beyond cryptocurrency trading. Ava Labs’ selection for this high-profile collaboration reinforces the platform’s position as a leading enterprise blockchain solution.

Developers and technology partners within the Avalanche ecosystem anticipate increased opportunities to participate in blockchain-based fund solutions development as the partnership creates demand for specialized tools and services.

The collaboration may also accelerate development of industry standards for crypto fund management as other blockchain platforms and financial institutions seek to develop competitive solutions.

Conclusion

The groundbreaking partnership between the $316 billion asset management giant and Ava Labs represents a pivotal moment in the evolution of institutional finance. By committing to develop innovative blockchain-based fund solutions, these industry leaders are not just adapting to technological change—they’re actively shaping the future of asset management.

This collaboration addresses the growing demand for digital asset management capabilities while maintaining the security, compliance, and operational excellence that institutional investors require. The blockchain-based fund solutions emerging from this partnership will likely set new industry standards and accelerate broader adoption of blockchain technology across the financial services sector.

As we witness this transformation unfold, it’s clear that blockchain-based fund solutions are no longer experimental concepts but essential components of modern asset management strategies. Financial institutions that embrace these innovations today will be best positioned to serve their clients’ evolving needs tomorrow.