The crypto market cap Bitcoin landscape has experienced a remarkable 2% uptick, propelling the world’s leading cryptocurrency tantalizingly close to the historic $118,000 threshold. This unprecedented surge comes in the immediate aftermath of the Federal Reserve’s strategic rate reduction, demonstrating the profound interconnectedness between traditional monetary policy and digital asset valuations. As institutional investors and retail traders alike witness this extraordinary momentum in the Bitcoin crypto market cap, the cryptocurrency ecosystem stands poised at a pivotal juncture that could redefine the future of digital finance.

The current Bitcoin rally in the crypto market cap represents more than mere numerical appreciation—it embodies a fundamental shift in how global markets perceive cryptocurrency as a legitimate store of value and hedge against traditional monetary policies. With Bitcoin’s dominance continuing to influence the broader digital asset ecosystem, understanding the mechanisms driving this surge becomes crucial for investors navigating the evolving cryptocurrency landscape.

Current Crypto Market Cap Bitcoin Dynamics

The recent expansion of the Bitcoin market cap in the crypto market reflects a complex interplay of macroeconomic factors, institutional adoption, and market sentiment. Bitcoin’s approach toward the $118K milestone represents approximately a 15% increase from its previous resistance levels, signalling robust bullish momentum that has captured global attention.

Market analysts attribute this surge in the Bitcoin cryptocurrency market to several converging factors. The Federal Reserve’s decision to trim interest rates has traditionally prompted investors to shift toward alternative assets, particularly those perceived as inflation hedges. Bitcoin, with its fixed supply mechanism and decentralized nature, has increasingly positioned itself as “digital gold” in investment portfolios worldwide.

Federal Reserve Rate Cuts: Catalyst for Crypto Growth

The Federal Reserve’s monetary policy decisions have historically influenced Bitcoin’s market cap movements, though the relationship has evolved significantly over recent years. Lower interest rates typically reduce the opportunity cost of holding non-yielding assets like Bitcoin, making cryptocurrency investments more attractive relative to traditional fixed-income securities.

This latest rate trim has injected additional liquidity into financial markets, with a portion inevitably flowing into cryptocurrency ecosystems. The cryptocurrency market cap’s Bitcoin response demonstrates the maturation of digital assets as legitimate components of diversified investment strategies, particularly among institutional investors seeking portfolio optimisation opportunities.

Bitcoin’s Journey Toward $118K: Technical Analysis and Market Indicators

The path toward Bitcoin’s $ 118,000 target involves analyzing multiple technical indicators that support the current cryptocurrency market cap trajectory of Bitcoin. Key resistance and support levels, trading volumes, and market sentiment metrics collectively paint a picture of sustained bullish momentum.

Key Technical Milestones

Bitcoin’s recent price action has systematically broken through several psychological resistance levels, with each breakthrough reinforcing the broader crypto market cap Bitcoin uptrend. The cryptocurrency has demonstrated remarkable resilience above the $ 110,000 support level, establishing a solid foundation for the anticipated push toward $ 118,000.

Trading volume analysis reveals increased participation from both institutional and retail investors, with daily volume figures consistently exceeding historical averages. This elevated trading activity supports the sustainability of the current Bitcoin rally in the crypto market, suggesting genuine market conviction rather than speculative bubbles.

Market Sentiment and Investor Confidence

Sentiment analysis across major cryptocurrency exchanges and social media platforms indicates overwhelming optimism regarding Bitcoin’s near-term prospects. The Bitcoin momentum in the crypto market cap has generated positive feedback loops, where rising prices attract additional investor interest, further supporting upward price pressure.

Fear and Greed Index readings have shifted toward “Extreme Greed” territory, though historical analysis suggests Bitcoin can sustain such sentiment levels during major bull runs. The current crypto market cap Bitcoin environment reflects measured optimism rather than irrational exuberance, suggesting potential for continued growth.

Impact of Federal Reserve Policy on Cryptocurrency Markets

The relationship between Federal Reserve monetary policy and Bitcoin’s crypto market cap performance has evolved from a peripheral correlation to a direct causation in many market scenarios. Understanding this dynamic becomes essential for predicting future cryptocurrency price movements and investment opportunities.

Interest Rate Environment and Digital Assets

Lower interest rates fundamentally alter investment landscapes by reducing returns on traditional fixed-income investments. This environment naturally drives Capital toward alternative assets, including cryptocurrencies, which contributes to the expansion of the Bitcoin market cap.

The current rate environment has created particularly favourable conditions for Bitcoin accumulation, as institutional investors seek yield enhancement and portfolio diversification. Major corporations, pension funds, and sovereign wealth funds have increasingly allocated Capital to cryptocurrency investments, providing sustained demand for the crypto market cap and driving Bitcoin growth.

Inflation Hedging and Store of Value Narrative

Bitcoin’s emergence as a potential inflation hedge has gained significant traction among professional investors, particularly during periods of expansive monetary policy. The correlation between the crypto market cap and Bitcoin’s correlation with inflation expectations has strengthened, reflecting a growing acceptance of cryptocurrency as a store of value proposition.

This narrative has proven particularly compelling as traditional inflation hedges, including gold and real estate, face their own unique challenges. Bitcoin’s digital nature, portability, and programmatic scarcity offer distinct advantages that resonate with modern investors seeking inflation protection strategies.

Institutional Adoption: Driving Force Behind Crypto Market Cap Bitcoin Growth

The institutional adoption wave represents perhaps the most significant structural driver supporting the current momentum of Bitcoin’s market cap. Major financial institutions, corporations, and investment funds have systematically increased their cryptocurrency exposure, providing fundamental support for price appreciation.

Corporate Treasury Allocation Trends

Forward-thinking corporations have begun allocating portions of their treasury reserves to Bitcoin, viewing cryptocurrency as superior to cash holdings in low-interest-rate environments. This trend directly contributes to the expansion of the Bitcoin crypto market cap, while demonstrating mainstream acceptance of digital assets.

Companies like Tesla, MicroStrategy, and Square have pioneered corporate Bitcoin adoption, inspiring others to consider similar strategies. These treasury allocations represent long-term holdings rather than speculative positions, providing stable demand foundations that support Bitcoin’s growth in the crypto market cap.

Exchange-Traded Fund (ETF) Impact

The introduction and success of Bitcoin ETFs have democratized cryptocurrency access for traditional investors, significantly expanding the addressable market for Bitcoin participation in the crypto market. These investment vehicles enable pension funds, insurance companies, and retail investors to gain exposure to Bitcoin without the complexities of direct cryptocurrency ownership.

ETF inflows have consistently exceeded expectations, with billions of dollars flowing into Bitcoin-focused investment products. This institutional infrastructure development supports sustained Bitcoin growth in the cryptocurrency market while reducing volatility through diversified ownership structures.

Global Economic Uncertainty and Cryptocurrency Adoption

Macroeconomic uncertainty across global markets has accelerated cryptocurrency adoption as investors seek alternatives to traditional financial systems. The surge in the crypto market cap, particularly for Bitcoin, reflects this broader trend toward financial sovereignty and portfolio diversification beyond conventional assets.

Geopolitical Factors Influencing Crypto Markets

International tensions, trade disputes, and concerns about currency devaluation have driven investors toward Bitcoin as a neutral and decentralized store of value. The crypto market cap Bitcoin benefits from this “digital safe haven” narrative, particularly during periods of heightened geopolitical risk.

Countries experiencing currency instability have witnessed increased adoption of Bitcoin among both institutions and individuals, contributing to the global cryptocurrency market cap and driving demand for the digital asset. This trend suggests structural rather than cyclical support for cryptocurrency valuations.

Central Bank Digital Currency (CBDC) Developments

Paradoxically, developments in central bank digital currency have increased, rather than decreased, interest in Bitcoin and other decentralized cryptocurrencies. The crypto market cap Bitcoin has benefited from growing awareness of digital assets, even as governments develop their own cryptocurrency alternatives.

CBDC initiatives highlight the inevitability of digital money while emphasising Bitcoin’s unique value proposition as a decentralised, censorship-resistant alternative to traditional financial systems. This dynamic supports long-term growth prospects for Bitcoin’s crypto market cap, regardless of government digital currency adoption.

Investment Strategies for the Current Market Environment

The current crypto market cap Bitcoin environment presents both opportunities and challenges for investors seeking optimal portfolio positioning. Understanding appropriate investment strategies becomes crucial for capitalizing on cryptocurrency market dynamics while managing associated risks.

Dollar-Cost Averaging in Volatile Markets

Dollar-cost averaging remains one of the most effective strategies for participating in the Bitcoin market cap, particularly during periods of high volatility. This approach enables investors to systematically accumulate Bitcoin positions without attempting to perfectly time market movements.

Historical analysis demonstrates that consistent Bitcoin accumulation strategies have outperformed most timing-based approaches, making dollar-cost averaging particularly suitable for long-term investors with a Bitcoin investment thesis focused on the crypto market cap.

Risk Management and Portfolio Allocation

Professional investment managers recommend limiting cryptocurrency exposure to 1-5% of total portfolio value, although this allocation may increase as the cryptocurrency market cap and Bitcoin markets mature and stabilize. Proper risk management ensures that cryptocurrency investments enhance rather than jeopardize overall portfolio performance.

Diversification within cryptocurrency holdings can further reduce risk while maintaining exposure to the crypto market cap and Bitcoin growth potential. Allocating across different digital assets, market capitalizations, and use cases provides balanced exposure to the evolving cryptocurrency ecosystem.

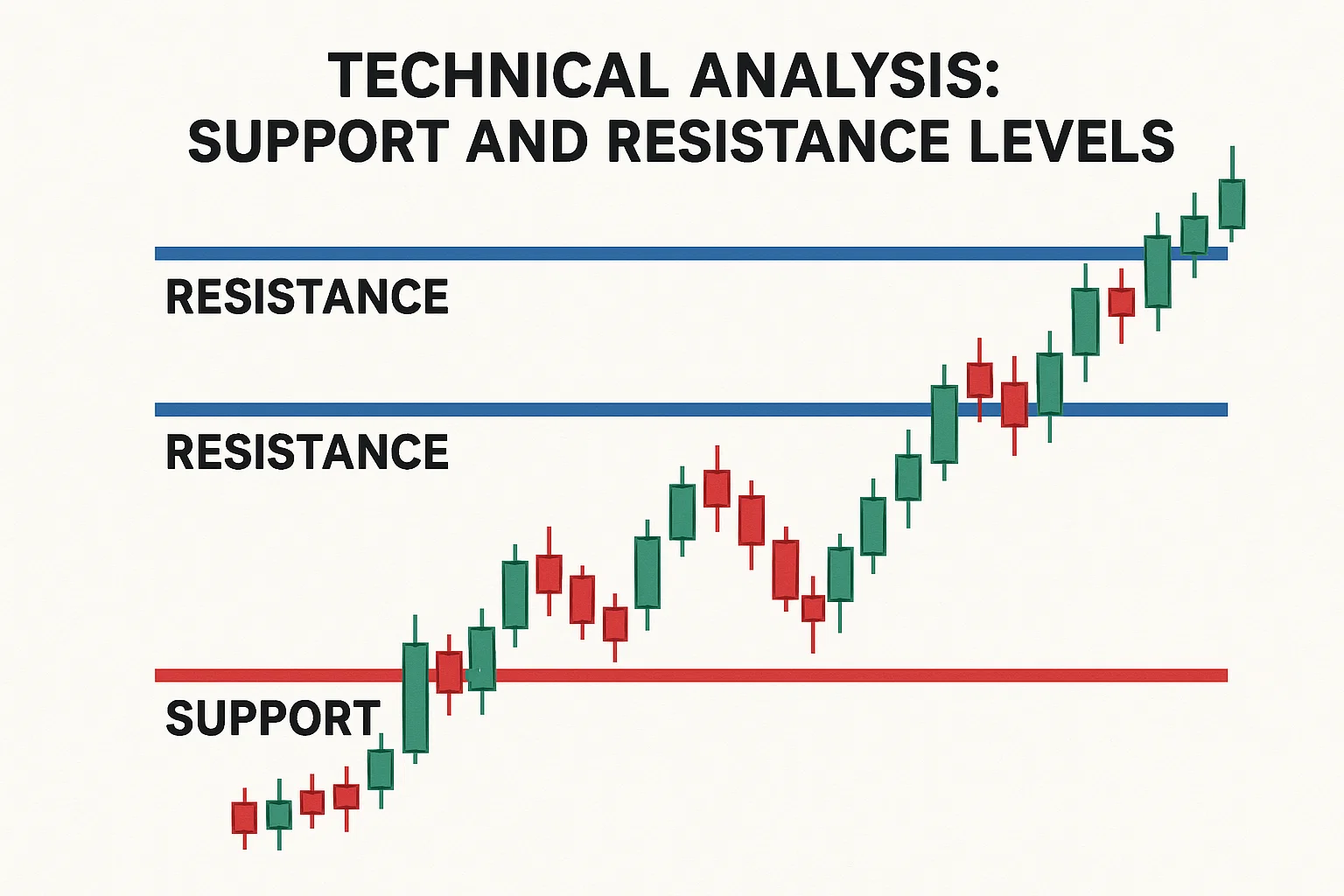

Technical Analysis: Support and Resistance Levels

Key technical levels become essential for navigating the current Bitcoin market cap environment effectively. Professional traders rely on these indicators to identify optimal entry and exit points while managing position sizing appropriately.

Critical Support Zones

Bitcoin has established strong support around the $ 1,110,000 level, providing a foundation for the continued ascent of the cryptocurrency market cap to $ 1,118,000. This support zone represents significant accumulation activity from long-term investors and institutional buyers.

Additional support levels exist at $105K and $100K, creating a stepped support structure that could cushion potential corrections while maintaining the overall crypto market cap Bitcoin uptrend. These levels represent psychological and technical significance for market participants.

Resistance Targets and Breakout Scenarios

The immediate $118K resistance represents a significant psychological barrier that, once broken, could trigger accelerated crypto market cap Bitcoin appreciation toward even higher targets. Technical analysis suggests a potential for continued momentum beyond this level, given the current market dynamics.

Fibonacci extension levels indicate potential targets at $125K and $135K following a successful $118K breakout, though such projections depend on sustained crypto market cap Bitcoin momentum and favourable macroeconomic conditions.

Future Outlook: Sustainability of Current Trends

Assessing the sustainability of current Bitcoin trends in the crypto market requires examining both fundamental and technical factors that support continued growth. While short-term volatility remains inevitable, several structural factors suggest potential for sustained appreciation.

Regulatory Clarity and Market Maturation

Increasing regulatory clarity across major jurisdictions provides a more stable foundation for the crypto market and coin growth, reducing uncertainty that previously limited institutional participation. Clear regulatory frameworks enable greater mainstream adoption and investment.

Market infrastructure improvements, including custody solutions, trading platforms, and derivative markets, support increased Bitcoin participation in the crypto market while reducing barriers to entry for traditional investors.

Technology Development and Network Effects

Ongoing Bitcoin network improvements, including scaling solutions and energy efficiency enhancements, address previous limitations while maintaining the cryptocurrency’s core value propositions. These developments support long-term crypto market cap Bitcoin growth sustainability.

Network effects continue to strengthen as Bitcoin adoption expands globally, creating self-reinforcing growth cycles that support Bitcoin’s market capitalisation and appreciation beyond current levels.

Conclusion:

The current crypto market cap Bitcoin surge toward $118K represents more than a temporary price rally—it reflects fundamental shifts in global financial markets and investment strategies. As Federal Reserve policy continues influencing cryptocurrency valuations, investors must remain informed about market dynamics while maintaining appropriate risk management practices.

The convergence of institutional adoption, macroeconomic uncertainty, and technical momentum creates compelling conditions for continued appreciation of the Bitcoin market. However, successful cryptocurrency investment requires disciplined approaches, thorough research, and realistic expectations about volatility and potential corrections.

Read more: Bitcoin Strategy Buys Another 525 BTC for $60M Holdings