Bitcoin price prediction models are showing renewed optimism. After months of turbulent trading and relentless selling pressure, BlackRock’s massive Bitcoin investment has finally returned to profitability, sending ripples of excitement through the crypto community. This development raises a critical question that every investor is asking: Has the selling finally come to an end? As institutional giants like BlackRock regain confidence and their positions turn green, understanding the implications for Bitcoin’s future becomes essential for anyone looking to navigate this volatile market successfully.

BlackRock’s Bitcoin Investment Strategy

BlackRock, the world’s largest asset manager with over $10 trillion in assets under management, made headlines when it entered the Bitcoin market through its iShares Bitcoin Trust ETF. The firm’s strategic positioning in the cryptocurrency space represents a watershed moment for digital asset adoption among traditional financial institutions.

The Significance of Institutional Bitcoin Holdings

When BlackRock’s Bitcoin price prediction turned from red to green, it signaled more than just a portfolio recovery. This milestone reflects broader market sentiment shifts and validates the long-term investment thesis surrounding digital currencies. Institutional investors typically operate with extended time horizons, meaning their profitability often precedes sustained upward movements in asset prices.

The recovery of BlackRock’s position demonstrates several key factors:

- Improved market liquidity following previous capitulation events

- Reduced selling pressure from overleveraged positions being cleared

- Growing confidence among institutional participants

- Technical support levels holding firm despite previous volatility

How BlackRock’s Position Influences Market Sentiment

BlackRock’s influence extends far beyond its direct holdings. When the firm’s Bitcoin investments show positive returns, it creates a psychological anchor point for other institutional investors. This “follow the smart money” phenomenon can trigger cascading effects throughout the market, as pension funds, endowments, and family offices reconsider their allocation strategies.

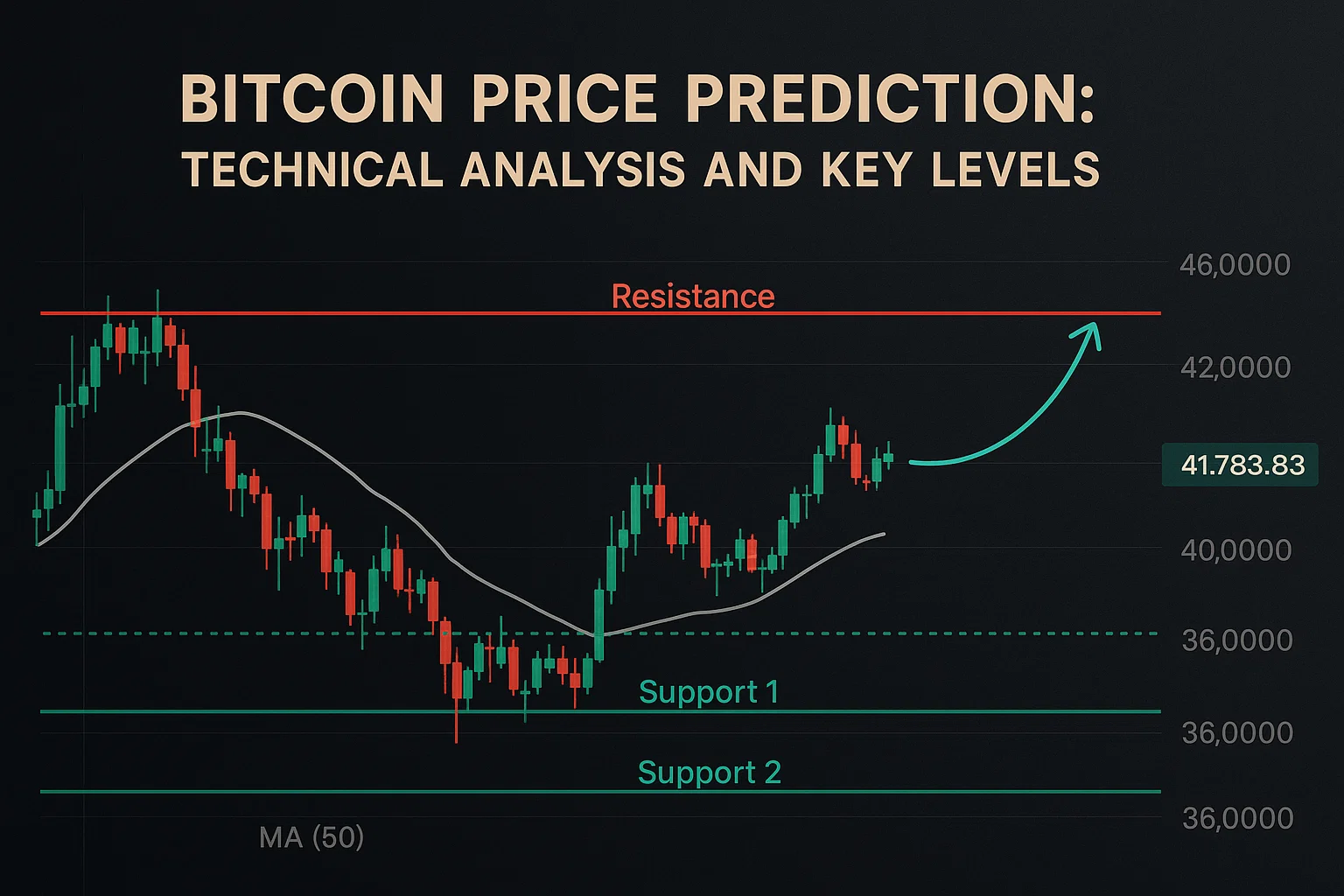

Bitcoin Price Prediction: Technical Analysis and Key Levels

Current Bitcoin price prediction models incorporate multiple technical indicators that suggest a potential shift in market dynamics. Analysts are closely monitoring resistance and support levels that could determine whether this recovery has staying power.

Critical Support and Resistance Zones

Bitcoin has established several important price levels that traders watch religiously. The cryptocurrency recently reclaimed the $95,000 support zone, which previously acted as resistance during earlier rally attempts. This role reversal from resistance to support represents a bullish technical development in Bitcoin price prediction frameworks.

Key technical levels to monitor include:

Support Levels:

- Primary support: $92,000 – $94,000

- Secondary support: $88,000 – $90,000

- Major support: $82,000 – $85,000

Resistance Levels:

- Immediate resistance: $98,000 – $100,000

- Medium-term resistance: $105,000 – $108,000

- Major resistance: $115,000 – $120,000

Volume Analysis and Market Participation

Trading volume patterns provide crucial insights into the sustainability of price movements. Recent data shows declining volume during pullbacks and increasing volume during rallies—a pattern typically associated with healthy uptrends in Bitcoin price prediction analysis.

The reduction in exchange outflows suggests that holders are becoming less willing to sell at current prices, indicating growing conviction among market participants. This supply-side dynamic, combined with renewed institutional demand, creates favorable conditions for price appreciation.

Is the Selling Pressure Finally Over?

Determining whether Bitcoin selling pressure has truly subsided requires examining multiple market indicators beyond just price action. Several data points suggest that capitulation may be complete, though caution remains warranted.

On-Chain Metrics Indicating Reduced Selling

Blockchain analytics reveal compelling evidence that long-term holders have stopped distributing their Bitcoin positions. The “spent output profit ratio” (SOPR) has normalized, indicating that entities selling Bitcoin are no longer doing so at significant losses—a pattern typically seen near market bottoms.

Additionally, the exchange reserve metric shows a continued decline, meaning more Bitcoin is moving from exchanges into cold storage wallets. This behavior pattern suggests accumulation rather than preparation for selling, supporting bullish Bitcoin price prediction scenarios.

Miner Capitulation Signals

Bitcoin miners, who must regularly sell portions of their holdings to cover operational expenses, have shown reduced selling pressure. The miner reserve metric has stabilized, and the hash rate continues growing despite previous profitability challenges. When miners stop capitulating, it often removes a significant source of persistent selling pressure from the market.

BlackRock’s ETF Impact on Bitcoin Markets

The iShares Bitcoin Trust has fundamentally altered Bitcoin market dynamics since its approval. Understanding this impact is crucial for accurate Bitcoin price prediction modeling.

Institutional Demand Through ETF Vehicles

BlackRock’s ETF has absorbed substantial Bitcoin supply, with billions of dollars in net inflows since inception. This demand channel provides consistent buying pressure that wasn’t present in previous market cycles. Unlike retail investors who may panic sell during corrections, institutional ETF investors typically maintain positions through volatility.

The ETF structure also introduces Bitcoin exposure to investors who previously couldn’t or wouldn’t directly purchase cryptocurrency. This accessibility factor significantly expands the potential investor base, creating sustained long-term demand that supports higher price levels.

Comparing BlackRock’s Performance to Other Bitcoin ETFs

While multiple spot Bitcoin ETFs received approval simultaneously, BlackRock’s offering quickly established dominance in terms of assets under management and daily trading volume. This market leadership position amplifies BlackRock’s influence over Bitcoin price prediction outcomes, as flows into their ETF can meaningfully impact spot market dynamics.

The firm’s reputation and distribution capabilities have attracted institutional capital at rates exceeding competitor offerings. This concentrated demand through a single vehicle creates more predictable buying pressure compared to fragmented retail participation.

Macroeconomic Factors Influencing Bitcoin Price Prediction

Bitcoin price prediction cannot be divorced from broader economic conditions. Several macroeconomic developments are shaping the cryptocurrency’s trajectory in ways that align with BlackRock’s renewed profitability.

Federal Reserve Policy and Interest Rates

The Federal Reserve’s monetary policy stance significantly impacts risk asset valuations, including Bitcoin. As inflation concerns moderate and rate cut expectations emerge, capital typically flows toward higher-risk, higher-return investments. This macro backdrop creates favorable conditions for cryptocurrency appreciation.

Lower interest rates reduce the opportunity cost of holding non-yielding assets like Bitcoin, making the cryptocurrency more attractive from a portfolio allocation perspective. Institutional investors are particularly sensitive to these relative return calculations when making allocation decisions.

Global Economic Uncertainty and Safe Haven Demand

Geopolitical tensions and economic instability in traditional financial centers have historically driven demand for alternative assets. Bitcoin’s fixed supply and decentralized nature position it as a hedge against currency debasement and financial system fragility—qualities that resonate with institutional investors like BlackRock during uncertain times.

Recent banking sector stress and sovereign debt concerns have reinforced Bitcoin’s narrative as “digital gold,” contributing to institutional accumulation patterns visible in BlackRock’s position recovery.

Technical Indicators Supporting Bullish Bitcoin Price Prediction

Multiple technical analysis frameworks are generating constructive signals for Bitcoin price prediction over medium to long-term timeframes.

Moving Average Convergence and Golden Crosses

Bitcoin has recently achieved a “golden cross” pattern where the 50-day moving average crossed above the 200-day moving average. This technical event has historically preceded sustained uptrends in Bitcoin markets. While not infallible, such patterns provide probabilistic support for bullish scenarios, especially when confirmed by fundamental factors like BlackRock’s position recovery.

The Relative Strength Index (RSI) has reset from overbought conditions without breaking critical support levels, suggesting healthy consolidation rather than trend exhaustion. This technical backdrop supports continued upside in Bitcoin price prediction models.

Fibonacci Retracement Levels and Price Targets

Fibonacci analysis places the next major Bitcoin resistance zone near $108,000, representing the 1.618 extension of the previous consolidation range. Breaking above this level could trigger accelerated upward momentum toward psychological resistance at $120,000 and beyond.

Conversely, Fibonacci support levels align with previously mentioned support zones, creating confluence that strengthens these technical anchors. Such alignment increases the probability that these levels will hold during future corrections.

Whale Accumulation and Large Holder Behavior

Large Bitcoin holders, including entities like BlackRock, exhibit distinct behavioral patterns that provide insights into market direction and inform Bitcoin price prediction analysis.

Wallet Analysis Revealing Accumulation Trends

Addresses holding between 1,000 and 10,000 Bitcoin have increased their aggregate holdings substantially over recent months. This “whale accumulation” typically precedes major price movements, as these sophisticated participants position ahead of anticipated catalysts.

The supply held by entities with coins older than one year has reached new highs, indicating strong holder conviction. When combined with reduced exchange reserves, these metrics paint a picture of supply tightening that supports bullish Bitcoin price prediction scenarios.

Exchange Whale Ratio Declining

The exchange whale ratio, which measures large deposits relative to total exchange inflows, has declined significantly. This suggests that whales are not preparing to sell into current prices, reducing the risk of sudden supply shocks that could derail the recovery in Bitcoin markets.

Regulatory Landscape and Its Impact on Bitcoin Price

The regulatory environment surrounding Bitcoin continues evolving in ways that impact institutional participation and long-term Bitcoin price prediction outlooks.

SEC Approval of Bitcoin ETFs

The Securities and Exchange Commission’s approval of spot Bitcoin ETFs, including BlackRock’s offering, represents a regulatory milestone that enhances cryptocurrency legitimacy. This approval removes a significant uncertainty that previously deterred institutional participation.

Ongoing regulatory clarity initiatives in major jurisdictions create more predictable operating environments for institutional investors. As regulatory frameworks mature, they reduce the risk premium embedded in Bitcoin valuations, potentially supporting higher sustainable price levels in Bitcoin price prediction models.

Global Regulatory Harmonization Trends

International coordination on cryptocurrency regulation is improving, reducing jurisdictional arbitrage concerns and creating more uniform standards. This harmonization benefits large institutions like BlackRock that operate globally and need consistent regulatory treatment across markets.

Clear regulatory pathways also enable traditional financial institutions to develop Bitcoin products and services, expanding the infrastructure that supports institutional participation and demand growth.

Alternative Bitcoin Price Prediction Models and Forecasts

Various analytical frameworks provide different perspectives on potential Bitcoin price trajectories, offering investors multiple lenses through which to evaluate opportunities.

Stock-to-Flow Model Implications

The stock-to-flow model, which relates Bitcoin’s scarcity (measured by the stock-to-flow ratio) to its market value, suggests significantly higher prices are justified by current supply dynamics. While this model has faced criticism during periods of underperformance, its long-term track record provides one framework for bullish Bitcoin price prediction scenarios.

Following the most recent halving event, the model indicates Bitcoin should trade substantially higher than current levels based on historical scarcity-value relationships. BlackRock’s position recovery aligns with the model’s directional expectations.

On-Chain Valuation Models

Network value to transactions (NVT) ratio and other on-chain metrics provide fundamental valuation frameworks for Bitcoin price prediction. Current readings suggest Bitcoin is fairly valued or slightly undervalued relative to network activity, indicating room for appreciation without entering bubble territory.

The realized price, representing the average cost basis of all Bitcoin in circulation, currently sits well below spot prices but shows upward momentum. This metric’s trajectory supports continued price appreciation in medium-term Bitcoin price prediction models.

Risk Factors and Potential Headwinds for Bitcoin

Despite positive developments like BlackRock’s recovery, several risks could impact Bitcoin price prediction outcomes and warrant investor attention.

Macroeconomic Deterioration Scenarios

Severe economic recession or financial crisis could trigger risk-off behavior that pressures Bitcoin alongside other risk assets, at least initially. While Bitcoin’s long-term haven properties may ultimately prove supportive, short-term correlation with risk assets during stress events remains a concern.

Unexpectedly aggressive Federal Reserve policy or liquidity withdrawal could reduce capital available for cryptocurrency investment, challenging bullish Bitcoin price prediction scenarios.

Technical Breakdown Risks

Failure to hold key support levels discussed earlier could trigger cascading stop-loss orders and momentum-based selling. Technical breakdown below $90,000 would call into question the current recovery narrative and potentially indicate that BlackRock’s profitability represents temporary relief rather than a sustainable trend reversal.

Regulatory Setbacks

Despite recent progress, regulatory risks remain ever-present for Bitcoin. Unexpected adverse regulatory developments in major jurisdictions could dampen institutional enthusiasm and challenge positive Bitcoin price prediction scenarios, even temporarily reversing gains.

Investment Strategies for Current Market Conditions

Given the current market dynamics and BlackRock’s position recovery, investors can consider several approaches to Bitcoin exposure aligned with their risk tolerance and time horizons.

Dollar-Cost Averaging Approach

For investors seeking Bitcoin exposure without timing risk, systematic dollar-cost averaging provides disciplined accumulation regardless of short-term price fluctuations. This strategy has historically produced favorable outcomes for Bitcoin investors with multi-year time horizons.

The current market setup, with institutional validation through BlackRock’s involvement and technical support levels holding, represents a reasonable environment for implementing DCA strategies in pursuit of Bitcoin price prediction upside scenarios.

Tactical Trading Around Support and Resistance

More active traders can structure positions around the technical levels discussed earlier, buying near support zones and taking profits near resistance levels. This approach requires closer monitoring but can enhance returns compared to passive strategies.

Setting stop-losses below major support levels helps manage risk if Bitcoin violates key technical structures, protecting capital if the positive Bitcoin price prediction thesis proves incorrect.

Portfolio Allocation Considerations

Financial advisors increasingly recommend modest Bitcoin allocations (typically 1-5% of portfolio value) as part of diversified investment strategies. BlackRock’s involvement lends institutional credibility that supports such allocation recommendations.

The portfolio impact of Bitcoin depends on correlation assumptions with traditional assets. Current evidence suggests a modest positive correlation with equities but potential diversification benefits during specific market regimes, supporting its inclusion in modern portfolios.

What Analysts Are Saying About Bitcoin’s Future

Professional analysts and research firms have updated their Bitcoin price prediction models following recent developments, including BlackRock’s position recovery.

Institutional Research Perspectives

Major investment banks and research providers have generally raised their Bitcoin price targets for year-end and beyond. Common price targets range from $110,000 to $150,000 by the end of 2025, with some optimistic forecasts extending to $200,000 or higher based on continued institutional adoption trends.

These revised Bitcoin price prediction figures reflect improved fundamental backdrop, technical momentum, and reduced tail risk following regulatory clarity improvements and institutional validation through products like BlackRock’s ETF.

Cryptocurrency-Focused Analyst Views

Crypto-native analysts tend toward more aggressive Bitcoin price prediction figures, often citing on-chain metrics and historical cycle patterns. Some prominent analysts project six-figure prices within six to twelve months based on supply-demand dynamics and institutional accumulation trends.

While these forecasts should be evaluated with appropriate skepticism, the directional consistency across various analytical frameworks provides supporting evidence for constructive Bitcoin outlooks.

Conclusion

BlackRock’s Bitcoin investment returning to profitability represents far more than a single portfolio milestone. This development signals a potential inflection point in cryptocurrency markets, suggesting that the selling pressure that dominated previous months may finally be exhausting itself. The combination of institutional validation, improving technical structure, supportive on-chain metrics, and a favorable macroeconomic backdrop creates a compelling case within current Bitcoin price prediction frameworks.

For investors considering Bitcoin exposure, the current environment offers a more attractive risk-reward profile than existed during peak uncertainty. While volatility will undoubtedly continue—it remains an intrinsic characteristic of cryptocurrency markets—the fundamental case for Bitcoin has strengthened considerably. BlackRock’s involvement brings institutional credibility, systematic demand, and operational infrastructure that didn’t exist in previous cycles.

Read More: Bitcoin Price Prediction: $13.3B Shorts Risk at $119K BTC