With the second-largest market capitalisation among cryptocurrencies, Ethereum Surge (ETH) is changing quickly. Ethereum roadmap to $5000 is building the groundwork for another big price surge—probably over the $5000 mark—with an ambitious plan, massive technological improvements, and growing institutional and retail interest. This paper thoroughly investigates the main forces behind Ethereum’s momentum and why many investors think it’s just a matter of time before ETH achieves fresh all-time highs.

Dencun Upgrade Boosts Layer-2

Especially important was the Dencun upgrade carried out in March 2024. It brought “proto-danksharding, a forerunner to complete sharding that allows Layer-2 solutions to use “blobs”—temporary data pieces that help settle transactions more effectively. This shift greatly reduced transaction costs on Layer-2 systems like Arbitrum, Optimism, and Base, which depend on the Ethereum roadmap to $5000 for security and settlement. Faster settlement times and lower costs have pushed developers toward stronger distributed apps (dApps), boosting network traffic.

Pectra Upgrade: Enhancing Security and Usability

Ethereum’s mid-2025 Pectra upgrade will likely integrate the Prague and Electra recommendations. Technical enhancements include higher maximum stake per validator, and letting smart contracts oversee Externally Owned Accounts (EOAs) will also be included. These characteristics will enhance security, user experience, and Ethereum’s capacity to provide the fundamental layer for the distributed internet.

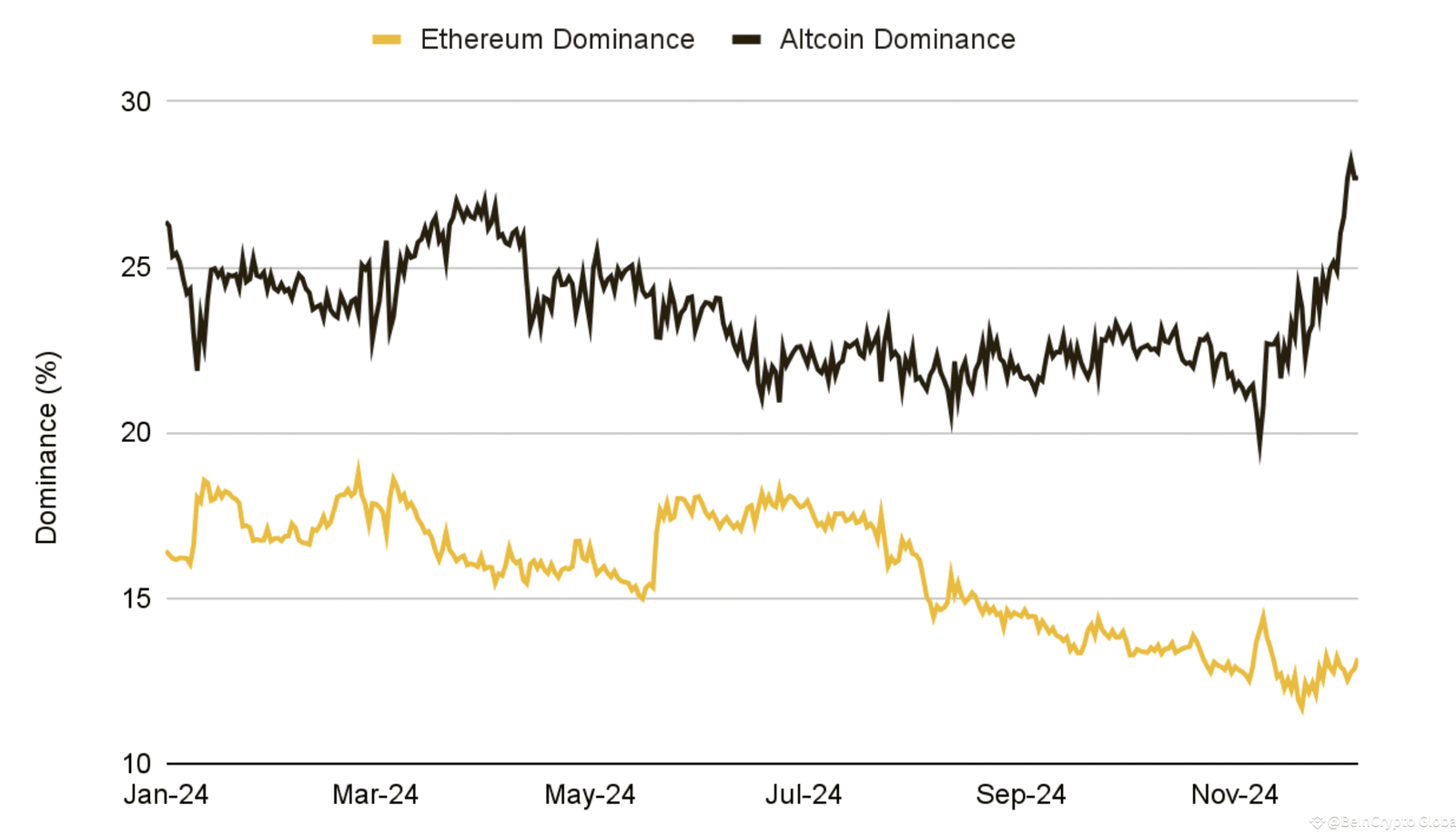

With the U.S. Securities and Exchange Commission (SEC) approving spot Ether ETFs in 2024, the Ethereum roadmap to $5000 made another significant step toward popular adoption. Like Bitcoin ETFs opened the floodgates for institutional funding, these investment products provide a more familiar, regulated approach for conventional investors to get exposure to Ethereum.

These ETFs have material and psychological impacts. Over the next 12 to 18 months, analysts believe the Ethereum Price could draw billions of dollars in assets under management (AUM). Growing demand from universities usually generates persistent buying pressure, which helps to steady and raise prices over time.

Ethereum is among its most significant real-world use cases in distributed finance (DeFi), where the protocol forms the backbone for applications providing lending, borrowing, and trading services. With total value locked (TVL) again rising, DeFi has shown great indications of recovery in 2024 and 2025, notwithstanding sporadic slowdowns during down markets.

DeFi activity’s comeback has boosted on-chain transactions, raised network fees, and burned more ETH. In 2021, a part of every transaction fee will disappear from the London Hard Fork (EIP-1559), lowering the total ETH supply. Especially in times of great activity, this burning mechanism and staking have made ETH a possibly deflationary asset.

This dynamic ecosystem guarantees Ethereum stays flexible and competitive. New blockchains can lack the deep liquidity, security, and developer tooling Ethereum enjoys, even if they might have faster speeds or cheaper fees. Ethereum’s constant improvements and flexible network architecture guarantee that it stays the hub of the Web3 movement.

Since ETH is used for staking and settling, they direct even more activity back to Ethereum when these networks embrace. Many Layer-2 ecosystems have also started their coins and DeFi systems, augmenting Ethereum’s importance as the fundamental layer for a multi-chain world.

Ethereum is usually the first platform developers and businesses consider when creating blockchain-based services in areas including Europe and Southeast Asia. Ethereum’s usefulness gains long-term value from this continuous development into non-financial domains, including supply chains, healthcare, and legal contracts.

Investors and organisations alike realise this difference; many now allocate to both assets for different strategic purposes. Hence, Ethereum’s road to $5000 does not call for it to “beat” Bitcoin, only for ongoing development along its distinct path.

Moreover, there is still intense rivalry from other Layer-1 blockchains, such as Cardano, Avalanche, and Solana. Although they don’t currently compete with Ethereum in terms of acceptance, these platforms provide low fees and high throughput; therefore, siphoning off some demand should Ethereum’s fees or congestion cause more problems.

Conclusion: Ethereum’s Promising Path to $5000+

A convergence of strong elements supports Ethereum’s road plan to $5000+: technology advancement, increasing institutional demand, ecosystem development, and actual utility. The network’s effective change to Proof-of-Stake, continuous scalability initiatives, and ETF debut have set the stage for a notable price increase.

Although there are still hazards, Ethereum has a long-term bright future. One of the most crucial technology platforms of the twenty-first century, Web3, digital identity, and distributed finance’s fundamental layer, is crossing the $5000 mark, which could not be a question of if but rather when, if present trends continue